Always use caution while making high-risk investments, which are frequently promoted as having great returns. They should only be used by seasoned investors who are aware of the hazards and are willing to lose all of their money.

In this article, we’ll look at the best high-risk investments available in the UK in 2022 and offer a comprehensive tutorial on how to get started.

What are high-risk investments?

Although there is a chance that high-risk investments will yield greater returns than other types, they also carry a greater danger to your capital. In other words, if everything works well, high-risk investments could result in high rewards. However, if something goes wrong, you can lose everything you invested. A negative outcome is also more likely.

Unfortunately, there isn’t always a straight correlation between risk and profit; occasionally, taking a risk doesn’t pay off.

We can tell with certainty that you will have to accept a proportionally higher level of risk if you’re hoping for large rewards in a short amount of time.

Features of High-risk investment

High return rate

The potential for returns that are potentially more alluring than those offered by conventional investments exists with high-risk investments. However, there is no assurance that investments carrying a high level of risk will result in significant returns. The actual returns can fall short of those of conventional investing in actuality.

High chance of losing money

In fact, you must accept the very real danger of losing part or even all of your money if you decide to invest in high-risk items. And if the worst happened with some high-risk investments, you can possibly find yourself not only with nothing but perhaps owing money.

Due to this, only the most seasoned investors who are completely aware of the risks and opportunities associated with high-risk investments and who have the resources to withstand losses should consider making them.

Harder to access your money

It may be more difficult to access your money when you need it with high-risk investments because they often have lower levels of liquidity than conventional assets, especially if anything goes wrong and performance falls short of expectations.

Since only a small portion of consumers are suited for high-risk investments, investors are likely to buy and sell these products less frequently than they do more commonplace goods.

It’s possible for high-risk investments to be made in assets that aren’t actively traded themselves. This can make it considerably harder for you to have quick access to your money. Even if you can access your investments on short notice, the investment provider may charge you a fee or impose penalties.

Volatility

Investments with a high level of risk are frequently more volatile than their low-risk counterparts. The value of high-risk assets frequently depends heavily on market confidence, which can vary greatly from day to day. During times of economic uncertainty, sentiment toward risky investments can be especially brittle. Investors in high-risk products should therefore expect substantially higher volatility in the value of their investments than they would with mainstream products.

Lack of Regulatory protection

In order to ensure that investors are treated properly, regulations are put in place. However, a lot of high-risk investments remain unregulated. You won’t likely be able to receive regulatory protection from the Financial Services Compensation Scheme (FSCS) and the Financial Ombudsman Service (FOS) if you invest directly in high-risk products like commodities, student housing, and wine (among many others) if something goes wrong.

Best high-risk investments 2022

1. Mini-bonds

These bonds, which are also known as high-interest return bonds, let you invest in a business and get a fixed rate of interest for a specific amount of time. Your first investment is refunded to you at the end of the agreed term. The higher risks involved are reflected in the substantial rewards normally offered.

Small businesses, start-ups, or businesses that are having trouble obtaining funding from big investors frequently issue them. This indicates that they are high-risk investments since there is a higher chance that your interest payments will be late and because you could lose your initial investment if the firm fails.

They are not appropriate for investors who might require access to their money because you are tied into the investment for a specific amount of time.

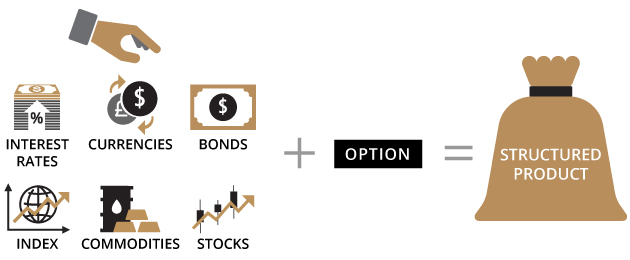

2. Structured products

In a structured product, the return is determined by a set of rules rather than the value of the shares or other assets contained therein. For example, a product could only cash out if the index or market to which it is linked performs at a certain level over a certain period of time.

They could be any of the many different kinds of investments.

Examples include insured investment funds, insured equity bonds, insured capital plans, and insured stock market bonds.

Certain structured products allow you to choose between receiving income, investment growth (a rise in the total value of your investment), or both.

It may be quite challenging to predict how an investment will perform due to the way returns are calculated.

Some structured products (complete capital protection) promise to return at least the amount you invested, but many don’t, leaving you open to the possibility of losing some or all of your funds. Before investing in a structured product, be sure you are aware of the dangers. If you have any questions, seek guidance from a financial specialist.

3. Venture Capital Trusts

Venture Capital Trusts (VCTs) are businesses that make investments in start-ups, small businesses, and expanding businesses that aren’t traded on a recognized stock exchange. They have certain unique tax benefits.

A qualified fund manager selects the emerging businesses they believe will succeed.

It’s dangerous since the companies the fund manager selects could suffer financial loss or even fail entirely. It’s possible that you won’t get back what you invested.

If you intend to keep your money in a VCT for the long term, only think about investing in it (at least five years). Make absolutely sure you are informed of the benefits and drawbacks; you might require impartial financial advice.

4. Spread betting

Spread betting resembles a bet more than an investment. You bet on whether an event, such as the value of a share, will increase or decrease. As it fluctuates, your chances of winning or losing increase.

Initially, the only emphasis of spread betting was the outcome of the stock market. Nowadays, you can spread bets on almost any topic, including politics, reality TV, and sports.

Typically, you need to have a certain amount of money in a specific account before you can place a spread bet. But, if you choose poorly, you can lose a lot more money than you anticipated.

Compared to other investment options, spread betting is riskier. It’s important to understand the consequences and any conditions before making a spread bet.

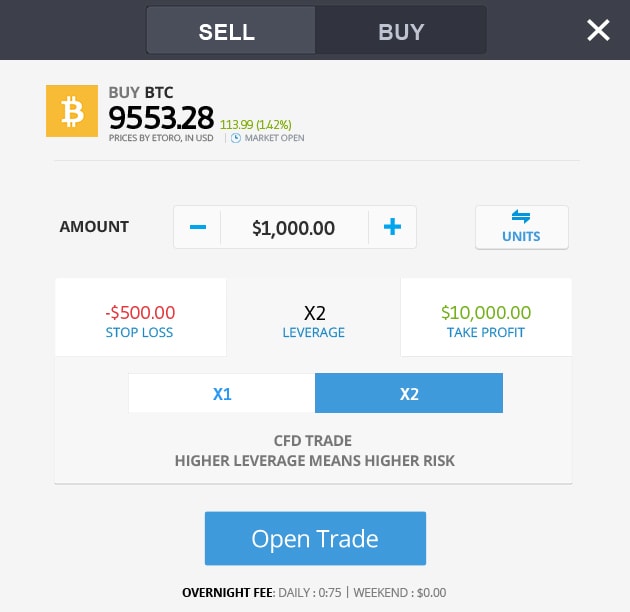

5. CFDs

CFDs, like spread betting, ask you to predict whether the worth of a certain asset will rise or fall. However, with CFDs, you purchase a stake in the price movement as opposed to making a wager on it.

The “contract” is a commitment between yourself and a broker. You consent to exchange the difference between the cost of an asset at the start of the contract and the cost of the asset at the end.

With CFDs, you run the same risk of losing more money than you put in, just like with spread betting. If you make a prediction that an asset’s value will rise but it really falls, you could lose money on your investment and wind up owing money.

Before purchasing CFDs, be sure you are aware of the hazards. You must only risk money that you can easily lose.

Learn more: CFD Trading In the UK – Complete Guide

6. Land banking

Purchasing a plot of land without planning permission in the hopes that permission will be granted and the plot’s value will rise dramatically is known as land banking.

A lot of the time, the land being sold is either too tiny to build on, in a green belt or brownfield, or it is simply of natural beauty and hence will never be profitable.

In general, the Financial Conduct Authority does not approve such land banking schemes (FCA). Many unlicensed plans violate FCA regulations if they are designed as collective investment schemes.

7. Unregulated collective investment schemes

The FCA regulates the majority of collective investment schemes (ones where contributions from many people are combined into a fund), although others are not. Such collective investment plans are not governed by any laws.

Unregulated collective investment schemes may carry greater risk than traditional investment since they usually invest in products that aren’t available to regulated investments. Your money may be lost in whole or in part. Additionally, the investments maintained might not be as widely diversified as they would be under a regulated scheme.

They are not bound by the same limits on borrowing and investing that apply to regulated collective investments. They are often regarded as high-risk as a result. Before making an investment, you should always make sure you are aware of the hazards.

8. Cryptocurrencies

A cryptocurrency is a type of digital asset or money that functions similarly to traditional money in terms of trade. Cryptocurrencies don’t have coins or notes attached to them; all they have is a digital record of the transaction.

While there are other types of cryptocurrencies, Bitcoin is the most well-known.

The process of acquiring and maintaining a cryptocurrency is incredibly complex, and errors frequently occur.

It’s very simple to lose some or all of your first investment when investing in cryptocurrencies because their prices are notoriously erratic.

Fraudsters are increasingly focusing on bitcoin investors, and there have even been cyberattacks on cryptocurrency exchanges.

It may be challenging for investors to comprehend the dangers due to the intricacy of some cryptocurrency products.

Cryptocurrency assets cannot always be changed back into fiat money. This demands a level of supply and demand that cannot be guaranteed.

Owing to the unavailability of oversight, investors are unable to have accessibility to the Financial Ombudsman Service (FOS) or the Financial Services Compensation Scheme, which makes it extremely challenging to request compensation or lodge complaints.

Learn more: Cryptocurrency Trading in the UK

9. Exchange-traded products

Exchange-traded products (ETPs) are assets whose value fluctuates in line with the value of an index (a collection of businesses used to gauge market expansion) or another metric, such as the price of gold or oil.

While some ETPs are well-known and simple, others are far more complicated and don’t provide the same amount of protection against problems.

Regulation applies to ETFs, which are investment funds in the form of ETPs.

They are generally simple and similar to other types of investment funds that you might choose because many actually hold the shares or other investments that they try to track.

However, some ETFs are sophisticated and more dangerous than others, for instance, those that artificially mimic an index (known as a synthetic investing strategy) or that track an uncommon asset that may be challenging to describe and quantify.

Other ETPs exist that are not organized as funds.

They may consist of bonds or include other, more intricate structures. You may have little to no protection because they are not subject to FCA regulation.

ETCs and ETNs are examples of securities that are not suitable for most investors.

10. Targeted absolute return funds

Targeted absolute return funds seek to generate consistent profits over a predetermined time frame (for example, two or three years).

In other words, they imply that regardless of how the stock market is performing, they can still provide you with a respectable return on your investment.

The issue is that they frequently just fail to provide the promised returns.

Absolute return funds employ intricate financial strategies that might be hazardous and result in losses if things don’t work out as expected.

You may believe that the investment gives capital protection, which ensures that you will at least get back the amount you invested, but if you read the tiny print carefully, you will discover that this is not the case.

Best Sites for Investing in High-Risk Investments

Although there are countless brokerages available, it can be very difficult to choose the one that best suits your needs and aligns with your financial objectives. It takes a lot of effort to examine and analyze the essential parameters for each and every platform, such as fees, commissions, investment assets, and regulations.

Therefore, in order to save you time and effort, we’ve compiled a list of the top brokerage services in the UK that you might want to look into.

1. eToro

eToro possesses all the outstanding features that make it the greatest brokerage platform according to our needs. The fact that it offers a variety of assets—many of which are categorized as high-risk investments—and doesn’t charge any commission is, however, what initially draws thousands of traders to it. The only difference is that you will be charged a 0.5 percent fee on all deposits and $5 on each withdrawal. It is the UK’s least expensive brokerage platform.

eToro offers the copy trading feature for new users. You can imitate the active transactions of seasoned traders using this option.

Account creation on this platform is quicker than on other sites. An eToro account can be created in a matter of minutes. You must fund your trading account after you’ve finished creating it in order to begin trading. It accepts a variety of payment options for deposits, including debit/credit cards, bank accounts, e-wallets, and so forth, for the convenience of its traders.

2. IG

/IG-ef2684aaa37d4d218af819f98d676d02.png)

IG is yet another fantastic broker that provides a wide range of assets, such as high-risk investing assets, foreign equities, ETFs, mutual funds, and many more. You don’t need to worry about the safety and security of your funds because it is a FCA-regulated broker. Users can get access to more than 12,000 assets through the platform. You can also use leverage, access cryptocurrency markets, and engage in short-selling thanks to it. For individuals wishing to make long-term investments through stocks and shares ISA, this trading platform is ideally suited.

On this trading platform, opening an account is also really simple. You must, however, pay an initial cost of £8. The good news is that this entry-level cost will be reduced to £3 if you trade frequently. Once you’ve opened an account, you must deposit a minimum of $250 before you may start trading on this platform. This minimum deposit isn’t the platform’s charge; rather, it represents the operating money that investors will need to begin their investment journey.

How to invest in high-risk investments?

Here, we’ll use eToro as an example to help you quickly grasp the entire process of purchasing high-risk assets. Of course, we strongly advise you to use eToro because it has all the characteristics that a reputable platform ought to have.

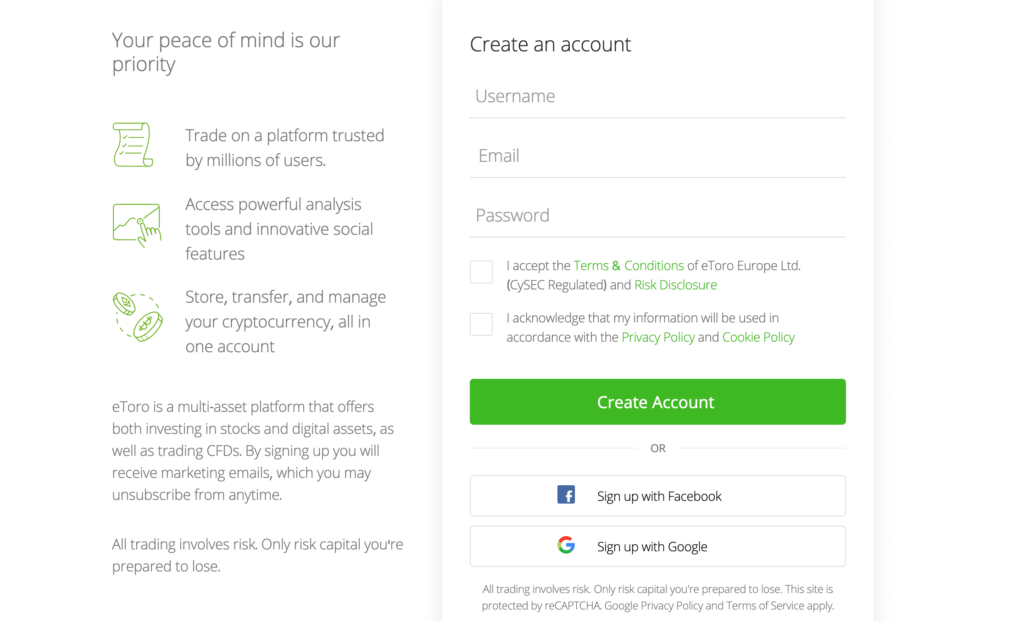

Step 1: Open an account

To begin making an account, you must first register on the website’s main page. A registration form, which is easily accessible on the eToro website, must first be filled out. You will need to fill out this registration form with some personal information, like your name, email address, phone number, and a secure password.

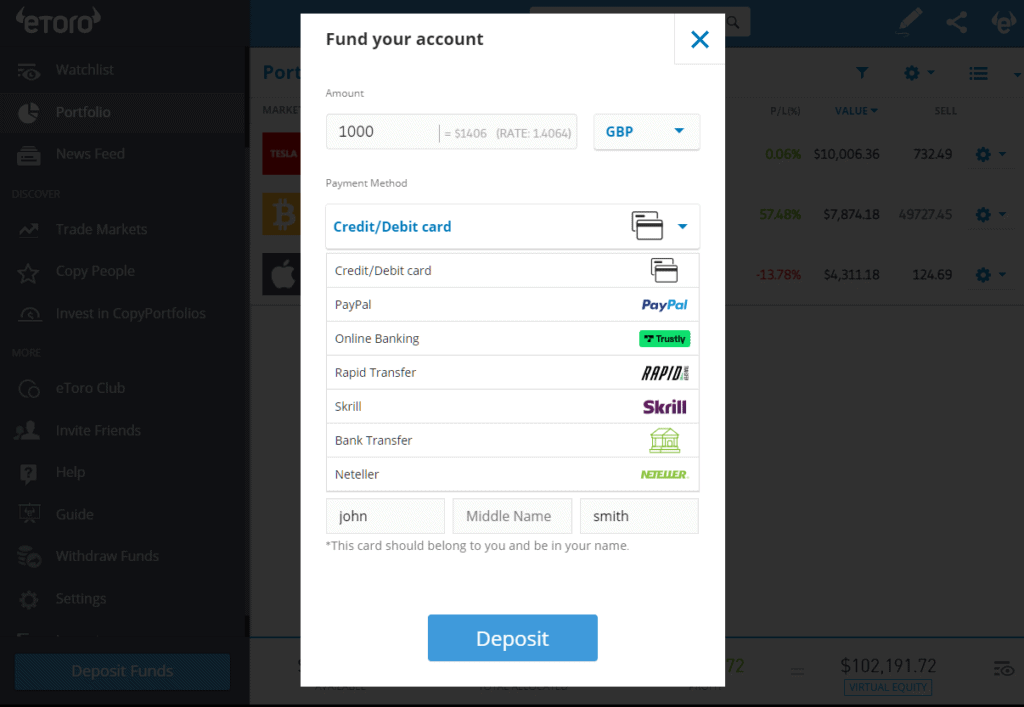

Step 2: Fund your account

After successfully creating an account on this site, you are now prepared to fund it with a minimum deposit of $50. This funding amount, which represents the working money required by the traders to carry out deals, is not the robot’s charge. eToro offers a range of payment methods for the benefit of its traders. You can choose the choice you are most accustomed to. eToro accepts payments by debit/credit cards, PayPal, Skrill, Netteller, and bank transfers.

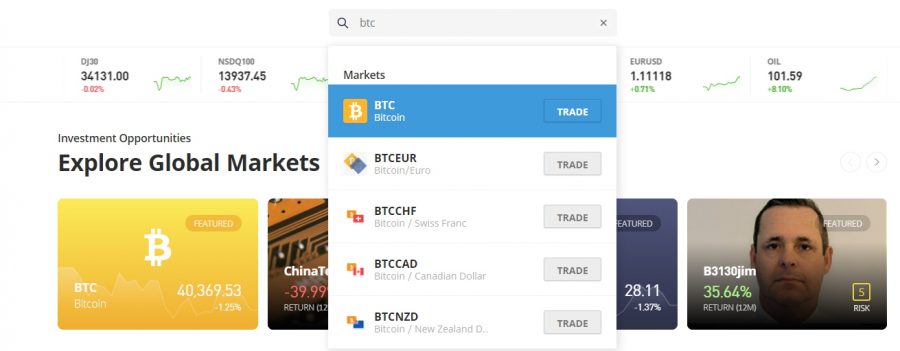

Step 3: Invest in high-risk investments

After successfully funding your account, you must now decide which high-risk investment asset you want to use. For instance, if you want to buy Bitcoin, just type its name into the search bar at the top of the page.

After choosing it, enter your desired investment amount, and then click “Open Trade.”

Conclusion

Even while high-risk investments yield substantially higher returns, they are best suited for seasoned investors who are well aware of the added risk associated with the asset. It is not for uneasy investors because high-risk investments also carry higher risk. It is obvious that a high-risk investment is not for you if you cannot afford to lose all of your capital.

But eToro is the site to use if you don’t mind losing money and are open to making high-risk trades. Due to the fact that it is commission-free, you can begin your investment career by making a $25 minimum deposit.

Frequently Asked Questions

What are high-risk investments?

A high-risk investment is one in which there is a significantly larger chance of losing money than with other investments. This investment carries the risk of losing all you invested.

Do I qualify for high-risk investments?

It is appropriate for you as long as you are able to afford to lose everything you have invested.

How much of my money should I put into high-risk investments?

It’s suggested that you limit your high-risk investment to no more than 5% of your whole portfolio value.

Which high-risk investment is the riskiest?

Bitcoin is the riskiest of all. The most volatile asset that has outperformed over the last ten years is this digital currency.