The foreign exchange market is the largest currency market in the world. Most of the foreign exchange market activity is driven by exchanges between large international banks. However, a small fraction of market activity is used by Forex traders who want to take advantage of the price fluctuations that exist between currencies to make a profit. Forex currencies are traded like other asset classes such as commodities, stocks, and indices. To understand how to trade Forex, it is necessary to understand the market background.

To find out, let’s take a full look at what Forex means in this comprehensive and detailed guide. What are the advantages and disadvantages? How can you approach and act accordingly, while mastering important concepts that will help you manage and orient your system in the best way possible? Which currencies pair with which options?

What is Forex UK?

The foreign exchange (forex) market is the world’s largest trading industry, with approximately $6.6 trillion traded every day. Most of that number comes from big banks, hedge funds, and financial institutions, but the retail market has never been stronger. In other words, everyone in the UK can now trade Forex from the comfort of their home. The most active forex trading site on the UK market now offers a comprehensive mobile app. This means you can buy and sell currency wherever you are.

The market is very dynamic and liquid. The forex exchange rates change quickly because of the highly liquid market, it changes with political changes, market news, global calamities, and other events. Because currency markets primarily reflect political and economic events in different regions, currency traders can take advantage of these market influences through trading.

Also Read: Best Ways to Invest Money UK- Complete Guide

What is Forex Trading?

The price of one currency relative to another is not fixed. Rather, the pound can rise or fall in value against the US dollar at any time. This creates opportunities for currency trading. In the foreign exchange market, you can estimate the future value of a currency by buying that currency and selling another currency at the same time. If the value of the purchased currency rises, you can cancel the trade and make a profit.

The best way to understand how currencies are traded in the UK is to give an example. Let’s say you want to bet on the strength of the Euro and the decline of the Australian Dollar. To grab the opportunity here you can invest in Euro and sell the Australian Dollar. If the price difference widens, you can sell your Euro position and buy more Australian Dollars than you originally sold. This additional Australian dollar represents the profit earned from the transaction.

Forex Currencies

All currency trading activities focus on currency pairs. As the name suggests, a currency pair consists of two competing currencies. For example, British Pounds and Australian Dollars are denominated in GBP/AUD. Also, USD/CAD stands for US Dollars and Canadian Dollars.

In every case, each currency pair has an exchange rate that is determined by the forces of the market. Later in this guide, we will explain how supply and demand affect currency pair prices. Let’s take the example of GBP/AUD, Here GBP is the base currency and AUD is the quote currency. If GBP/AUD is valued at 1.81 on your chosen UK Forex trading platform, it means the market is willing to pay $1.81 for every pound received. This rate of change varies from second to second.

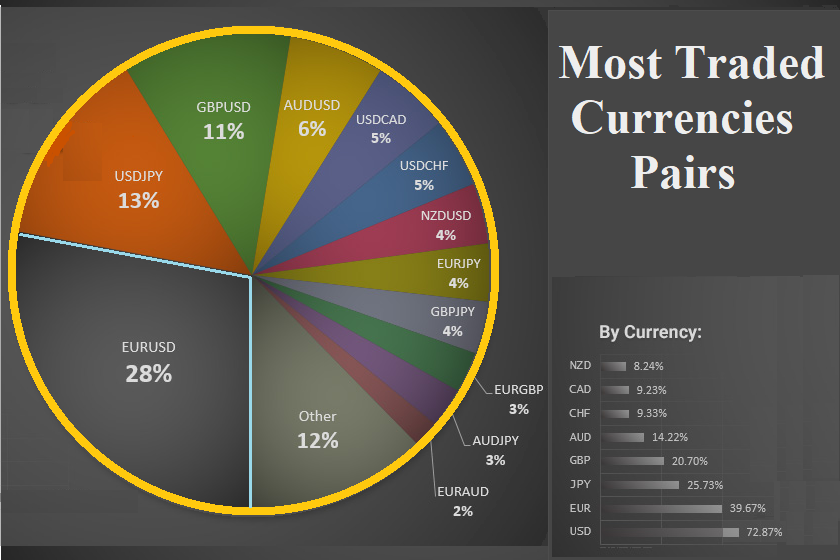

Currency pairs can be divided into three main categories: Major, Minor, and Exotic.

Major Pairs

The major pairs are by far the most popular currency pairs for online trading because it contains the highest liquidity, highest volume, and most competitive spreads. The key to the main pair is that it should include the US dollar. Along with the dollar, there will be strong currencies such as the British pound, Canadian dollar, or Euro. The top major pairs are-

- EUR/USD

- GBP/USD

- USD/CAD

- USD/USD

- USD/JPY

- USD/CHF

- NZD/USD

Minor Pairs

A smaller pair is worth considering, even for inexperienced UK Forex traders. Eventually, they will contain two hard coins. The main difference is that minor pairs do not include US dollars. Liquidity levels are slightly lower compared to the majors, but the minor liquidity still allows for a lot of commercial activity. The top minor pairs are-

- EUR/AUD

- AUD/CAD

- EUR/NZD

- EUR/GBP

- GBP/JPY

- EUR/CAD

- EUR/JPY

Exotics Pairs

Exotic pairs are so volatile in comparison to majors and minors pairs. The liquidity and trading volume are so low that the exchange rate can move like a parabola. Ultimately, this is because exotic pairs often include emerging market currencies. It can be Mexican Peso, Kenyan Shilling, or Chilean Peso. Top exotics pairs are-

- CHF/ZAR

- CHF/RUB

- TRY/JPY

- USD/CZK

- USD/DKK

- USD/HKD

Forex Trading Orders

When trading currencies in the UK, you must use a suitable broker. In return, the broker must know what trades you want to make. This includes the direction of the market you think the pair will take, as well as other indicators such as equity and leverage. Therefore, you need to place a series of Forex buy and sell orders so that the broker of your choice can fulfill your request. The most important orders to consider are-

Buy or Sell orders

Some orders are optional in the UK foreign exchange market, but buy and sell orders are a minimum requirement. This is because these orders tell the broker if they think the currency pair will rise or fall in value.

- Buy Order – Place a buy order when you believe a currency pair is rising in value.

- Sell Order – Place a sell order when you think a currency pair will depreciate.

Market and limit orders

Once you have decided whether to place a buy or sell order, the next step is to place a market or limit order. Simply put, this tells your broker when you want to enter the market.

- Market Order- Place a market order and the Forex Broker of your choice will execute the trade immediately. You will receive the following market price. As the currency pair moves from one second to the next, the price you get may be slightly higher or lower than the price displayed on the trading screen.

- Limit Orders- Limit orders allow the broker to select a price at which to execute a trade. For example, GBP/AUD might be 1.8105. However, I do not want to enter the market until the price drops to 1.8100. So, you need to place a limit order at 1.8100. Your limit order will remain on hold until this price is adjusted in the market.

Stop-Loss and Take-Profits Orders

Market and limit orders

Once you have decided whether to place a buy or sell order, the next step is to place a market or limit order. Simply put, this tells your broker when you want to enter the market.

- Market Order – Place a market order and the Forex Broker of your choice will execute the trade immediately. You will receive the following market price. As the currency pair moves from one second to the next, the price you get may be slightly higher or lower than the price displayed on the trading screen.

- Limit Orders- Limit orders allow the broker to select a price at which to execute a trade. For example, GBP/AUD might be 1.8105. However, I do not want to enter the market until the price drops to 1.8100. So, you need to place a limit order at 1.8100. Your limit order will remain on hold until this price is adjusted in the market.

Take-Profit Orders

In particular, you don’t have to go too far for take-profit orders because they work the same way as stop-loss orders. However, stop-loss orders reduce losses while take-take orders lock profits. This means you can set realistic profit goals without having to sit at your computer for hours to manually complete trades.

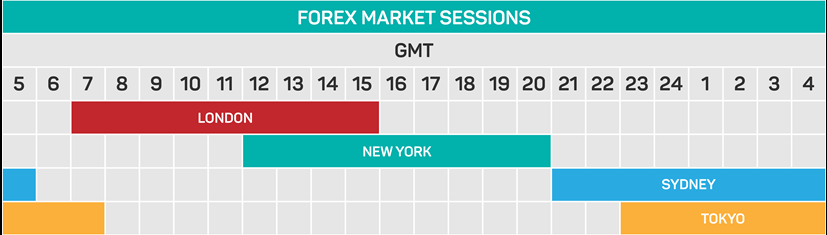

UK Forex Market Hours

Forex can be traded 24/7. However, most business takes place between Sunday evening and Friday evening UK time. The US market closes for the week on Friday night.

The bottom line is that you can trade at any time you think is right. However, we recommend that you adhere to the above deadlines. This is because it has the advantages of high liquidity, trading volume, and low volatility. This means you can benefit from the tightest spreads. To be clear, most UK forex trading sites allow 24/7 trading, but the conditions aren’t really helpful for beginners on weekends.

Forex software

Having the right forex software is the key to successfully and consistently making profits in the forex market. Currency trading shares many tools with trading stocks and commodities, including price charts and technical indicators. Two software tools are present in the market- Forex Signal and Forex Robot.

Forex Signal

Forex Signal as the name suggests are the signals that convey the trading opportunities to the investors. These are the automatic market signals that spot profitable opportunities as well as the upcoming threats in the market. Forex signals are related with prices changes and others.

Alerts generated by forex signals are especially important for intraday trading, where missing a sudden price change can mean the difference between a profit and a loss. However, it can also be very useful if you want to enter the Forex market but cannot watch the market from your computer all day.

Forex Robot

Forex robots take Forex signals to the next level. Signs are simply warnings. It is still up to you to make trading decisions as soon as you receive the signal. For robots, forex signals are accompanied by certain trading actions that occur automatically when the signal is triggered. For example, a forex robot can trigger a trade to be automatically triggered when a currency pair reaches a set price level and then to close a position when another price level is reached.

It is important to be careful when using FX robots, as automated trading can happen quickly. You should be notified when a transaction starts, but the location may open and close before it even reaches your computer. Thoroughly test your forex robot with a paper trading account before using it for live trading.

Forex Strategy

There are various strategies for trading Forex in the UK. The question arises that which is the best strategy? The best strategy is defined after analysing your risk tolerance factor. We recommend that you practice your forex strategy with a demo account before trading using real money. There are three forex strategies- scalping, swing, and price action.

Scalping Trading

Scalping trading is a form of same-day trading that relies on fast trading with small margins. The profit of a single trade can be only a fraction, but scalping traders typically make dozens of trades per day. Small profits can be accumulated over a day, which can turn out to be significant.

Swing trading

Forex swing trading is a multi-day trading strategy that aims to capitalize on changes in price dynamics. A swing trade may open in response to strong momentum or a price reversal. If the price continues to move for days or weeks, your earnings may increase. Then the swing trade closes as soon as the momentum subsides.

Price action trading

Price action trading analyses price changes as opposed to technical indicators to determine the future price of a currency pair. Using price as a leading indicator can be helpful as it indicates your best position in the market situation.

How to Trade Forex?

All you have to do is sign up for the platform of your choice as described below and make the process fairly fast with just a few clicks.

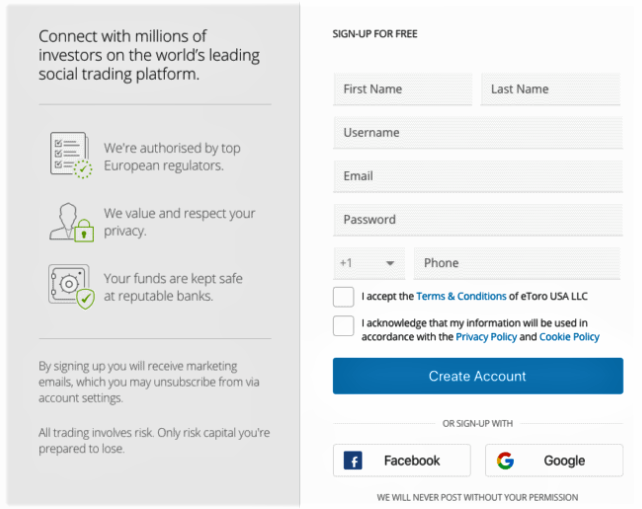

Step 1 – Open your eToro account

If you are new to eToro, you must first register with the platform by creating an account. To do this, you need to go to the home page of the store. Next, if you viewed the site in English, select the little French flag and then click the Sign up Now button. You will then be taken to a registration page where you will be asked to enter your username, password, and email address. Simply tick the two boxes indicating that you agree to the website’s general terms of use, confidentiality, and cookie policy and click on the “Create Account” banner to apply the action.

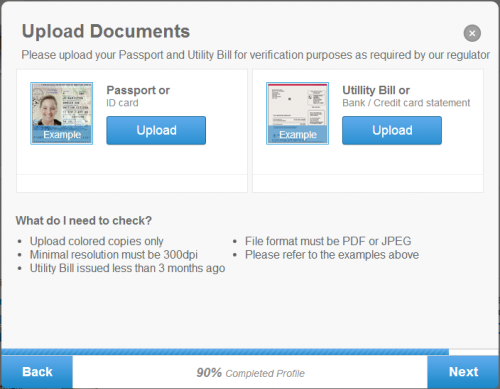

Step 2 – Account Verification

There are two ways to verify your account. After completing your profile, you will simultaneously receive an email confirming your registration either directly on the page or on eToro. The first authentication is performed with a mobile phone number. You will receive an SMS with a code that must be reported by the platform.

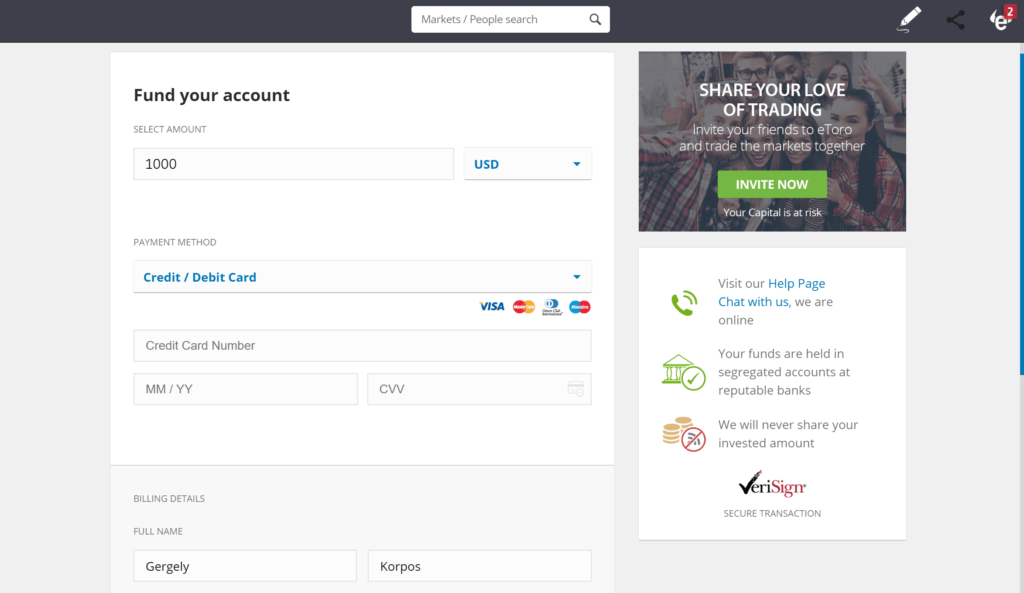

Step 3-Deposit funds

You are now ready for the most exciting part of the process: depositing your funds. Simply deposit the funds by credit card, PayPal, Rapid Transfer, bank transfer, Skrill, or Neteller.

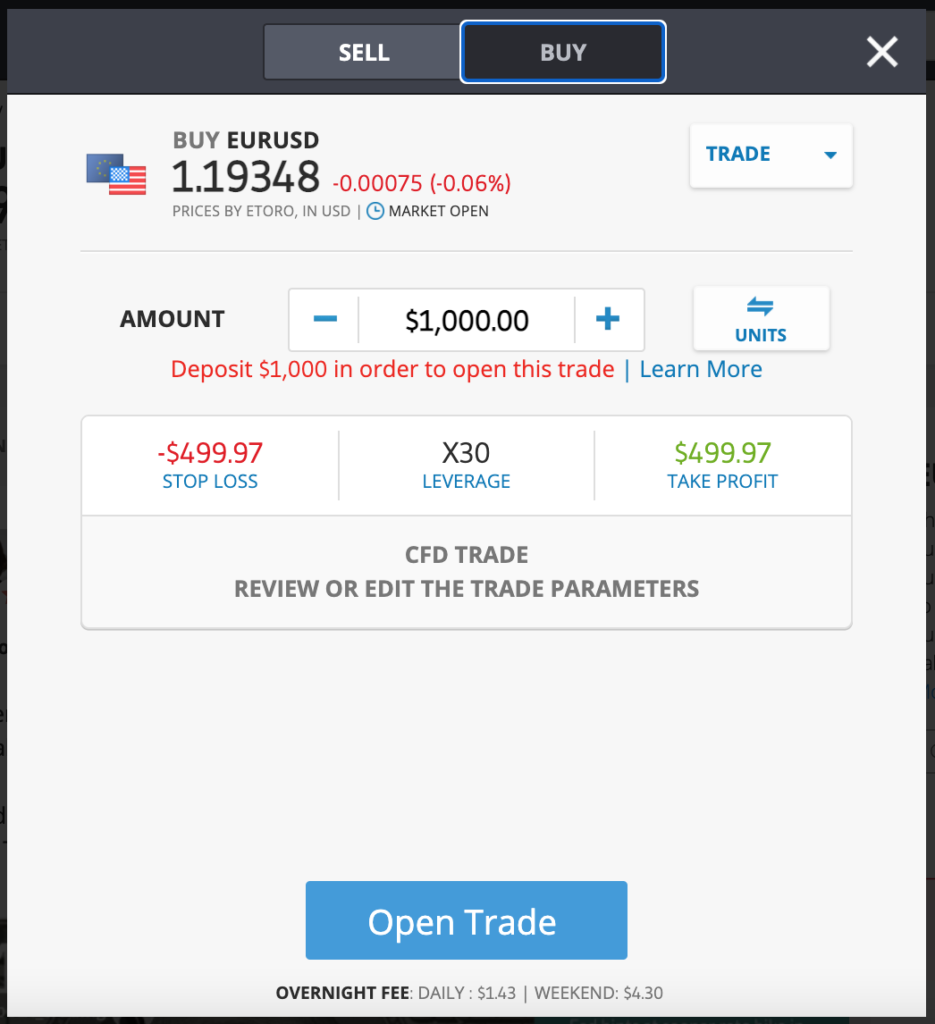

Step 4- Start investing in foreign exchange

Once the deposit is complete, simply search for coins by clicking on “Markets” in the search bar in the top center or the gray menu banner on the left, then clicking “Currencies” below the picture. You will then be taken to a page dedicated to coins and 52 pairs (Major, Minor, Exotic) where you can bet and a graph of variations.

You then need to open a position by clicking on the “Invest” banner. The long-awaited untouchable moment to invest in Forex trading has arrived. To do this, select “Buy” or “Sell” at the top of the window that will open, then select “Invest” at the bottom.

Top online brokers

eToro

eToro was founded in 2007 as the first online broker known for inventing “social and collaborative trading” with booming popularity. Its headquarters, initially in Israel, are now located in Cyprus. The platform allows you to invest in most financial markets, whether stocks (CDFs), currencies, cryptocurrencies, commodities, or ETFs (trackers). Forex has 52 currency pairs, both major and minor currency pairs. Also, the good news is that they charge no fees for their transactions and the tracking costs (spreads, account management, sophisticated strategies, inactivity, withdrawals, etc.) are competitive.

Features

- Brokers regulated by international organizations

- Ideal for novice traders

- Trade stocks with 0% commission

- It provides demo accounts for educational purposes.

- PayPal used as a payment method

Capital.com

Capital.com, a stock trading company founded in Cyprus in 2016, has less than 800,000 users to date, has won more than 7 international awards in the past two years, and highly appreciated its achievements.

These include the best currency trading apps from “UK FOREX AWARDS” in 2018 and Europe’s most innovative brokers from “The EUROPEAN” in 2018 or the best online trading platforms from “SHARES” in 2018 and 2019. Here you have access to over 3,000 markets: 2,733 stocks, 142 currencies, 84 cryptocurrencies, 24 commodities, and 34 indices.

Features

- FCA Regulated Brokers

- Response Support, 24/7

- Offers many financial assets

- No brokerage fees

- Using AI for Optimal Commerce

Conclusion

Investing in Forex is an attractive way to get used to trading quickly and proficiently. However, this decentralized market is not for beginners but offers profitable prospects, so many seasoned brokers do not hesitate to specialize to take advantage of liquidity. However, the risks are present and it is important to follow international news as much as possible and ignore the scope of risks that affect countries where currency fluctuations are more agile investment activity. Enjoy real-time information and personalized advice with confidence and security with an online broker like eToro, a true reference in the market.

FAQs

What is a Pip?

A pip in the Forex transaction is referred to the one-hundredth decimal of 0.01%. It is often used to quantify the spread in currency trading, which is the difference between the buy and sell ratios of a currency pair. For example, if the EUR/USD pair is traded at 8 pips, you will pay a 0.08% transaction fee.

What is Leverage in Forex?

Leverage allows you to borrow money from a broker, allowing you to increase the size of your trading position. For example, with 10:1 leverage, you only need €100 in your trading account to buy €1,000 worth of currency. Keep in mind that leverage usually entails additional costs and risks.

What is Margin in Forex?

Margin comes into play when applying leverage in Forex trading. Margin is the minimum amount that must be in your trading account as part of your trading volume. If your trades start losing money, you may need to add more money to your trading account than your margin.

What is Forex Spread Betting?

Differentiated betting on Forex is an alternative to CFD trading. In the UK, margin betting can be advantageous as winnings from margin betting are not subject to capital gains tax.