For traders looking to benefit from fluctuating token prices and high levels of volatility, cryptocurrency trading is suitable. You will discover how to trade cryptocurrencies profitably in this manual even if you have no prior experience.

Along with the fundamentals, we’ll also show you how to open your first cryptocurrency trading position with a licensed broker.

What is Cryptocurrency Trading?

Similar to other investment markets, cryptocurrency trading operates on a similar fundamental principle. For instance, you will buy and sell cryptocurrencies with the intention of profiting, much like stock trading. When you accurately estimate the route the market will take in the future, you will be able to accomplish this aim.

For instance, if you bet $1,000 on Bitcoin at a token price of $40,000 and the value of the digital currency rises to $44,000, you would have gained 10%, or $100. And just like stock values, supply and demand have an impact on the value of cryptocurrencies. As a result, a cryptocurrency token’s value will fluctuate second by second.

As we previously mentioned, in order to enter this market, you will need a crypto exchange or crypto trading platform Additionally, keep in mind that cryptocurrencies are speculative and very volatile, thus extreme price fluctuations are to be expected. Thus, learning how to trade cryptocurrency becomes even more essential.

Knowing the basics of risk-management tools is one of the greatest methods to approach the market. For instance, by using stop-loss orders on each bitcoin trade you make, you may ensure that you never lose more money than you can afford. Money management is also crucial. This will specify, in percentage terms, how much of your account balance you can risk on a deal.

How Does Cryptocurrency Trading Work?

We go over the fundamentals of how cryptocurrency trading operates in the sections below. To guarantee that you may enter this market with your eyes wide open, be sure to read through each segment.

Cryptocurrency Trading Pairs

The first thing to keep in mind is that you will be gambling on “pairs” when you trade cryptocurrencies. Two assets, either in the form of fiat currency, digital currency, or a combination of both, will be present in each pair.

For instance, you can trade dozens of cryptocurrencies against the US dollar when you use a licensed broker like eToro. This makes determining the present and future value of the digital money you have chosen simpler.

However, you will probably be trading your chosen digital asset against a stablecoin like Tether if you utilize a cryptocurrency exchange that lacks the legal authority to deal with US dollars.

Advice: It’s advisable to start with BTC/USD if this is your first time learning how to trade cryptocurrencies. The most liquid, least volatile, and narrowest spreads are available on this pair, which lets you trade the expected value of Bitcoin relative to the US dollar.

Cryptocurrency Trading Orders

You must create an order after choosing the cryptocurrency pair to trade. As a novice, you might choose to begin with a market order, which enables you to immediately place a deal at the following best available price.

You might then place a limit order when you are more familiar with how the markets operate and trade cryptocurrencies. You can thus choose the precise price at which your purchase will be filled.

When placing a bitcoin trading order, you must also define your stake. Simply put, this is the sum of money, expressed in dollars, that you are willing to stake on the position.

Why Trade Cryptocurrency?

You can trade a wide variety of assets as part of a short-term plan. This applies to securities like stocks and currency as well as goods like oil and gold.

In light of this, we discuss why trading cryptocurrencies can be a better choice for you than trading traditional financial assets in the sections below.

Market Diversity

Similar to equities, there are hundreds of cryptocurrencies available on the open market that you may purchase and sell. You will therefore never run out of trade chances.

Additionally, there are cryptocurrencies to match every financial goal and risk tolerance. For instance, if you are a total beginner learning how to trade cryptocurrencies, you can choose to stick with large-cap projects. This would include digital currencies with significant market capitalizations, such as Bitcoin, Ethereum, and BNB.

But if you want more volatility, you may consider trading smaller-cap cryptos such as COMP, CHZ, EJN, and DASH. Each of these initiatives has a market valuation of less than $2 billion.

You might even think about trading micro-cryptocurrencies, which have a market capitalization of less than $100 million if you really have a taste for excessive risk.

Volatility

The fact that the cryptocurrency market is incredibly volatile, especially in comparison to traditional stocks, is another reason why short-term traders are now gravitating to it.

Smaller-cap cryptocurrencies, for instance, frequently see their value rise by several hundred percent in only one trading day. On the other end of the spectrum, a cryptocurrency’s value can drop by more than 90% in the same amount of time.

If you are just starting to understand how to trade cryptocurrencies, such large price swings won’t be appropriate. It is preferable to stick with cryptocurrencies like Bitcoin and Ethereum, whose values hardly ever fluctuate by more than 10% in a day.

Growth Potential

Even traders that trade for the short term can aim for large gains quickly.

- Let’s say, for illustration purposes, that you bet $2,000 on USDT.

- On September 1st, 2022, you opened the deal with USDT valued at $2.20 per token.

- USDT’s price on September 9th, 2022, was $3.34.

- As a result, the value of your position climbed by nearly 50% in just seven days of trading.

- This indicates that you earned a $1,000 profit on a $2,000 initial investment.

This is only one of many examples. The crucial issue is that there are numerous, high-growth trading possibilities offered by the bitcoin markets every single day.

How Can I Profit from Crypto Trading?

The sections following go into greater detail on the many ways to profit from the bitcoin trading markets.

Gains from Trading Cryptocurrencies

Experienced bitcoin traders primarily profit from capital gains. This is the amount of money a trader makes off of a certain position.

Calculate this by deducting the cost of the cryptocurrency from the price at which you cashed out your position.

Liquidity Provision

Another approach to profit from bitcoin trading is to add some much-needed liquidity to exchanges. Since you won’t actually be buying or selling digital currencies, this is more of a passive investing technique.

Instead, you will receive interest by adding extra tokens to exchange. One of the greatest methods to do this is through crypto yield farming, which gives you the chance to make money in exchange for depositing bitcoin into a liquidity pool.

Is Cryptocurrency Trading Safe?

Since there are a number of risks associated with trading cryptocurrencies, it’s critical that you are aware of what you can do to protect yourself.

The majority of crypto trading platforms are, first and foremost, unlicensed. As such, in using an unregistered platform, your funds are in danger.

This is why we prefer eToro, which is accredited to provide bitcoin brokerage services to UK citizens and is overseen by numerous tier-one licensing organizations.

The hazards of losing money from your trading operations are the next thing you should consider. These were previously covered in terms of managing bankrolls and making sure that stop-loss and take-profit orders are always used.

The way you store your bitcoins is another aspect of safety that you need to consider. After all, the provider of the trading platform will be in charge of keeping your digital money secure.

The platform’s security controls should be evaluated for this reason. As an illustration, eToro provides a custodial wallet service that makes use of high-grade security procedures.

As a result, you are no longer in charge of keeping your own private keys secure. Additionally, eToro has an internal risk management division dedicated to protecting its clients from financial fraud.

How to begin Cryptocurrency Trading?

How to trade cryptocurrencies in a risk-averse way has been discussed in this guide. When you’re prepared to put your newly acquired theoretical understanding to use, we’ll show you how to sign up with eToro.

In conclusion, the eToro platform is governed and only requires a $10 deposit to start an account. Additionally, UK consumers can deposit money using a debit/credit card or an e-wallet without paying a fee, and trading fees are quite cheap.

Step 1: Create an Account

Before you may make a deposit into the eToro platform, you must first create a verified account. Your selected username and password should be followed by your full name, email address, and phone number.

To move on to the following step, click the “Create Account” option. This step will ask you for some additional personal information and a brief summary of your prior trading experience.

Step 2: Deposit Funds

The following step is to make a deposit of US dollars into your eToro account, which you may do for free.

Then choose a debit or credit card, PayPal, Neteller, or any other supported e-wallet if you want your deposit to be processed immediately. It may take a few days for ACH and bank wires to settle.

Across all accepted payment methods, the minimum deposit is a mere $10.

Step 3: Use Demo Account

Despite the fact that you have trade dollars in your eToro account right now, it might be a good idea to begin in demo mode. You can practice trading cryptocurrencies in a risk-free setting as a result.

A $100,000 sum will already be in your demo account. You only need to change to “Virtual Portfolio” mode.

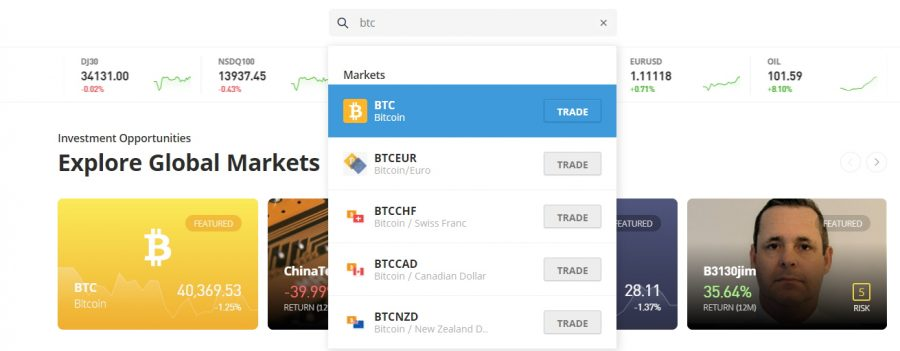

Step 4: Search for Cryptocurrency

Return to “Real Portfolio” mode when you’re ready to start trading cryptocurrencies for real money. Then, look for the cryptocurrency you wish to trade using the search box.

By selecting “Discover,” you can also see the whole list of supported cryptocurrencies.

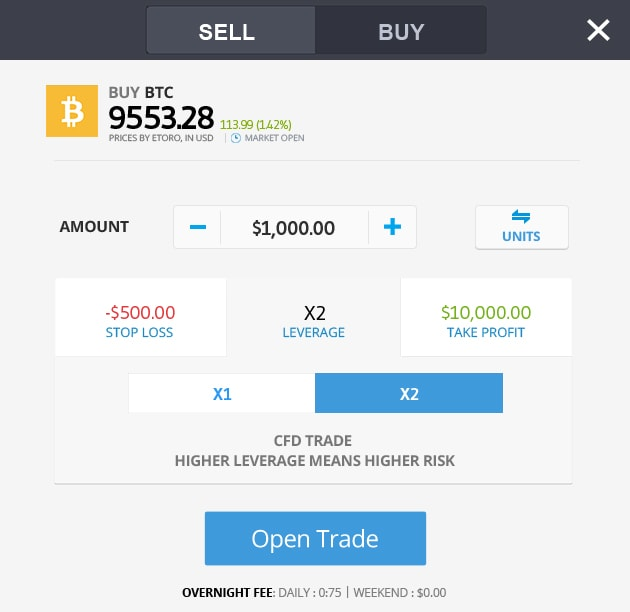

Step 5: Trade Cryptocurrency

After selecting the cryptocurrency you want to acquire, click the ‘Trade’ option. This will then fill out an order, which we previously described in great detail in this article.

To reiterate, you must choose between a market order and a limit order in addition to entering your stake. Deploying a stop-loss and/or take-profit order is another choice you have.

Click the “Open Trade” option when you are ready to open your trade.

Pros and Cons of Cryptocurrency Trading

While cryptocurrencies may or may not replace conventional currencies, they have at the very least established themselves as a successful trading venue. The future success of it as a digital currency will largely depend on how governments manage it. Let’s now examine the advantages and disadvantages of cryptocurrencies as they stand right now.

Pros

Anonymity and Flexibility

Traditional investments lack the privacy and flexibility that cryptocurrency does. When trading in other assets, including such stocks or gold, for instance, traders are required to give their personal data and bank info. Although this is done to verify identities, it also puts sensitive data in danger. Since you may even trade with just your crypto wallet number, this is one of the reasons why many younger traders are lured to cryptocurrencies.

Decentralized

The decentralized nature of cryptocurrencies is a significant advantage. Cryptocurrency cannot be manipulated or monopolized because it has no central authority. Cryptocurrency gives traders equal access to each token and currency movement, in contrast to traditional currencies that may have governing bodies and bureaucracy. This implies that you can take advantage of the same lucrative opportunities without outside interference if you have the necessary resources and time.

Easy of Access

In contrast to other traditional investments, cryptocurrency investors can easily access their money from a distance. Since cryptocurrencies are digital assets, crypto traders can check on their tokens at any time from any place with a steady internet connection by logging into their crypto wallets or exchanges. This accessibility means that any transactions are promptly reflected with low to no transaction fees.

Return on Investment

Although cryptocurrency can occasionally be quite volatile, the long-term trend has been favorable. For instance, in 2016 Bitcoin was selling for about $300. It has climbed to over $30,000 in the following years, representing a return of 10,000 percent. The value of cryptocurrencies continues to defy expectations, despite the predictions of many experts that the bubble will collapse.

Cons

Market Volatility

In contrast, the nature of digital currencies makes them unstable. Cryptocurrency value fluctuations might be erratic and there is no profit guarantee. In reality, it’s not unusual for cryptocurrency traders to suffer substantial financial losses in a short amount of time. Even popular currencies like Bitcoin are susceptible to sharp decreases in value. Just in November, the price of Bitcoin and other popular coins fell by more than 5% in a single day. Investors are left with little alternative but to hold or sell at a loss in such circumstances. Having to sell or retain a token can mean destroying their investing strategy and postponing ROI for inexperienced crypto investors, many of whom are day traders or have less substantial resources.

Lack of Security

Additionally, it doesn’t provide any safety nets for investors because it is unregulated. This indicates that there are no backup plans for your benefit in the event that your cryptocurrency investments fail, you are defrauded, or your computer is hacked. Governments and federal authorities may decide to abruptly prohibit or limit transactions because cryptocurrency is similarly uncontrolled. Local cryptocurrency investors are left with little choice except to give up or scale back their transactions in exchange for lower earnings in these circumstances.

Taxable

Even though cryptocurrency is unregulated, many nations like the United States, the United Kingdom, and Japan nevertheless tax it. Any upward trends in the cryptocurrency have the potential to boost a trader’s revenue, which automatically includes it in their taxable income. Additionally, cryptocurrency may be subject to sales taxes if it is used to make transactions.

Prone to Scams

Due to scammers looking to profit from a flourishing market, there has been an inverse correlation between the popularity of cryptocurrencies and the number of scams. The Financial Times reports that in total, cryptocurrency scams cost investors $7.8 billion, and in 2021, almost $3.2 billion worth of cryptocurrencies was stolen.

Conclusion

Because of how speculative and volatile the cryptocurrency markets are, this area of investing is perfect for day traders. You should now understand how to approach the cryptocurrency trading market in a risk-averse manner after reading this article.

We’ve talked about a variety of tactics you can use, even as a beginner, to outperform the market. On the eToro platform, you may start trading cryptocurrencies with real money right now for just $10.

Importantly, you can access dozens of cryptocurrencies on this well-known platform in a safe and affordable setting.

Frequently Asked Questions

How to trade cryptocurrencies profitably?

You must resell your digital tokens for more money than you spent on them if you want to earn from cryptocurrency trading. Only an increase in the cryptocurrency’s open market value will allow for this to happen.

How should I trade cryptocurrency?

The ideal method to trade cryptocurrencies if you are just getting started is by using a long-term plan. This entails collecting premium coins and keeping your investment for a long period of time.

How does crypto trading function?

The fundamental idea behind cryptocurrency trading is that you will frequently acquire and sell digital assets with the goal of generating steady profits.

Is trading cryptocurrencies profitable?

Trading cryptocurrencies can be rewarding for those who are skilled at market research and analysis. As a result, you must commit time to learn fundamental and technical analysis if you want to be successful yourself.