Futures trading is a more sophisticated yet more complex form of trading in the UK. It is more beneficial and of course more difficult when compared to traditional trading. You cannot start it, without having full detailed knowledge on how it works, what are the cons, and why it is beneficial. Therefore, we decided to create an article to make you understand what futures trading is and decide whether or not it is for you.

What is Futures Trading?

Future Trading consists of the trading of Futures contracts. A futures contract is an agreement between the buyer and seller of the contract. That some asset such as a commodity will be bought/sold for a specific price, on a specific day in the future. Futures trading is the complete opposite of traditional Trading. All you need to do in futures trading is to predict whether the price of an asset will rise or fall on or before the expiry date of futures contracts.

Why trade futures?

Following are the amazing reasons that will convince you to trade futures.

Allow trading with leverage

Futures contracts can be traded with leverage, which means future contracts enable you to trade for much more value than you have actually deposited. Simply put, if you want to trade on increased market exposure but cannot afford it, you can simply deposit a small percentage of the amount, known as margin and the rest of the amount can be borrowed from your chosen trading platform. However, one thing to be sure of is that profits or losses are determined by the total position and not by the small percentage that you used to open it. It means that there is a great risk of incurring a loss of more than you have invested in.

Free of overnight funding charges

Unlike cash positions on which overnight funding charges are applied, futures are free from such a thing as it is included in the spread. Therefore, futures trading is preferred by those who are looking to take a long-term position on an underlying market.

Go long or short

Trading Futures with CFDs and Spread bets allow you to either go long or short according to your predictions. If you believe that the market price will fall, you’d go short and if you believe the market price will rise, you’d go long.

Hedging

Hedging with futures enables you to minimize the risk you may get exposed to in the underlying market. For example, if you are concerned about the value dropping of your owned shares or assets you can go short on that share or asset.

How does Futures Trading works in UK?

Before you start trading futures in the UK, you must have a keen knowledge of how it works in the UK. Following are the points that will make you understand everything you need to know :

All Futures Contracts Expire

Unlike traditional assets like stocks and shares which you can keep for as long as you wish, futures contracts will always have an expiry date and you cannot hold it any longer than that. And, as soon as it expires you need to settle it down, which simply means that the holder of the futures contract will have to buy or sell the underlying asset as per their commitment.

For example, let’s say that you are holding futures contracts for stocks A, if your future contract consists of 10 individual stocks, at a price of $10 each, then you are legally required to purchase 10As at a price of $10 each.

All Futures Contracts have some value.

In the example above we explained you have purchased a future contract on Stock A at $10 per share and you are legally required to purchase it at the above mentioned price before the contract expires. But what if at the time you purchased the three-month futures contract, Stock A’s shares were priced at $9.

Therefore, it is your duty to precise whether the shares will be worth more or less than the future contract price.

Minimum Futures Contract

When you buy or sell or a futures contract you are not only committing to a single asset but a basket of assets. Typically, one futures contract typically consists of 100 individual stocks. However, the other classes may differ in the figure, they might be higher or lower depending on the category of assets.

However, the relieving thing is that you can utilize leverage when accessing the futures market. That means you only have to deposit a small percentage of the total future contract known as margin and in the UK futures trading, the maximum leverage ratio retail clients can enjoy is 1:30.

Long or Short

Once you have chosen your futures market assets, you are then required to determine whether the value of the asset will rise or fall, or in financial terms, you need to decide whether you want to go long or short, before the date of expiry.

Best Futures Trading Platforms in the UK

There are many futures trading platforms in the market and you of course are free to use the platform of your choice. Following we have mentioned the Platforms that we think are the best when it comes to futures trading.

AvaTrade

AvaTrade is an online futures trading platform that was founded in 2006 under the name of AvaFx. It is regulated by multiple jurisdictions. It allows you to trade in various tradable instruments, including stocks, commodities, forex, and cryptocurrencies. When it comes to AvaTrade’s futures trading offering, it offers various asset options to choose from, including indices like the FTSE 100, hard metals such as gold and Dow Jones. It also gives you exposure to trade futures contracts on government bonds, and agricultural products like wheat, sugar, rice, and corn.

AvaTrade is the most reliable futures trading platform option for UK traders who are looking to access the futures trading world without paying huge fees. AvaTrade is a futures trading platform that doesn’t charge any fee or commission instead it works on spreads. Another amazing quality of this platform is that along with being a platform that supports MT4 it even offers social trading through the Zulutrade platform. The minimum deposit required on this platform is £100, which can be funded through various payment modes.

Pros

- Offers 0 percent commission

- Allow trading everything from stocks, forex, cryptocurrencies, and commodities

- Regulated by multiple jurisdictions

- Charges no deposit or withdrawal Fred

- Requires minimum account balance to be £100

Cons

- It is not regulated by FCA

FinmaxFX

This futures trading platform allows traders to trade futures with high leverage of up to 1:200 on forex positions and moreover, it is not bound with restrictions such as imposed by ESMA on UK traders which limit them to trade with leverage of no more than 1:30.

When trading commodities through this platform you get a leverage of up to 1:100 and less on other asset options. Having such high leverage can be beneficial in agricultural trading. FinmaxFX offers different commodities, including sugar, coffee, and corn. The minimum deposit required on this futures trading platform is $200 which can be funded through various payment modes including debit/credit cards, Bitcoin, e-wallets, and a traditional bank wire.

Pros

- Offers to trade on agricultural products

- Offers minimum deposit of $200

- Offers a leverage of up to 200:1

Cons

- Offers high spreads for forex trading

IG

IG is the most popular UK brokerage platform that ranks the top in the world’s largest CFD brokers list. It was founded in 1974 by Stuart Wheeler. It is licensed and regulated by Financial Conduct Authority (FCA) and as well as by foreign financial regulators including the Australian Securities and Investment Commission (ASIC) and Germany’s Federal Financial Supervisory Authority (BaFin).

It is packed with all the features which a reputed broker should have. It has a user-friendly interface that makes it easy for everyone to access and use the features of this platform. It uses the latest encryption technology to safeguard its user’s data and funds.

IG allows you to access several marketplaces via CFDs in terms of futures trading offerings. In addition to futures trading, IG offers other investment opportunities. IG requires a deposit of a minimum of £250, which can be funded either by bank transfer or a debit/credit card.

Pros

- Well reputed platform

- Offers leverage and short selling

- Offers spread betting and CFD products

- Offers access to the UK and international markets

- Offers great research department

Cons

- The minimum deposit required is £250

- Charges $15 commission on US Stocks

What are the benefits of Futures Trading in the UK?

Following are the benefits of futures trading :

Profit from Rising and Falling Markets

The only possible way to earn profit traditionally was if the stock price of the company rises. However, that’s not the case when trading futures. Since with futures trading, you can enjoy profit from both rising up and falling down markets.

Leverage

Leverage simply means that you can trade with more money than you have in your pocket and most UK trading platforms give you access to leverage which are complied with the regulations set out by ESMA. How much leverage you can apply to an asset completely depends on the specific asset class that the futures contracts are linked to. Following is the leverage ratio that you can apply to specific asset classes.

- For Major forex pairs: 1:30

- For Minor forex pairs: 1:20

- For non gold commodities: 1:10

- For stock CFD: 1:5

- For cryptocurrencies: 1:2

Provides access to all sectors

Traditionally, the only way to trade the future value on agricultural assets like wheat, oil, and commodities like gold was to own them physically in a store, or a barrel or to have proper transportation for the delivery of the assets. However, this new derivative has changed the whole scenario. Now, trading these assets is virtually possible, that is now to trade everything from sugar, wheat, gold, to natural gasses is possible, without owning them physically.

Beneficial for longer-term trades

Futures trading allows you to keep your position open for up to three months, without burdening yourself with the thoughts of overnight financing charges. However, factoring in the fees of trading futures with leverage is something that cannot be avoided.

What are the Risks of Futures Trading in the UK?

- Trading in any sector comes with a risk of losing money, the same is the case with trading futures. Because when trading futures you have to predict the future value of the asset and if your prediction is wrong then you will have to bear the loss. Chances of winning and losing are always fifty-fifty.

- Purchasing a futures contract means that you are legally agreeing to buy or sell the asset at a specific time in the future. However, it is not likely always the case that you will be able to offload your settled contracts.

- To trade futures contracts you need to have a keen understanding of what it is, what are the contract durations, minimum lot sizes, strike prices, and many more.

What is Algorithmic Futures Trading?

Futures Trading is not a piece of cake and for beginners, it can be very tricky because of the fact they are new to this platform, they lack experience and confidence. But to their relief, they can opt for algorithmic futures trading. It is an automated trading platform that trades futures on your behalf. With this software, you don’t have to worry about the hard work that is required while trading futures since all the hard work from scanning the financial markets to finding the best opportunities to enter a long or short position is done by this algorithmic software. Well, one thing you must be aware of is that this software lacks the capacity to assess fundamental news, and on the contrary, it focuses on the technicals. To use an algorithmic futures trading platform you are required to search for the best provider, purchase it, download the software and install it. Once installed you will have to install a third-party platform like MT4

What are the supported Asset classes in Futures Trading UK?

Following are the asset classes that are supported in the UK :

Commodity Futures

Commodities such as gold, wheat, and oil are very difficult to trade in the traditional trading manner. But, thanks to futures trading which has made virtual trading possible for every asset class. Because it allows you to trade commodities virtually, that means you do not need to own the asset class. For example, if you want to trade Crude Oil then with futures trading you can trade Crude Oil without purchasing barrels of Crude Oil, or without owning the transportation system for delivery. In futures trading, you can trade commodities like Gold, Silver, Platinum, WTI Crude Oil, Brent Crude Oil, Sugar, Wheat, Soybeans, and Natural Gas.

Crypto Futures

Crypto Futures are other supported crypto assets classes in Futures Trading. The CME group allows investors to start Bitcoin futures trading. However, there are some restrictions when trading Bitcoin Futures. These restrictions state that you can trade 5 Bitcoins per Contract. So that according to the current price it means you would need to outlay at least $50,000. However, We advise you to trade crypto futures in the form of CFDs because the leverage that is available in crypto futures is an exchange for larger-scale investors.

Forex Futures

Forex Futures are exchange-traded currency derivative contracts in which buyer and seller are obligated to transact at a specific time in the future at a predetermined price. There are two primary purposes of Forex Futures, they can be either used by sole proprietors, companies as hedging to mitigate the risk involved in cross-border transactions or they can be used to speculate currency fluctuations by investors and enjoy profit from it. Simply put, Forex Futures are a form of contract that are settled by cash on or before the expiry date of the contract. Forex trading allows investors to enjoy leverage, which is very beneficial in every sense. However, there is one drawback to this that you are obligated to pay an overnight financing fee for each day, that you keep your position open.

Stock Futures

The stock Futures market allows investors to go both long and short, and benefit from leverage. In this, the underlying asset is considered as an individual stock. It is an agreement between buyer and seller to buy or sell a specified quantity of an underlying asset at a specific time in the future at an agreed price. In the UK future markets are offered on leading FTSE 100 players like Unilever, Diageo, and BP.

How to Start Trading Futures in the UK?

Following are the steps you need to follow to start trading futures:

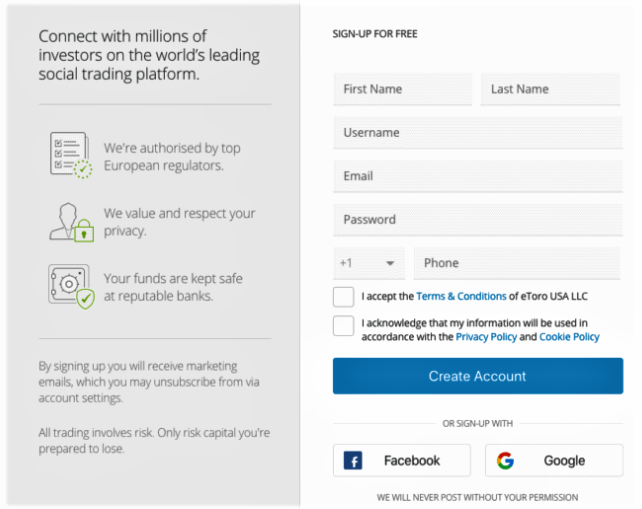

Step 1: Open an account

The very first step to start trading futures is to create a futures trading account. To do so you are required to register yourself by filling in a few basic details such as your name, email, and phone number. You can create your Futures trading account on whatever platform you desire. However, we recommend you choose either Avatrade, FinmaxFX, or IG. The registration process on every platform is almost the same. Once you have successfully created your futures trading account you can then move to the next step.

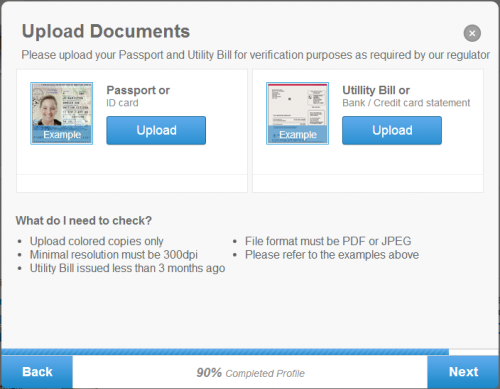

Step 2: Verification

Now you are required to provide your ID, it can either be a copy of your driver’s license or passport so that you get verified. The verification process is a very important step that you cannot skip, it ensures that the bot is not trying to access the account.

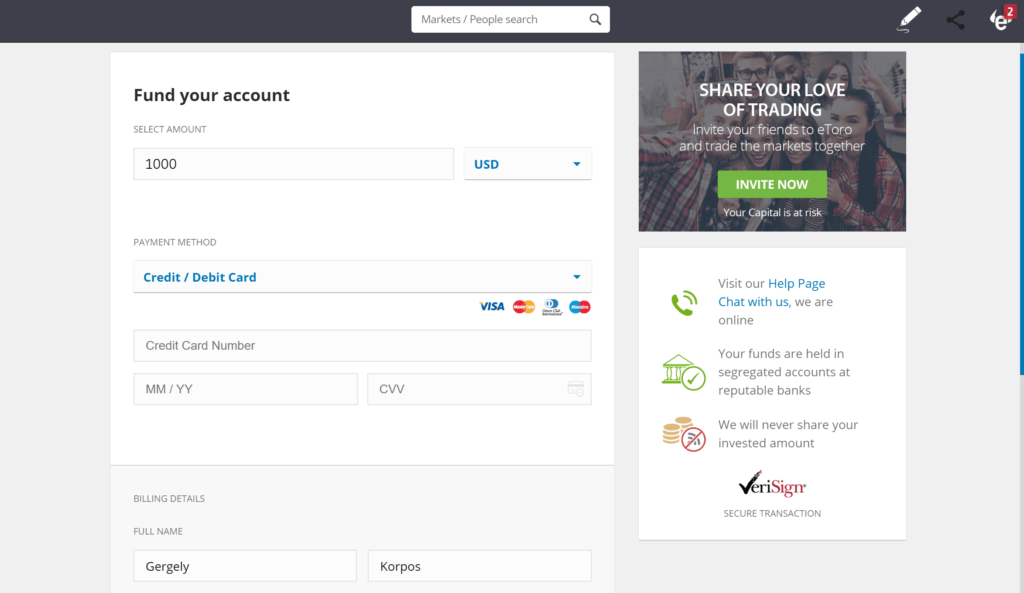

Step 3: Deposit Funds

Now that you are successfully verified, you are now required to fund your account by making a deposit of as low as possible. The minimum deposit required on a platform varies from platform to platform. The minimum amount required on AvaTrade is $100, on FinmaxFX is $200 and on IG is $250.

Step 4: Browse Futures Markets

Now that you have successfully funded your futures trading account, you are now all set to browse the futures market and select what you want to trade.

Step 5: Place a Futures Trade

Now that you have selected the futures market you want to trade, you are then required to select either you want to buy or sell a position. An order box will appear on the screen on which you have to enter a stake and leverage ratio, you wanna go for. Now that you have entered it, you need to confirm the order and the position will be matched at the next available market price.

Conclusion

From all the information we have gathered we can confirm that Futures trading is a bit tricky and not everyone can start futures trading. Well, we are not saying that there are no restrictions or eligibility criteria on traders when trading futures, but the thing we are trying to imply here is that it is a complex form of trading, the exact opposite of traditional simply buying and selling assets. Therefore, first, you need to master yourself when trading Futures.

However, if you are willing to start futures trading you can do so, and if you have the knowledge of how things work in futures trading then it’s the right thing for you to do as it allows you to start trading without owning the assets physically. But before you start futures trading, we suggest you gain all the information you can and whatever you need to know is available on the internet. Make sure you read all the blogs and watch all the information on YouTube futures trading videos.

Happy Trading.

FAQs

- What are the Futures in trading?

Futures in trading refers to a futures

contract – it is an agreement between the buyer and the seller that a commodity will be bought/sold at a predetermined price on a specific date in the future.

- Who can trade futures?

Anyone can trade futures, there are no eligibility criteria on it.

- What is the difference between futures and options?

Future contracts are different from options contracts because in futures both parties are obligated to exchange the underlying at a specific time upon a predetermined price in the future. However, that is not the case with options contracts because, in options, only one party is obligated to either buy or sell if the other party exercises their side of the agreement.

- What is Margin in futures trading?

Margin is known as the small percentage of the amount that you deposit to open a CFD or a spread bet while getting exposure to a much larger market. However, one should always remember that your profits and losses are determined by the total position, and not just on the Margin.

- When do futures contracts expire?

Usually, future contacts expire on the third Friday of the respective month.

- How much leverage can you get when trading Futures in the UK?

Trading Futures in the UK offers leverage of up to 1:30 on forex pairs, and less on other asset categories.

- What are futures CFDs?

UK traders prefer CFDs over traditional futures because it allows you to trade without having to own(purchase or sell) the underlying asset.