How would you invest £1,000? We frequently get this question. Don’t underestimate the power of the money you invest just because a thousand pounds doesn’t seem like much in the grand scheme of things. A great place to start when constructing long-term financial flexibility is with even just £1,000.

In this article, we’ll examine some of the best ways to invest £1000 in the UK, along with our own recommendations on how and where to invest.

Best Ways to Invest £1000

You have a lot of investing alternatives with £1,000. However, if you just have that much money, you should make sure that it is easily accessible in case of an emergency. Although it is good to have so many options, picking one could be overwhelming. To get you started, here are a few investment options to invest £1000 in the UK.

1. Savings account

Since the finest yearly rates of interest are below 1%, saving money in a savings or money market account (MMA) may not sound like much of an investment in anyway. However, plenty of households may not have sufficient funds available to deal with crises. This is an excellent place to start if you’re in that situation.

Here are some reasons why basic savings accounts are the best way to invest £1000:

Although it is hard to forecast all of life’s twists and turns, including when they will happen, having some cash on hand will always help to soften the impact.

If it keeps you from taking out a high-interest loan, like a credit card, then the little yield on the savings account is very well worthwhile having. Try to save enough money for 3 to 6 months’ amount of expenditures.

2. Invest in a 401(k)

Who wouldn’t desire a pay increase? While many people feel underpaid, they can be missing out on a benefit that their employer provides: a matching 401(k) or other company-sponsored retirement plan account contribution.

Simple mechanisms are used. If your company matches contributions, they normally match your contribution up to a specified percentage of your gross salary. If a corporation provides a 3 percent reward, for illustration, it will give £30 for every £1000 of your earnings. Typically, though, you can only take advantage of this offer if you choose to contribute the same 3 percent of your income to a 401(k) or another retirement plan. If your employer provides it, it’s a quick and simple method to double your money. It’s also a wonderful way to reduce your tax burden because your contribution typically enters your account prior to taxes.

Keep going after the matching contribution, though. Most 401(k) plans allow for a maximum employee contribution of £20,500 for 2022 (plus an additional £6,500 if you’re over 50). Ask your HR department or benefits specialist how to set aside £1,000 for retirement if you have the money to invest.

3. IRA

If your workplace does not provide a retirement program or if your plan does not allow you to contribute extra money, you do not have no other options. IRAs, or individual retirement accounts, may be useful here.

An IRA does not offer business matching, but if you have earned income (from a job or self-employment, for example), you should think about it. IRAs can be divided into two categories: traditional and Roth.

A regular IRA’s personal contributions are frequently tax deductible, and gains accumulate tax-deferred until they are withdrawn. Being an after-tax contribution, a Roth IRA cannot be deducted. However, investments can be withdrawn without being penalised as long as the account was created at least five years prior, profits increase tax-free, and those profits can be withdrawn after you’ve reached the age of 59+.

Starting an IRA at an online brokerage with £1,000 is a terrific way to get started on the path to long-term wealth creation. Investors may contribute up to £6,000 in 2021 to an IRA, plus an additional £1,000 if they are over 50.

4. Taxable brokerage account

Opening a taxable investment account is a good choice if you have £1,000 to invest and have used all three of your other options. Think of this as a savings account because any generated profits and interest will be taxed yearly. However, compared to a savings account, the upside potential is greater.

Although there is a risk involved in investing, there is no assurance that you won’t lose your £1,000 in the process. To lessen the uncertainty that comes with investing, there are many solutions accessible in brokerage accounts (more on that below). Additionally, keep in mind that a £1,000 deposit should only be the beginning. Making consistent deposits is key to successful investing; the more frequently, the better. After opening a brokerage account, think about setting up a regular deposit either monthly or quarterly to move closer to your financial goals.

5. ETFs

Once you’ve opened an IRA or brokerage account, you can begin picking out where to invest. If you’re just getting started, an exchange-traded fund is a smart place to invest £1,000 in 2022.

There are tens of thousands of ETFs available, many of which follow a benchmark like the UK stock market or bond market. ETFs often offer lower costs than many other investing options, including actively managed mutual funds, can accept even modest investments, and they are easy to purchase.

Learn more: Best ETFs You Should Buy In UK 2022

6. Robo-advisor

You don’t want to look for and manage a portfolio of investments? Use a robo-advisor, an online tool that automates some aspects of managing a portfolio and a financial plan.

There are numerous robo-advisors available nowadays. The majority of them will pick a selection of funds or ETFs with low to zero initial deposit thresholds (£1,000 is more than sufficient to get began) and that are tailored to your long-term goals. The service will assist you in setting up a plan for making recurring payments to help you reach your ultimate financial destination. General management costs are just under 0.3 percent annually or £3 for every £1000 in account balance.account.

Learn more: Best Robo Advisors for UK Investors in 2022

7. Stocks

If you want greater authority over your investments and the businesses you intend to invest in, think about buying individual stocks. You can create a well-rounded portfolio of starter stocks even with just £1,000. Even fractional shares of such stocks with high share prices can be purchased by investors through many brokerages.

Individual equities may be held in taxable brokerage accounts as well as IRAs. This method of delaying taxes in a brokerage account is good because gains in individual equities aren’t taxed until you sell them.

Stocks represent a stake in a business. Few people launch a new business with the intention of doing so for a little period of time. Similar principles apply when owning stocks. The more one stays with a good company, the more power comes from owning a portion of it. The key is to conduct your research and buy with the intention of owning the stock for at least a few years, if not forever if you choose to go this route.

Learn more: Most Traded Stocks UK – Investors Guide

8. Investing in P2P

On a variety of P2P platforms, you can invest £1000 in peer-to-peer lending. These sites offer investors the opportunity to earn interest on a range of assets. These investments typically have a duration of two to five years and provide respectable returns at minimal risk. Even though the coronavirus outbreak has been in the headlines recently, many P2P networks are still accepting new investors. If you’re seeking a Cashback chance, investing in P2P is also advantageous.

Diversifying your P2P platform investments might provide higher returns in addition to avoiding dangerous ones. For instance, you may spend ten euros on one hundred people rather than one thousand pounds on one person. Compared to investing £1000 in just one person, this is far safer. Additionally, you have more borrowers the more money you put into P2P investments. You can lower the risk of a few bad loans by diversifying your investment.

9. Cryptocurrencies

When you are willing to trade at a high level of risk, the bitcoin market is fantastic. The most innovative cryptocurrency, known for its tremendous volatility, is this digital coin. One Bitcoin is now selling for around £47,000 at the moment this article is being written and is becoming more and more popular every day. It is the most promising cryptocurrency and has created billionaires in real life. It has increased by almost 700 percent since 2020, vastly outperforming itself.

Learn more: Cryptocurrency Trading in the UK

10. Gold

In the UK, you can invest £1000 in commodities like gold. Gold has historically fared well both as an investment and in terms of returns. During times of market stress, gold is frequently utilized as an investment asset to reduce market risk. Gold serves as an insurance against both currency risk and inflation. risk. Due to its excellent hedging capabilities, gold is the safest investment and is very popular in the UK. It is typically bought in its physical form. However, you can invest in gold right now by purchasing gold-tracking exchange-traded funds (ETFs).

A sort of exchange-traded fund called SPDR ETF enables investors to indirectly invest in gold and other metals. On your behalf, the ETF provider purchases and holds onto gold.

Learn more: Gold Trading UK – Beginners Guide

Best sites to invest £1000 in the UK

There are a huge number of online brokers that are governed by the FCA and affiliated with the FSCS, but you need also to consider other things like fees and commissions, minimum investments, and support charges.

We have listed the top online brokers that provide everything you need in order to benefit you more by saving you time. You don’t need to look for other broker platforms because this list contains them.

1. eToro

eToro is the best broker to Invest £1000 in the UK. From rules to minimum investments to fees and commissions to supported payment methods, this online broker has everything you need. By using this online broker, which is governed by the FCA, you can access several asset classes and diversify your portfolio. Access to more than 2,400 shares from 17 UK worldwide markets is made possible by this brokerage platform.

There are no commission fees on this platform. That implies that buying and selling are completely free. CopyPortfolios and CopyTrading are also available.

This brokerage platform’s user interface is user-friendly for beginners and provides a variety of payment options for the convenience of its investors.

2. Fineco Bank

Fineco Bank is the next online broker platform on our list. This online broker is FCA-approved and collaborates with FSCS to protect the money of its clients. You have access to a variety of asset classes, thousands of foreign equities, and dozens of exchanges and markets through this platform. The absence of support for cryptocurrencies and copy trading tools is FinecoBank’s lone flaw. It involves little investment and only a little cost. This tiny fee is charged for each international exchange you use to trade. FinecoBank requires a minimum deposit of £100.

How to Invest £1000 in the UK?

You are prepared to begin investing your £1000 once you have chosen your investment options and an online broker. The actions you must take to make an investment are listed below.

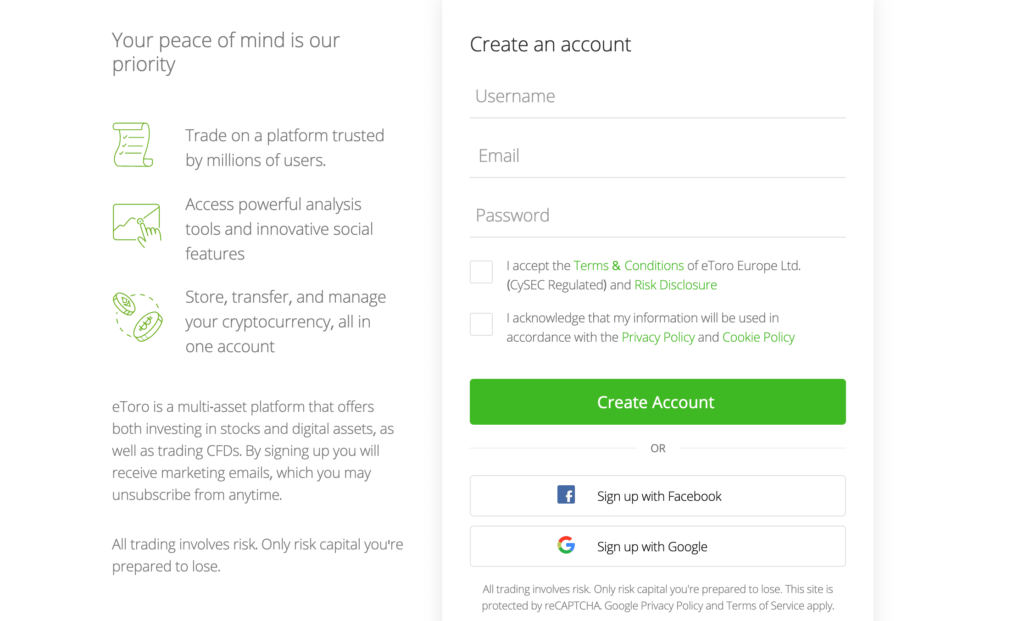

Step 1: Open an Account

Opening an account with your favourite brokerage is the first step in beginning an investing career. To help you understand, we’ll use eToro as an example in this section. You must first complete a registration form on eToro by providing your contact information, including your name, phone number, email address, and date of birth.

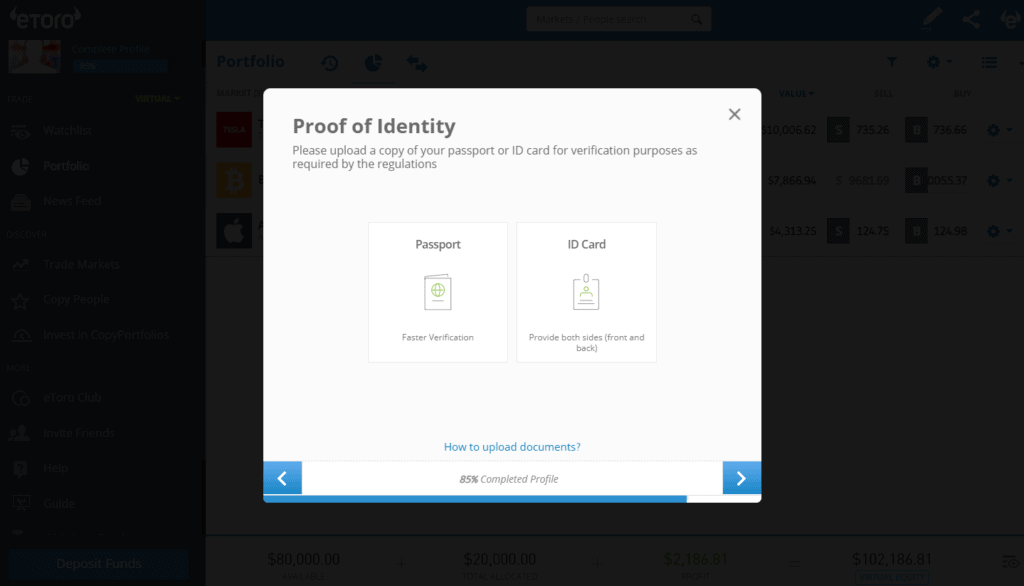

Step 2: Verification

You must go through a verification process by providing a copy of your ID proof after enrolling on the platform. A copy of your passport, licence, or residence verification are acceptable forms of identification.

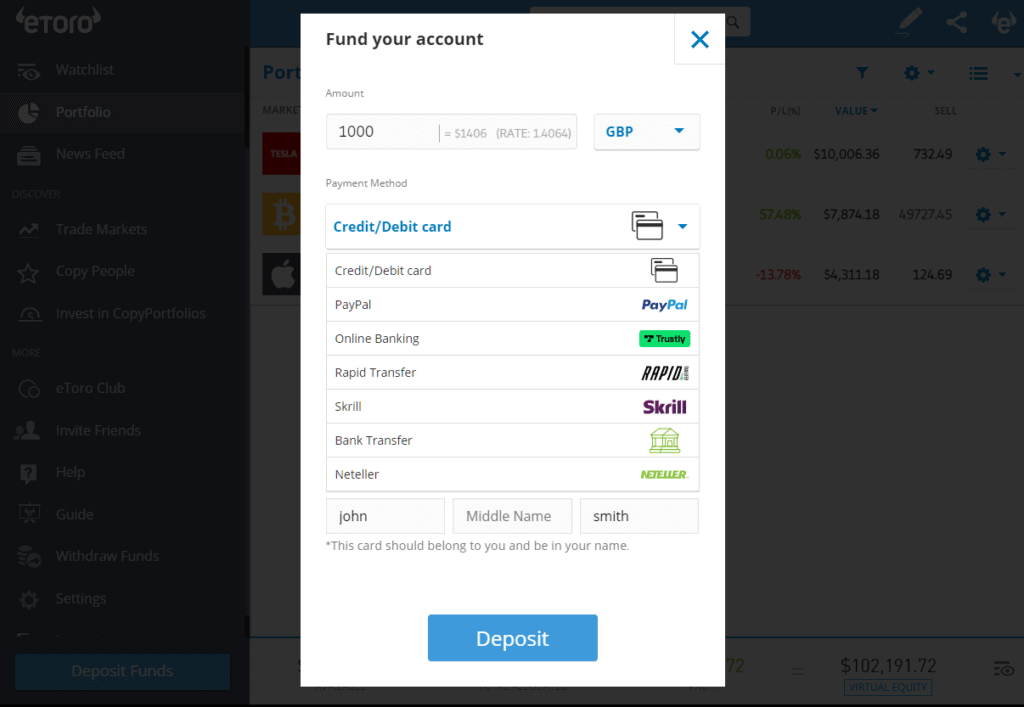

Step 3: Deposit Funds

After successfully completing the registration process on this platform, you must fund your account by making a deposit. For the convenience of its traders, eToro provides a number of payment options for making a deposit, including credit/debit card, Neteller, PayPal, bank transfer, and Skrill.

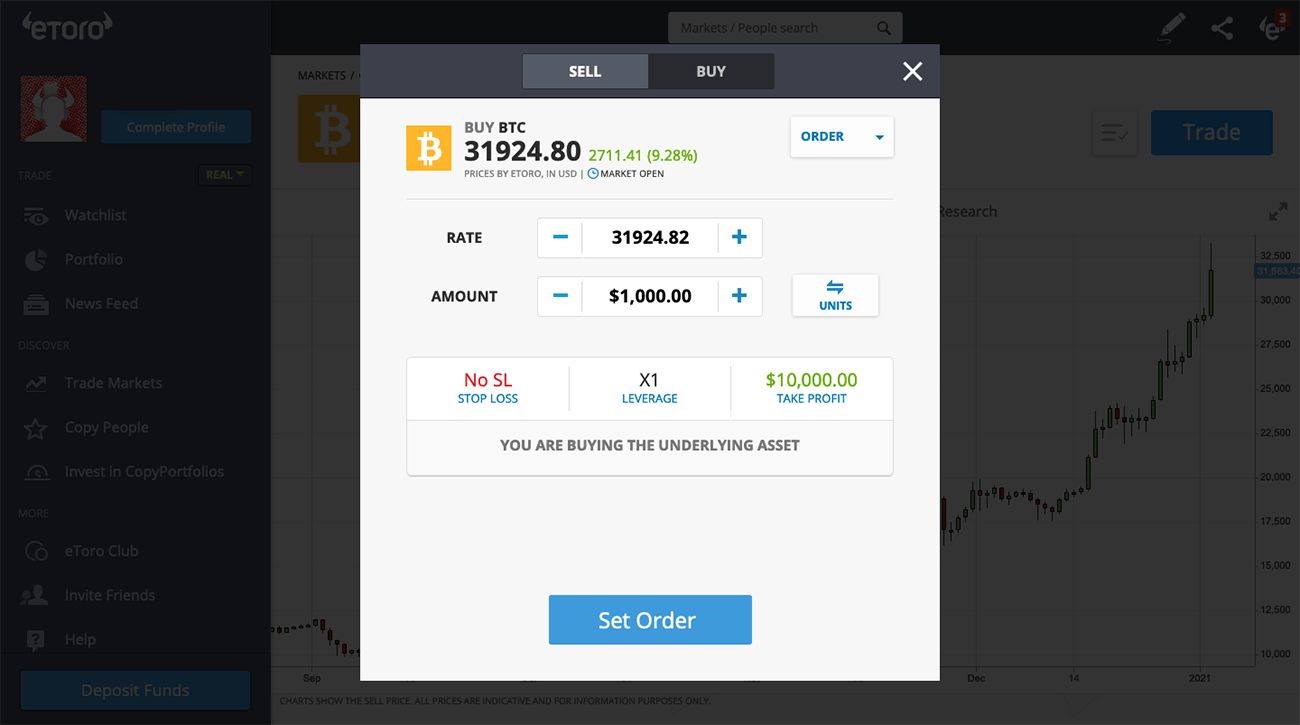

Step 4: Invest £1000

You can access a variety of assets with eToro; simply choose the one you want to invest in, input your desired investment amount, and then confirm your purchase by pressing “Open Trade.”

Conclusion

Even if making a £1,000 investment is unlikely to make you rich, you shouldn’t minimize the potential effects on your financial status. It could set you on the road to a brighter financial future if used appropriately. Consider your options, such as whether you have high-interest debt and the types of investments you would like to make, such as stocks and shares or yourself.

Last but not least, always check to see if the online broker platform you select is commission-free, has access to several asset classes, and is governed by the FCA or other jurisdictions.

Frequently Asked Questions

What assets can I buy with £1000?

£1000 can be used to purchase a variety of assets. You can purchase cryptocurrency, stocks, exchange-traded funds, and other assets if you pick eToro. You can invest small amounts with this internet broker.

How do I invest £1000in the United Kingdom?

£1000 can be invested through an internet broker. You only need to set up an account on the platform, fund it, and then begin investing.

How much can I earn by investing a $1000?

The asset and level of risk you are willing to accept will determine how much money you make. But the expected gains from securities like stocks and cryptocurrency are greater.

How can I make a risk-free investment of £1000?

Since risk is inherent to investments, there is no way to avoid it. There is no risk-free investment strategy or platform. However, if you’re still looking for a means to invest without taking on any risk, you might want to think about UK Gilts (government-issued bonds), Cash ISAs, or FSCS, all of which have a risk of less than 1%.

Is it worthwhile to put £1,000 into Bitcoin?

Bitcoin experienced a meteoric rise in 2017 and is regarded as the asset with the highest performance over the previous ten years. It is, however, rather volatile as well. It is worthwhile to invest in, but you should diversify your holdings and keep stake sizes low.