GameStop, headquartered in Texas, is the largest distributor of video games all over the world. Thanks to Reddit’s WallStreetBets users who collectively purchased its shares in 2022, the company’s share price has been oscillating since its founding in the 1980s and climbed significantly since then. Many investors became interested in this as they anticipated greater development potential in the GameStop business and began seeking ways to purchase GameStop stock.

If you’re looking for information on how to purchase GameStop stock using an online broker in the UK, our detailed guide outlines the steps in detail.

How to Buy Gamestop Shares: A Step-by-Step Guide 2022

Nowadays, investing in firms online is an easy process. You can open a broker account once you’ve made up your mind about where to purchase Gamestop stock.

The instructions for purchasing Gamestop shares through your favorite broker are provided below.

- Step 1 – Open a Trading Account: Users can start the registration procedure by going to the website of their favorite broker.

- Step 2 – Upload ID: Upload a copy of your ID to instantly have your newly formed account confirmed. Select a passport, state identification card, or driver’s license.

- Step 3 – Deposit Funds: By selecting a payment option, such as e-wallets, credit/debit cards, or ACH, users can deposit money.

- Step 4 – Buy Gamestop Shares: Users can start the open order procedure by searching for GameStop stock in their platform’s search box. Enter your desired investment amount, then confirm the transaction.

Examine Gamestop Stock

You should obviously do your research before making any kind of investment. As a result, before deciding to purchase Gamestop stocks, you must conduct a comprehensive analysis to see whether it would be a wise investment for you.

We’ve provided more information for you to study below in order to save you some time researching online. This includes, among other things, the Gamestop stock price and some important financial information.

GameStop Overview

Established in 1984, GameStop is an American supplier of digital games, electronic goods, and gaming accessories. Its headquarters are in Texas, and it has expanded its services to countries across the world such as Italy, Austria, Germany, Canada, Australia, and New Zealand. The business today runs thousands of physical storefronts in addition to online retail space, making it the largest video game retailer in the world.

Early in 2002, GameStop made its first public offering (IPO), with a share price of just $18. Since then, the value of the company’s stock has fluctuated until 2019, when it suffered a significant setback as a result of a transition from purchasing and downloading physical video games to online video game shopping and downloading.

But in 2022, the share price began to increase as a result of selling part of its holdings to WallStreetBets members on Reddit. Its involvement in the internet retail industry demonstrates the firm’s tremendous potential for expansion. By an online stockbroker having exposure to the NYSE, in which the stocks are listed, you can purchase GameStop stock.

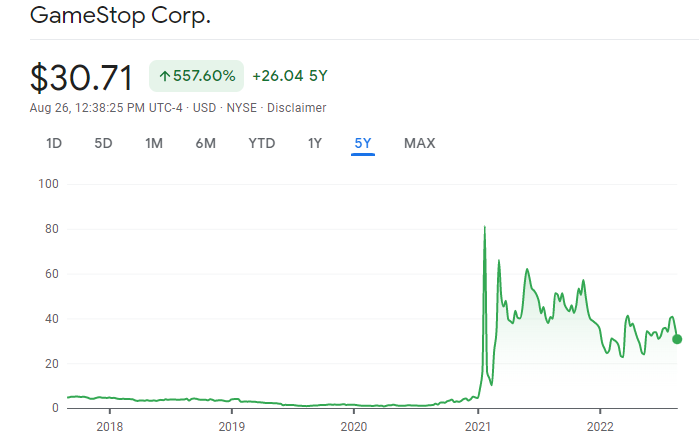

GameStop Share Price History

Gamestop was founded in 1984. With a stock value of $18 in its IPO in February 2002, Gamestop officially became a publicly traded company. The stock’s most latest high, which happened on December 24, 2007, was just over $63. It did not reach above $50 for a number of years. Since Gamestop’s shares began trading on the NYSE five years ago, their stock has increased by 625%.

In 2021, things flipped. The Gamestop stock had a share price of roughly $17 in 2021. Gamestop then became the face of a meme-stock craze that same year, which revealed problems with the share market’s trading system, as you are surely well aware.

The uproar surrounding the massive acquisitions by retail and casual traders caused Gamestop shares to surge to about $350 by January 27. A day afterwards, during an afternoon trading period, stocks briefly increased to roughly $500.

This shows a tremendous rise of about 2000% in less than a month. The shares fell to about $40 by February 2021. To prevent shareholders from selling their shares and profiting from the sharp decline, many online brokers set limitations or froze trading in the stock.

Gamestop’s share price didn’t decrease for very length of time since it started to rise again in March 2021. For the balance of 2021, Gamestop’s cost remained over $100.

Gamestop share Price 2022

The demand in Gamestop’s stock has increased once again. The firm’s chairman, Ryan Cohen, said in March 2022 that he had increased his ownership in Gamestop common stock by 100,000 units. In addition, as we will detail in a moment, WallStreetBets, the online community where GameStop stock first shot to fame in 2021, has GameStop stock at the top of its discussion boards once more.

The proposed stock split has improved the performance of GME shares as of the writing in August 2022. In the end, this will make it simpler for regular investors to purchase shares of GameStop.

Dividends

Gamestop paid a stable yearly dividend from 2012 to 2019. However, due to financial difficulties, the corporation no longer provides dividends. However you can read our alternative guide to the Best Dividend Stocks You Should Buy in UK 2022 to find the best dividend paying stocks in UK.

Index Funds

The stock of Gamestop is included in the S&P 400 Midcap index, the S&P 600 index, and the NYSE Composite.

Market Capitalization

Gamestop is a large-cap stock as of the time of this writing because of its market valuation, which is close to $13 billion. This is more than 300% more than the market capitalization it had a decade ago.

Best trading platform to Buy GameStop Shares

If you wish to purchase GameStop stock, you must locate a broker with access to the New York Stock Exchange (NYSE), where GME stock is listed. Additionally, we suggest that you take into account a broker who enables you to trade the company’s shares in various formats, including CFDs or indices. Trading GME shares this way will increase your chances of success.

You are undoubtedly aware of how challenging it is to choose the best stock broker in the UK. To help you buy GameStop stock, we’ve listed the best two brokers below that have been examined and found to be reliable by our team of experienced researchers. This is to make sure you have the necessary equipment to effectively purchase the company’s shares.

1. eToro

Numerous stock traders in the UK have come to love eToro since it provides so many trading options. With a $50 minimum deposit, you can browse the NYSE and purchase Gamestop shares without paying any commissions.

eToro also gives you the option to trade the equity assets as CFDs and indices, maximising your potential. You will also have access to the social and copy trading platforms, which bring together like-minded traders to exchange trading ideas and duplicate positions with greater potential for profit.

On the other hand, this broker levies large spreads and withdrawal costs. The minimum trade amount for the copy trading feature is $500, making it expensive as well.

2. IG Markets

/IG-ef2684aaa37d4d218af819f98d676d02.png)

Awarded stock broker IG Markets provides more than 15,000 instruments for trading. You will trade Gamestop stocks as CFDs utilising top-notch research tools. Since IG Markets has some of the best learning resources, it is also simple to develop your skills there. Depending on your degree of experience, IG Markets also has excellent trading platforms for you to select from. These consist of the L-2 Dealer, ProRealTime, and MT4.

IG Markets encounters difficulties just like other brokers. First off, it has a steep $300 minimum deposit requirement and exorbitant trading commissions. Second, it is best suited to active traders because failing to trade at least three times in a three-month period will result in a $50 quarterly subscription cost.

How to buy Gamestop Shares?

The two stock brokers mentioned above are well-equipped to trade GameStop shares successfully in the UK. However, you still need to select one that is right for you, which means it must be inexpensive, dependable, and simple to use.

This being the case, here is how to buy GME shares using eToro.

Step 1: Visit eToro

Visit the company’s website to open a trading account with eToro. To make things easier, we provide a number of links on this page that will take you to the broker’s website. You may create a trading account after reading and agreeing to eToro’s terms and conditions. By installing the broker’s application on your smart device, you may easily keep track of your open trades and perform market analysis.

Step 2: Open an Account

If you have never traded stocks, we suggest opening a demo account so you may practice and learn the process. You must enter your personal information in order to sign up as an eToro client, whether you create a demo or live account. Name, address, phone number, email, information about your source of income, etc.

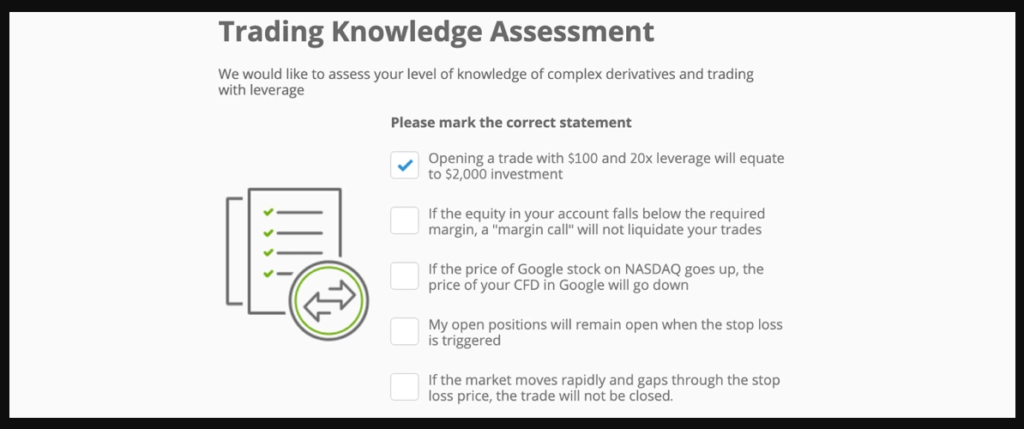

Step 3: Trading Test

Based on the results of a provided basic knowledge test, eToro determines the optimum trading package for you. Additionally, a margin trading test will be used to calculate your leverage cap. This is so because CFD trading, which has higher risks when done with leverage, is permitted on eToro.

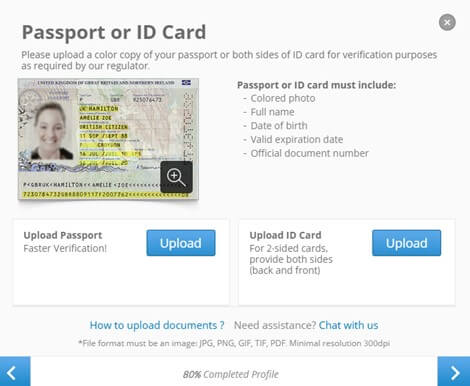

Step 4: Identity Verification

To safeguard their accounts, traders are required to confirm their identities as routine practice by all FCA-regulated brokers. You will be needed to send a recent utility bill or bank statement so that eToro may confirm your residence address. A notification email will be issued once your account is fully activated, which could take two to three days throughout the verification process.

Step 5: Deposit Funds

Once your account has been approved, you can fund it with one of the payment options accepted by the broker, such as a UK bank transfer, Paypal, Skrill, Debit/Credit Card, and Neteller.

Step 6: Buy GameStop Shares

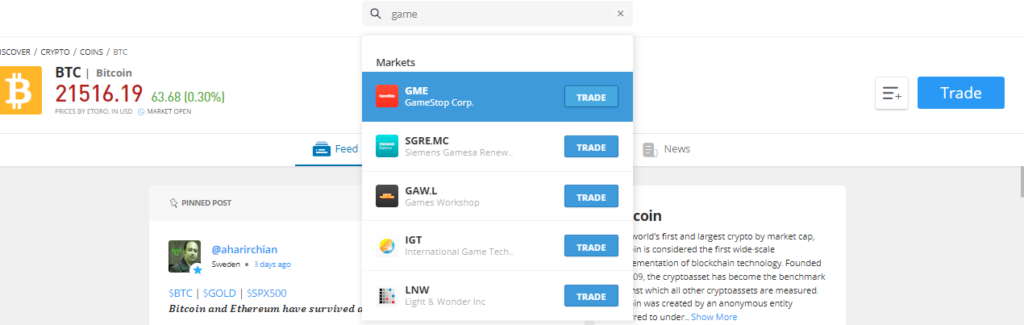

You can acquire GameStop shares after creating an eToro account and depositing money into it. To begin, type “GameStop” into the search bar and then click “Trade.”

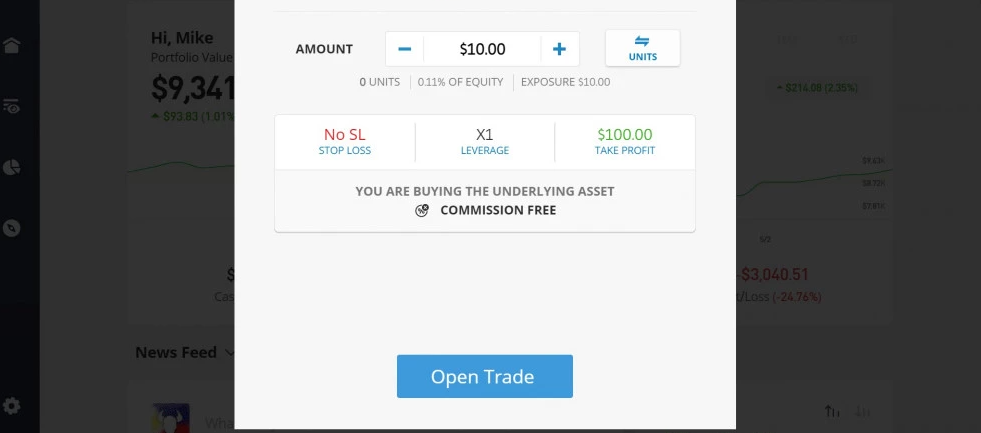

Enter your stake next, making sure you satisfy the $50 minimum.

If the NYSE is open, select “Open Trade” to quickly finish your purchase of GameStop shares. If the markets are shut down, select “Set Order.”

Conclusion

Don’t let the idea that consumers increasingly favor streaming and downloaded video games scare you. While this may be the case, both the demand and supply for physical video games are always rising. The recent revenue boost for GameStop shows this to be the case.

GameStop has been focusing on online platforms designed for competitive gaming, despite the fact that it may currently appear to be in limbo. This is a wise approach that will strengthen the company’s sustainability and attract a large number of shareholders. In this sense, now is the greatest time to buy GameStop shares so that you can reap the rewards of strong future profits.

Frequently Asked Questions

Can you buy GameStop shares?

Yes. Through an online stock broker, any qualified investor may purchase GameStop shares. The top stock brokers to acquire GME shares include IG Markets, and eToro.

How do I purchase GameStop shares?

Finding a broker with exposure to the NYSE, where GameStop’s shares are listed, is the easiest approach to purchasing shares of the company. ou can make the necessary deposit, gain access to the NYSE, select the appropriate number of GME shares, and finish your purchase with the help of the best broker.

Can UK citizens purchase GameStop shares?

Absolutely. Many stockbrokers in the UK, like the ones we’ve included above as recommendations, have access to NYSE, enabling UK traders to purchase GME shares. Before investing, though, be careful to research the firm and perform the appropriate due diligence.

What is the dividend per share for GameStop?

Sadly, GameStop no longer distributes dividend payouts to its shareholders. 2019 saw a significant decline in the company’s annual revenue, which led to the decision to stop paying dividends. Now that the company is profitable, we want to see dividend payments returned.

Is GameStop closing its doors?

No. Despite suffering a severe setback in 2019 that led to the closure of hundreds of locations, GameStop is steadily recovering and displaying growth potential, particularly with the recent sale of its shares to Wallstreetbets users.