Are you considering making an investment in one of Asia’s biggest and most powerful stock indices? Let’s discuss it. If yes, you should research Hong Kong’s Hang Seng Index (HSI).

In this guide, we’ll go over all the numerous methods you can learn about Hang Seng Index. In this manner, you can be ready to decide wisely when it’s time to invest your money.

How to Invest in Hang Send Index – An overview

- Step 1: Choose a Broker – The first thing you must do is locate a broker who is trustworthy and enables Hang Seng Index investments.

- Step 2: Open an Account – The next step is to create an account with the trading platform of your choice. Users often need to input some personal information and upload evidence of ID and address.

- Step 3: Fund Your Account – Users must fund their accounts before they may invest.

- Step 4: Invest in Hang Seng Index – You can complete your investment after funding your account. Enter the desired investment amount after searching for any Hang Seng Index business in the search bar.

What is Hang Seng Index?

The performance of the 50 biggest businesses listed on the Hong Kong Stock Exchange is gauged by the Hang Seng Index (HSI), which was introduced on November 24, 1969. Since it accounts for more than 50% of all market cap on HSI, the market capitalization-weighted index is the barometer of the Hong Kong economy that is most frequently watched.

History of Hang Seng Index

The HSI, which has been around for almost 50 years, was essentially the brainchild of Ho Sin Hang, chairman of Hang Seng Bank, to create a “Dow Jones industrial average of Hong Kong,” and it appears to be serving that purpose at the moment. Since that time, HSI Services Limited, a Hang Seng Bank subsidiary, has been in charge of managing the index.

The index’s initial base was 100 points per the total value of the companies as of the market’s close on July 31, 1964. Prices initially surpassed the 10,000 barriers in 1993, then reached the 20,000 barriers over 13 years later, yet it only took ten months, in October 2017, for prices to reach the 30,000 barriers for the first time. The HSI enjoyed its best year in terms of percentage change in 1999, with gains of 68.8%, and its worst year, with reductions brought on by the 2008 financial crisis, with an annual dip of 48.27%. When the Hong Kong Observatory issues typhoon indicators or black rainstorm warnings, the HSI and the Hong Kong exchange must halt market activities. Typhoons are notoriously lethal.

Composition of HSI

The 50 most important and liquid businesses listed on the Hong Kong Stock Exchange make up the capitalization-weighted HSI index. This implies that the larger component stocks will have a bigger impact on the index as a whole. To prevent any single stock dominance, representation is capped at 10%; as of the most recent report, only HSBC Holdings has reached the threshold. The 50 component stocks can be divided into four categories, each of which can create a separate sub-index. These include the sub-indices for banking, utilities, real estate, and commerce & industry. Each quarter, the index is evaluated.

The most latest data on the top five weighted constituents are as follows:

| Company Name | Industry Classification |

| HSBC HOLDINGS | Financials |

| TENCENT | Information Technology |

| AIA | Financials |

| CHINA MOBILE | Telecommunications |

| ALIBABA | Consumer Discretionary |

Ways to invest in Hang Seng Index

Your first choice will be whatever method you want to use to own a portion of an index because there are many different ways to do so. Being motivated by all of these options rather than feeling scared by them is the key. Consider elements like the relative quantity of transaction costs for each technique and the level of customer support you desire while investing in order to reduce your options for investment types.

The most common ways to invest in the Hang Send Index are briefly summarised here:

ETFs

An exchange-traded fund, or ETF, is a type of investment fund that functions similarly to an individual stock when it comes to trading on a stock market. ETF trading is available any time the normal stock market is open. A Hang Seng ETF can be designed to replicate an index like the Hang Seng Index and typically holds a variety of assets at once, including stocks, bonds, and commodities. Given that it provides you with a diverse portfolio of 50 blue-chip firms and still allows you to trade your investment on an exchange, an ETF can be a wise, inexpensive way to invest. Just keep in mind to refrain from purchasing stock index ETFs in down markets.

Individual stocks

You can acquire shares of the 50 different stocks that the Hang Seng Index tracks in separate trades if you prefer to concentrate on the index’s top-performing stocks rather than obtaining exposure to the entire index. As opposed to when you invest in the index as a whole, this enables you to assess each stock as you go and pick which Hang Seng Index stocks you want to keep and which ones you want to sell.

Mutual funds

A mutual fund is an investment vehicle managed by a qualified money manager that pools capital from numerous investors and then invests it in a variety of assets. You can invest in all 50 of the stocks that make up the Hang Seng Index at once with a Hang Seng fund, sometimes referred to as an index fund. This lowers your risk because you’re owning a sizable, diversified group of stocks. A mutual fund can be purchased directly from the company that manages a Hang Seng fund or through a broker.

Factors influencing Hang Seng Index

Equity indexes, which measure stock performance collectively, are impacted by the same factors as stock trading or investing. These elements could be fundamental, technical, or emotional.

Given the close proximity to China and the substantial presence of Chinese companies in the HSI, one may anticipate that China’s political and economic environment will have a significant impact on price changes. The performance of the numerous Chinese companies listed on the HSI as well as the overall index itself is directly impacted by changes in the value of the Chinese yuan. Recall that the sudden devaluation of the yuan in August 2015 sent the HSI plummeting and affected regional equity indices as well because of the interconnected economies. Recently, despite steady economic development in Asia, the US and China engaged in a series of retaliatory tariff attacks that hit the HSI from fundamental and market sentiment angles, sending the index into the bear market territory.

Tips to consider while investing in Hang Send Index

To increase your chances of financial success when investing in the Hang Seng Index, bear the following advice in mind:

Make research: It takes a lifetime to become an expert at investing, as well as a lot of time, effort, and patience. If you’re thinking about investing in the Hang Seng Index, you should weigh all the benefits and drawbacks of doing so.

Make a budget: Your unique degree of risk tolerance and the amount of money you can afford to lose without negatively affecting your financial situation or emotional stability should be taken into consideration when creating your budget. If you allow your losses to mount, you risk damaging both your self-assurance and your capacity to execute successful transactions in the future.

Pick the appropriate platform: For some investors, selecting the best platform to begin trading the Hang Seng can mean very different things. One investor may choose a platform only based on the magnitude of its transaction costs, whereas another investor may place far more emphasis on the quantity and caliber of investing advice available. Whatever your objectives may be, do your research, choose a platform, and don’t be afraid to switch if you’re not satisfied with it.

Increase your investments slowly: The wisest course of action for a novice investor is to make a modest initial investment. As you gain knowledge and success as an investor, you may always increase your investment. With this methodical process, you’ll be able to minimize short-term losses and maximize long-term benefits.

Take a long view: You can purchase and hold an ETF or mutual fund linked to the Hang Seng Index to achieve long-term success while pursuing greater returns. However, given that investing in a down market might result in significant losses, that method is only recommended during a bull market.

Best platforms to invest in Hang Send Index

The most crucial step in investing in the UK Hang Seng Index is choosing the right broker. We have examined two of the top investment applications and brokers in the UK for trading Hang Seng indices in order to make this process simpler.

1. eToro

More than 20 million people use eToro worldwide. It offers a large variety of trading items such as shares, ETFs, indices, and commodities and is used by both professional and amateur traders.

The fact that eToro does not charge a commission for trading is a great characteristic of this broker. Although eToro does charge a tiny spread, this is a common and affordable practice among UK brokers.

As if that weren’t alluring enough, eToro now enables you to invest in specific stocks that are part of the Hang Seng Index. You don’t have to make a sizable upfront investment because fractional shares can be purchased for as little as $50 (about £36). For instance, you may begin by making a little investment in Tencent Holdings. Then, you may progressively raise your stake over time while making no commission payments.

The UK FCA oversees eToro, ensuring a safe environment for trading HSI. You can pay the $50 minimum deposit required by the broker with a credit or debit card, as well as with an e-wallet like PayPal, Neteller, or Skrill. 24/7/365, eToro’s customer service department is open.

2. Libertex

More than 2.2 million customers are served by the UK-based CFD broker Libertex. You don’t have to be the owner of the asset on which the CFD contract is based in order to trade CFDs. The benefit of this style of trading is that you can raise your effective position in the Hang Seng index without having to make additional upfront investments thanks to leverage.

Libertex is unique among UK CFD Brokers in that it uses fixed fees rather than variable spreads for trading. Libertex has very reasonable trading fees, making it a wonderful option if you want to pay as little as possible to invest in the UK Hang Seng index. The money can be deposited through a variety of payment methods, including e-wallets, debit/credit cards, and bank transfers. CySEC has authorized and overseen the broker.

How to invest in Hong Seng Index?

Step 1: Open an Account

Click “Sign up now” on the eToro Investments website or app to get started. Click “Create Account” after entering your contact information (such as name and email address).

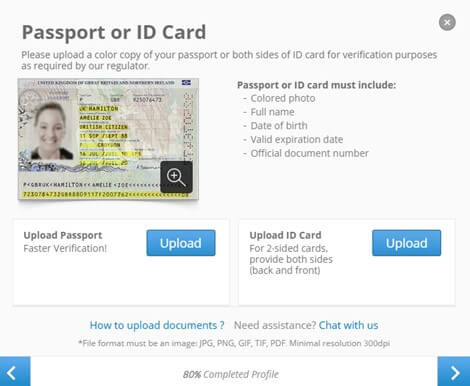

Step 2: Verify the identity

You need to confirm your identity and address because eToro is a broker governed by the FCA. Your driver’s license or passport and proof of address should be uploaded (copies of utility bills or bank statements).

Step 3: Deposit the funds

To invest in the Hang Seng Index, fund your account. Payment options include bank transfer, e-wallet, debit card, and credit card. The required amount of funds is $200.

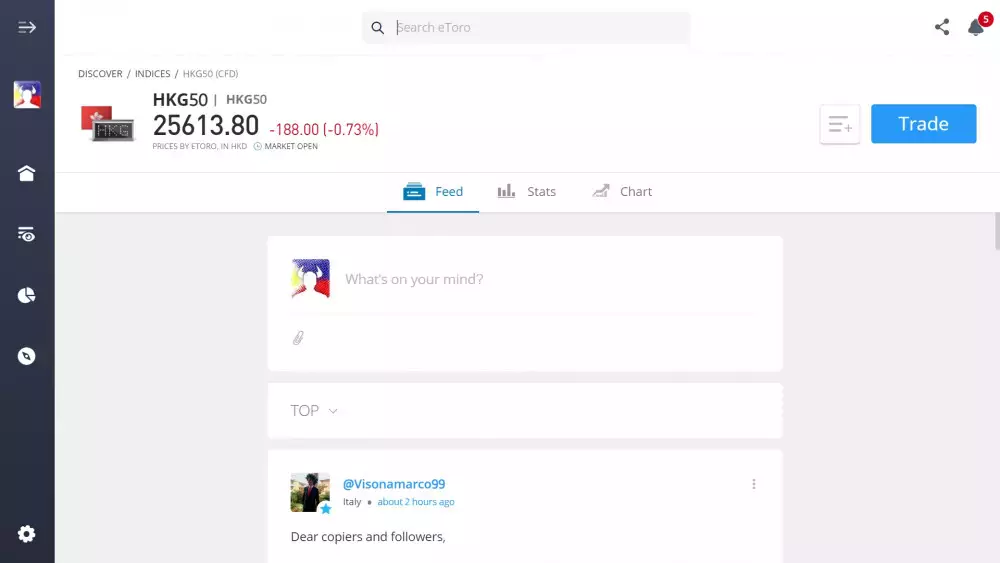

Step 4: Search Hang Seng Index

Find the Hang Seng indexes or specific equities you want to add to your portfolio by conducting a search.

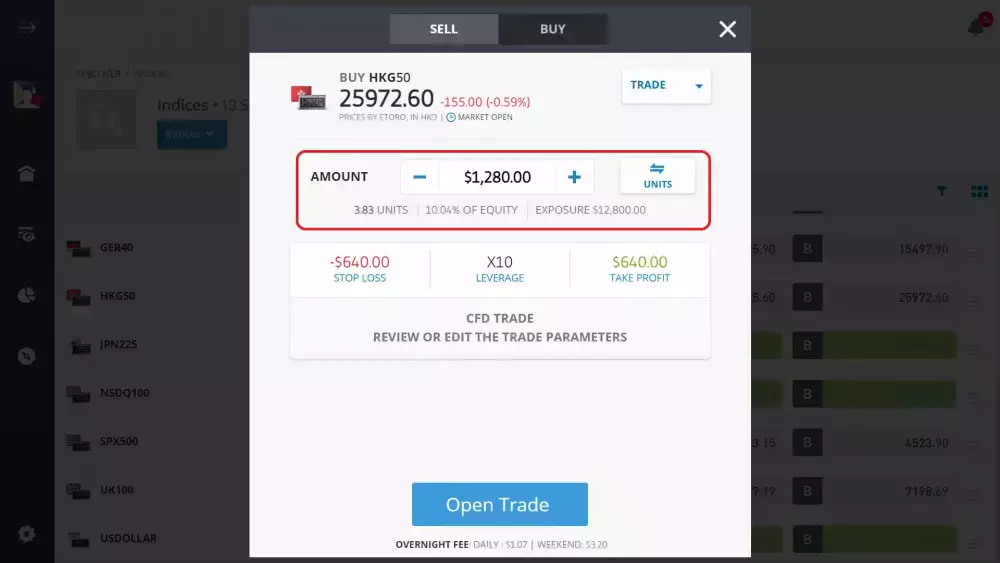

Step 5: Start Trade

Simply select “Trade” from the menu as displayed in the image below. Then, after entering your desired investment amount, click “Open Trade.”

Conclusion

If you wish to invest in the Asian stock market, the Hang Seng Index may be a wise choice. The Hang Seng index offers exposure to rapidly expanding stocks in China and other Asian nations, even if it may be riskier than the US and European market indices. The UK Hang Seng index can be purchased, albeit indirectly, using a mix of exchange-traded funds (ETFs), mutual funds, or index funds. You can also trade value through derivatives using the techniques outlined above.

Frequently Asked Questions

Is it possible to buy Hang Seng Index in the UK?

Yes, you can trade value through derivatives using the methods outlined above, or you can invest in the UK Hang Seng index using a combination of ETFs, mutual funds, or index funds.

What time slots are available for trading the Hang Seng Index?

Monday through Friday, the hours for trading Hang Seng Stocks are 9:30 am to 4:00 pm and 1 pm to 4:00 pm.

Why invest in the Hang Seng Index?

Hang Seng may also introduce the biggest firm in China. Because of its high volatility, some investors prefer Hang Seng.

How is the Hang Seng index being impacted by the coronavirus?

When the coronavirus epidemic started in early March, Hang Seng was severely impacted, much like the majority of stock markets worldwide. Despite having recently recovered well, it has not yet returned to its pre-pandemic levels.