Day trading is a growingly popular technique to profit from the minute-to-minute changes in the financial markets as a side business or a full-time job. You need to select a specialized platform from the wide range of day trading platforms with access to numerous markets, real-time research tools, and advanced technical analysis capabilities if you want to make money from this kind of short-term trading.

This guide will assist you in locating a day trading platform in the United Kingdom for 2022. Moreover, a brief explanation of what day trading is and its advantages.

Best Day Trading Platforms UK 2022

Choosing the best day trading platform will necessitate the study of trading platforms based on various factors. Below are detailed analyses of the best day trading platforms in the UK to consider right now.

1. eToro

As we ranked the UK’s top day trading platforms altogether, eToro came in the first place. More than 25 million users use this platform, which is approved and governed by the FCA, CySEC, ASIC, and the SEC. Additionally, the fact that eToro is protected by the FSCS will be welcomed by UK citizens.

We appreciate that eToro allows UK citizens to invest in equities and ETFs at no commission and provides a secure environment for day trading. As opposed to CFDs, these are actual stocks, thus investors will continue to have full ownership of the underlying shares.

Trading is available on both UK and international marketplaces with no commission. The greatest day trading platform for cryptocurrencies is eToro. eToro charges a low fee of 1 percent each slide when customers want to invest in cryptocurrencies here.

Additionally, users may purchase nearly 80 additional cryptocurrencies at eToro in addition to Bitcoin. Along with stocks and ETFs, eToro also provides CFD markets that cover commodities, indices, and currencies. At eToro, the minimum trade stake is a mere $10, or roughly £8.

The Copy Trading service provided by eToro is another noteworthy feature. As the name implies, this enables investors to “copy” an experienced trader’s buy and sell positions. The eToro Smart Portfolios are great for long-term investors as well. These are collections of stocks and digital assets that each reflects a particular strategy and are professionally managed.

UK citizens just need to make a $10 initial investment to register an account with eToro. e-wallets like Paypal and Skrill, as well as UK debit and credit cards, are some of the most practical payment methods accepted by eToro.

2. Capital.com

Capital.com is a CFD trading service in the United Kingdom for day trading equities. This CFD brokerage offers over 3,000 equities from the US, UK, Europe, and Asia. Capital.com’s spreads are substantially below the industry norm, and all share trades are fully commission-free. Furthermore, Capital.com does not charge an inactivity fee or any other account fees.

With its unique user interface, the Web Trader platform provides comprehensive charting with more than 75 technical indicators. Furthermore, it offers a discovery pane, individual watchlists, an integrated news feed, and the ability to swiftly search for the investment products with the maximum volatility. The only drawback is that Web Trader does not provide price alerts.

Alternately, you can benefit from the TradingView and MetaTrader 4 integrations offered by Capital.com. One of the most widely used day trading platforms worldwide, MetaTrader 4 is made exclusively for FX trading. One of the largest UK day trading platforms, Capital.com offers 142 currency pairs for trading.

Experienced traders use the third-party analysis software TradingView. A built-in scripting language allows you to construct entirely customized indications, and you also have the choice to borrow customized indicators from other traders.

Capital.com is governed by the FCA and provides amazingly responsive customer care around the clock. You only need to deposit £15 to start an account.

3. Libertex

Libertex is the next option, and it’s arguably the greatest day trading platform for novices interested in making commodity bets. Trades can be made on this platform, which has been in existence for more than 24 years, in the three main commodity classes of metals, energy, and agriculture.

As a result, UK citizens can trade anything they choose, including crude oil, sugar, coffee, natural gas, gold, and silver. Leverage trading is permitted on all of the commodity trading markets provided by Libertex in accordance with UK rules. This again means that retail customers can receive 1:10 for other commodity classes and 1:20 for gold.

Commodities can be traded for a very affordable commission rate of about 0.0003 percent each slide. Simply put, this means that a commission of just 3p will be charged for every £10,000 exchanged. The Libertex marketplace features fierce competition for spreads as well. Libertex covers a wide variety of additional CFD markets in addition to commodities.

Stocks, foreign exchange, options, indices, and ETFs are all included in this. Starting a Libertex account only costs £10, and approved payment methods include bank transfers, debit/credit cards, and e-wallets. There is also a demo account for Libertex that includes $10,000 in virtual trading money.

We also appreciate that Libertex offers a mobile app for iOS and Android as well as compatibility for MT4 and MT5. Last but not least, Libertex now enables users to invest in actual equities. This not only provides access to hundreds of US-listed firms but there are also no trading commission fees.

4. Alvexo

With Alvexo, a well-known day trading platform, UK clients can trade financial assets on margin with leverage of up to 300:1 using CFDs (contracts for difference). Although keep in mind that only Alvexo’s other supported markets are available to UK users for bitcoin CFD trading.

Alvexo supports MT4 and has a proprietary online trader platform that is a browser-based system with quick execution and sophisticated charting capabilities for technical analysis. Along with training classes and webinars to help you learn how to trade, daily, weekly, and monthly trading signals are also available.

Alvexo now provides trading in stocks, indices, currencies (FX markets), and commodities in addition to cryptocurrency. Alvexo has more than 372,000 registered users who trade, with more than $54 billion in total volume.

This day trading platform is a licensed and regulated platform under the Financial Services Authority of Seychelles. For UK trading platforms, Visa and Mastercard are available along with some less typical payment options like Paypal, Apple Pay, Google Pay, and Skrill.

Alvexo has earned numerous honors, including best investment product, best mobile trading app, best trading platform, and best product innovation, all from the London Trader Show Awards, in addition to the great reputation it has established since its start in 2014.

5. Pepperstone

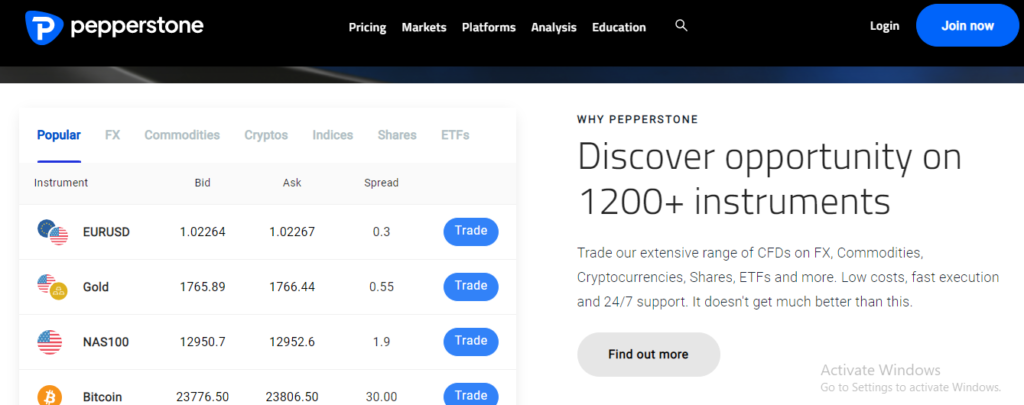

Experienced day traders are aware of the significance of selecting a platform with competitive spreads. In any case, this indirect trading fee is charged on almost all holdings. Spreads can be completely avoided by choosing to register an account with Pepperstone, though.

This is due to the fact that Pepperstone provides raw spread accounts, which enable users to transact directly with key market players. Most of the time, this allows traders to trade popular forex pairs at 0 pip costs with just a $3.50 per slide charge. This will work for traders that normally invest a lot of money in their trades.

People who want to day trade with small investment amounts should think about using Pepperstone’s basic account. There are spreads associated with this, but no trading commissions are assessed. Pepperstone provides access to a number of different CFD asset classes in addition to FX. This includes commodities, indexes, ETFs, and stocks.

Factors for selecting the Best Day Trading Platforms

UK residents have access to a wide variety of trading platforms, many of which provide a broad range of markets and secure regulations.

Having said that, no two trading platforms are alike, so before opening an account, investors should do their homework on the potential supplier.

We describe how we rank and contrast the top day trading platforms in the UK in the sections that follow.

Regulation

The FCA is not the only tier-one financial organization that has authorized and regulated the top day trading platforms in the UK. As a result, inhabitants of the UK are well protected in terms of secure trading environments.

For instance, ASIC (Australia) and CySEC both regulate Capital.com and eToro (Cyprus). Additionally, eToro investors are protected by FSCS in the UK. If a brokerage fails, this protects UK residents up to £85,000 against financial loss.

Range of Assets

The fact that day trading may be used with almost any asset class is one of its strongest features. The best day trading platforms must offer a variety of markets.

For instance, thousands of stocks and ETFs, as well as currency, commodities, and indices, are all accessible through Capital.com and eToro.

The precise financial instrument that the platform offers must also be taken into account. For instance, Capital.com supports spread betting and CFD markets, enabling traders from the UK to transact without acquiring ownership of the underlying asset.

Spreads

When looking for the best day trading platform in the UK, spreads are yet another crucial factor to take into account. This indirect cost is determined by subtracting the asset’s acquisition price from its sell price.

For instance, the spread is measured in pip when trading forex. On EUR/USD, Capital.com offers a very competitive minimum spread of 0.6 pips.

Finally, it is suggested that day traders pick a platform that provides tight spreads across their selected market.

Fees

When selecting a UK day trading platform, additional expenses besides spreads could be necessary. The primary factor in this is the trading charge, which is calculated for every buy and sell position.

The best part is that two of the best day trading platforms in the UK, eToro and Capital.com, operate with a 0% commission structure for stocks and ETFs. The latter additionally provides marketplaces with zero percent commissions on indices, commodities, and currencies.

There may also be non-trading fees involved, such as transaction fees for deposits and withdrawals. There are no account fees associated with any of the platforms we’ve been talking about today—those are only charged for utilizing the broker.

Please be aware that costs frequently change based on the type of account being opened, as some platforms provide UK citizens a choice.

Tools and Analysis

The strategy of day trading necessitates some depth in technical analysis. As a result, the trader will need to be quite proficient at reading real-time pricing charts and using technical indicators.

The finest day trading platforms in the UK include a wide range of features to aid in the analytical process. Having said that, newbies who lack any skill in performing technical analysis may probably value the eToro Copy Trading option.

Simply put, this feature allows eToro users to duplicate the trades of a profitable day trader.

Minimum Deposit

Additionally, traders should find out what the minimum deposit requirement is for their preferred day trading platform. Some platforms have high minimum deposit requirements, making them unsuitable for new users.

For instance, IG needs a minimum deposit of £250 to start an account in the UK. Contrarily, Capital.com just needs £20, but only if the deposit is made using a debit/credit card or an e-wallet (bank transfers need £250).

Demo Account

If the platform in issue provides a demo account function, it is worthwhile to use it before making a deposit. The top day trading platforms in the UK provide practice accounts that accurately reflect the financial markets.

Positions will be opened using paper funds rather than actual money. This is a fantastic, risk-free method to get started with day trading.

Mobile App

Although placing orders on a desktop computer is how most day traders operate, having access to the markets while on the go is essential. And using day trading platform’s mobile application is the most effective method to do this.

Capital.com provides the top UK day trading app that we have found. The app’s zero percent commission access to the day trading marketplaces is the cause of this.

Due to its straightforward user interface, we also discovered that eToro is one of the finest UK day trading apps for beginners.

Payment Methods

Traders must fund their trading accounts before they can access the financial markets.

Using websites like eToro and Capital.com, which both handle UK debit/credit cards and e-wallets, makes this process straightforward.

Customer Service

Traders will be able to get in touch with a customer care agent if a problem or inquiry arises.

The best choice, in this case, is live chat because it provides real-time customer care without requiring you to pick up the phone.

How to start Day Trading?

In this section, we’ll show you how to sign up for Capital.com and how to start day trading.

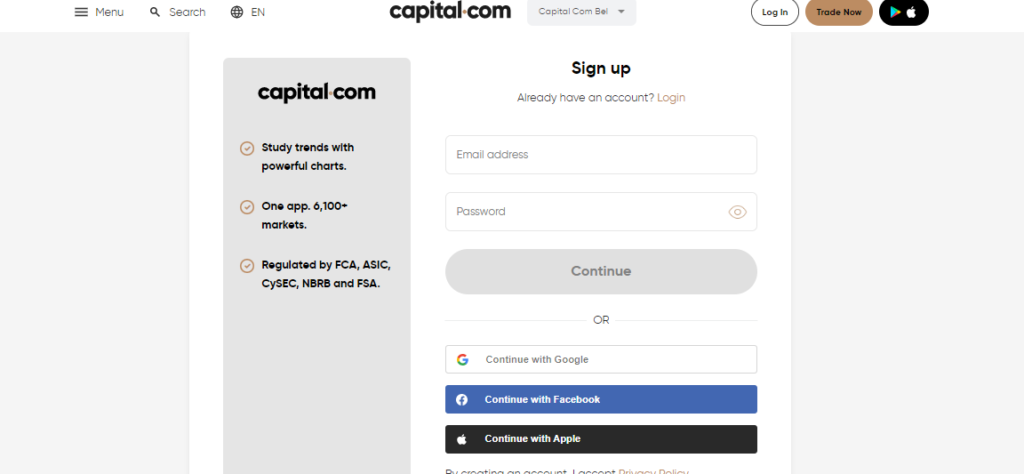

Step 1: Open an Account

Visit Capital.com, select “Trade Now,” and fill out the registration form that appears.

A password and email address are originally needed for this.

When prompted, provide your contact information and personal information after selecting “Continue.”

Following that, Capital.com will request a copy of a passport or driver’s license in accordance with FCA anti-money laundering requirements.

Step 2: Deposit Funds

Investors only need £20 to open a Capital.com account and begin trading. Select from a compatible e-wallet or a UK debit/credit card.

Capital.com also accepts bank transfers, although a £250 minimum deposit is required.

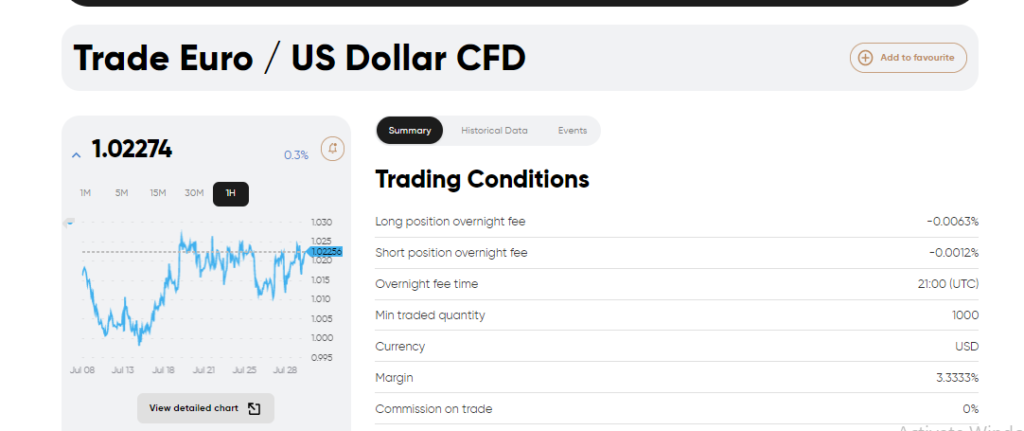

Step 3: Find the Day Trading Market you want to invest

On the homepage of capital.com click the “Menu” button, then “Markets.”

The several financial markets that Capital.com supports will subsequently be displayed.

Users can look for the precise market they want to trade on as well. For instance, we are looking for the currency pair EUR/USD in the figure above.

Step 4: Start Day Trading

Making an order is the last step.

Depending on whether an increase or reduction in the asset price is anticipated, users will need to select either a buy or sell order.

Next, pick a limit order and the price at which Capital.com should execute the transaction. Leverage, as well as stop-loss and take-profit orders, are also options.

Finally, Capital.com will execute the trade commission-free after receiving confirmation of the order.

Conclusion

The best day trading platforms provide a wide range of asset classes with reasonable costs and close spreads. We discovered that top-tier suppliers like Capital.com completely eliminate trading commissions across tens of thousands of markets.

Additionally, Capital.com has a £20 minimum deposit requirement, and UK traders can open a free practice account before investing real money.

Frequently Asked Questions

What is day trading?

The goal of the day trading strategy is to profit from rapid changes in price. The role will typically be available for a number of hours. In addition to speedy entrance and exit positions, day traders prefer tumultuous market conditions.

Is day trading legal in the United Kingdom?

Yes. Numerous day trading platforms, many of which are approved by the FCA, actually allow UK retail consumers.

What is the starting capital needed for day trading in the UK?

The minimum deposit amount at the day trading platform of the trader’s choice must first be determined. Additionally, investors frequently require a sizable quantity of funds in order to make day trading profitable. But here’s where leverage comes into play since day traders in the UK can increase the value of their position by as much as 1:30.

Is day trading taxed in the United Kingdom?

Yes, capital gains from day trading are subject to taxation in the United Kingdom. However, UK citizens are entitled to a £12,300 annual capital gains allowance. Additionally, there is absolutely no capital gains tax while using a spread betting platform.