Oil has increased by over 500% to surpass $100 since 2020 when it hit lows of under $20 per barrel. Despite this, the asset class of oil continues to be very volatile, which will benefit short-term traders who want to start Oil Trading.

We describe how to trade oil online using futures, options, equities, and ETFs in this tutorial. We also provide brief summaries of the oil trading platforms and a step-by-step explanation of how to start trading oil in the UK.

How to start Oil Trading – An overview

See the tour below for a quick summary of how to trade oil in four easy steps:

- Step 1: Select a Platform for Trading Oil: The initial step is to open an account with an online broker that provides marketplaces for trading oil. Because it provides a variety of oil trading instruments across equities, ETFs, and financial derivatives, we discovered that eToro is an excellent option.

- Step 2: Make a money deposit: At eToro, there is a $10 minimum deposit required to get started. When financing your account in USD, there are no deposit fees to pay, and you can use debit and credit cards, e-wallets, and bank transfers as payment methods.

- Step 3: Pick an Oil Market to Trade: eToro allows users to trade oil stocks and ETFs. CFD trading is available to UK clients.

- Step 4: Trade Oil: At last, select “Trade” and input the sum of money you are willing to risk on your oil trading position. For a location to enter your order, click the “Open Trade” button.

What is Oil Trading?

Oil is among the most valuable commodity on the planet. Like any other asset, the worldwide price of oil is influenced by supply and demand. However, because OPEC controls a significant portion of the world’s oil production, prices are frequently fraudulently manipulated.

As a result, it’s wise to keep a watch on everything OPEC announces and does while trading oil. In terms of the fundamentals, you will need to forecast whether you believe that worldwide prices will rise or decline when learning how to trade commodities. The WTI and Brent crude prices are the two main benchmarks to pay attention to.

You will be successful if you are able to predict properly whether oil will increase in value or decrease in price. The oil market that best matches your skill set must be considered, though. For instance, persons residing in the UK can simply speculate using CFDs on the price of oil in the future.

Numerous internet brokers provide this financial product, and it simply tracks the price of oil second by second. US-based investors won’t have access to oil CFDs, other markets like futures and options allow them to trade oil on leverage in both of those marketplaces.

Having said that, futures and options are sophisticated financial derivatives that frequently call for the opening of a margin account, which necessitates a deposit of $2,000 or more in accordance with SEC regulations. If you don’t want to risk that much money, you might want to think about investing in oil-related equities or exchange-traded funds (ETFs).

Options for Oil Trading

After going over the fundamentals, this section of our tutorial will focus mostly on how to trade oil.

Stocks and ETFs

When learning to trade oil, it is essential to select an appropriate market and financial instrument. We advise against using sophisticated financial instruments like futures and options if you are a complete beginner. Instead, investing in corresponding stocks is an excellent method to obtain exposure to the oil markets.

Numerous oil companies are listed on UK stock exchanges, making it simple to diversify. Stock values in this sector are significantly impacted by oil prices. As a result, when oil prices rise, equities in this sector frequently follow suit. The price of oil and the equities you choose, however, will never connect perfectly.

Investing in a suitable ETF is another approach for a beginner to trade oil. ETFs will follow the price changes for WTI Light Sweet crude oil. You will therefore have a far better chance of becoming exposed to the constantly fluctuating price of oil – but in a diversified way.

The SPDR S&P Oil & Gas Exploration & Production ETF is another highly regarded oil ETF that you might want to take into account. This ETF makes investments in more than 60 oil and gas-related businesses, including EQT Corporation, Antero Resources, and Southwestern Energy.

The ideal place to attain this goal is eToro if you choose to invest in oil-focused companies or ETFs. You can invest in your preferred stock or ETF starting at just $10, and there are no trading commissions to pay.

Oil Futures

In essence, oil futures let you make predictions about the price of oil without actually holding the underlying asset. Instead, your decision to purchase or sell a futures contract will depend on your prediction of whether oil prices will increase or decrease.

You must first determine the oil futures market’s strike price in order to achieve this. The next step is to forecast whether oil prices will increase or decrease at the time the futures contract expires or before.

A futures contract typically has a length of three months. Based on the difference between the strike and expiry prices, you will profit on each futures contract that you own if your prediction is correct.

Having said that, the majority of oil futures markets allow for entry and exit prior to the contract’s expiration, which provides for more flexibility.

Oil Options

You can consider trading oil via options if you don’t want to commit thousands of dollars to future investments.

In that you don’t have to possess the underlying asset to make a transaction, oil options resemble futures in some aspects. Additionally, you have the choice to buy or sell future oil prices.

Despite this, because oil options only cost a tiny premium to initiate a position, many people believe that they are less hazardous than oil futures.

The most you could lose from making a mistaken guess is the premium you paid, which is often around 5%. But if your guesses are right, you can use your right to buy or sell the corresponding options contracts.

Oil CFDs

The ideal approach to trade crude oil if you are based in the UK is through CFDs. As said earlier, online brokers are in charge of developing and backing CFDs, and they are responsible for monitoring the price of oil in the real world.

Therefore, all you need to do is predict whether oil prices will increase or decrease. Oil CFDs have no expiration date, unlike futures and options. Despite the fact that you can do this and hold a position open as long as you wish, CFDs charge overnight financing fees.

CFDs can, however, be traded using leverage. In the UK, Australia, and in European Union countries, retail clients can commonly trade oil CFDs with a leverage of 20x. This results in a trade value of $2,000 from a position of $100.

Best Oil Trading Strategies

You will need to employ a number of tactics when learning how to trade oil to make sure that you start your investment journey with your eyes wide open.

The sections below discuss the top oil trading tactics for newcomers to think about:

Read Financial News

Reading financial news is the greatest approach to determining whether the price of oil is likely to rise or fall. You should keep an eye out for news and events that might affect the supply and demand for oil.

A financial alert service that tells you when a relevant news story breaks is another smart move.

Track OPEC Declarations

Oil traders pay attention when OPEC says. In reality, you must watch live OPEC meetings, which are frequently broadcast on the organization’s website, if you intend to take your oil trading seriously.

The most important thing to watch for is any hint from OPEC, particularly Saudi Arabia, that production output will change.

Day Trading Oil

When making predictions regarding the price of oil in the future, you need also to consider the kind of trading method you want to use. Since oil volatility is ideal for short-term positions, many speculators in this market will choose a day trading approach.

A long position in oil, for instance, may be opened at 10 am and closed with gains of 2% at 1 pm. US clients will need to choose futures or options when day trading oil. CFDs are a better alternative if you are from the UK.

Stop-Loss Orders

Given how volatile oil is, it’s crucial to think about putting stop-loss orders in place on all of your trading positions. This will cap lost transactions at the amount you select, as the name implies.

For instance, you may simply say this via a stop-loss order if you don’t want to risk losing more than 10% of your position in the oil trade.

In doing so, your broker will immediately close the position on your behalf if the value of your oil trade decreases by 10%.

Bankroll Management

When learning how to trade oil, managing your bankroll is yet another risk-averse tactic to use. This entails restricting the amount of money you risk on each trade relative to the balance of your current account.

Consider that you want to set a maximum transaction size of 5% of your balance and that you have a $3,000 bankroll. This implies that you shouldn’t put more than $150 at risk in a single trade.

You can prevent your trading funds from being wasted by doing this. As long as you stick to your bankroll management approach, you can also increase the size of the trade as your balance increases.

Best Oil trading platforms

You must use an internet broker if you’re seeking places to trade oil online. Users should be able to access the particular financial instrument you want to trade on your selected platform, such as the top oil stocks, ETFs, or derivatives.

You can trade WTI crude oil and other key markets from the comfort of your home by visiting the websites reviewed below.

1. eToro

The most effective platform for trading oil in the UK is provided by eToro. More than 25 million people use eToro, which was founded in 2007. By opening an account, you will have access to a large selection of oil stocks, including Exxon Mobil, BP, ConocoPhillips, and Shell.

For a beginner learning how to trade oil for the initial time, stocks active in this sector are the best way to get exposure to this commodity. You might instead consider making an investment at eToro in oil ETFs.

eToro won’t charge you a commission no matter which oil stock or ETF you choose to trade. As a result, you can learn how to trade ETFs for some of the lowest market fees. Both UK and foreign listed markets are affected by this. Additionally, eToro only has a $10 minimum trade size, so you can access oil without taking on significant financial risk.

The copy trading option offered by eToro is another highly regarded feature valued by users. As you will be copying an expert trader exactly, this provides a passive way to invest in the stock market.

2. Capital.com

The CFD supplier Capital.com is a favorite of novice investors. Simply choose the trading instrument you want to use, enter your stake, and you’re ready to go. This FCA broker provides a range of markets for oil trading goods.

For instance, both Brent and WTI crude have CFD markets. The spreads on both markets are quite competitive at just 0.06 pip, which is a small amount. You can also trade oil futures using CFDs on Capital.com. Although you won’t own the underlying contract, this operates in a similar manner to conventional futures.

No matter whatever oil trading market you choose at Capital.com, the website does not impose any commission fees. Fees are instead included in the spread. There are no costs to deposit or withdraw monies either. Finally, when using a debit/credit card or an e-wallet, you can begin trading with a deposit of £20.

How to begin Oil Trading?

This portion of our beginner’s tutorial will bring you through the process step-by-step using eToro if you need some direction on how to trade oil now.

For UK clients, this platform provides a wide selection of commission-free oil-focused equities, ETFs, and CFDs.

Step 1: Open an Account

Before you can begin trading oil, you must create an eToro account. You’ll need to enter your first and last name, email address, and mobile number; this should take a few minutes.

Step 2: Deposit Funds

You will then be required to make a deposit in order to fund your trading account.

Additionally, a number of e-wallets, including Skrill and Paypal, are supported. A normal bank wire or an ACH transfer are other options.

In terms of fees, no deposit charges are enforced on USD payments. In any other case, a 0.5% minor FX fee will be charged. For US and UK clients, the minimal deposit is $10, whereas it is $50 for the majority of other nationalities.

Step 3: Search for Oil Market

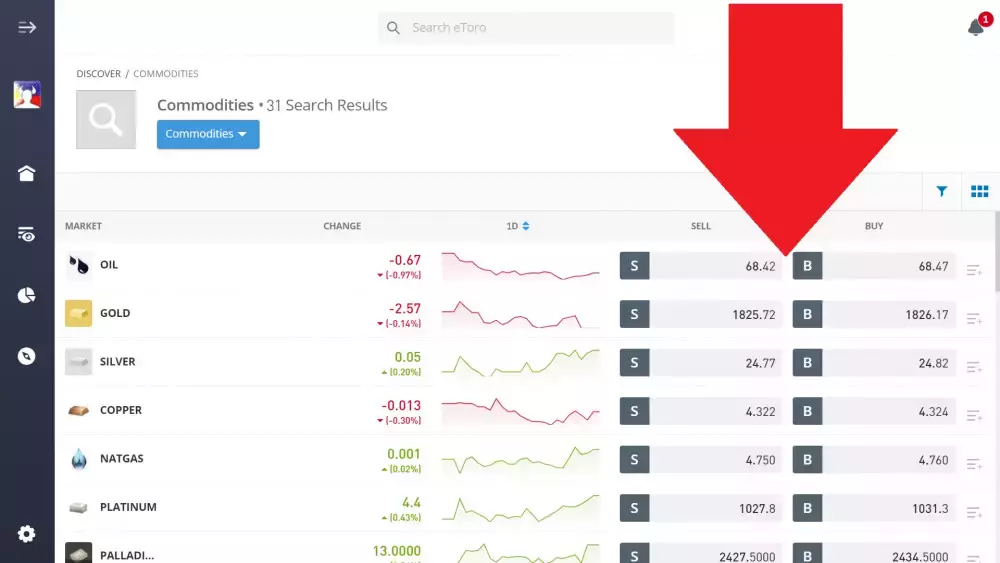

Now use the search bar to locate the oil market you want to trade.

By selecting “Discover,” you can also see which oil markets are supported by eToro.

Step 4: Place Oil Trading Order

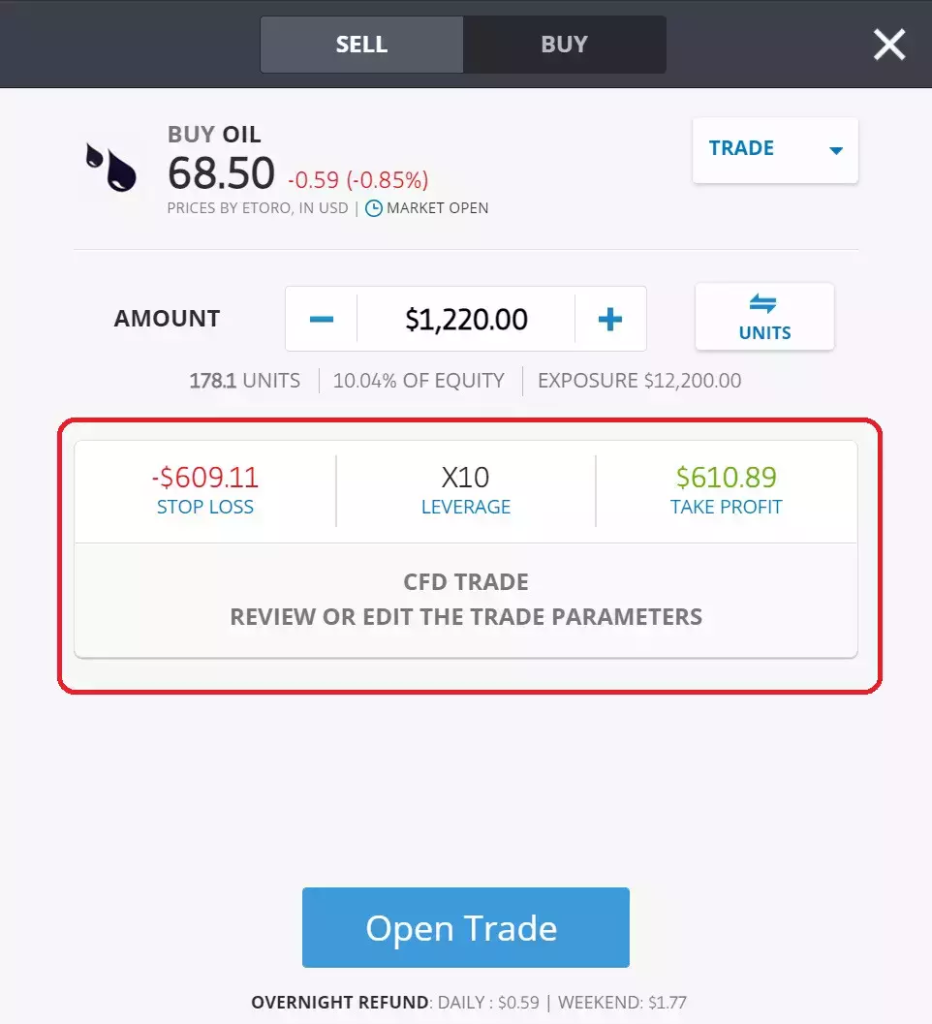

To make an order box popular, click the “Trade” button. You must enter your total bet in the “Amount” box. In the example given below, we are investing the bare minimum of $10 in this trade.

To submit your order, select “Open Trade.”

Conclusion

You will be joining a market that has the potential to be very volatile if you want to learn how to trade oil. However, this will work for short-term investors who want to make predictions about the cycles and patterns in the oil market.

You should also consider the types of oil markets that you are interested in, such as stocks, ETFs, futures, options, or CFDs. You can register an account with eToro in under five minutes and begin trading a number of oil markets right away.

This top-rated broker offers extremely low costs, modest account minimums, fee-free deposits and withdrawals using bank wires, debit/credit cards, and e-wallets.

Frequently Asked Questions

Can crude oil be bought and sold?

Without actually receiving any barrels, crude oil can be bought and sold. Several investment vehicles, including stocks, ETFs, futures, and options, can be used to achieve this.

How can you profit from trading crude oil?

Trading crude oil will be profitable for you if you make predictions about the future value of the commodity.

Which trading platform is better for crude oil?

We discovered that eToro, which offers a huge selection of markets at market-beating costs, is the best platform for trading oil. For those learning how to trade oil for the first time, in particular, eToro is great. Additionally, eToro provides the top oil trading app.

What time of day is best to trade oil?

The greatest time to trade crude oil is when a major announcement is published to the public regarding demand and supply.