High-yield investments have a high rate of risk. By taking a gamble on high yields, you run the risk of losing the majority, if not the entirety, of your investment.

It’s critical that the business and product you’re thinking about meeting your risk profile. There are several investment opportunities, making it challenging to decide where to invest your money. You can reduce your options by conducting a thorough risk and goal evaluation.

In this article, we’ll examine the UK’s best high-yield investments for 2022 and provide a thorough tutorial on how to get started.

What are High-Yield Investments?

Investment instruments with higher yields but higher risks are referred to as high-yield investments. Given that these investments carry a larger risk than safer investment-grade assets, the issuers of such instruments entice investors by promising a higher return relative to those of safer products. Investments that don’t meet investment grade standards typically have larger yields and are hence referred to as high-yield investments.

Best High-Yield Investments 2022

1. FTSE 100 Index Funds

If you want to earn a greater yield than you would with a bank account or bonds, you must make investments in the stock market. Due to the significantly higher profits that stocks can generate, your money grows faster. Individual stocks, on the other hand, might be a dangerous investment. Even the most promising businesses can experience poor years, which can ultimately cost you money.

Investment in index funds is a great way to lower this risk. An index fund is a selection of equities made to follow the performance of a specific index. The FTSE 100 is the most well-known of them, and there are several FTSE 100index funds.

These top 100 UK businesses were selected from a variety of sectors. Some of them are even holding corporations, such as Aviva, which has a staggering level of diversification on its own. Ultimately, this results in a fund that keeps track of the market as a whole as opposed to any particular stocks. Since the market as a whole frequently increases exponentially, you’re looking at a reliable long-term high-yield investment.

Also read: Best FTSE 100 Brokers in UK 2022

2. High-Yield Savings Accounts

Savings accounts with a higher interest than the more conventional options are what high-yield savings accounts are all about. A larger minimum amount is required for the high-yield accounts that are offered by several institutions. Since companies do not have to cover the costs of maintaining physical branches, online savings accounts also have higher rates.

Savings accounts with a “high yield” don’t offer high returns in the same way as most of these other assets, as we’ve already discussed. However, they’re a convenient source of funds that are excellent for making quick savings. Which would you choose to do if you were saving for a marriage, a vehicle, or a holiday? Put the investment in a current or standard savings account or receive a significantly bigger yield?

Savings accounts are another another fantastic way to preserve your emergency savings. Why not keep those funds in an account with a high yield? The majority of financial experts advise keeping three to six months’ worth of expenses in store at all times.

3. Certificates Of Deposit

A particular kind of bank account called a certificate of deposit, or CD offers higher returns than regular savings accounts. When you open a CD, you consent to deposit a specific sum of money and hold it in the account for a predetermined period of time. As the period gets longer, the interest rate goes up. When the CD expires, you have two choices: remove the money or apply it to a new CD.

There are many different time frames for which CDs might be issued, ranging from a few weeks to several years. Throughout the investment time and until the CD expires, interest is paid. Remember that if you take any money out before it matures, you will forfeit your exceptional interest rate. You will also be assessed a penalty charge on top of the skipped interest.

Retirees, who can’t afford to take numerous chances, can choose CDs. It’s a method for increasing your investment returns slightly while preserving their long-term value.

4. High yield bonds

Bonds are frequently thought of as being secure investments that act as a cushion when stock prices fall. In reality, some bonds may carry risks equal to or greater than those of stocks. The likelihood that an issuer will pay its debts on schedule, if at all, determines the return on bonds. Bonds with a high credit rating are referred to as “investment grade” bonds and typically don’t pay their bondholders very much. Non-investment grade bonds, sometimes known as junk bonds, are those that are issued by corporations with a poor track record or none at all.

Individual junk bonds can be purchased through a broker by those looking to invest in high-yield bonds, albeit this option comes with a high level of difficulty considering how tough it is to choose one. Investors looking for returns similar to those offered by individual high-yield bonds but with more financial diversity may opt to put their money into a mutual fund or exchange-traded fund (ETF) that holds dozens or even hundreds of these bonds.

5. Money Market Accounts

Savings can be invested in a safe and dependable manner with money market accounts. Except for a few exclusions, they function in a manner akin to a savings or CD account.

There is a cap on the number of checks you may make against them each month, but they pay out more than regular checking or savings accounts.

In addition, if you issue upwards of six checks each month against the account balance, the bank could impose a transition to a checking account—often one that doesn’t yield interest.

For savers looking for an alternate storage option, the money market account has numerous benefits. They can protect your money from inflation better, maintain liquidity, and generate higher returns than other depository products.

These financial products are suitable for those who desire a respectable return on their investment but have lower risk tolerance.

These kinds of accounts could be preferred by young investors who want to save money for down payments or start emergency funds.

Additionally, older people could prefer them as lower-risk investments because they are better equipped to give them money when they need it in retirement.

6. Dividend Stocks

People typically invest in stocks due to the possibility of growth. However, this may cause problems for big, prosperous businesses. Each fiscal year’s end sees a large number of large corporations returning a percentage of their profits to the shareholders. Known as “dividends,” these payments are excellent news for long-term investors. You put your money into dividend paying stocks, and every year you are paid. You can choose to take the earnings or put the dividend payment into more stocks.

Although these stocks have the potential to be great investments, not everyone should purchase them. Instead of using a fund, you must select and determine your own stocks. This implies that you must have the time and motivation to conduct your own research and stay current on the businesses you’re investing in.

Learn more: Best Dividend Stocks You Should Buy in UK 2022

7. Value Stocks

Despite the coronavirus, the past few years have seen a phenomenal stock rise. Unfortunately, this has resulted in an overvaluation of many stocks. Due to the fact that the stock price of some of the most successful companies has surpassed any reasonable value, many investors are wary of investing in them.

Value stock funds look for stocks that are inexpensive in relation to their profitability. Although these equities may not be performing well right now, the theory holds that they are less susceptible to economic downturns. On the other side, when the economy weakens, expensive stocks are the first to suffer.

Learn more: Best Value Stocks You Should Buy in UK 2022

8. Government Bond Funds

A fund that invests in a variety of treasury bonds is known as a government bond fund. Among them are Treasury bonds, bonds produced by various government agencies, and often local and state bonds. To maximise yields, such funds frequently invest in short-term bonds and reinvest the earnings as the bonds expire.

The two main federal home lenders, Freddie Mac, and Fannie Mae are also investors in these bond funds’ holdings of their bonds. You will be exposed to both the overall bond market and the real estate industry. Overall, even if the rates of return are lower than those of index funds, you are looking at a safe investment that will outperform inflation.

9. Mortgage REITs

Real estate investment trusts (REITs) may be something you’ve heard of before, but you’ve probably never thought of them as particularly risky investments. The REITs you’ve likely heard of are equity REITs, and they own and combine a large number of income-producing assets into a business that you may invest in. The income that mortgage REITs produce typically comes from interest rather than rent because they are businesses that group together mortgages rather than actual properties.

Mortgage REITs must pay out 90% of their yearly profits as dividends to shareholders, just like equity REITs are required to do. Mortgage REITs are frequently high-yielding and quite risky due to the fact that their heavily leveraged business models depend on borrowing money. Do you recall the subprime mortgage crisis? The high yield is due to the fact that some mortgage REITs are made up entirely of mortgage-backed securities that might not be lending to the most reliable borrowers.

10. Options investing

In essence, investing in options means paying to make a wager that a stock will increase over a predetermined amount of time. The reason it’s called an option is that you have the choice, not the obligation, to purchase the underlying security at a predetermined price and within a specified time frame. You pay the premium, which is the cost, to purchase this. If you have an agreement to purchase a security at a price that is much less than it is now trading, there are considerable benefits. The risk is that if the stock or security swings against you and you have extensively invested in premiums, your options may become worthless and you may lose everything you invested.

Learn more: What is Options Trading – UK Guide

Best Sites for Investing in High-Yield Investments

Before making a large financial commitment, you need not only thoroughly investigate a high-yield investment; you should also locate a broker from whom you may purchase the asset. Due to the extensive considerations that must be made before signing up, this process in and of itself can take some time. This covers everything, from approved payment methods and security to tradable marketplaces and trade costs.

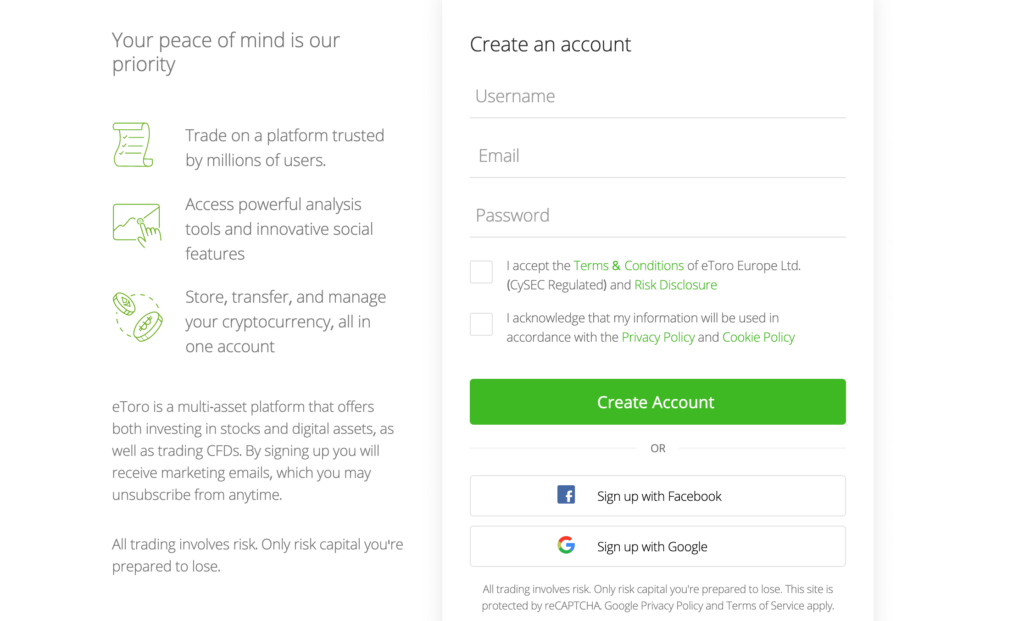

1. eToro

With the help of eToro, an online broker, you can invest in high-yield investments. In actuality, there are no commissions or dealing fees at all on this trading platform. Additionally, there are no monthly fees and $5 withdrawal costs.

Having said that, eToro waives UK stamp duty, allowing you to recover the 0.5% charge when purchasing UK stocks. The eToro stock library includes more than 1,700 shares from 17 UK and foreign markets in terms of the high-yield investments the site allows. This comprises a sizable number of companies in emerging countries as well as high-growth and tech stocks. More than 150 ETFs, including bond funds and REITs, will be available to you as well. There are other 16 digital currencies accessible.

Additionally, eToro has a function that enables you to duplicate the portfolio of an expert investor. The platform offers thousands of investors, and you can choose one based on the trader’s prior success there. eToro offers a wide range of payment options including bank transfers, e-wallets like Paypal, and debit/credit cards from the UK. The required down payment is simply $50. Of course, the Financial Conduct Authority (FCA) regulates eToro and the Financial Services Compensation Scheme (FSCS) insures your funds.

2. IG

/IG-ef2684aaa37d4d218af819f98d676d02.png)

The widest variety of asset types is arguably offered by IG. Over 12,000 markets will be available to you, many of which are suitable for high-yield investments. This includes ETFs, investment trusts, mutual funds, and thousands of shares from the various UK and foreign markets. Additionally supported are ISAs, which are advantageous for maintaining tax efficiency.

When you place at least three orders every month, your dealing fees drop from £8 to £3 per trade. There are no charges for deposits or withdrawals unless a credit card is used (0.5–1%). The required down payment is $250. Given that it has been in business since 1974, this brokerage house enjoys a high reputation in the UK. IG is listed on the London Stock Exchange with a multi-billion pound capitalization, an FCA license, and a collaboration with FSCS.

How to invest in high-yield investments?

Now we are going to give you a general overview of how to begin investing in high-yield investments in the UK using an online broker. The procedures listed below are based on eToro, a platform that is governed by the FCA and offers access to a broad choice of assets across numerous international markets. These are the steps:

Step 1: Create an account

Go to the eToro website and begin the account creation process. You will be asked for details such as your name, phone number, and social security number.

You must provide a copy of your passport or driver’s license to complete the KYC process if you want to deposit more than $2,250. If you don’t go through the KYC procedure right away, you must go through it again before withdrawing.

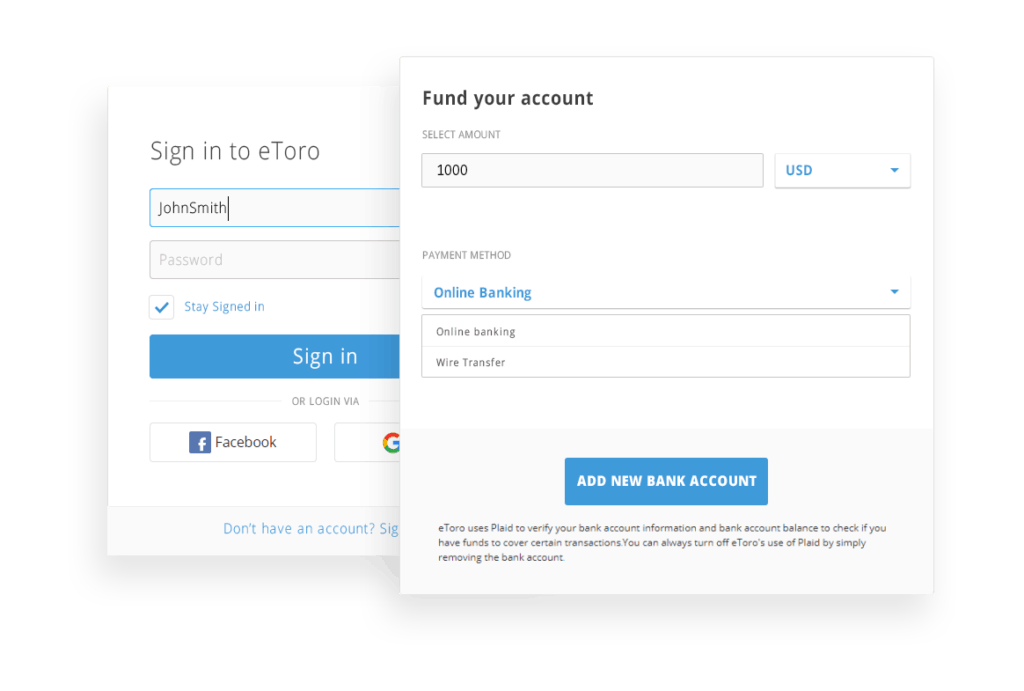

Step 2: Deposit funds

You can use a bank card or online wallets like Neteller or Skrill to fund your eToro trading account. A bank transfer is an additional option, but it can take longer.

Step 3: Select an asset

You can search on eToro if you already have high-yield investments in mind. If you want to invest in value stock, for instance, type the name of the stock into the search box, click on the result, and you will be taken to the investment page.

Step 4: Place your order

You can enter the amount you wish to invest in that asset at this step. To finish the purchase without commission, click the “Open Trade” option.

Conclusion

As a result, it is clear that high-yield investments are riskier and hence have larger returns to entice investors. Before beginning to invest in high-yield investments, traders or investors must grasp the risk-return trade-off involved. High-yield investments are ideal for individuals who are prepared to take on risky investments.

The traders are encouraged to always pick an FCA-regulated platform when making stock or other investment decisions.

Frequently asked questions

What high-yield investments in the UK offer the best returns?

You can choose from a variety of high-yield investments, all of which carry varying levels of risk. REITs, mutual funds, stocks and bonds from developing markets, and pension funds are a few examples.

Does a stock that pays dividends to have a high yield?

The dividend is fixed here with the market return, therefore dividend pay stock does indeed produce a high yield.

What high-yield investment is the safest in long run?

Real estate is typically regarded as a low-risk investment with the potential to yield returns above average. You don’t need to own a home to access this market because you may invest through a REIT.

Are investments in high-yield bonds secure?

Yes, a high-yield bond produces a substantial yield and is a secure investment over the long term.

How high-yield bonds fare in a recession?

If the market assumes that bond issuers are more likely to miss coupon payments or, worse, assumes that the principle itself, bond yields will rise.