Finding businesses with a higher value than their present stock price is the goal of value investing. Value investments have been employed for a long time by long-term investors like Warren Buffett, Benjamin Graham, Charlie Munger, and others to reduce risk and increase gains.

We will discuss value investing in the UK and the top UK value investments for 2022 in this guide. Additionally, we will offer a thorough tutorial on where and how to start investing in value investments.

What are Value Investments?

A method of investment known as value investing entails purchasing inexpensive stocks. Value investors typically assess a company’s inherent value and contrast it with the market. Worth investors rush to buy when a stock’s inherent value is lower than its market value, or share price.

Value investing is a radical method to approach the stock market in the UK. Fundamentally, it is predicated on the notion that the stock market is poor at fairly valuing stocks. A company’s price could temporarily fall below its genuine value if the market overreacts to adverse news. That overreaction offers value investors the chance to purchase shares at a discount with the expectation that the price will eventually rise to the intrinsic value.

Knowing the correct value of a stock is therefore essential to any value investing strategy. This intrinsic value can be determined in a variety of ways; even well-known value investors like Benjamin Graham and Warren Buffett, the current CEO of Berkshire Hathaway, approached determining a company’s valuation in various ways.

What is Deep Value Investing?

Deep value investment and value investing are similar terms. It is sometimes used to refer to a more extreme value investing strategy, though, in which investors seek out companies that have been severely undervalued. The stock prices of these companies are frequently quite low when compared to both their intrinsic worth and historical average price.

Deep value investment may carry a little bit more risk than standard value investing. Companies that have been defeated can be having financial difficulties or losing their competitive edge. While this might not be taken into account when determining intrinsic value, value investors should pay close attention to what it will take for a company to turn things around and attain its predicted valuation.

What distinguishes growth investments from value investments?

Value investing and growth investing are different long-term investment strategies that concentrate on a firm’s technical aspects.

Value investors examine a firm’s price in relation to both its historical average and the larger stock market. Additionally, ideal value stocks have to be less expensive than competing businesses in their sector, at least in terms of the price-to-earnings ratio.

On the other side, growth investors search for businesses whose earnings per share are increasing quickly year over year. Rather than being priced lower than competitors, these businesses frequently charge a premium to the larger market. Compared to value companies, growth stocks tend to be higher-risk investments because their valuation might drop significantly if earnings growth slows.

What are the metrics of Value investments?

To determine a stock’s valuation or intrinsic value, investors employ a variety of indicators. A few indicators used to assess a stock’s worth are as follows:

- Price-to-book: Often known as book value, is a ratio that assesses a company’s assets against its stock price. Assuming the company is not experiencing financial difficulties, the stock is undervalued if the price is lower than the value of the assets.

- Price-to-earnings: This metric displays the company’s history of earnings, and can be used to assess whether the stock price is fairly valued or not.

- Free cash flow: It is the money a business generates from operations or sales after deducting costs for expenses. Free cash flow is the money that is left over after all expenses, such as operational costs and significant acquisitions known as capital expenditures, such as the purchase of equipment or the expansion of a manufacturing facility, have been paid. If a corporation is producing free cash flow, it will have extra funds to repurchase shares of stock, pay dividends to shareholders, pay down debt, and invest in the company’s future.

Of course, the research uses a wide range of additional variables, such as the examination of debt, equity, sales, and revenue growth. If the comparative value—the stock’s current price in relation to the company’s underlying value—is seen to be favorable after considering these indicators, the value investor may choose to buy shares.

Value Investing Example

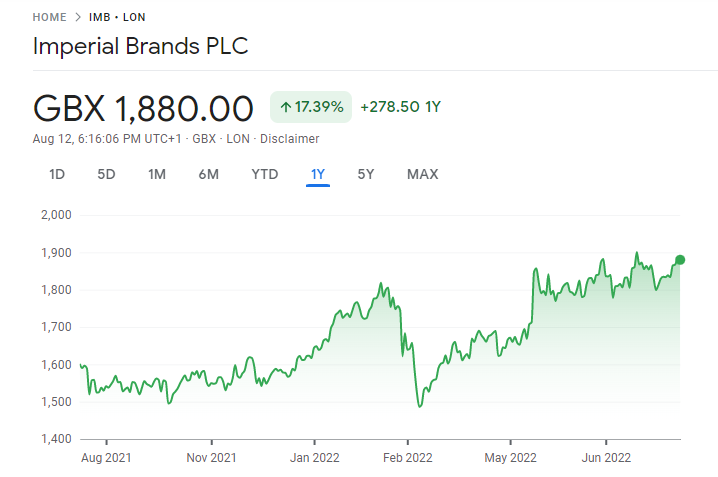

Look at an example to better understand value investment. We’ll concentrate on Imperial Brands (LON: IMB), a global cigarette giant with its global headquarters in Bristol, England.

To begin with, this firm is a great value opportunity just by virtue of its sector. Imperial Brands is resilient; during economic downturns, demand for tobacco products is more likely to increase than decrease. With 51 plants around the world and more than 160 countries where its goods are sold, Imperial Brands manufactures more than 320 billion cigarettes annually.

The fact that Imperial Brands pays a dividend is another advantage. At the present share price of 1880p, the dividend yield is roughly 8.59% per year.

The price-to-earnings ratio for Imperial Brands is 8.77 as a result of the company’s recent share price growth. That is comparable to the average for the FTSE 100 index fund but marginally greater than the average for the UK tobacco industry.

As a result, value investors may wish to monitor Imperial Brands. The value of shares is not being sold. But if the price drops by more than 10%, it might be a great value investment with steady growth and long-term dividend payments.

Best Value Investments 2022

1. Walmart (NYSE: WMT)

The largest retailer in the world, Walmart has tens of thousands of retail locations as well as warehouses for Sam’s Club members only. Buffett previously owned was Walmart, which he started buying in 2005 after first disclosing a 19.9 million-share holding in the company. Buffett increased the size of his Walmart investment by 2009, but he fully sold out in 2018.

Buffett claimed that Amazon was Walmart’s “difficult competition” at the time he sold his stock. While Amazon continues to pose a real threat to all established brick-and-mortar retailers, Walmart has invested heavily in expanding its e-commerce business and launching cutting-edge omnichannel services like pickup and delivery as well as its Walmart Marketplace platform for independent small and medium-sized businesses over the past four years since Buffett sold his stake.

Additionally, Walmart offers a 1.50 percent dividend return.

Also read: Best Supermarket Stocks You Should Buy In UK 2022

2. Nvidia Corp. (NASDAQ: NVDA)

One of the biggest manufacturers of premium semiconductors worldwide is Nvidia. Nvidia semiconductors offer the massive processing power necessary for a diverse variety of cutting-edge innovations, including high-end games, enterprise graphic elements, software leveraging artificial intelligence, the metaverse, the Internet of Things, driverless cars, and cloud services.

Nvidia is the furthest thing from a traditional Buffett bargain stock in recent years. However, NVDA stock is currently trading at 30 times forward earnings expectations due to Nvidia’s unrelenting growth and a 47.3% year-to-date sell-off. Nvidia announced $1.6 billion in net income and a remarkable 46.4% increase in revenue for the first quarter.

3. Meta Platforms Inc. (NASDAQ: META)

All of the social media and messaging services, including Facebook, Instagram, and WhatsApp, are controlled by Meta Platforms, Alphabet’s main rival in web advertising.

Stocks in the technology sector have fallen hard so far in 2022. Sadly, Meta shares have had the worst year-to-date performance on this list, with shares down 51.6% as of June 17. Buffett admirers are aware that he views market reversals as periodic chances to purchase premium stocks for cheaper prices, so they might not be discouraged by Meta’s recent decline. However, the stock only trades at 14.1 times forward profits despite the corporation reporting a $7.4 billion net income in the first quarter.

4. UnitedHealth Group Inc. (NYSE: UNH)

The largest managed care organization in the United States, UnitedHealth offers millions of consumers health plans and medical services. Investors believe that the healthcare stocks industry will continue to grow, and UnitedHealth is in a good position to take advantage of this enormous long-term opportunity.

UnitedHealth said that its insurance clientele increased by 3% in the first quarter to reach 51 million clients. A significant earnings and sales beat for UnitedHealth, including a 14.2% revenue increase and $5 billion in net income, was produced by that client expansion combined with growing insurance rates. From a value standpoint, UNH shares are only trading at 21.5 times forecasted future earnings.

5. Microsoft Corp. (NASDAQ: MSFT)

Microsoft is the leading software company in the planet and the creator of the Windows, the Office, and the Azure cloud computing website. Additionally, the parent corporation of the video game console Xbox and the professional social media site LinkedIn is Windows. Additionally, Microsoft recently disclosed plans to acquire video game publisher Activision Blizzard Inc. for almost $70 billion.

The qualities Buffett seeks in stock, such as Microsoft’s monopoly in professional software and its valuable brands, are exactly what Microsoft possesses. A staggering $61.2 billion in net income was also produced by Microsoft in 2021. Microsoft’s latest quarter had 18.3% increase in revenue and 8.2% increase in net income, but the business is still trading at a reasonable price of only about 23.4 times projected revenue.

Also read: Best AI Stocks You Should Buy In UK 2022

Why should you invest in Value Investments?

Long-term investors, who view this technique as relatively low risk and great payoff, frequently commend value investments. The following are the benefits or reasons to invest in value investments

Reduced Risk

In principle, value investments are low-risk investments. That’s because cheap stocks that are already discounted in comparison to their industry and historical average are probably not going to fall all that far. You essentially reduce your downside risk by buying low.

This isn’t always the case, of course. Remember that certain stocks are cheaply priced for a reason, such as continuous financial difficulties. There is a thin line separating inexpensive stocks from those that are about to crash.

Passive Investing

The fact that value investing tactics don’t require much labor once you’ve made an investment is a plus. While purchasing a stock, you must conduct extensive research in an effort to select the firm and establish your points of entry and exit. This approach suggests that, unlike day trading, value investing does not necessitate constant stock market surveillance.

Compounding Yields

Compound returns can also be utilized if your value investing strategy is concentrated on dividend stocks. Dividends are automatically reinvested by value investors, giving you over time an even bigger stake in your value investment. As a result, as the share price increases, there will be more dividends, more reinvestment, and higher returns.

Best sites to invest in Value Investments

You will require a top-notch stock broker if you want to begin value investing in the UK. There are numerous brokers that provide stock trading, but they vary in the number of stocks you can invest in, the costs you’ll incur, and the resources they make available for identifying value companies.

1. eToro

Using this service, you can trade more than 800 stocks from the United States, United Kingdom, Europe, and other nations. Given that many value stocks trade on exchanges that are less well-known than the New York Stock Exchange or the London Stock Exchange, the selection is a major advantage.

100% of trades on eToro are commission-free. You can invest in value stocks without paying a penny because there are no fees associated with opening an account or making a deposit. Long-term investors should be aware that eToro does levy an inactivity fee after one year; however, you can avoid this by making one value stock investment every year.

You can connect with other value investors on eToro’s social trading network to find out what they think of a given firm.

2. Fineco Bank

When you purchase shares through this platform, there are no trading costs, spreads, or inactivity fees to be concerned about. Instead, you pay an annual charge equal to 0.25 percent of the account’s total value. This may wind up costing more or less than fee-free brokers, based on how often you invest in stocks and how much capital you have in your account.

Access to a variety of portfolio management tools is one of the benefits of investing with Fineco Bank. These can assist you in diversifying your portfolio of value stocks across the market and in determining whether you are overexposed to a certain industry. Furthermore, it’s easy to monitor the progress of your assets over time and reinvest dividends for compound growth.

How to invest in Value Investments?

In the UK, purchasing Value Investment is a straightforward process. Here, we’ll use eToro as an example to help you easily grasp the entire process of purchasing high-risk investments. Additionally, since this broker is commission-free and enables you to diversify your trading portfolio, we heartily recommend it.

The actions you must take to purchase a value investment in the UK are listed below.

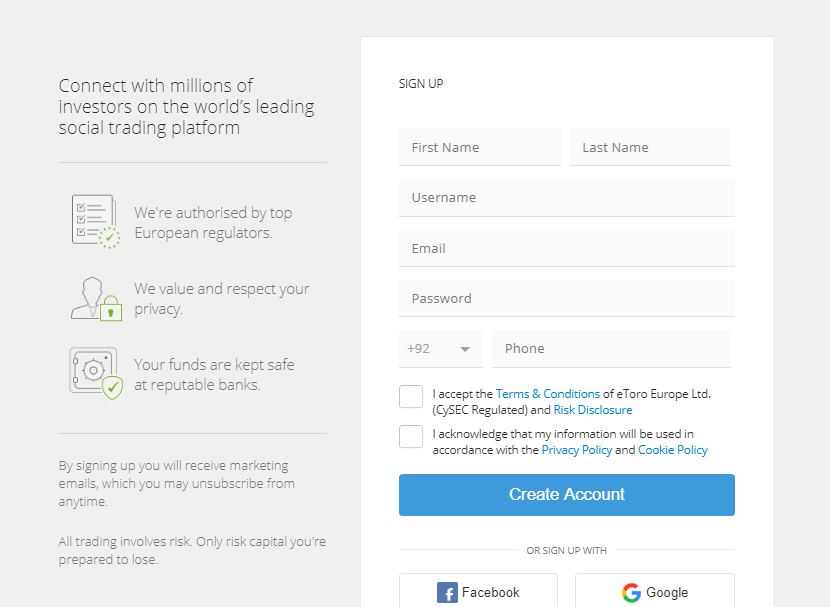

Step1: Open an account

To purchase a value investment asset, an account must first be created. Prior to using the eToro’s website, you must first register by filling out the registration form. You will need to fill out this registration form with some personal information, like your name, email address, and phone number. You must also create a secure password for your trading account.

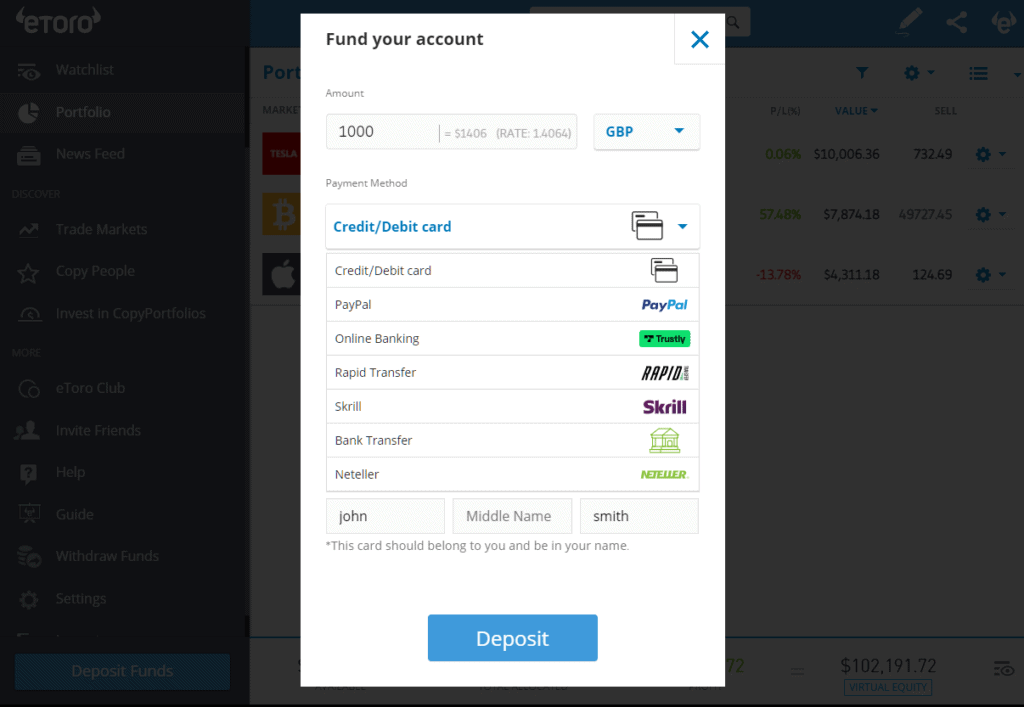

Step 2: Fund your account

You are now prepared to fund your trading account by placing a minimum deposit of $50 after successfully registering on this platform. This funding amount, which represents the working money required by the traders to carry out deals, is not the robot’s charge. eToro offers a range of payment methods for the benefit of its traders. You can choose the choice you are most accustomed to. eToro accepts payments using debit/credit cards, PayPal, Skrill, Neteller, and bank transfers.

Step3: Invest in Value Investments

You are now able to buy a value investment stock of your choosing after successfully funding your account. You must choose your preferred stock in order to achieve this. In the search bar at the top of the page, for instance, type “Walmart” and then click “Trade” when it comes in the drop-down selection if you wish to purchase Walmart shares.

After entering your desired investment amount in BP, click the “Open Trade” option. Congratulations, your eToro portfolio has been successfully updated with the chosen value investment.

Conclusion

Popular traders including Warren Buffett and Ben Graham, who is regarded as the father of value investment, support value making investments as a strategy for making investments. With this investment strategy, you can lower your overall risk while still taking advantage of the overreactions in the stock market without having to monitor its daily volatility. You must put in the effort to locate the several potential value stocks that are available on the market at any given time.

Frequently Asked Questions

What is value investing?

Value investing refers to the practice of purchasing stocks for less than their intrinsic value.

Is there a value investing course offered in the UK?

Currently, you can learn how to invest like an expert from the comfort of your home thanks to a wide variety of online courses. Additionally, if you cannot afford to pay for an online course, you may still use the internet to your advantage by reading blogs, watching YouTube videos, and listening to podcasts.

How do I find value investing?

Use stock newsletters, research websites, or make your own bespoke database of stocks and prices to remain current on the finest value investing prospects.

Is value investing a good idea for me in the UK?

You can, of course, answer this question for yourself by considering your own financial objectives, level of risk tolerance, and willingness to make long-term investments.

What is intrinsic value?

A company’s intrinsic value is determined by key parameters such as sales, earnings, projected dividend growth, brand value, and capital assets. When selecting stocks, value investors aim for intrinsic value, commonly referred to as book value.