There are numerous financial instruments available online that let you speculate on the potential value of gold. ETFs and equities with a connection to gold may be of interest to long-term investors, although futures and options are more ideal for day traders. We go over all there is to know about learning gold trading in this beginner’s tutorial.

This guide also contains a summary of the major gold trading platforms, recommendations for methods to trade gold, and information on how to begin gold trading in UK.

How to start Gold Trading – An overview

When using a platform that is user-friendly for beginners like eToro, trading gold online can be a very simple process. Follow the detailed instructions below for an overview of how to trade gold on eToro.

- Step 1 – Open an Account: You must first create an account on the gold trading website of your choice. Entering your personal information allows you to create an account on eToro.com in less than two minutes.

- Step 2 – Deposit the minimum capital: Starting an account with eToro for UK just requires a $10 deposit. Transaction costs for USD deposits and withdrawals are zero. A debit or credit card can be used to make an instant deposit, while other methods like e-wallets, online banking, ACH, and more are also accepted.

- Step 3- Pick a Gold Market to Trade on: eToro offers access to a number of gold marketplaces. Gold stocks or ETFs may be chosen by novices and long-term investors alike.

- Step 4- Trade Gold: Click “Trade” and enter your stake, which starts at $10. You can confirm your position by clicking the “Open Trade” button.

What is Gold Trading?

Depending on your investment objectives, the gold trading process can differ greatly.

But in its simplest form, you’ll be trying to make money by making predictions about the price of gold in the future.

Similar to the majority of other commodities, gold is priced and traded versus the United States dollar. The majority of traders and experts will evaluate the cost of gold per ounce (oz).

Its price will fluctuate every second because it is based on worldwide supply and demand.

Long-term and short-term traders will find the conditions created by this to be quite favorable.

When you start learning about gold trading, you’ll find that you don’t need to own or store any gold bars in order to buy and sell this valuable metal. On the other hand, a number of well-liked trading instruments allow you to expose yourself to the future value of gold.

For novice investors, you might think about buying a suitable ETF that is backed by real gold bars. If you want to invest in gold for the long or medium term, you should also take gold stocks into consideration.

As an alternative, you might think about trading gold futures or options if you have some past experience with financial derivatives.

UK consumers can also access CFDs, which track the market price of gold in real-time.

By choosing gold derivatives, you will also have the choice of shorting the pricey metal and even engaging in leveraged trading.

In either case, your main goal when trading gold online is to forecast whether the price will climb or decline. The magnitude of your stake, combined with whether and how much of your speculation was true, will decide your profit or loss.

Options for Gold Trading

There are numerous ways to trade in gold. Depending on the financial instrument you choose, we will explain in the sections below how you can trade gold online.

ETFs and stocks

When deciding how to trade gold, the first approach to take into account is to use a traditional asset class, such as equities or ETFs. You will begin by making stock investments in businesses involved in the gold sector. This will frequently be a gold mining firm that is listed on a significant UK exchange.

For more diversity, you may also take into account gold equities from Canada, Australia, or Europe. In terms of advantages, gold-centric stocks give you a beginner-friendly way to indirectly expose yourself to this precious metal.

However, there will often be a large performance gap between the profitability of your selected gold-related stock and that of the market’s current pricing.

Beginners could think about trading gold utilising a top ETF in addition to equities. One of the better options is the SPDR Gold Shares ETF. Because this ETF is physically backed by gold bullion, it indirectly enables passive precious metals speculation. Furthermore, compared to stocks, this ETF will have a far stronger correlation with spot prices.

After all, the gold bullion that the ETF physically owns and keeps will fluctuate in value in accordance with market pricing. Just keep in mind that gold-backed ETFs do not pay dividends.

Gold Futures

The most popular method of trading gold is through future contracts, but doing so is far more expensive and involved than doing it through CFDs. Farmers, producers, and large corporations have long used these financial agreements as an insurance mechanism. Futures contracts are now utilized to both hedges a position and make price speculations on an asset.

In essence, you engage in an agreement to buy or sell the commodity at a specific date, location, and price when you purchase a futures contract rather than paying the settlement price. Although trading futures on an exchange provides great liquidity and gives you the ability to build trading strategies, it is highly difficult, necessitates a protracted registration process, and demands a sizeable initial commitment.

Gold Options

Options trading is another method of trading gold. The opportunity to purchase or sell the commodity at a specified price and on a specified time is essentially what call and put options on gold give the contract’s owner. Even while call-and-put options can be found on CFD platforms like Plus500, these options are primarily traded on futures exchanges.

When opposed to futures, gold options include benefits including more leverage, the ability to control your potential losses, and the use of hedging trading tactics.

CFDs

Furthermore, CFDs allow you to trade UK spot prices without having to hold any of the underlying gold.

However, gold CFDs only track the spot value of the valuable metals. Therefore, all that is required of you is a forecast of whether you believe the price of gold will increase or decrease.

When it comes to regulation, minimal fees, and access to leverage, eToro is a fantastic choice if you’re looking for a place to trade gold CFDs.

Forex

If you’re wondering how to trade gold on the forex market, it functions quite similarly to CFDs. This is so because you will be exchanging the value of gold for that of another currency, usually the US dollar.

As a result, you must make a profit when learning how to trade gold on the currency market by making a prediction on whether its spot price will increase or decrease.

Best Gold Trading Strategies

In this section of our tutorial on trading gold, we’ll go over a few techniques you might want to take into account if you’re trying to get your first exposure to this asset class.

Begin with an ETF

The best course of action for a beginner is, to begin with, an ETF that is backed by actual gold.

As previously said, this only requires a $10 or higher investment when utilizing eToro, after which a sizable provider like SPDR will handle your ETF portfolio.

Since the ETF will be supported by genuine gold, there should be a high relationship between spot rates and those of your selected fund.

Learn how gold and stocks are related

Additionally, we already established that gold and larger stock markets frequently have an inverse relationship. Theoretically, this implies that while stock markets globally are rising, gold prices will fall, and vice versa.

You will have the best chance of correctly predicting the price of gold if you comprehend how this inverse relationship operates.

Watch for important economic indicators

Because gold is regarded as a safe haven during times of economic instability, investors frequently turn to it.

As a result, it may be a smart idea to start a long trading position in gold when economic indicators, such as growing inflation and unemployment, hint at the possibility of a recession.

Gold Day Trading

If you’re considering starting a day trading business, you should concentrate on asset classes with a large number of trading opportunities. And gold is leading the way in this because of the increased volatility it draws.

Furthermore, there will never be a liquidity issue because gold is among the most traded commodities globally.

Watch for the rising demand for gold

To predict future price movements for gold, another excellent trading strategy is to keep an eye out for signs of rising demand from important economies.

For instance, the Chinese government has increased its imports of gold significantly during the past few years. And when it reveals fresh import data, the gold price frequently rises.

Best trading platforms to Trade Gold

Choosing a broker and deciding where to trade gold are two of the first steps you will need to take.

An overview of the top online gold trading sites is provided below.

1. eToro

Over 25 million customers from the UK and other countries use eToro. With just a $10 minimum deposit, you can start a verified account with this high leverage broker in under five minutes. Both short-term and long-term traders can access a vast array of gold markets with eToro.

For instance, the SPDR Gold ETF might be something to think about if you’re a newbie trying to invest in gold for the long term. This investment vehicle offers a great opportunity for passive exposure to the precious metal because it is primarily backed by genuine gold bullion. Additionally, all gold ETFs at eToro allow commission-free trading.

You might also think about making an investment in one of the many gold-related equities available on the eToro platform. When buying and selling stocks, there are no commission fees to pay, and the minimal trade amount is merely $10, much as ETF.

Investors who are short on time or without experience will value the copy trading option, which enables you to instantly replicate the positions of a true professional. Additionally, you can invest in a ready-made smart portfolio that monitors a particular market or sector.

2. Plus500

Another choice for active day traders who want to make numerous orders at once in the markets is Plus500. The spread for gold at Plus500 is 0.77, or 0.04%, to be more precise.

As part of its selection of trading tools and services, Plus500 provides a market sentiment feature that enables you to monitor the current positions of traders on a specific asset. Additionally, you may use its price notifications tool, which warns you when prices on specific products change. Another benefit is that you can purchase a call and put options because it provides choices on gold.

The parent business of Plus500 is strictly regulated, and it is traded on the LSE under the ticker PLUS.

How to start Gold Trading?

To make your initial gold trading trade pretty quickly, check through the comprehensive instructions provided below.

Step 1: Open an Account

Open an account by visiting the eToro website and selecting “Join Now.” Name, address, and a few of other personal information must be entered.

Your cell phone number must also be entered and verified.

Step 2: Deposit Funds

The eToro minimum deposit amount for UK residents is a mere $10. Additionally, you can deposit money with no costs attached.

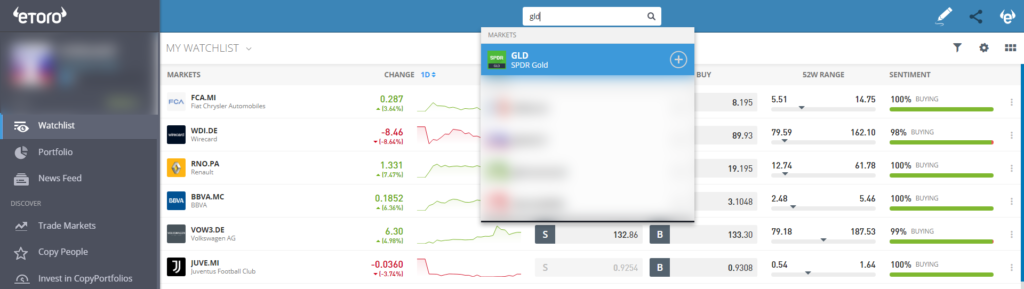

Step 3: Search for Gold Market

The search bar is where you would type in the name of the gold market you want to trade on.

In the given example, we are looking for the SPDR Gold ETF.

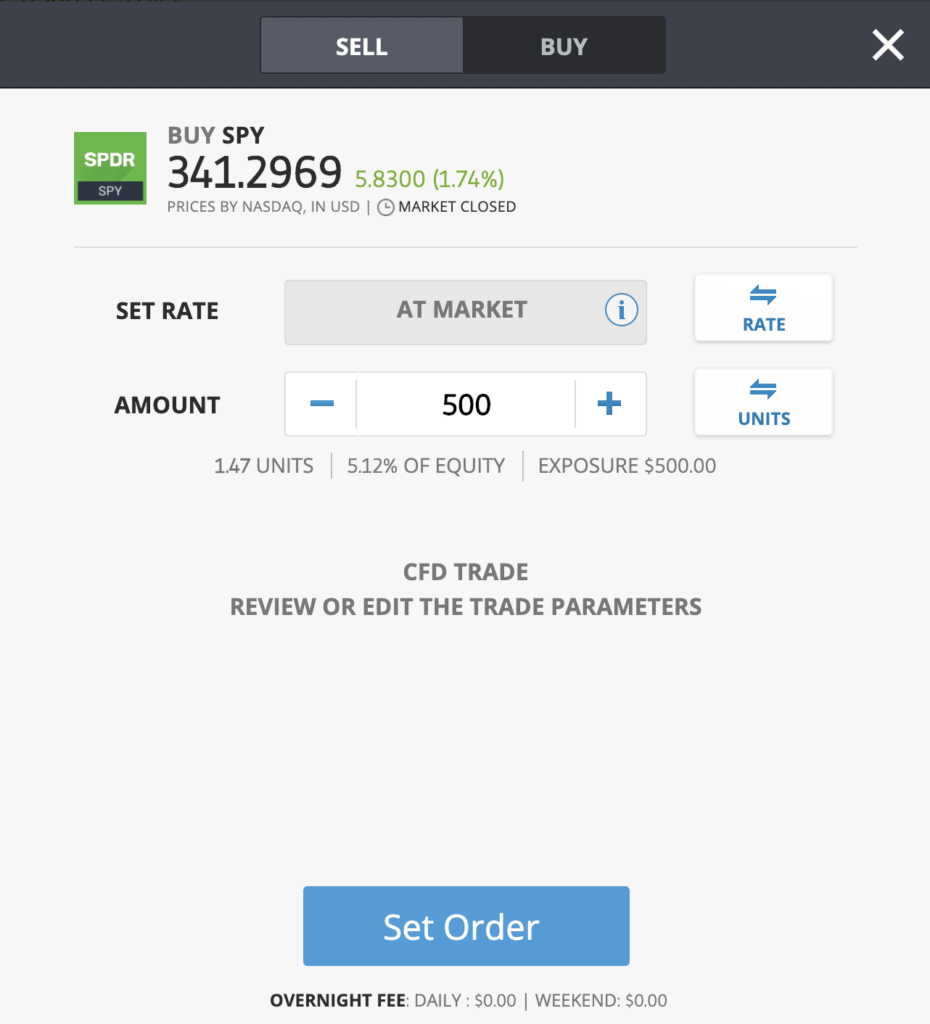

Step 4: Place Gold Trading Order

At eToro, the minimal stake is a mere $10 whether you are trading gold equities or ETFs. Specify your investment in the “Amount” box and select “Open Trade” to establish the gold trading position.

Choose “Set Order” if the relevant gold market is closed. Your order will then be placed when the market opens by eToro.

Conclusion

There is no longer a requirement to purchase gold bars or coins in order to gain exposure to this priceless metal. Instead, a variety of strategies to enter this market have been covered in this guide on trading gold, covering stocks, exchange-traded funds, CFDs, options, and futures.

Opening an account with eToro and making the required minimum fee-free deposit of $10 will allow you to start trading your preferred gold market immediately. The next step is to find your favorite gold trading instrument and place the necessary orders.

Frequently Asked Questions

Where can I begin gold trading?

The eToro platform is the best place to trade gold. A wide range of gold stocks and ETFs are available at eToro with no commission. Additionally, we discovered that eToro provides the finest gold trading software for iOS and Android.

What time of day is ideal for trading gold?

During erratic movements is when gold trading is most profitable. This sometimes occurs when there is a risk of an oncoming recession or when the economy is uncertain.

How can gold be traded most effectively?

The ideal option to trade gold online for a newbie is through equities that are involved in this sector of the economy.

Is gold a suitable day trading option?

Yes, due to the increased volatility it attracts, gold is among the best asset classes for day trading.

Is gold trading secure?

By using a regulated commodity broker, you can trade gold securely. When trading gold, you need also to use a bankroll management strategy and be sure to use stop-loss orders.