Because of the economy’s rising inflation, the Treasury Department has begun boosting interest rates. Since the months ahead are probably going to be difficult, traders must keep their discipline. Creating a portfolio of low-risk investments might be helpful in assisting you in navigating market turbulence.

In this article, we’ll examine the UK’s best low-risk investments for 2022 and provide a thorough tutorial on how to get started.

What are low-risk investments?

There isn’t a completely risk-free investment. Some investments, meanwhile, carry lesser risk than others. If an investment’s value doesn’t move significantly over time, it is sometimes regarded as having reduced risk.

Three important aspects contribute to low-risk investments:

- Low volatility: These investments might be less volatile, which indicates their value does not fluctuate significantly over time. If you put money into low-risk assets, you may lose capital less frequently.

- High liquidity: Low-risk investments have greater liquidity, making it simpler and quicker to sell them. The price you will receive from an investment property may be less predictable and your cash may be restricted when you need it if it takes a while to sell.

- Diversification: Low-risk investments are typically diversified among a large number of distinct shares or other assets. For this reason, experts frequently advise investing in equity funds rather than specific shares. Due to the fact that your investment is distributed over numerous businesses, you are exposed to less risk if one of them fails.

Best low-risk investments 2022

Compared to the typical savings account, these options can help you increase your returns more quickly. However, keep in mind that despite being low-risk investments, they do carry some risk.

Having said that, you could be ready to accept a little bit more risk in exchange for products that nonetheless provide excellent liquidity and ease of access at greater rates of return. Before investing extra money that you could need in a pinch, make sure you have a fully stocked emergency fund to preserve excellent financial health.

1. Government Bonds

Government bonds are your best and first choice if you want to avoid taking on a lot of extra risks while earning a little bit more return than a savings account. Treasury bonds currently have yields ranging from 2.93 percent for 30 years to 2.22 percent for a month (as of August 2022).

Treasury bonds carry a lot of weight because they are backed by the government’s complete faith and credit. The government has also always compensated its liabilities in the history. In the event that you want access to your money before the debt matures, this makes government debt dependable and simpler to purchase and sell on secondary marketplaces.

However, because of their stability, bonds could have fewer returns than you might expect from bonds, such as corporate bonds, whose obligation was more probably to be repaid.

2. Corporate Bonds

If you don’ mind a little bit extra risk for higher yields, high-grade corporate bonds can be a good option. Typically, these bonds give returns that are higher than those of Treasury securities or money market accounts since they are issued by reputable, high-performing businesses. According to the latest data from the St. Louis Federal Reserve, 10-year high-quality bonds offer average interest rates of 4.78 percent as of July 2022.

Even while investing in high-grade corporate bonds is generally safe, you still run the risk of losing money if:

- Rates of interest rise. Your money won’t benefit from the increased rate because the interest rates that bonds pay are often fixed for a specific period of time. If interest rates have increased generally, you might also have to sell your bonds for less money than you purchased for them if you need to. You will receive your bonds’ face value plus interest if you retain them until they mature.

- Issuer becomes bankrupt. Investment-grade bonds are generally thought of as being a safe investment, although they still aren’t as safe as cash kept in bank accounts. Because of this, it’s crucial to concentrate on debt issued by reputable businesses that are most likely to repay you. Higher interest rates may be offered by organizations with lower ratings, but you are also more likely to lose money with them.

3. Money Market Mutual Funds

Mutual funds for the money market make investments in short-term instruments like overnight commercial paper. The returns offered by even the best money market funds are frequently very low. Contrary to Government bonds and corporate bonds, money market funds do offer investors complete liquidity: You can withdraw your income at any time, and they hardly ever suffer volatility.

It is noteworthy that many financial institutions also offer money market mutual funds. Even if you don’t have or don’t want to open a brokerage account, you could be able to buy money market funds through your financial institution.

4. Fixed Annuities

Fixed annuities are a particular kind of annuity contract that let investors pay a one-time lump sum in exchange for regular payments in the future. Identical to certificates of deposit, fixed annuities work by requiring you to give up accessibility to your money for a set period of time in exchange for a higher rate of interest.

As of August 2022, fixed annuity rates of interest are yielding up to 4.80 percent for a 10-year period, according to Blueprint Income, a fixed annuity platform. However, keep in mind that less reputable insurers frequently charge higher interest rates, which means customers are more likely to miss payments.

Also keep in mind that, similar to CDs, you can be subject to fees if you access all of your funds before the fixed annuity’s maturity date. However, you will often have monthly access to a portion of your funds without incurring any fees.

5. Preferred Stocks

A mix of stocks and bonds, preferred stock gives some of the opportunity for gain that comes with common stocks as well as the reliable income payments that come with bonds. In fact, because payment is not entirely assured, preferred stock usually pays higher dividend payments than a company’s bonds.

Preferred stocks have provided investors with more than 7% annual returns on average since 1900, the majority of which have come via dividends.

In addition to dividends, a buyback could result in the growth of your investment. Due to the fact that preferred stocks pay larger dividends than corporate debt and hence cost corporations more money, many companies have recently been buying back preferred shares, typically at a little premium to the price at which they were originally sold.

6. Dividend stocks

For investors seeking a larger yield in the current context of low-interest rates, several ordinary equities are also quite secure alternatives to preferred stock. The most notable of them are utility stocks and real estate investment trusts (REITs), which have generally been regarded as being safer, less volatile, and more dependable in their dividend payments.

Utility dividends have an average yield of 2.93 percent as of August 2022, while REIT dividends pay an average of 1.04 percent.

No matter what sector you choose to invest in, it is ideal to choose common stocks that have a great track record, a stable dividend history, and are not growth stocks that depend entirely on investor enthusiasm.

However, keep in mind that, like other equities, common stock dividend payments aren’t guaranteed, and investing in them could result in a loss of capital.

Learn more: Best Dividend Stocks You Should Buy in UK 2022

7. Index Funds

Individual equities do not have a diversified portfolio, unlike common and preferred stocks or bonds. Bonds and stock can only be purchased from one or two firms, which makes them intrinsically very hazardous.

Through index funds, you can engage in large numbers of unique equities and bonds. This offers high interest or dividend rates while significantly lowering the risk you assume while investing. The BOND fund from PIMCO, the BND or VDADX (Dividend Appreciation) funds from Vanguard, and others are diversified, higher-rate funds.

8. Gold

Particularly during economic volatility, investing in gold can give an investment portfolio stability and diversification.

Investors may be able to preserve their wealth by investing in gold, which is seen as a low-risk investment. It has served as a strong buffer against the effects of inflation.

This is due to the fact that, in principle, higher demand during periods of inflation, like the ones we are currently seeing with prices in the UK increasing by almost 9% year over year, might induce a spike in the gold price.

Gold is an asset that, along with money, stocks, bonds, and real estate, may give investors the crucial component of diversification. When one asset class, like shares, underperforms, diversification can provide a measure of financial protection.

It is frequently asserted that it correlates negatively with other asset groups. In other words, gold may offer a better return if stock markets are declining as a result of growing inflation and economic uncertainty.

Gold can be bought directly in the form of bars, coins, or jewellery. As an alternative, it is possible to increase exposure through pooled investments, which combine many different investors’ contributions into a single managed fund.

A third choice is to make an indirect investment by purchasing stock in businesses that mine, process, and exchange gold. Although the prices of mining firm shares often correspond with the price of gold, it should be noted that individual share values are also influenced by basic factors including profitability, environmental concerns, and geopolitical and regulatory risks.

Gold exposure carries some risk. You run the risk of losing your initial investment because gold prices vary and are governed by the same supply and demand laws as other asset classes.

Learn more: Gold Trading UK – Beginners Guide

9. High-yield savings accounts

Despite not being considered investments, savings accounts offer a modest return on your investment. The best paying options are available online, and if you’re willing to compare prices and look at rate tables, you can get a little bit more return.

Savings accounts are completely safe because there is no risk of money loss. The bulk of accounts are insured by the authorities up to $250,000 for each type of account and per bank, so even in the event that a financial institution fails, you will still receive payment.

10. Short-term certificates of deposit

Bank CDs are always loss-free in an FDIC-backed account until you take the money out early. To find the best prices, you should research throughout online and contrast what financial institutions have to offer. Considering that rates are already rising, it may make sense to own short-term CDs and reinvestment as interest rates rise in 2022. Remaining too long in CDs with a discount is not advised.

As an option to a short-term CD, a no-penalty CD enables you to avoid the standard early withdrawal penalty. You can take your income and move it to a CD that provides a higher interest rate in order to avoid the standard fees.

If you keep the CD until it matures, the bank promises to pay you a fixed rate of interest for the duration of the specified period.

Although the deposits for these high-yield accounts may be significant, some savings accounts offer interest rates that are greater than many of the CDs.

Best Sites for Investing in Low-Risk Investments

We’ve put up a selection of the top brokerage services in the UK so you can save time and effort when looking into them for investing in low-risk investments.

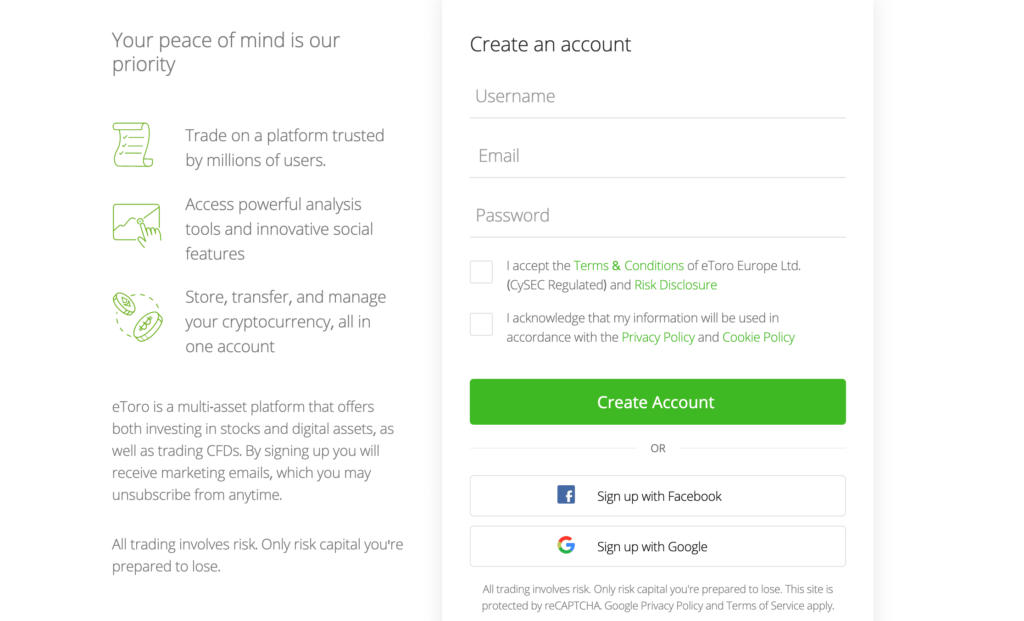

1. eToro

Either you want to make a long-term investment or the short-term investment, with low-risk investment or high-risk investment, eToro is for you. The most successful investments presented on this page are available to FCA brokers. The site is especially well-liked by new users because it has a multinational client base of over 12 million investors, including over 12 million investors in the UK.

More than 1,700 equities (both domestically and abroad) as well as various ETFs and cryptocurrencies are available on the eToro platform. Additionally, you can trade CFDs for stocks, indices, light metals, energy, foreign exchange, and other assets. There are no continuing costs with eToro, regardless of your trades or investments.

2. Plus500

Consider using Plus500 if you want to make low-risk investment decisions. There are dozens of investment instruments accessible on this free CFD trading platform. Plus500 is for you whether you’re interested in stocks, indices, commodities, bonds, interest rates, or currencies.

Both the provider’s native mobile app and a desktop computer can be used to access the Plus500. You can use this online platform quickly and easily once you’ve registered. Checks, credit cards, and e-wallets can all be used for immediate deposits. There aren’t any transaction fees and you just need to identify an account with at least £100.

Read: eToro vs Plus500- Which is better in UK 2022?

How to invest in low-risk investments?

We’ll now show you how to invest in low-risk investment to wrap up our guide. You can open an account with eToro, make an immediate deposit of funds, and make fee-free investments in assets by following the step-by-step instructions provided below.

Step 1: Open an account

Visit eToro website and register for a new account where you’ll have to provide information about yourself, such as your name, residence, and birthdate. Your contact information and national insurance number are also required. One of the top investment applications in the UK, eToro, is available for free download from the smartphone app store if you wish to invest on your mobile device.

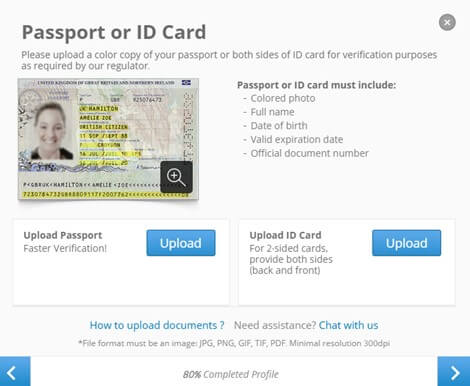

Step 2: Verify identity

Since eToro is a broker governed by the FCA, it now requests that you confirm your identity. By submitting a copy of a current passport or driver’s license as well as recent bank statements or utility bills, you may complete this in a matter of minutes.

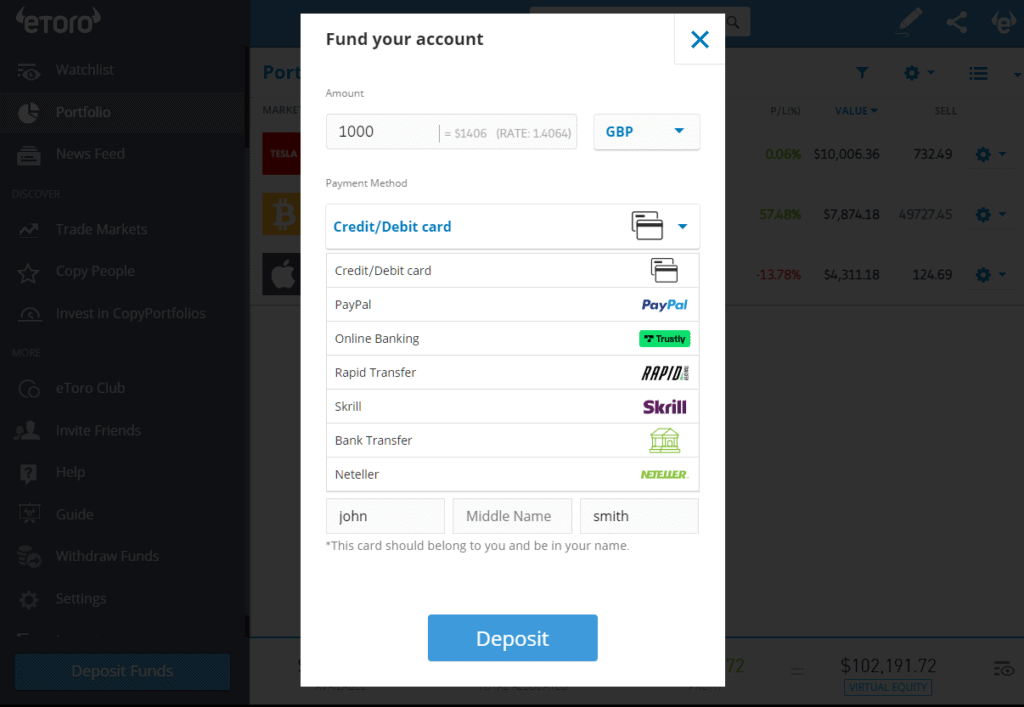

Step 3: Deposit funds

You’ll be asked to locate an investment account right now. The following payment options are all available for as little as $200. Deposits can be made via a credit card, wire transfer, or an electronic wallet like PayPal, Skrill, or Neteller. The deposit is subject to a currency conversion fee of 0.5 percent.

Step 4: Invest in low-risk investments

As quick as the funds are placed into your eToro account, you can start investing. Enter “Gold” in the search box if you wish to invest in gold.

Enter the appropriate investment amount after selecting the low-risk options, and then click “Open Trade.”

Conclusion

Building a well-balanced financial portfolio requires a variety of investments, including low-risk ones. They’re especially helpful if you’re nearing retirement or concerned that a stock market crash would devalue your money. By choosing a diversified range of investments and routinely rebalancing your portfolio, you can also reduce your investment risk.

Your wealth can grow over time with the greatest low-risk investments, and they can also reduce your potential losses in the event of a market slump. It’s important to keep in mind that minimal risk doesn’t necessarily translate into a low return. Many low-risk assets offer returns that are comparable to those of high-risk investments, and for long-term investors, diversified portfolios can be much more successful than individual investments.

If you don’t mind losing money and are willing to engage in low-risk transactions, we advise you to start with eToro. You can start your investment career by placing a $25 minimum deposit because it is commission-free.

Frequently Asked Questions

Which UK assets offer the lowest risk?

There are numerous chances for investing. Everything is based on your financial objectives. So, take some time to consider your goals and your finest resources for achieving them.

How much should I invest?

Depending on the broker you choose. You can start trading with eToro and Capital.com with a $200 minimum deposit.