If you’re a casual trader who desires to benefit from stock market rewards without having to devote years studying and monitoring market movements, copy trading may be for you. You can easily replicate more seasoned traders through copy trading and achieve the same profits. What assets you buy and sell will then depend on the trader you choose to copy and how long they have been trading the market.

In this article, we look at the best copy trading platforms in UK 2022, along with the copy trading process.

What is Copy Trading?

If you don’t have enough time to master trading tactics, copy trading is a type of trading that enables you to quickly get started. By automating every step, this trading strategy enables you to replicate the deals of the most experienced investors.

Numerous additional markets, including currency, stocks, and CFDs, allow for copy trading. You should be aware that copy trading carries a significant level of risk, so we suggest you learn more about it before committing fully.

Like any other trading strategy, copy trading has advantages and disadvantages. To help you understand, we have summarised a few of them below.

Pros of Copy Trading Platforms

- A decent option for beginners: As a novice, it’s advisable to keep in mind that becoming familiar with trading takes time. So you can boost your chances of making money by copy-trading the deals of experienced investors.

- It pays off: If you are an experienced investor, copy trading enables you to take part in the market even more. The majority of brokers will pay you for each transaction you copy, encouraging you to open positions more frequently.

- Trade on a number of markets: Regardless of which market you choose, copy trading lets you to invest on a variety of securities, including FX, equities, and commodities, and many others.

- Builds a social network: In addition to allowing you to copy deals, copy trading also allows you to connect with other investors via a chat platform. You trade trading methods with one another and engage, which enhances your trading experience.

Cons of Copy Trading Platforms

- Risky: Keep in mind that even experienced traders have losing days. Consequently, if the trader you are copying loses, you also lose money.

- Limits your performance: You will have less influence over your trading operations because you will only be relying on another trader’s techniques.

- Gives little incentive to traders: A trader who relies too much on copy trading may lose interest in completing market research and refining their own trading techniques.

Best Copy Trading Platforms 2022

You must select a reputable broker who can accommodate your trading needs before you can begin copy trading. The top copy trade platforms in the UK are listed below. We can assure you that they will make your trading experience rewarding because they have all been put through hours of extensive testing.

1. eToro

If you’re looking for a copy trading platform in the UK, you can sign up with eToro. They serve millions of clients, many of whom make use of the eToro copy trading function, one of the easiest copy trading platforms to use.

By opening a new account with eToro, you may navigate the hundreds of traders who have registered for the copy trading service. They provide a filtering method that will enable you to minimize the sample size by focusing on factors like average gains, asset classes, and the typical time spent holding deals.

Once you’ve narrowed down your list of traders, you can start thoroughly investigating each one. With eToro, you can check out a specific trader’s portfolio to see how they’re doing on each transaction, examine their monthly returns, and learn more about their risk tolerance. It gives you all the data you require to choose whether or not to invest with a specific trader.

It is as easy as choosing the amount to invest once you have decided which trader you want to copy. Your initial investment must be at least $200 (about £140).

However, eToro stands out as a copy trading platform in the UK because it doesn’t charge any commission or administration fees for investments.

You can trade a wide range of asset classes on eToro, including stocks, ETFs, cryptocurrencies, foreign exchange, indexes, and commodities. If you decide to fund your account in a currency other than GBP, you will be charged a 0.5 percent forex cost; however, all asset classes are available for commission-free trading.

You can be sure that your money is safe with eToro because they are both regulated by the FCA and registered with the FSCS.

2. MT4

MetaTrader 4 is one of the most well-liked third-party solutions for online investing because of the wealth of tools it offers for the implementation of specific methods. Experienced day traders choose this platform because of the sophisticated tools and indications it provides. This suggests that when utilising MetaTrader 4 for copy trading, you will be able to imitate experienced traders who focus their orders on technical analysis.

Due to its Expert Advisors, the platform is especially appropriate for FX trades. After you obtain the programme file and install it on the MetaTrader 4 platform, the Expert Advisor will trade on your behalf. As your EA will identify trading chances and trade on them, you will be able to trade continually throughout the day without having to conduct the necessary research.

The only significant disadvantage of utilizing MT4 is that it does not include any of its own EAs. As a result, you will need to spend some time online looking for the ideal EA whose specifications and trading style are within your risk tolerance.

However, MetaTrader 4 is not a broker; it is merely a trading platform. Finding a broker that not only supports MT4 and EAs but also has the lowest fees is therefore necessary. Capital.com is a reputable broker to use with the MetaTrader 4 platform due to its tight spreads. With a debit or credit card, it is very easy and cost-effective to add funds to your trading account. Additionally, they provide demo accounts that you may utilize to test out your ideas without taking any risks.

3. MT5

Because the MT5 platform is a more recent evolution of the MT4 platform, it functions quite similarly. But in addition to supplying forex-specific capabilities, it also provides CFD trading-specific tools. Nevertheless, it still has a number of sophisticated charting tools and supports a large range of technical indicators utilized by traders.

However, in addition to their EAs, MT5 also has a copy trading facility. Mirror trading is a function that allows you to browse through the platform’s traders, examine their trading patterns and styles, and then choose to copy their active deals. However, MT5 charges a monthly subscription fee for this in exchange for providing you with continued access to the trader’s trading history.

MT5 is also a merely a trading platform and not a brokerage; therefore, you must find alternative broker who operates with the MT5 software. The CFD broker Libertex is one of the most popular MT5 brokers that we have discovered. On the majority of CFDs, it enables commission-free trading.

The commission for trading other asset classes is often less than 0.1 percent. You can make a deposit of as low as $100 with your credit/debit card, a bank transfer, or any other e-wallet.

4. IG Markets

/IG-ef2684aaa37d4d218af819f98d676d02.png)

Perhaps the most financial products are available to trade at IG Markets. They provide the chance to invest in assets all around the world with their additional 16,000 shares from businesses in various nations and industries, along with commodities, currencies, indexes, and cryptocurrencies.

Comparable to eToro, their copy trading tool allows you to register an account, fund it with a suitable deposit method, and then view a selection of traders you can replicate.

You can choose the trader who best suits your demands after investigating them, at which point you can start trading. The IG Traders’ minimum investment requirement is £250. They also let you create a demo account so you may test out a strategy or trader without risking any of your own money. They impose minimal commissions on the most of investment vehicles, and the IG platform is compatible with MetaTrader4.

5. AvaTrade

When AvaTrade introduced the AvaSocial app, it recently elevated its emphasis on automated trading. Similar to aforementioned copy trading platforms, this AvaTrade application will link traders from all corners of the world and give them the tools they need to benefit from one another. You can then automate your trades by using that knowledge to copy other more successful traders.

AvaTrade claims that this innovative copy trading platform will advance the business. Additionally, this broker is best used on mobile devices, as anyone who has used the AvaTradeGo app will attest.

Since the platform is fresh, we anticipate numerous updates and improvements, but we still believe it to be well worth it.

Factors for selecting a Copy Trading platform

You should locate a platform that meets your trading needs if you want to increase your possibilities of profitability. Consider the following factors as you go through this process:

Licenses

The best copy trading platform must be affiliated with a broker that is authorized and subject to the regulation of a reputable agency, such as the Financial Conduct Authority, in accordance with UK trading regulations. One method of protecting your investment funds is to confirm the legitimacy of a copy trading platform.

Available Markets

You likely already have a general idea of the markets you want to invest in when looking for a copy trading platform. You cannot copy trade on all market assets with all brokers. Consequently, select a copy trading platform in accordance with your trading requirements.

Trading Charges

The majority of broker systems offer free copy trading. Before you open a position, you will still be charged the standard trading fees. As a result, the copy trading platform you choose must have trading costs you can pay.

Customer Support

If you experience any trading problems, you should be able to contact customer assistance through the top copy trading platform in the UK. They should be reachable by phone, email, and live chat, among other means of communication.

Payment Methods

For your trading needs, you will require a flexible payment mechanism for deposits and withdrawals. A number of payment methods, like bank transfers, debit/credit cards, and e-wallets, are accepted by the brokers we’ve listed above.

How to begin with a Copy Trading platform?

In less than five minutes, you may begin copying a top trader on the eToro platform by following the instructions in this section of our course.

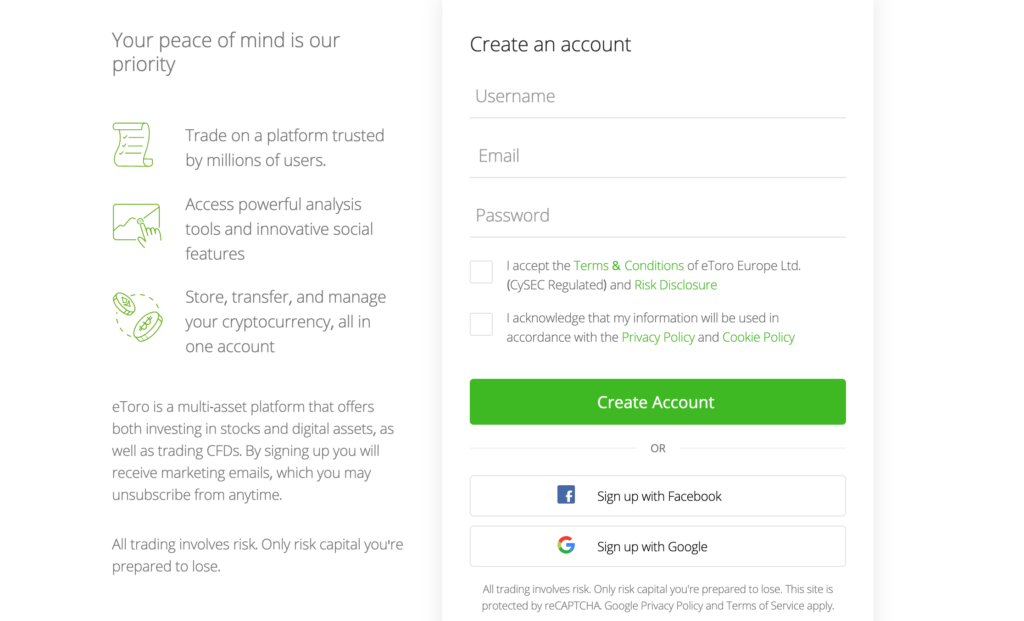

Step 1: Create an account

Visit etoro and register for a new accout by clicking ‘Join Now’ button. Due to regulation, eToro is required to gather some personal data in order to provide brokerage services in addition to its copy trading tool.

The user’s first and last name, date of birth, and cell phone number will be listed after the email address.

Before answering a few straightforward questions about any prior trading experience, choose a username and password for the account.

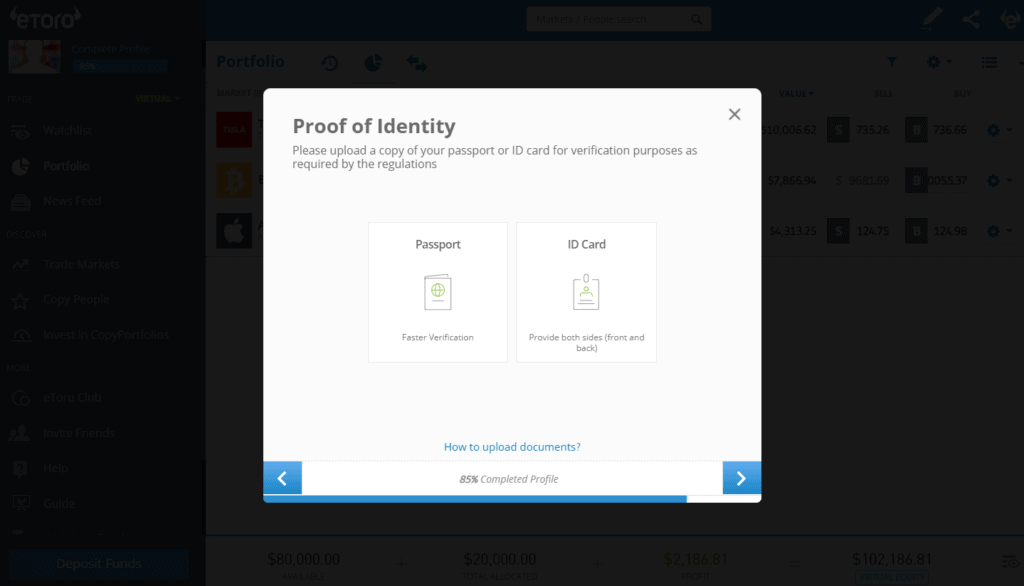

Step 2: Verification

New users must upload identification in order to utilize a regulated copy trading platform like eToro. This can be a current passport, license, or state identification card.

A clear upload of the document is a must. If so, eToro ought to be able to validate the account right away.

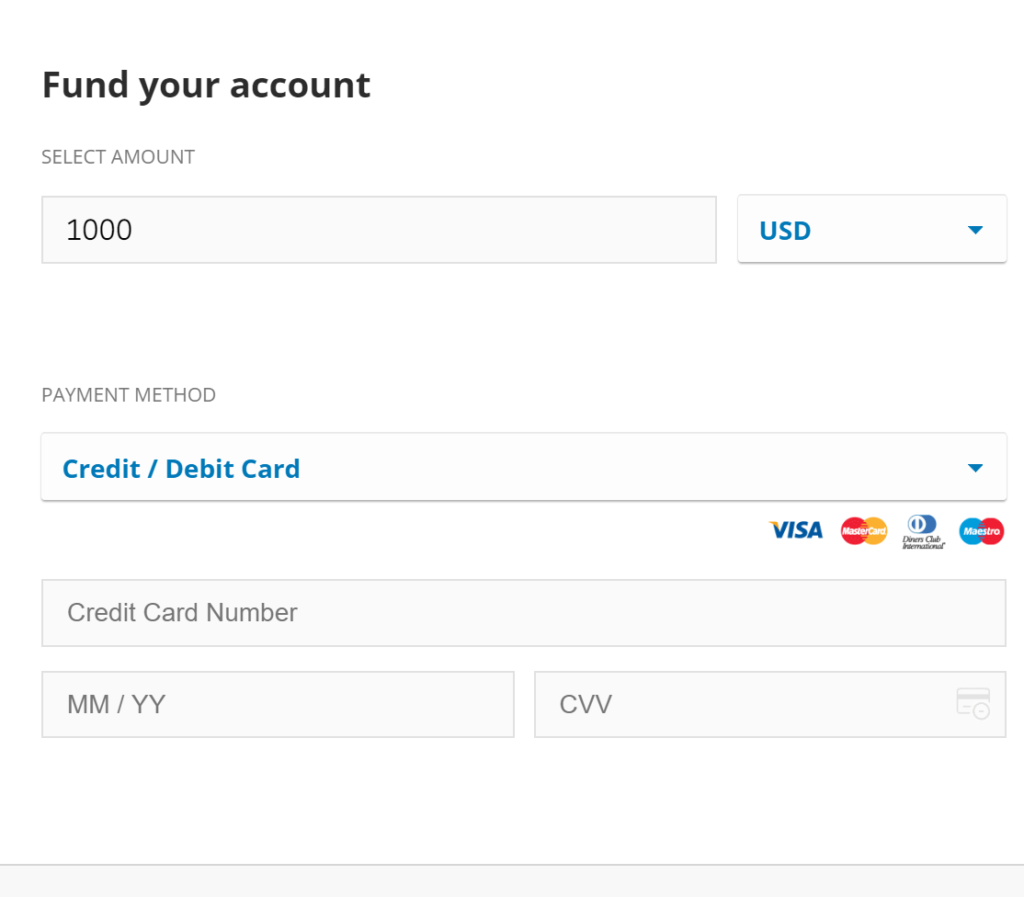

Step 3: Deposit

Making a deposit into the eToro account is the next action. Although the first deposit requirement is only $10, customers must invest a minimum of $200 to use the eToro copy trading service.

Type in the needed deposit amount, and then from the list of alternatives, choose your chosen method of payment. Visa, MasterCard, Skrill, PayPal, Neteller, internet banking, and more are all accepted by eToro.

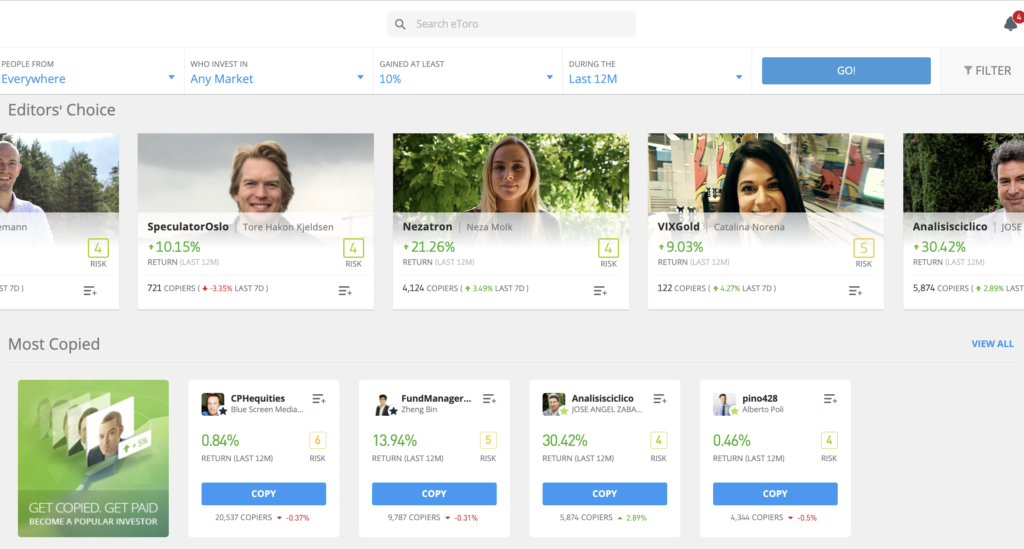

Step 4: Pick a Trader to Copy

The user will now need to select an appropriate trader to clone, making this step arguably the most crucial. First, select the “Discover” button located on the dashboard’s left side.

Then, next to CopyTrader, click the ‘View All’ button.

As a result, the traders will be capable to use the filters. For instance, based on the selected asset class, historical ROI, risk rating, and other factors, users can find a good trader to copy.

A trader’s individual profile will then be filled out after clicking on them. Here, the user can conduct in-depth due diligence on the trader.

Step 5: Confirm trade

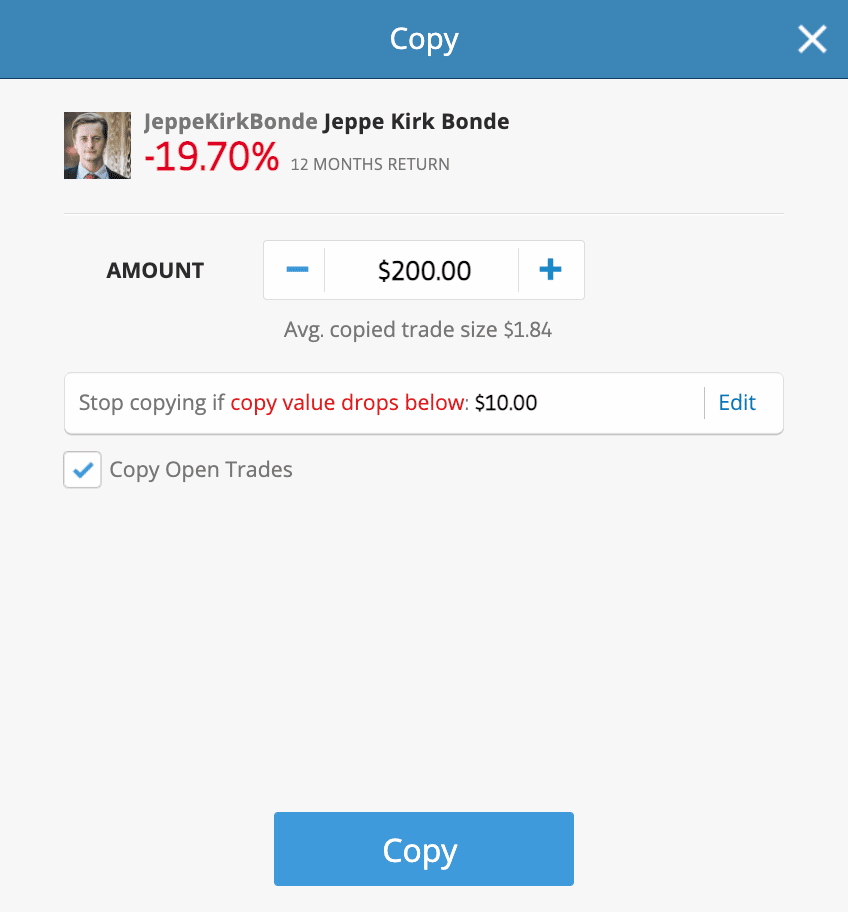

Click the “Copy” button once a suitable trader has been located. In the order form enter the initial investment amount in the appropriate copy trader.

This can be any sum starting at $200 and going higher, as was mentioned earlier in our eToro copy trading review. Then, make sure the “Copy Open Trades” button is selected.

The user will copy both the current portfolio and future investments by doing this. To finalize the investment in copy trading, click the “Copy” option.

Conclusion

The best copy trading platforms enable users to make major income in the stock market. All that is required is choosing an appropriate trader to copy and deciding how much money to invest.

Opening an account with eToro, currently ranked as the best copy trading platform worldwide, only takes a few minutes, and the required minimum investment is a very reasonable $200.

The supported markets on eToro include forex, equities, ETFs, indices, crypto, and commodities, and the platform is home to hundreds of traders who may be imitated.

Frequently Asked Questions

What is copy trading?

Copy trading is the process of initiating and terminating trades simultaneously with the signal provider you wish to copy.

How is a trade copied?

Once you have opted to replicate a trader, your software will automatically initiate and cancel positions in line with them.

Which is the best copy trading platform?

eToro is the most well-known trading platform for this reason despite the fact that there are many copy trading platforms that provide competing services. This is because they are regulated and provide the greatest selection of assets to trade from with no commission. Additionally, it gives you access to thousands of legitimate copy traders from which you can select based on your requirements.

Is it feasible to make money using copy trading?

Yes, you could make money with copy trading if you pick the appropriate trader to copy who is knowledgeable in their field, but nothing is ever guaranteed. It’s essential to do extensive research before deciding on a trader to copy. When deciding to copy trade, use prudence since you’re ultimately taking a financial risk.