You will need to select a top-rated trading platform if you want to invest in FTSE 100 Index, the most well-known UK index.

In this guide, the best and most affordable FTSE 100 Brokers in 2022 are revealed. At the end of the guide, you will additionally be prepared to invest in the FTSE 100.

Best FTSE 100 Brokers 2022

There are thousands of possible results when searching the Internet for FTSE 100 brokers. Identifying the top FTSE 100 brokers can be quite time-consuming and challenging. As a result, we’ve listed our top picks for brokers below to assist you to invest in the FTSE 100 Index.

1. eToro

The best trading platform to choose in 2022, according to our thorough analysis of hundreds of the Best FTSE 100 Brokers, is eToro. The social trading platform was first created with novice traders in mind. This is primarily attributable to the broker’s user-friendly layout and well-liked copy trading options.

In addition to stock and ETF trades eToro also provides FX trading. Additionally, eToro supports trading on all of its supported financial marketplaces with a 0% commission fee. eToro is the ideal trading platform for bargain trading because there are no continuing expenses.

Since it is the greatest option for new FTSE 100 traders, eToro takes the top spot in our ranking. The web and mobile trading interfaces are relatively simple to use, the account opening is simple, and social trading is supported. You may mimic the trades of knowledgeable FTSE 100 traders thanks to eToro’s ground-breaking Copy Trading function.

Another thing to note is that with eToro, you may change how much leverage the tradeable products have. This is excellent in terms of lowering possible trade risks. Leveraged trading has the potential to increase earnings but also has the potential to increase losses.

Regarding the fundamentals, eToro is governed by renowned financial organizations such as the UK’s FCA, Australia’s ASIC, and CySEC.

2. Capital.com

The next supplier on our list of the Best FTSE 100 Brokers is a 2016-founded global forex and CFD trading platform. Low trading fees and no non-trading fees are provided by this FCA, CySEC, and NBRB-regulated broker.

This fully regulated CFD trading platform offers commission-free transactions with market-beating spreads to its customers. The broker accepts a number of payment methods, including Apple Pay and credit and debit cards.

Trades on Capital.com can be made on more than 2,700 stocks. Several of the largest FTSE 100 shares are represented in this. You can purchase and sell holdings in significant LSE-listed businesses like Aviva and Lloyd, for example.

Capital.com can be your broker of choice if you’re the kind of trader that has a strong eye for the larger stock markets. The S&P 500 index to the FTSE 100 is among the more than 30 indices available on this CFD trading platform. You will have to pay a minimum spread of 8.4 if you want to trade one of the major stock indices, such as the FTSE 100.

3. Libertex

Libertex, founded in 1997, has about 3 million clients worldwide. This broker, one of the Best FTSE 100 Brokers in the financial industry, focuses on CFDs.

Libertex is subject to CySEC regulation and offers a wide range of CFD asset classes, including stocks, indices, ETFs, cryptocurrencies, and commodities. One of the numerous extra advantages of trading with Libertex is that there are no spread fees.

Libertex does not provide you with legal ownership of the shares when you trade stock CFDs because they are not backed by actual stock. However, using this method to trade stock CFDs gives you access to minimal trading costs, leverage, and the choice to go long or short on the deal.

You’ll be pleased to learn that Libertex supports a wide range of marketplaces if you’re trying to get more exposure to the indices trading sector.

4. AvaTrade

Since 2006, AvaTrade has operated as a global FX and CFD brokerage. Fundamentally speaking, AvaTrade is overseen by a number of prestigious financial regulators, including ASIC, the FSA, and the Central Bank of Ireland, to mention a few.

AvaTrade provides 620 Stock CFDs, 41 ETF CFDs, and 19 distinct stock index CFDs as traded instruments. CFD trading can be a challenging idea for inexperienced traders to grasp, but AvaTrade provides AvaSocial, a social trading mobile software. This feature is excellent for beginning investors since it makes it simple to communicate with other traders and mimic their deals.

The average spread for this broker during busy trading times is 0.5 points, with the costs already factored into the spread.

In addition to offering its customers a spread structure that leads the industry, AvaTrade also enables CFD trading with a 0% commission fee. This broker offers a tonne of additional financial products, including trading in commodities and foreign exchange.

5. Fidelity International

Low trading and non-trading fees are provided through the UK-based trading platform Fidelity International, which is governed by the FCA. Fidelity International, however, is included on our list because this analysis is concentrated on the top FTSE 100 brokers. With typical trading costs, 280 ETFs and a variety of stocks listed on the London Stock Exchange can be accessed.

A fixed fee of £10 will be charged if you trade outside of a basic savings plan. Orders for share trading that are placed over the phone also incur a £30 cost. You can easily fund your account with a debit card or check through Fidelity, which levies no deposit fees. On the other hand, this broker does not accept e-wallets like Paypal.

Additionally, this FTSE 100 broker has a sleek, user-friendly mobile trading platform. With a swipe of your finger, you can invest in ETFs and place order types, but you cannot create price alerts or notifications.

6. Interactive Brokers

/interactive_brokers_productcard-5c61eec746e0fb0001f25462.png)

The UK’s FCA oversees and authorises Interactive Brokers, one of the Best FTSE 100 Brokers, and it provides low-commission exposure to products from stocks and exchange-traded funds to investment funds and bonds.

You can access bond and equity indexes with Interactive Brokers on a huge number of exchanges in more than 12 different countries. This includes trading in options and futures contracts, as well as trading in leveraged and short exchange-traded funds. Additionally, the trading platform is accessible in Britain, the United States, and Europe.

Overall, we found that Interactive Brokers is ideally equipped to professional traders and active traders since the desktop trading platform might be somewhat difficult to use for new traders. This is according to our study of the top FTSE 100 brokers for 2022.

7. IG

/IG-ef2684aaa37d4d218af819f98d676d02.png)

IG, a highly regarded CFD trading platform, was founded in 1974 and is governed by a number of financial regulators, including BaFin and the UK’s FCA. Its regulation is strengthened by the premise that it is traded on the LSE under the ticker symbol IGG.

This CFD trading platform provides its clients with easy access to equities in addition to other tradable assets including currency, cryptocurrencies, and ETFs.

The trading commissions you pay will vary based on where you live. This means that some nations enjoy zero-cost access to UK stock CFD trading, while other countries must pay a small average trading commission of about 0.10 percent.

There are two choices for IG’s trading platform: the internally built platform, or MetaTrader 4. Both platforms contain a tonne of technical indicators and fundamental analysis, and they are both highly user-friendly.

8. Plus500

A global CFD provider that is FCA and ASIC regulated, Plus500 is traded on the London Stock Exchange under the ticker PLUS. Plus500 provides upwards of 2,000 stocks CFDs in addition to the CFD indexes, digital currencies, as well as commodities. Additionally, this covers the majority of international and UK exchanges, which is ideal for traders looking to invest in and trade less liquid marketplaces and assets.

We have mainly centered on its CFD costs, which seem to be usually ordinary when contrasted to those charged by other brokers. The S&P 500 and FTSE 100 index CFDs, for instance, have a 0 percent cost because everything is covered by the spread.

9. XTB

/xtb_productcard-5c61e60d46e0fb0001f08eb8.png)

Developed in 2002 XTB, a provider of CFDs and FX on a global scale is governed by the FCA. With somewhat higher than usual CFD trading fees, XTB provides low-cost forex trading. The trading costs that you are likely to pay when investing are determined by the account types offered by XTB.

With no account, deposit, or withdrawal fees, XTB performs about averagely in terms of non-trading fees. You also don’t have to bother about currency conversion costs because this broker offers 5 alternative account basic currencies, namely EUR, USD, and GBP.

Indexes from the most well-known stock exchanges are available on XTB. Investors are drawn to features that make it simple to diversify your trading portfolio. When contracts expire, index holdings can be rolled over, allowing the open position to be kept for a longer length of time.

10. CMC Markets

/cmc_productcard-5c61eb07c9e77c0001d93109.png)

Lastly, CMC Markets is renowned forex and CFD stock broker that was established in 1989. Fundamentally, the Financial Conduct Authority, the highest financial regulatory body in the UK, regulates this CFD service. CMC Markets is additionally traded on the LSE under the ticker CMCX.

CMC Markets offers cheap stock index CFD fees for trading and non-trading activities, and there are no fees for deposits or withdrawals. For instance, because the fees are included in the spread when trading the FTSE 100 CFD, the expenses are modest. On the other hand, there are no fees associated with opening an account with this CFD broker or using its services. However, after a year, there is a £10 inactivity fee per month.

The quick payment alternatives provided by CMC Markets range from credit and debit cards to e-wallets like Paypal. The desktop, smartphone, and web trading platforms offered by this CFD broker are appealing and simple to use. CMC Markets provides excellent alternatives for tailoring your chart and interface modification to meet your needs.

How to begin with FTSE 100 Brokers?

We will walk you through the process of starting to invest in or trade the FTSE 100 index with eToro at this point in our study of the Best Brokers for FTSE 100. eToro offers amazing trading features like Copy Trading and a huge selection of tradable instruments at no additional cost. We suggest eToro as the top FTSE 100 broker in 2022 because it is ideal for new traders.

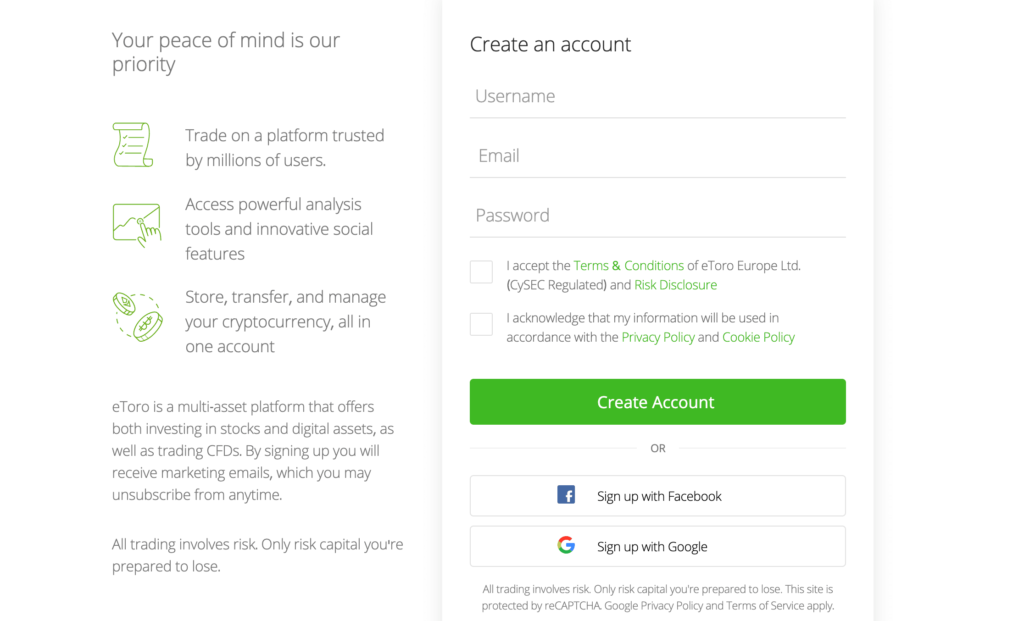

Step 1: Open an account

Just provide your username, email address, and password as your login details. You only need to click one button to begin trading online once you have accepted the terms and conditions and the risk information.

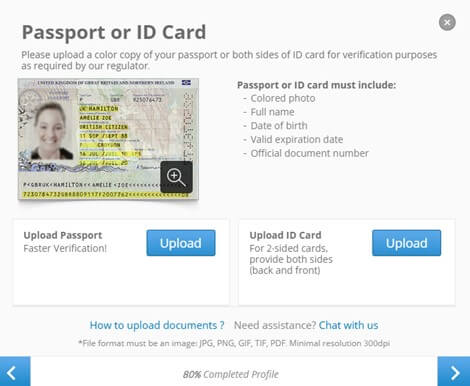

Step 2: Verification

Leading financial regulators including the FCA, CySEC, and ASIC oversee eToro. Verifying the address and identity of its users is a requirement of this regulation.

Providing a copy of your passport or other official documents will help you prove your identity quickly. You can then attach a bank statement or utility bill with a date within the last six months to prove your address.

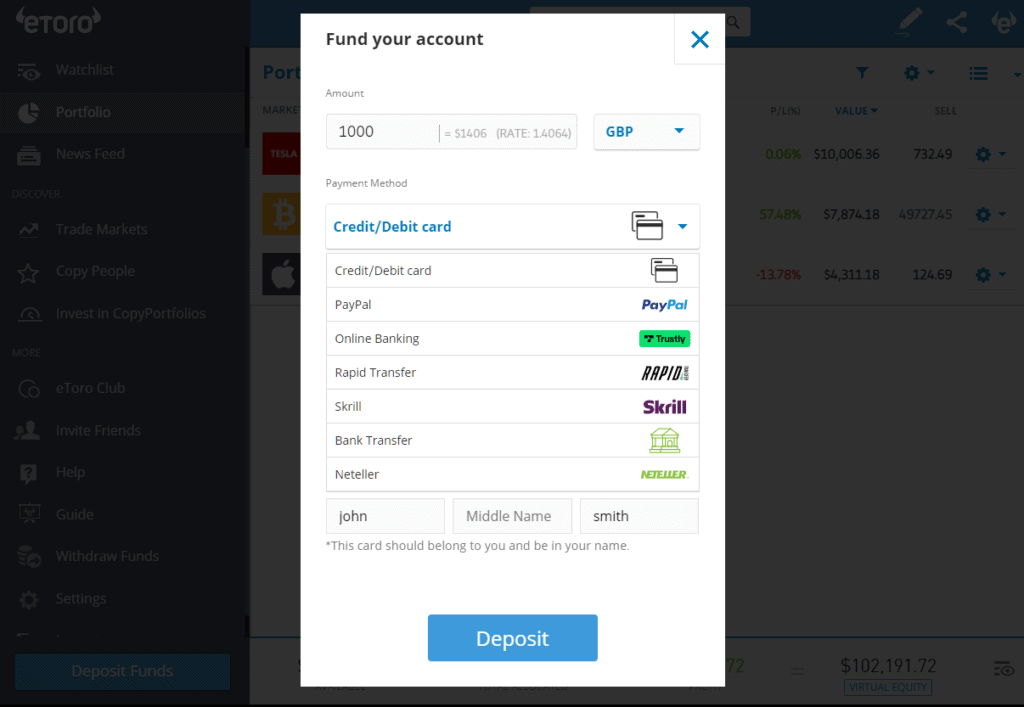

Step 3: Deposit

It’s just as easy to add money to your new trading account as it is to open one in the first place. Simply select Deposit by clicking the button in the lower right hand corner of the page. The fact that this budget broker charges no commission on deposits is one of its strongest selling features.

With eToro, a number of payment methods are available, including bank wire transfers, debit and credit cards, and e-wallets (PayPal and Skrill).

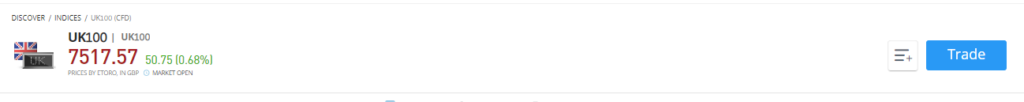

Step 4: Choose your FTSE 100 instrument and place an order

eToro provides a wide range of commission-free financial instruments, including CFDs, stocks, and ETFs.

Trading FTSE 100 CFDs and investing in FTSE 100 tracker funds and ETFs are both relatively affordable options. In addition, you could benefit from specific stocks that are included in the FTSE 100 index.

Simply click the “trade” button once you have decided which asset class you want to trade or invest in.

You have the choice to enter order types such as stop-loss orders as well as the investment amount, leverage, and leverage percentage on the trading ticket. The cost of an overnight stay is often indicated on the ticket. Tapping the Open Trade Button completes the process.

Conclusion

In this FTSE 100 broker’s guide, we have studied the best FTSE 100 brokers and discussed how you may get started trading right away while also looking at a selection of outstanding and top-tier regulated trading platforms.

As the UK starts to recover from the Covid-19 outbreak and its exit from the European Union, many seasoned traders are optimistic about the near- and long-term direction of the FTSE 100 index. The FTSE 100 is after all among the most undervalued indices in the world right now, according to analysis.

You must employ the best platform and resources in order to take full advantage of this special trading opportunity. According to our comparisons and analysis, eToro will outperform all competitors in 2022 as the finest social trading platform with a 0% commission.

Frequently Asked Questions

What is FTSE 100?

The UK’s growth index, the FTSE 100, is made up of the top 100 market-value-based corporations that are listed on the London Stock Exchange.

How can I buy FTSE 100 stock?

By acquiring exposure to the businesses that make up the FTSE 100 index, you can invest in or trade it. Basically, you have the option of spread betting or CFD if you want to trade the FTSE 100 index. On the other hand, you must choose an ETF provider if you want to invest in the FTSE 100.

Which brokers offer the FTSE 100 index the best deals?

You can select any of the aforementioned options or another platform of your choosing, but be sure to take into account the metrics we have already discussed. But eToro is, in our opinion, the very best broker.