Seeking information on how to Invest in Commodities Raw materials or basic agricultural goods that can be traded for profit are considered commodities. Commodities are a hot topic in the news due to the natural gas crisis around the world.

In this guide, our main concern is teaching novices how to invest in commodities. We examine where to invest in commodities simply using our reviews of two pertinent brokers.

How to Invest in Commodities – An overview

- Step 1: Open a trading account – Many online stock brokers offer free demo accounts for customers to test out their services. We advise you to compare prices. Next, choose a broker (below we review Capital.com and eToro). Get a bank account. Give a few identifying details.

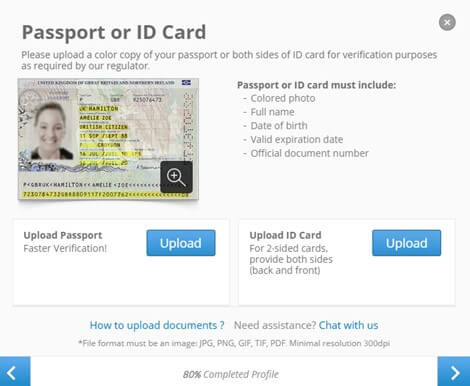

- Step 2: Verification – According to regulations, new investors must present identification and address proof.

- Step 3: Deposit – Most brokers offer a variety of options for making deposits. We take a variety of e-wallets, bank transfers, credit/debit cards, and more.

- Step 4: Find Commodities – Browse commodities before looking at statistics and research specific assets.

- Step 5: Buy Commodities – Have you conducted any research? consulted a financial expert to clarify the tax repercussions? If so, place a trade using your broker’s online trading tool.

What are commodities?

Simply defined, investing in commodities entails investing in tangible assets as opposed to stocks and companies. Usually, these tangible assets are employed directly or indirectly to create other goods.

For instance, you might decide to invest in fuels like crude oil and natural gas or precious metals like gold and silver. Investments in commodities typically fluctuate in value according to the unique supply, demand, and other market factors impacting linked firms.

Some goods, like oil, have a limited supply. This indicates that as the supply is exhausted, they become more expensive to extract and purchase. However, because of their economic importance and tendency to operate independently of stock market volatility, commodities may be valuable for diversifying your investment portfolio.

Private investors should always obtain financial guidance and consult with seasoned traders before deciding to engage in real commodities because commodity prices can fluctuate just like any other investment.

Is it worth investing in commodities?

When inflation is high, commodities are sometimes thought of as an inflation hedge since they can outperform the rising cost of living. Positive returns are not guaranteed, though, just like with any investment.

Commodity prices may not decline during a market downturn since they frequently vary separately from stock market prices. However, this also means that they might not increase throughout periods of rapid economic expansion.

Contrary to stocks and shares, commodities themselves rarely make money unless someone is ready to pay more for them than you did when you first bought them. You might have a gold coin on your shelf for many years without any other commodity investors showing any interest.

As a result, certain commodity investments on the stock market have produced significant returns during difficult economic times, while others have been ineffectual for years as a result of the holding never finding a suitable buyer.

How to invest in commodities UK?

Contrary to shares and bonds, commodities weren’t always intended for trading. Commodities are tangible items with practical economic uses, or they might be consumer and agricultural goods, so buying shares of them on the stock market isn’t exactly the simplest option.

Energy, precious metals, cereals, livestock, and industrial metals are the five main groups into which commodities normally fall.

The three most popular methods to begin investing in commodities are listed below.

1. Direct investment

Buying and storing the actual commodity itself is one approach to investing in commodities. In other words, if you wished to deal in gold, you could buy a certain amount in the form of coins or, if you needed very big numbers, ingots.

However, since you will be in charge of looking after your own investment, buying commodities in person brings with it an additional storage problem. Depending on the asset class you choose, it may be challenging to ensure that your commodity investment is stored properly and effectively.

Direct investment in crude oil, for instance, may be challenging if you don’t have access to large international transport vehicles, warehouses, storage facilities, or a large number of barrels.

Luckily, a plethora of companies offer online trading and safe storage for the majority of commodities. However, before sending any money, be sure the website you choose to use is trustworthy.

2. Derivatives and call options

Prior to the development of investing and trading as we know it today, commodities were only utilized for production, marketing, and consumer usage. Suppliers and purchasers would create contracts outlining the quantity of an item that would be supplied and the price that would be paid upon arrival.

These contracts, known as forwarding contracts, were effectively orders placed by buyers when they signed one of them. The buyer would have to sell the contract to another buyer if they wished to cancel the order.

The initial buyer may have made a profit or lost money depending on the circumstances if commodity prices changed between the time of contract signing and the period of resale. These procedures were replaced by more contemporary ones as the financial industry developed.

Futures, options, and swaps on commodities were developed from forwarding contracts. These types of futures contracts operate somewhat differently and take the form of a “bet.”

In very simple terms, two parties agree to swap money at a later time based on who won the “bet” when one party predicts the price of a commodity will rise and the other will predict the price would fall.

As an alternative, call options to let you take a position while forecasting a “strike price” and expiration date by paying a fixed premium. You will be paid the difference multiplied by the number of “options” you purchased if the price of the commodity you choose is higher than the strike price on the expiration date.

Spread betting can be utilized in a manner similar to this to make money while trading in commodities.

Before choosing to invest in commodities using this strategy, always get professional financial counsel due to the complexity of the commodity market.

3. Indirect investment

Trading commodities indirectly by purchasing shares of commodity businesses or exchange-traded funds (ETFs) is your final choice.

With the funds they obtain from users, commodity ETFs will make investments in commodities. Physical and synthetic are the two main categories that they normally fall under.

ETFs, like the SPDR Gold Shares ETF, that invest in real commodities like precious metals are likely to purchase and hold those commodities themselves.

Synthetic ETFs frequently decide to invest in derivatives instead of holding physical commodities.

As an alternative, you might make stock market investments in businesses that produce commodities. Purchasing shares in commodity companies can be equivalent to investing in the commodity itself because commodity producers will perform well if commodity prices rise and poorly if commodity prices fall.

Best trading platforms to Invest in Commodities

There are many choices available to investors looking to purchase commodities online. The majority of full-service brokers provide a selection of the top commodities for investment.

We list the services provided by two well-known brokers below. eToro and Capital.com are both completely regulated. Additionally, both brokers provide a user-friendly interface, a wealth of market news, and transparent cost structures for those new to commodity investment.

1. Capital.com

Capital.com is a CFD (Contracts-For-Difference) and spread-betting expert, offering 5,600 markets for trading. This broker has locations in nine different countries and services 70,000 clients each month.

Users of Capital.com can invest in stocks, ETFs, foreign exchange, and indexes in addition to commodities. 20 different commodities, including gold, natural gas, and crude oil, are available for investment. Carbon emissions and crude oil both have futures available. Commodities make up 45% of all the assets traded on Capital.com.

Capital.com does not charge a commission for commodity investments. Spread costs and overnight CFD fees do, however, apply.

With this broker, all transactions are carried out as Contracts-For-Difference (CFDs). Traders can short commodities and leverage trades as a result, which is advantageous. The drawback is that overnight charges might add up. For this reason, CFDs are not appropriate for holding long-term holdings.

2. eToro

This full-service broker was founded fifteen years ago and currently has close to 29 million registered clients. Fully licensed by FCA, ASIC, and CySEC, eToro provides options in stocks (including well-known oil stocks), ETFs, indices, currency, and commodities for both novice and experienced traders.

eToro offers a variety of leading commodities to invest in, similar to Capital.com. There are a total of 23, with futures in wheat, oil, cocoa, and palladium available.

With eToro, all commodities trades are carried out as CFDs, and there is a $1,000 minimum trade requirement (including leverage).

One of eToro’s features, CopyTrader, makes it one of the most well-liked social trading platforms for all types of assets. With the money they set aside, investors can emulate other, more seasoned traders for free. There are 150+ commodity traders who you can copy.

eToro’s Smart Portfolios may also be interesting to novice investors. These offer a model for diverse investments organized around a particular subject.

How to invest in commodities?

You can access a wide selection of commodities through one of the many trading platforms available. But in this case, eToro is used as an illustration to help you comprehend the entire procedure of investing in commodity using a trading platform. However, as the investment process is essentially the same across all platforms, you are free to select the trading platform of your choosing.

Step 1: Open an Account

You must first register by completing a registration form with your basic information, including your name, phone number, and email address, as well as choosing a secure password.

Don’t worry, since your documents are completely protected on this site, even though eToro will require you to upload some of your documents to prove your identification. You won’t have to go through verification, though, until you deposit more than $2,250 or make a withdrawal request.

Step 2: Fund your Account

For the convenience of its traders, eToro provides a variety of payment options. Debit/Credit Card, PayPal, Skrill, Nettler, and Bank Transfer are all accepted payment options by eToro.

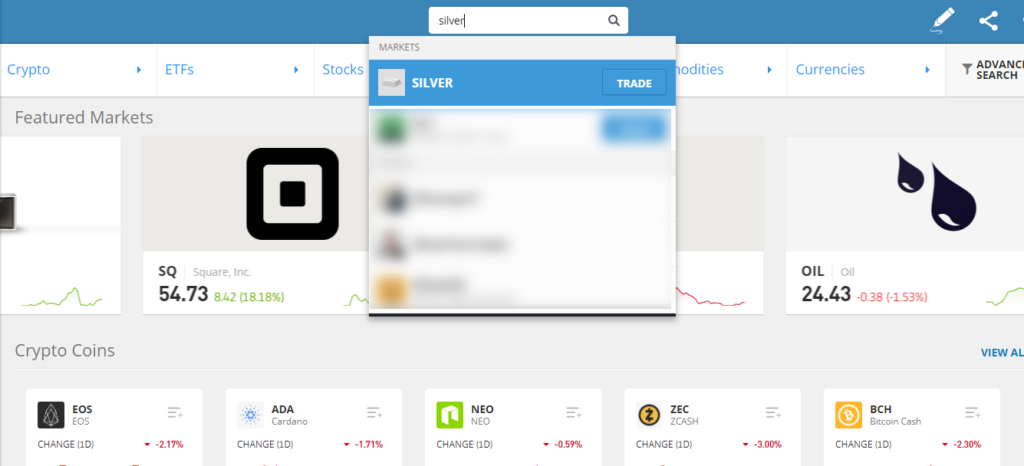

Step 3: Find your commodity

After successfully opening a trading account and funding it, you are now prepared to trade in the commodities of your choosing. If you are aware of the commodity you wish to invest in, great. Or else, just use search bar at the top of the main page.

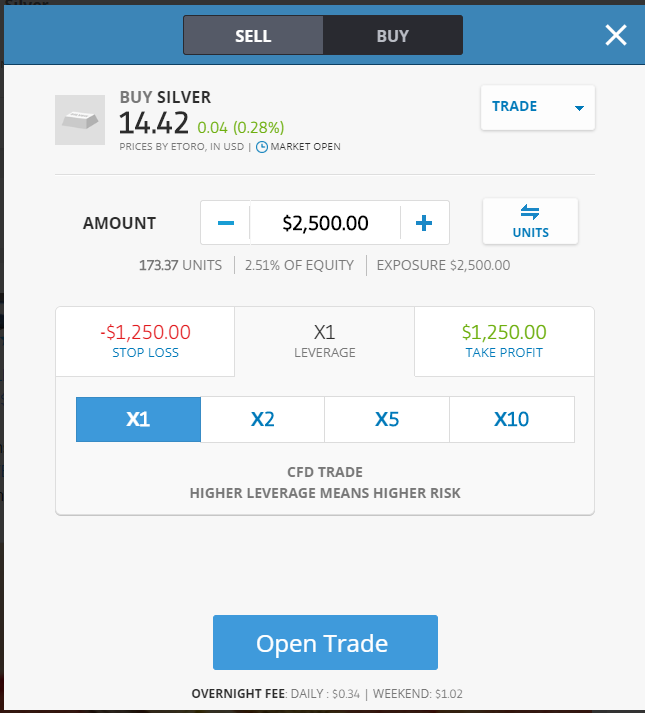

Step 4: Place your order

You are now required to place your order once you have decided on the commodity you want to trade. There are, however, two ways to buy or sell commodities. Trading at the going market rate is one way to do this, and entering an order with a limited price is another.

Additionally, you can specify whether you wish to apply a cash sum or a certain number of units on this platform.

You can also use a stop loss and take-profit order once you’ve finished entering your order. This will assist you in reducing the trade’s risk and ensure that you leave when the price reaches the appropriate level. Take profit and stop-loss levels are dependent on price levels, the most you can lose, the profit you’re willing to take, or a combination of these three.

Pros and cons of investing in commodities

Commodity trading has its own unique set of possible rewards and drawbacks, just like all other sorts of investing.

Pros

Portfolio diversity

Commodity trading, particularly with exchange-traded commodities that you normally do not have to handle yourself, can offer some much-needed diversification to an investment portfolio. EFTs typically reflect commodity price performance rather than economic expansion.

Inflation insurance

Commodities are thought to have the ability to rise in price more rapidly than inflation as an inflation hedge. This implies that the erosion of your savings due to growing living expenses may not happen.

Naturally, this will depend on the current state of the commodities market and the particular commodity you decide to trade. Investment results are never guaranteed.

Cons

Complex

Commodity investing can be challenging. You have a variety of options, but most of them will need expert financial guidance to be used effectively to maximize the return on your investments.

Volatility

Due to their participation in the global economy, commodities tend to be a little bit more volatile than usual investments, with some of the most traded commodities routinely seeing changes in demand.

Conclusion

We really hope this article gave you all the information you needed. Due to the fact that the worldwide economic recovery is currently in its early stages, now is the ideal time to invest in commodities. This industry has been in a bull market for the past ten years, and it appears that commodities will continue to offer profitable returns for the foreseeable future.

According to our perspective, using CFDs is the easiest yet most productive approach to investing in commodities if you have already made up your mind to do so. Your preferred commodities can be purchased using CFDs on eToro.

Frequently Asked Questions

How can a newbie purchase commodities?

Anyone can access the internet, register with a licensed broker (such as Capital.com or eToro), deposit money, and invest in commodities using stocks, contracts-for-difference (CFDs), and exchange-traded funds (ETFs).

How can you invest in commodities directly?

Investors have the option of investing directly in a commodity by using Contracts-For-Difference or investing in companies that deal with that commodity (CFDs).

Which commodity is the greatest to invest in?

Only about 20 commodities are among the finest to invest in. So choosing a commodity is not as difficult as choosing stocks. Five of the most popular commodities that investors are currently following have been selected.

Is investing in commodities a wise move?

Before a retail investor can trade, market news, whether positive or negative, is typically taken into account in the price of the commodity. Commodity investing carries significant risk. Before making any financial commitments, you must conduct your own market research because this is an unstable and uncertain asset class.

What commodities will increase in price in 2022?

Given that the price of silver has decreased since the start of 2021, several analysts believe that a revival is imminent. However, in all honesty, it is impossible to predict which of the greatest commodities to invest in will surge in 2022.