Which FTSE 250 companies will soon be FTSE 100 components? Here are the nominations without further ado!

1. 4imprint Group (LSE:FOUR)

Designing and producing promotional goods and stuff with the help of 4imprint, which sells to both businesses and private customers.

Currently listed in the FTSE 250, 4imprint’s market capitalization has lately increased. This has largely been attributed to the share price’s spectacular 80% increase over the previous year.

With revenue for 2022 up 45% from the previous year, the company has been growing steadily. Although its business model is quite straightforward, it executes plans effectively and rapidly. As a result, it is gaining more consumers overall and especially in the US and Canada, which are its two largest markets.

By opening up the UK market and the rest of Europe, we believe the company can go even further. We see no risk of cash flow issues because there is no debt on the books. The size of the dividend being paid out, though, is something we are concerned about. We would prefer to see this kept within the company to aid with future expansion.

2. EasyJet (LSE: EZJ)

EasyJet offers flights and vacation packages, primarily in Europe.

EasyJet stock has increased by over 50% so far in 2023. We believe that there might be more to come.

The business said in May that revenue for the first half of the fiscal year had increased by 80% and was anticipated to rise further.

Analysts predict that the £3.7bn cap will change from a sizable pre-tax loss in the first half to a pre-tax profit of £345m for the entire year, which is even more encouraging. Investors will rush to buy the stock at the first evidence that it beats the latter.

However, none of this can be ensured. EasyJet is susceptible to fluctuations in fuel prices and potential air traffic controller strikes, just like every other business in this industry. Additionally, there is no dividend stream.

Delays therefore cannot be completely ruled out, despite our conviction that the Luton-based company will soar back into the FTSE 100.

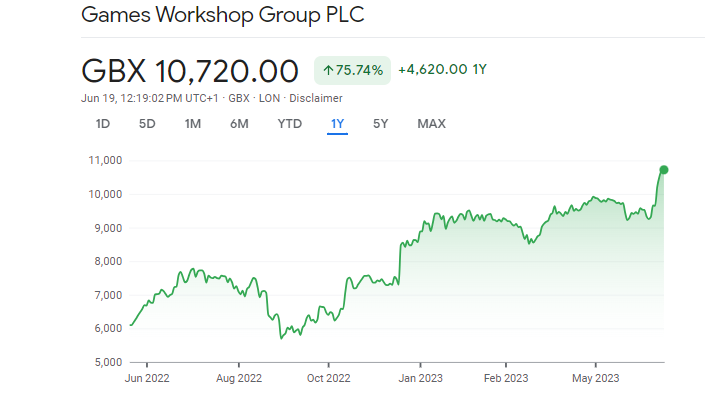

3. Games Workshop (LSE: GAW)

Miniature figurines and wargames are created and produced by Games Workshop, which then sells them online, in brick-and-mortar locations, and through independent retailers.

We predict that Games Workshop may one day enter the prestigious FTSE 100. We believe this because of a number of factors.

First off, the business has a large and passionate fan base. We just not fathom this expanding global consumer base turning their back on their cherished specialized activity. However, the company’s sporadic price rises can occasionally try customers’ patience, which could ultimately prove to be a problem.

Second, the company consistently pays cash dividends to shareholders, has a strong balance sheet, and has an outstanding profit margin. These are all necessary components for an increase in stock price.

Third, it appears to only be just beginning to monetize its intellectual property. An agreement made recently with Amazon Studios to make a Warhammer 40k movie and TV show could result in a huge increase in fans (and revenue).

And lastly, Games Workshop is a £3.1 billion company already. A 50% increase in the share price might be sufficient to get it a blue-chip Footsie listing.

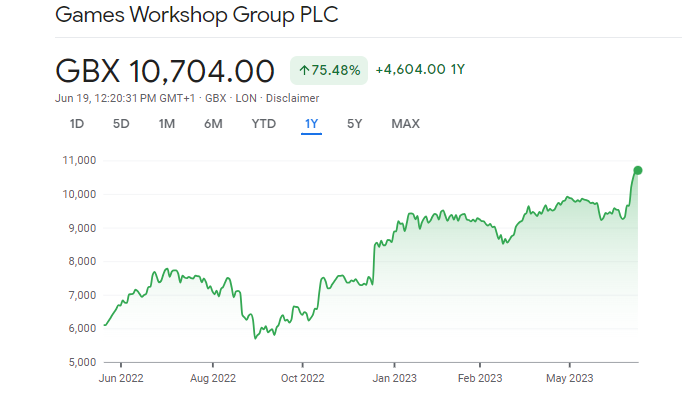

4. Games Workshop Group (LSE:GAW)

Market-leading miniatures and tabletop gaming platforms like Warhammer 40,000 are produced by Games Workshop.

A cult has formed around the fantasy goods produced by Games Workshop. As it develops abroad and increases licensing of its intellectual property (IP) across mass media, we anticipate this company’s revenues to rise.

The FTSE 250 company began operations in 1975 as a mail-order company before opening its first store in London three years later. Today, it operates a sophisticated internet business in addition to 507 locations around Europe, North America, and Asia.

Many people consider the company’s Warhammer goods to be the greatest in the field of tabletop gaming. This offers it the best defense possible against rivals. We anticipate a steady increase in demand for its miniatures and books as interest in the fantasy genre rises on a global scale.

The deal Games Workshop made with Amazon last year to create television shows based on its intellectual property excites us particularly. As hordes of new fans join the band, this could skyrocket royalty income and boost merchandise sales.

5. Marks and Spencer (LSE:MKS)

One of the oldest retailers in England is Marks & Spencer. It specializes in selling high-end household, clothes, beauty, and food items.

Marks & Spencer shares may be on their way to a trendy return to the FTSE 100 later this year after nearly doubling in value since October.

The retailer most recently smashed analysts’ consensus on every front, completely shattering expectations for the full year. Despite the cost-of-living problem, M&S experienced phenomenal sales growth over the past year. Even more encouragingly, dividends will be resumed later this year, to everyone’s delight.

As a result, despite the difficult times, Marks and Spencer has increased its market share in both its food and clothes categories. Because of the remarkable strides management has made in the group’s turnaround, the enormous increase in its share price is proof of that.

However, ongoing challenges with labor and food costs at the wholesale level could have an immediate negative effect on profits.

However, given the company’s capacity to survive such a challenging year, we are optimistic about its ability to return quickly to Britain’s top index as soon as possible.

Also read: How Buying FTSE 100 Stocks Could Help You Live Well In Retirement

Leave a Reply