Indices trading is a popular way for investors to gain exposure to financial markets without having to research and invest in company stocks themselves. Stock index trading is one way to reduce risk when trading stocks. Instead of buying and selling individual company stocks, traders should trade indices or collections of stocks.

This is the comprehensive guide on indices that covers their meaning, types, and trading strategies. In this guide, you will get all the information related to indices trading. Read and learn that how you can make a profit from trading indices in the UK.

What is Index Trading?

An index is usually calculated from the prices of individual stocks as a weighted average. Each index lists the criteria that a company must meet to be included. By tracking the performance of large groups of stocks, indices are designed to reflect stock market conditions across a wide range of industry sectors or countries as a whole.

Indices trading is different from trading commodities, where traders invest in commodities, or currency trading, where they invest in currencies. An index is a number that reflects the health of a market or economy. Therefore, investing in an index is essentially investing in a fund that reflects the movement of the index.

Index trading allows you to invest in a very large part of a market or the entire market. For example, in stock index trading, you have the option to invest in the FTSE 100, NASDAQ, Dow Jones, or S&P 500. All of these reflect other general characteristics of the market. Investing in the Dow, for example, is investing in a significant portion of the industrial market.

How are indices calculated?

The first exponent was calculated as a simple average. The stock prices of all components are summed and divided by the number of companies. However, some major indices, such as the NASDAQ-100 and Hang Seng, are weighted averages today. The two most important formulas for calculating the value of a weighted index are weighted value and weighted price.

Market Value Weighted Index

A market-weighted index is calculated based on the total market capitalization of a company. This means that the largest companies have the greatest impact on the value of the index. Each company’s market capitalization is calculated based on its publicly available floating stock. The free-float market capitalization of a company is less than its overall market capitalization because it excludes insider equity in the company.

Price weighted index

A price-weighted index is calculated based on the stock price of an individual stock. This means that companies with higher stock prices have a greater impact on the value of the index. Price-weighted indices are less common than indices based on market capitalization.

Types of Indices

There are different ways of exposure to the index, depending on the financial instrument you are most comfortable with and the risk you are willing to take.

Index fund

Index funds may be mutual funds or include some exchange-traded funds. In their mutual fund form, they are a collective investment vehicle that pools investors’ money and invests in all the companies that make up the index. These types of mutual funds were called trackers, but today they are more commonly referred to as index funds. Although this is not limited to stock indices, this guide will focus on stocks.

Index funds typically charge investors in the 0.25% to 0.85% range. It may sound like a no-brainer, and it’s certainly a lot less than you’d expect from an actively managed mutual fund, but it can still affect your earnings due to compounding effects.

Exchange-traded funds

Exchange-traded funds are similar to mutual fund trackers in that they track the price of an underlying asset or basket of assets that are frequently represented in an index, but unlike mutual fund index trackers, ETFs on the stock market is like regular stocks, it has been traded. ETF has a stock price that constantly moves in real-time according to the supply and demand for stocks of buyers and sellers. ETFs are very popular with individual investors because they provide a cost-effective and flexible way to access stock indices in addition to other asset classes and hard-to-reach niches.

Contracts for Differences (CFDs)

A contract for difference (CFD) is a derivative created by a financial institution where parties to a transaction agree to pay the difference between the opening price and closing price. These derivatives and the CFD brokers they offer are popular with UK investors and several brokers are specializing in them. They can be used to gain exposure to all kinds of financial asset classes, not just stock indices.

By their composition, they are riskier than ETFs or mutual funds, which means that they are more expensive to hold for long periods because issuers charge an overnight fee to hold positions for contract holders.

Options and Futures

Options contracts give the owner the right to purchase an asset at a specific price, but no obligation. Once reserved for professional and institutional traders, these derivatives are now much more common, especially in the United States.

Futures are similar to options but have the right, but not the obligation, to buy or sell an asset before expiration. Options contracts are more acknowledgeable in comparison to futures. Two types of options are available- call option and put option. If you expect the stock to go up, buy a call option and buy a put option. Read our article on Futures to know more about What is Futures Trading?

Benefits of Trade Indices

Diversification

Many individual investors choose to trade indices on their index accounts, especially because they save for retirement. Index trading gives investors exposure to multiple companies. The stock price of some companies declines over time, while others rebound. Dispersion compensates for extreme volatility.

No major changes

Index values fluctuate with each trading session, but you will not lose or gain large sums unless there are major changes such as market crashes, geopolitical events, or natural disasters.

Less Risky

Indices are less risky than investing in individual stocks. If you invest in company stock and the company goes bankrupt, you may lose your investment. However, if a company fails in the index, it may be replaced by the next largest company in the index. Depending on the size of the insolvent company and the performance of other components, the value of the index may decline temporarily or have no appreciable impact.

Better Returns

As you will now understand, investing in index funds has several benefits. The most obvious of these is that they consistently outperform other types of funds in terms of long-term total returns.

Low Fees

Another benefit of investing in index funds is low fees. Because index funds are passively managed compared to other funds, management fees are generally low. Index funds do not have a trade manager or research team to analyze and recommend stocks. Instead, an index fund’s portfolio simply replicates the management of the selected index.

Low Transaction Costs

Most index funds hold investments until the index changes. Transaction costs are low because this rarely happens. These lower costs can have a huge impact on your bottom line over time and make you more profitable.

Index Trading Risk

Low risk with long-term investment

Investing in an index and leaving it as part of a long-term investment strategy is a low-risk approach as you can offset your losses with the index over time. Stocks are the most important asset class over the long term.

Short-term trading is riskier

However, trading is different from medium-to-long-term investments and is usually short-term. Because of this, the short-term investment risk may be higher. This is especially true if you cannot keep the position open until it becomes a profitable position, you cannot meet a margin call, or there is no Stop Loss and Index on the position falling sharply, thus you are exposed to large losses.

Indices Trading Strategies

We have picked the top strategies for indices trading that will generate profits-

Moving Averages

Moving averages show the direction the index is moving and the potential levels of support and resistance. Moving averages themselves can act as support and resistance. A moving average is formed by finding the average closing price of an index at a specific point in time and then plotting that point on a price chart. The result provides a smooth line that follows the price movement of the index.

You can adjust the volatility of the moving average by adjusting the time frame the indicator sees to get its average price. A moving average that uses fewer time frames to determine the average is more volatile. Moving averages, which take longer to determine the average, are less volatile.

Oscillating indicator

Oscillating indicators move back and forth as the index goes up and down. Oscillating indicator determines how the current trend is moving. If the volatility indicator is too high, the index is considered overbought. This suggests that the index is at risk of losing momentum and retreating, either declining or consolidating. If the oscillating indicator moves too low, the market is considered oversold. This suggests that the index is at risk of losing momentum and retreating, either rising or consolidating.

Price Pattern

Learning to recognize different price patterns gives you an advantage over traders who only use basic or technical indicators. A price pattern is in the form of a chart that provides information about how traders think and feel at different price levels. There are two types of course patterns: continuous patterns and reversal patterns.

A continuation pattern provides an early warning when an index is likely to resume a trend after a short-term consolidation and tells you how likely the index is to move in that direction. Of course, a continuous pattern is not perfect, but it does increase your chances of success.

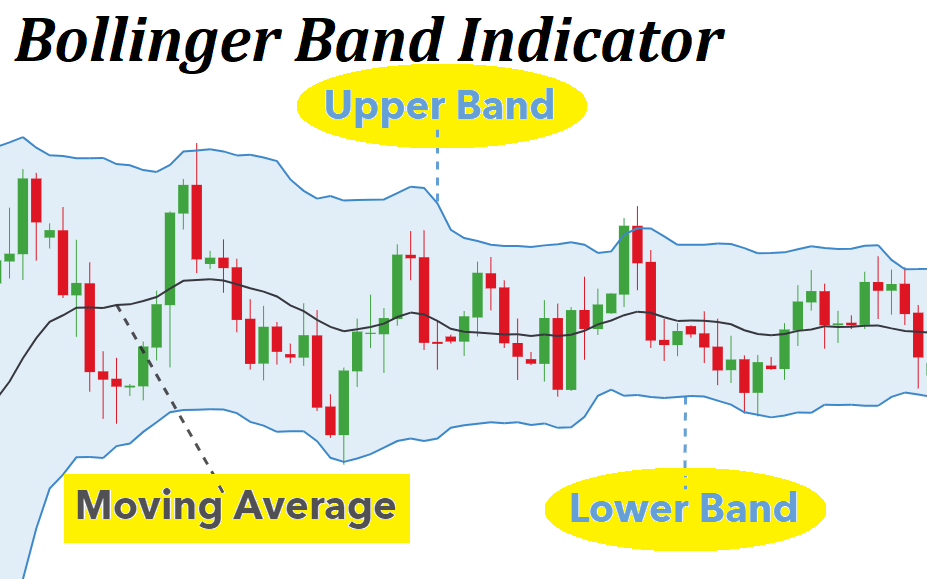

Bollinger Bands Trading Signals

Bollinger Bands provide a useful breakout signal that is integrated.

Entry Signal: If the band expands and begins to move in the opposite direction after the consolidation period, the price may reverse in the direction it moved when the band began to expand.

Exit Signal: At some point after the breakout, the bands begin to move towards each other again. In this case, you would set up a tracking Stop Loss to sell when the trend reverses.

Best Indices Trading Platforms

Now that you know in detail how index funds work, it’s time to talk about brokers. This is because it is very helpful for online brokers to invest in index funds from the comfort of their own homes. With that in mind, below are the brokers you can use to invest in the best UK index funds for 2021.

eToro

eToro has been mentioned several times in this index fund guide for good reason. First, FCA-regulated brokers, which currently have over 12 million investors, offer a very extensive platform with thousands of assets. It specifically includes over 150 ETFs, many of which track the best index funds. Most of the index funds including FTSE, Dow Jones, S&P 500 or China 25are offered by eToro. Best of all, the platform does not charge any fees. There are also no monthly or annual maintenance fees. This is what you usually pay when you go directly to an ETF or mutual fund provider.

You can also benefit from lower account balances with eToro. For example, if you only deposit $200, that’s roughly £160. You can invest only $500,000 in an index fund ETF of your choice, which is great for those on a tight budget.

Plus500

Plus500 also offers a unique approach to invest in index funds in the UK. This is because FCA regulators specialize in CFDs. So, you are not investing directly, you are trading the index of your choice. Although you do not own the underlying stock, you can benefit from a much wider range of trading options. For example, with Plus500 you can profit from both bull markets and bear markets.

In other words, if you think the short-term value of FTSE 100 is likely to rise, you are simply placing a buy order. If you think the FTSE 100 is going down, you should also place a sell order. This is not possible when investing in index funds in the traditional sense. Also, and perhaps most importantly, you can leverage Plus500 to trade index fund CFDs. It can be used to trade leading indices with up to 1:20 leverage subject to the UK and European limits. This means an account balance of £200 allows for a maximum transaction size of £4,000.

Vanguard

Vanguard is one of the largest and most trusted financial institutions in the world. In addition to several other investment flows, Vanguard also offers a variety of index funds in various financial sectors. In addition to stocks, this includes industry-specific funds and bonds.

If you decide to move straight to Vanguard index funds in the UK, there are a few indicators to consider. First, you always have to pay an annual maintenance fee. This depends on the specific index tracking fund you are interested in. For example, the FTSE All-Share Index costs 0.22% per year. For a minimum account, you usually need to invest a minimum of £500 in the fund of your choice. However, you can also pay at least €100 per month with direct debit.

How to trade Indices UK

Once you have chosen an online broker or fund provider you like, you will need to go through the online investment process. Depending on the platform you are registering on, it only takes a few minutes to register, deposit, and allocate funds to the index tracker.

With this in mind, the following tutorial is based on the FCA eToro broker. Because it allows you to invest in index tracker funds with no fees, it is a very suitable platform for beginners.

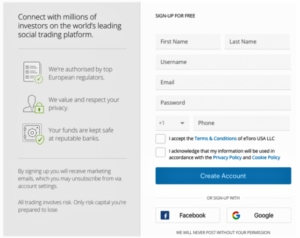

Step 1: Register for an account

First, visit the official site of eToro. You will be asked to provide certain personal information, contact information, and national insurance number. You are also needed to create strong username and password.

As eToro is regulated by the FCA, you will also need to verify your identity. Uploading a copy of your passport or driver’s license is easy to do. You must also upload a document confirming your home address. This can be a utility bill or a bank statement from the last three months.

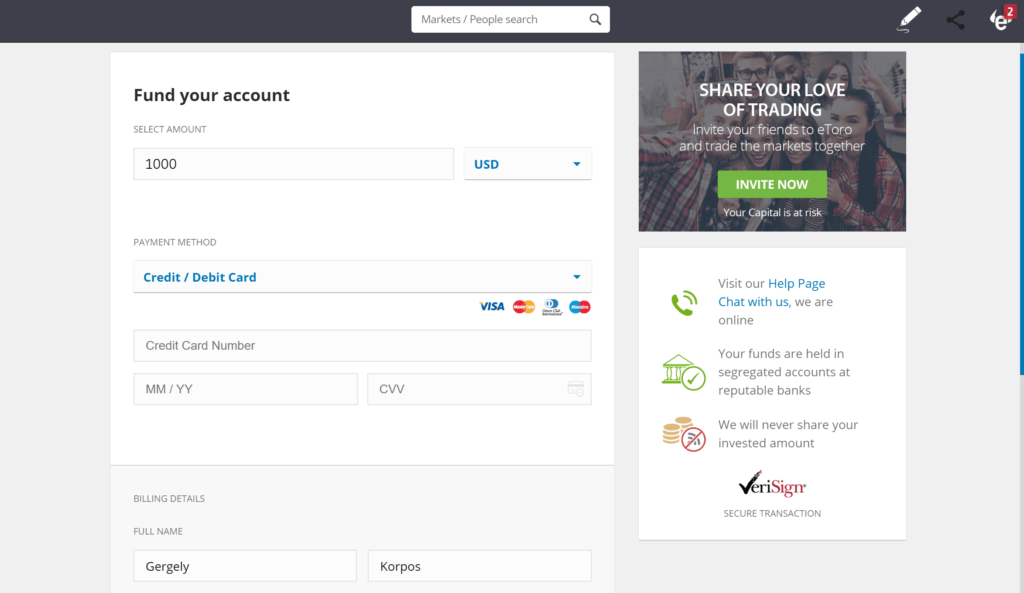

Step 2: Deposit the funds

Now you have to make a minimum deposit of $200 (about £160). The following deposit methods are supported:

- Debit/credit card

- wire transfer

- Paypal

- Skrill

- Neteller

Bank transfers can take several days and are best avoided. All other payment methods are credited instantly, so you can immediately invest in the index fund of your choice.

Step 3: Invest in Index Tracking Funds

Click the “Trade Markets” button after “ETF”. Below you can see the index fund ETFs supported by eToro. If, like us, you know which index fund to invest in, just enter the ETF name in the search bar at the top of the screen. Finally, you need to enter the amount to invest. It must be at least $50. Once an order is placed, it will remain active until you decide to withdraw it.

Final Conclusion

Indices trading are available through an extensive section of the UK investment platform, but for beginners, we believe that easy-to-understand and accessible trading tools and features are paramount. Index funds offer many advantages to investors. You can invest in the widest range of stock markets, as well as build a very diverse portfolio in a single trade. Your ETF or mutual fund provider does the rest, so you don’t have to lift your finger after investing.

Investing in index-tracking funds is also a great option for those who have little or no experience with how financial markets work. Because there is no need to select individual stocks.

If you want to start investing in index funds right away, you can do it commission-free through the FCA broker eToro. There is no annual maintenance fee, you can deposit funds instantly using your check/credit card or e-wallet, and the minimum investment to access the index tracker fund is $50.

FAQs

What are index funds?

Index funds act as replicas of stock indices. This could include the FTSE 100, FTSE All-Share, NASDAQ 100, or Dow Jones 30.

What is indices trading?

Indices trading allows you to invest in a very large part of a market or the entire market. Indices trading is a popular way for investors to gain exposure to financial markets without having to research and invest in company stocks themselves.

When is the best time to buy an index fund?

UK index funds should always be considered as long-term investments. This allows you to participate in the ups and downs of stock market trends. So now is a good time to start thinking about an index fund that will meet your investment goals.

Which index funds do track the UK stock market?

The most important UK index is the FTSE 100. The index tracks the top 100 companies listed on the London Stock Exchange. If that’s what you’re looking for, there are many ETFs and mutual fund providers that track FTSE.

Do index funds pay dividends?

Yes, you are entitled to dividends in most cases. The provider you choose usually pays every three months.