It should not come as a surprise that Meta shares, which were once owned by Facebook, and are well-liked by both investors and traders given their 175% value growth over the last five years. Facebook stock has repeatedly shown itself to be a risky, thrilling, and frequently successful investment.

The stock of Meta/Facebook will probably experience significant swings in value over the next few years as a result of Facebook’s recent name change to Meta and the plans to launch the “metaverse.” Additionally, it is anticipated that Meta would offer a wealth of investment options.

We’ll go over all the details of buying and selling Meta shares on the page that follows. As a starting point, we’ll also provide you with two broker recommendations.

How to buy Meta Stocks – An overview

- Open a Trading Account – Visit the website of your preferred broker and register for an account. Submit the required personal information, including your email address.

- Verify Your Account – You will then be prompted to upload identification documentation (such as a passport) and proof of residency (such as a bank statement) for validation.

- Make a Deposit – Users can deposit money by choosing a payment method, such as e-wallets, credit/debit cards, or Wire transfer.

- Purchase Meta Shares – In the search box, enter “FB” or “Meta,” and then click “Trade” when the business pops up. In the order box, type the amount you want to invest, then click the “Confirm Trade” button.

Examine Meta Stock

An integral component of the stock evaluation is research.

In light of this, the data shown below include parameters pertaining to the business model of the company, its stock performance on the NASDAQ, dividends, and more.

Meta Platforms Overview

Today, Facebook, one of the largest social media platforms in the world, was initially introduced in 2004. Facebook has purchased a number of other top social media services, including Instagram and WhatsApp, since becoming public in 2012.

Unsurprisingly, this has elevated Facebook to the status of one of the most popular tech firms worldwide.

Facebook announced a significant change to the corporation in November 2021 with the establishment of a new parental firm called Meta Platforms Incorporated (called Meta). The company will continue to run all related platforms, but it has also started working on a brand-new technology called the Metaverse, a virtual reality, augmented reality, and artificial intelligence (AI)-based cosmos.

This significant shift has probably assured Facebook’s (and Meta’s) dominance in the tech sector, creating excellent investment opportunities in the years to come.

Meta Stock Price History

On May 12, 2012, Facebook began trading on the NASDAQ stock market for just $38 per share. At the time, it was among the most widely discussed stock launches on Wall Street. Following the IPO, the Meta stock fell precipitously, reaching a record low of just $17.73.

You would have roughly 1,500% more money today if you had purchased shares at that price. Meta stock began a continuous ascent from 2013 to 2018. In 2015, the stock touched $100 per share, and in 2018, it reached $200 per share.

The price of a share of Facebook fell back to barely $125 by the end of 2018. The business received criticism following the Cambridge Analytica controversy, in which it was discovered that a UK company had improperly accessed Facebook data for political advertising during the 2016 US presidential election. Facebook came under fire at about the same time for its involvement in violations of human rights in Myanmar and India.

Despite the criticism, before the COVID-19 epidemic struck, Facebook shares rose back to above $220 per share. During the market meltdown in March, shares fell to a low of $137, but they swiftly rose to a new all-time high in May 2020.

Shares of Facebook have remained between $260 and $300 ever since.

Meta Stock Price 2022

In the first half of 2022, many growths and tech equities fell. This was mostly caused by concerns about rising interest rates and inflation.

Additionally, Apple updated its policies and software regarding app privacy. This made it much more difficult for advertisers to track people’s habits, which reduced revenue for companies like Meta that primarily rely on this source of income. As a result, Meta released a dismal financial projection in February 2022.

In a statement, Meta cited competition from other platforms and Apple’s privacy changes as the main causes. What happened to the Meta stock, then? The share price of the stock was $232 on February 2nd, 2022. The price of Meta stock on August 30th, 2022, was $160. This shows a decline of 367% in just 5 months.

Having said that, several sell-side analysts rate Meta as a strong buy, so this might be a great deal. Anyone who is still debating whether or not to purchase Meta stock will hear why this might be a worthwhile addition to a portfolio of investments soon.

Also read: Best Tech Stocks You Should Buy In UK 2022

Dividends

Investors do not get dividend payments from Meta. The business claims that it keeps its profits instead. This is done in order to finance the company’s long-term expansion.

However you can read our alternative guide to the Best Dividend Stocks You Should Buy in UK 2022 to find the best dividend paying stocks in UK.

Market Capitalization

The market capitalization of Meta is currently a little over $434 billion.

Although the price of Meta stock has dropped recently, it still ranks among the top worldwide firms by market valuation, similar to Snap stock.

Best trading platform to Buy Meta Stocks

You require a broker who can put you in touch with the appropriate stock exchange or financial instrument if you want to access Meta shares. We have determined that the following two brokers are the best for trading Meta stock after investing countless hours in research, testing, and trading.

1. eToro

One of the many well-known UK trading brokers you can use to purchase Facebook shares is eToro. Trading is available on approximately 2,000 shares from the UK, US, and other countries through this mobile-friendly stock broker. Additionally, hundreds of ETFs, including those that cover the US stock market and the IT sector, allow you to invest in Facebook shares.

You have the choice to purchase shares altogether or trade Facebook share CFDs on eToro (contracts for difference). On eToro, all transactions are completely commission-free. You have a leverage option of up to 5:1 if you choose to trade Facebook CFDs.

The sophistication and caliber of this brokerage’s trading tools make it stand out. You may quickly customize your analysis with a few touches and access over 100 distinct technical studies and drawing tools.

A social trading network is also included with eToro. To share trade ideas, recount successful deals, and discover new stocks to trade, you can follow traders from the US and the UK. This network is also quite useful because it allows you to swiftly identify changes in market sentiment regarding shares of Facebook.

Copy portfolios are supported by eToro if you wish to quickly establish a portfolio. With just a few clicks, you can quickly duplicate a preset portfolio, or you can emulate a day trader’s actions to actively trade around the price of Facebook’s stock.

The UK Financial Conduct Authority (FCA) oversees eToro, which provides email and phone support twenty-four hours a day. To learn more about what this brokerage app has to offer, read our in-depth eToro Broker Review UK 2022 – Complete Guide.

2. Capital.com

Using the web or mobile trading platforms of Capital.com, all CFD trades are 100% commission-free, and you can use the leverage of up to 5:1 to boost your trade sizes. The absence of inactivity fees at Capital.com is another benefit for long-term investors.

This brokerage offers both novice traders and seasoned investors access to a powerful mobile trading platform. A market news feed, a market sentiment indicator, and dozens of highly customizable technical indicators are available for experienced traders to use. A variety of order types are now available on Capital.com, including guaranteed stops that guard your position against unexpected market dips.

The teaching materials that are part of the Capital.com mobile app make it an extremely user-friendly tool for beginners. The technical analysis and CFD trading fundamentals are covered in a collection of videos available from this broker. Even more, Capital.com offers virtual trading classes with self-tests at the conclusion of each lesson through a specialized educational app.

Access to expert analyst research is the single thing Capital.com does not provide. The market news stream is useful in this regard, but you can’t access the Capital.com mobile app to learn what Wall Street thinks of Facebook’s prospects.

Capital.com is subject to UK FCA regulation and provides email, live chat, and phone support around the clock. The support staff at the brokerage responds quickly. To learn more about what this brokerage app has to offer, read our in-depth Capital.com Broker Review UK 2022 – Complete Guide.

How to buy Meta Stocks?

Step 1: Visit eToro

To start the process, visit the eToro website or click one of the buttons on this page. They’ll take you straight to eToro, where you can begin the signup process. Keep in mind that you can create an account on both a desktop computer and a mobile device.

Step 2: Personal Information

Additional personal data that will serve as the basis for your account must be provided. Basic details like your full name, address, email address, phone number, etc. are included in this. You will also be required to provide eToro with information regarding your income and employment.

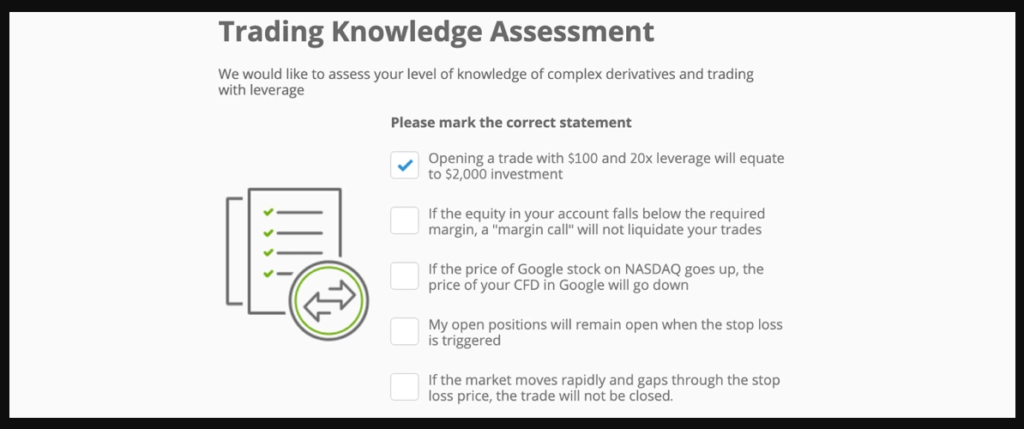

Step 3: Basic Knowledge Test

Customers of eToro can take advantage of leverage and margin. Due to the increased potential dangers associated with trading, eToro will require you to pass a basic knowledge exam on leverage. The test is in place to protect you because the results will be used to assess your permissible levels of leverage.

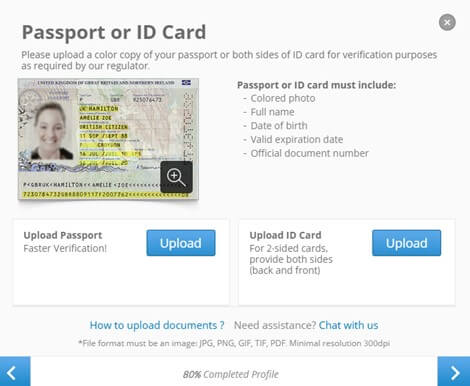

Step 4: Verify your Identity

Since the FCA oversees and regulates eToro, the broker adheres to a stringent customer registration procedure.

To accomplish this, you must provide evidence of your identification (a copy of your ID) and residency (utility bill or bank statement). Before eToro fully activates your account, these documents are examined.

Step 5: Make a Deposit

You must presently deposit £200 with eToro in order to begin trading Meta/Facebook shares with the broker.

Step 6: Buy Meta Shares

Now that you are prepared, you may begin trading Meta shares on eToro. Remember that one of the largest IT businesses in the world is Meta. As a result, you can trade Meta shares in a variety of formats. CFDs on Meta shares as well as indices that contain Meta shares are offered by eToro.

%20order%20on%20eToro's%20platform.webp)

Conclusion

Facebook has significantly altered the world we live in over the past ten years by establishing social media as an everyday topic for everyone on the planet. According to our forecasts, this won’t cease anytime soon, and Facebook and Meta Platforms should continue to expand.

Therefore, for the majority of investors, Facebook/Meta shares are a wonderful investment. Just be careful to research the stock before investing so that all of your decisions are based on your research and not just on what other people think.

Frequently Asked Questions

Is now the right time to purchase Meta stock?

We think that now is an excellent opportunity to buy Meta shares given the significant improvements that Facebook has undergone since changing its name to Meta. Just keep in mind to carefully assess the market first and to always base your investments on your research. How many shares does Meta have?

There are between 2.5 and 3 billion Meta stocks on the market right now. This figure changes as stocks are bought, traded, and issued.

Is Meta a reliable investment?

It is true that meta shares can be a long-term investment, and the majority of Facebook investors do so. But you may also trade Meta shares as CFDs and other speculative products with all the big online brokers.

Who is the largest Meta stock owner?

With a total holding of 7,28% of the outstanding shares, The Vanguard Group, Inc. is the largest shareholder of Meta stocks at the moment. With a total of 600,000 shares (or 0,02% of the firm), Michael Schroepfer has the most Meta shares among private investors.

Will Meta’s growth continue?

Yes, it is all but certain that Facebook will keep expanding, especially in light of the Meta branding. Facebook won’t be Meta’s top concern going forward, though, as more attention will be paid to the brand-new Metaverse.

Do dividends on Meta stock get paid?

No, Meta doesn’t give its shareholders dividends. Investors disagree on this issue; some want dividends, while others are content with just getting a return on their regular investment.