Exchange-traded funds (ETFs) give investors a reasonably inexpensive method to diversify their exposure across a variety of shares or bonds inside a single investment offering.

ETFs often attempt to replicate the performance of a particular stock market index, such as the S&P 500 in the US or the UK’s FTSE 100. They resemble index tracking funds, which are similarly created to mimic the movements of a specific stock market index, in this regard.

In this guide, we’ve mentioned the best ETFs you should buy in UK 2022, a detailed analysis of each fund, and a step-by-step tutorial on how to trade ETFs.

After a deep research, we have This guide is the result of numerous hours spent researching the top ETFs in each area, as well as how to invest in these ETFs at a lesser cost.

Best ETFs in 2022

The best ETFs to acquire right now in the United Kingdom are listed below.

- Invesco Physical Gold ETC (SGLD.MI)

- iShares UK Property UCITS ETF (IUKP.L)

- Vanguard FTSE All-World UCITS ETF GBP (VWRA.L)

- Vanguard FTSE 250 UCITS ETF (VMID.L)

- Invesco Global Water ETF (PIO)

- iShares NASDAQ 100 UCITS ETF (CNDX.L)

- iShares MSCI Europe SRI UCITS ETF (IESG.L)

- Vanguard FTSE Emerging Markets UCITS ETF (VFEM.L)

Best ETFs Analysis

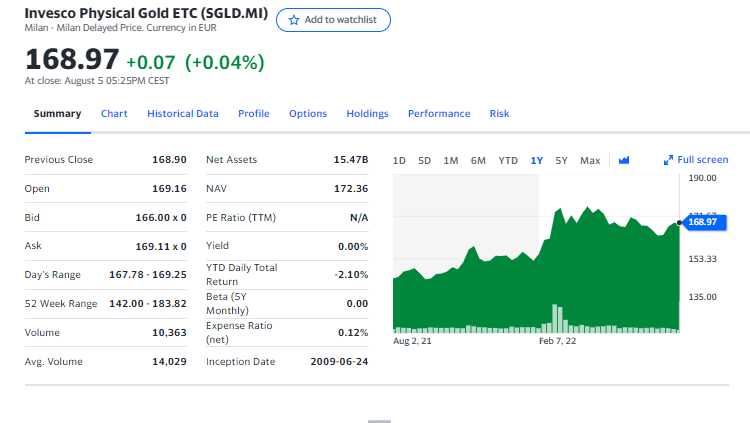

Invesco Physical Gold ETC (SGLD.MI)

This ETC offers a cheap option to access the price of actual gold through a liquid fund that is listed on the London Stock Exchange. It can be held without having to purchase and keep gold in a safe or vault in individual savings accounts (ISAs), pensions, or investment accounts.

With a value of almost £13 billion, this is the largest and most affordable physical gold fund accessible in the UK.

Physical gold bars kept in JP Morgan Chase Bank’s London vaults are used to fully back the ETC. A long-term inflation hedge, gold often performs well during uncertain or stressful financial times.

It’s crucial to keep in mind that actual gold has few uses outside of jewelry and doesn’t produce any money. In the end, gold is only worth what the next buyer is willing to pay.

Read: Gold Trading UK – Beginners Guide

iShares UK Property UCITS ETF (IUKP.L)

High street retailers have closed owing to internet competition in certain areas of the UK commercial real estate market, and the epidemic has caused businesses to minimize their need for office space.

As internet shopping has grown, there has been a tremendous demand for logistics sites and depots. Having real estate may diversify a portfolio and bring in rental income. The property also contributes to inflation-proofing, as commercial rent evaluations frequently take inflation into account.

This ETF offers exposure to a large portfolio of properties because it tracks an index made up of about 40 real estate securities and investment trusts that are listed in the UK.

The ETF now has a yield of 2.3 percent, and it distributes income on a quarterly basis.

Read: How To Invest In Private Equity? – Beginners Guide

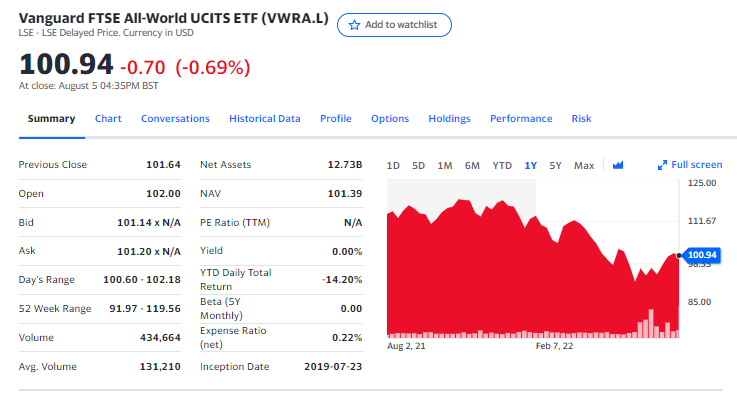

Vanguard FTSE All-World UCITS ETF GBP (VWRA.L)

It is worthwhile to look beyond UK equities because the world is rife with investing opportunities.

The performance of this ETF is based on the FTSE All-World index, which comprises large and mid-sized companies from established and emerging economies.

For a little annual cost, this highly diversified portfolio offers exposure to roughly 4,000 companies in about 50 different countries.

The United States (60%) is the most geographically biassed country, followed by Japan (6%), the United Kingdom (4%), and China (3 percent ).

Technology is the sector with which the ETF has the most exposure, followed by consumer discretionary, financials, and industrials.

The tech behemoths Apple and Amazon as well as Nestle, a manufacturer of consumer goods, are among its major investors. The median market capitalization of its holdings is approximately $100 billion.

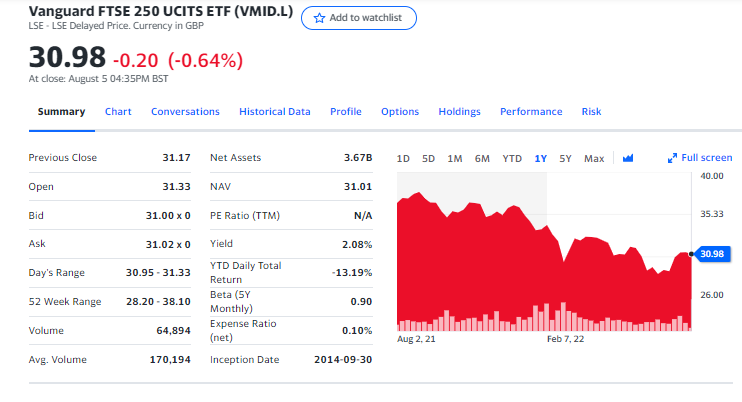

Vanguard FTSE 250 UCITS ETF (VMID.L)

The FTSE 250 index, which represents mid-sized publicly traded UK companies with values ranging from about £450 million to £5 billion, is what the fund tracks in terms of performance.

About half of the FTSE 250’s revenues come from within the UK, as opposed to the FTSE 100, which is made up of multinational corporations that collectively generate three-quarters of their revenue from outside the country.

The giants of the FTSE 100 have been greatly outperformed over the long run by the returns from FTSE 250 businesses, making this a considerable portion of the UK equities market.

Financial equities are the sector to which the ETF is most exposed, followed by consumer discretionary, industrials, and real estate.

The ETF fully mimics the assets of the FTSE 250 and has modest annual fees.

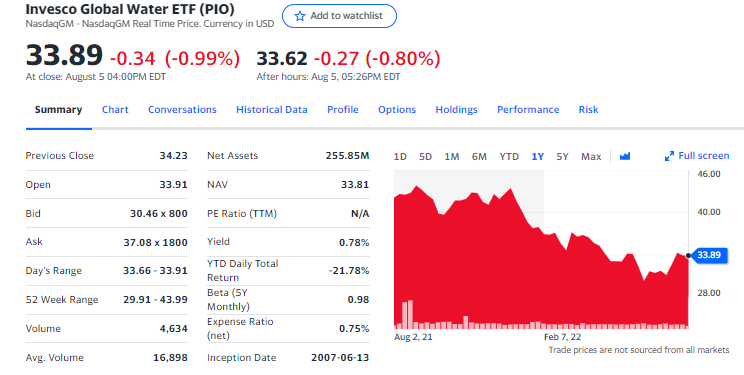

Invesco Global Water ETF (PIO)

The most valuable resource of the future may turn out to be clean water. Given that they see water as a significant long-term economic risk, some pension funds are already requesting reports from corporations on their water policies. Water assets can be a wonderful source of portfolio diversity as well as a long-term tale of capital growth.

At now, the Invesco Global Water ETF has a value of $24.7 billion (£18.68 billion). It follows the firms that make goods intended to cleanse and preserve water for use in households, businesses, and industries, as measured by the NASDAQ OMX Global Water Index. Danaher, Geberit, and Ecolab make up its top three holdings.

iShares NASDAQ 100 UCITS ETF (CNDX.L)

It is believed that any portfolio that wants to profit from emerging trends must include a sizable portion of the technology sector. A decade earlier is always a better time to buy technology, and the asset class is probably going to be volatile. Having said that, a diverse portfolio of blue-chip technology businesses should see healthy growth.

The technology industry is represented by the NASDAQ stock market. With a total cost ratio of 0.33 percent, the iShares NASDAQ 100 UCITS ETF seeks to mimic the performance of its 100 largest equities. The familiar FAANG companies, including Meta, Amazon, Apple, Microsoft, and Alphabet, make up its largest stakes. The amount of the fund is $5.9 billion, or roughly £4.47 billion.

iShares MSCI Europe SRI UCITS ETF (IESG.L)

If you’re fascinated in socially conscious investing, this iShares fund, which follows companies from throughout Europe, is a solid option Only businesses with strong environmental, social, and governance (ESG) scores in comparison to peers in their industry pass the screening procedure.

The ETF stays away from companies that are involved in the extraction and manufacture of fossil fuels. Each corporation is limited to a weight of 5%. It has a 0.2 percent overall expense ratio. Roche, Siemens, and Unilever are among the top investments in the fund.

Vanguard FTSE Emerging Markets UCITS ETF (VFEM.L)

The Vanguard ETF has an ongoing cost of about 0.20 percent and tracks the 1,722 company FTSE Emerging Markets Index. China makes up around half of the fund and has recently had quicker growth than any other rising nation. The two biggest investments it has are Tencent and Alibaba. In addition, a number of Chinese technological businesses are given a lot of weight. Nevertheless, no business accounts for more than 8% of the index, giving access to a wide range of nations and industries.

How to invest in the best ETFs in UK?

After talking about the top ETFs in the UK, we’ll walk you through the investment process.

Step 1: Choose a broker

Finding the best ETF trading platform is the first step in investing in an ETF. Not only should you consider a broker’s availability of your preferred ETFs, but also the fees and commissions it levies.

1. eToro

More than 20 million traders worldwide currently use eToro. You may trade ETFs on eToro in addition to equities, cryptocurrencies, currency, and commodities.

Each ETF on the platform has a $10 minimum investment requirement. This enables you to invest in a variety of ETFs without having to make a sizable initial investment.

The social trading platform also provides CopyPortfolios with a range of aims and methods. A portfolio that focuses on green energy equities and another that monitors virtual currencies like Bitcoin and Ethereum are included in this. This is a fantastic replacement because a cryptocurrency-specific ETF has not yet reached the UK retail customer market.

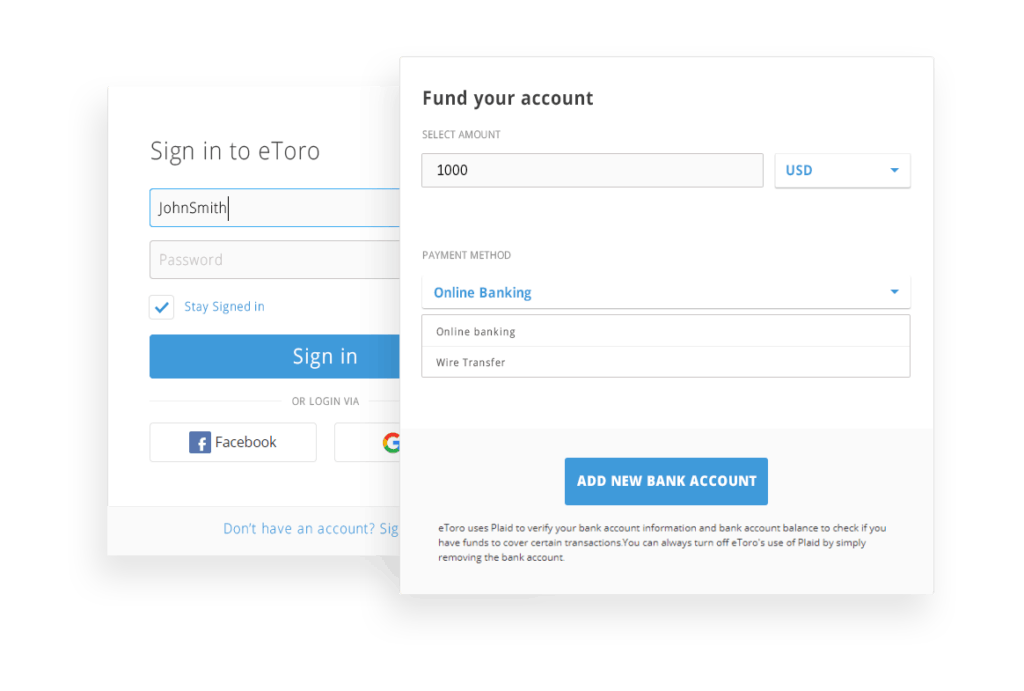

An eToro account can be created in a few minutes. You can make a deposit with a Skrill, PayPal, or UK debit/credit card. A bank transfer is also supported, albeit it can take a little bit longer. The Financial Conduct Authority has approved and overseen eToro and the FSCS protects your trading capital.

2. Fineco Bank

The asset library at Fineco Bank is diverse and comprises hundreds of items.

This includes numerous foreign exchanges in addition to ETFs listed in the UK. You could invest in ETFs from the US, Singapore, Japan, and a large portion of Europe, for instance. This stock broker provides one no-cost ETF each month when it comes to costs.

However, you need to pick an ETF from a limited choice of 200 or so. If the investment you want to make isn’t on this list, you’ll have to pay $3.95 or £3.95 for ETFs listed in the US or Europe, respectively. The exchange will determine how other regions are. We especially appreciate Fineco’s auto investment option.

This enables you to make a set monthly investment into your preferred ETF of a defined amount (minimum £50). You will only pay a flat monthly charge of £2.95 when you invest in this way. You are protected by the FSCS in addition to being approved and regulated by the FCA, which oversees Fineco Bank’s safety measures.

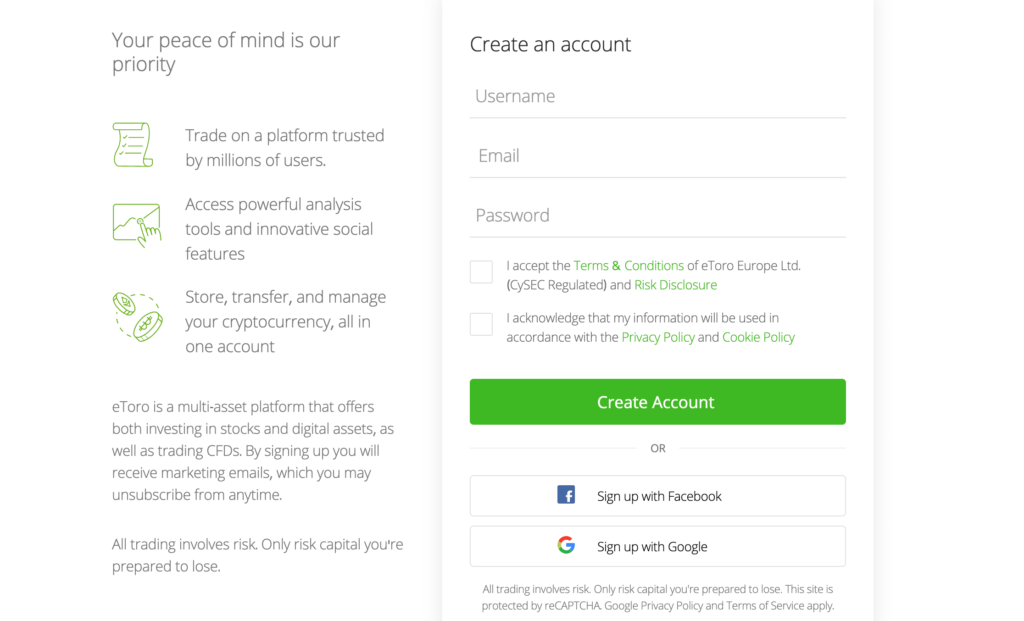

Step 2: Open an Account

For this example of purchasing ETFs, we have chosen eToro, a commission-free and FCA-regulated platform, where you must first complete a registration form with some basic information. In order to connect to the eToro platform, you must also give a password. You must check the appropriate boxes to agree to the General Terms and Conditions and Privacy Policy after completing the form, just as with any other online form. After that, you must click “Create Account” to validate the form.

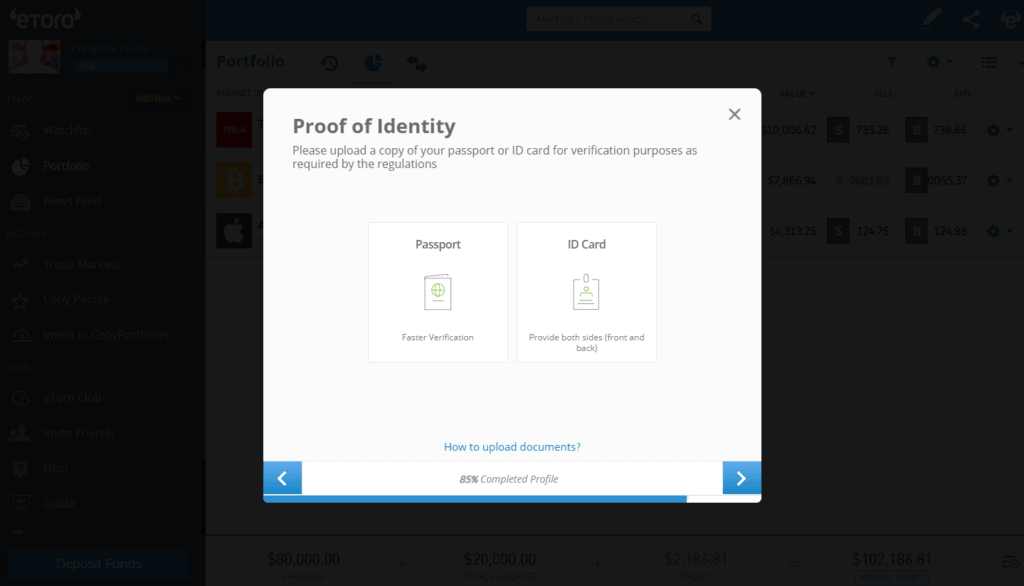

Step 2: Verify your account

It is a procedure that has two distinct phases. To begin, your personal details will be requested of you. Additionally, a Know Your Customer (KYC) question will be posed to you. These inquiries concern your understanding of money matters and trade, as well as your goals, income, assets, and other information.

Step 3: Make the deposit

You can fund your account and begin trading ETFs after having your documentation and account validated by eToro customer support.

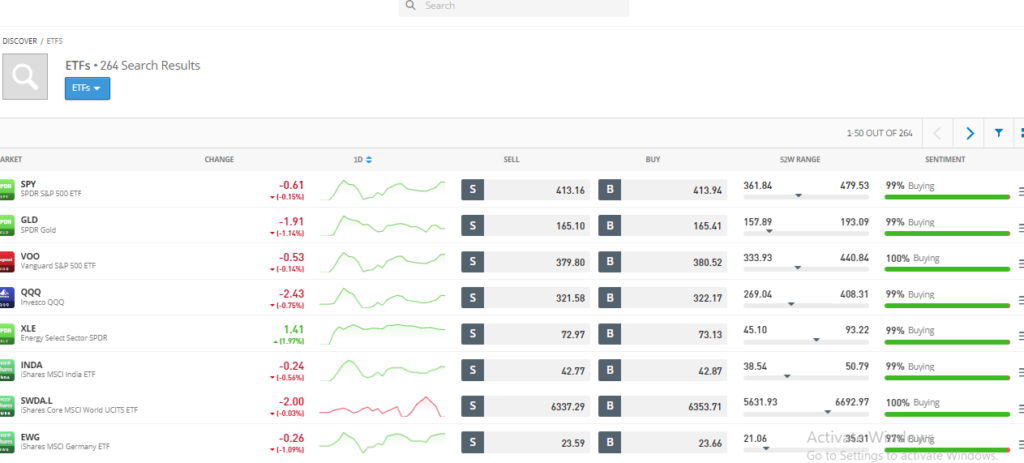

Step 4: Select the ETF and invest

Browse through the 264+ ETFs on the platform to find the best ETF before making your investment. The ‘Trade’ button will show up next to the ETF you want to buy as soon as you click it.

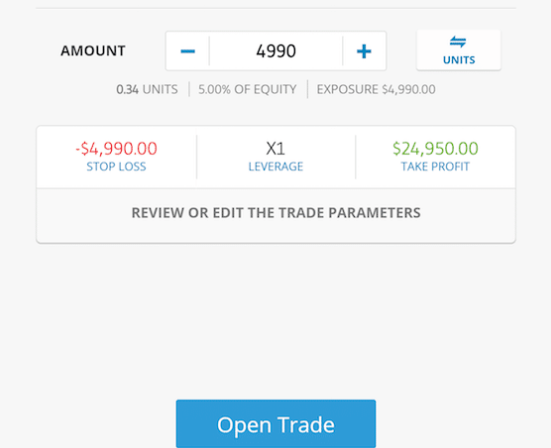

Put your investment’s amount in the “Amount” box after that. Finally, click the “Open Trade” button to acquire the ETF without paying a commission!

Conclusion

The use of exchange-traded funds (ETFs) to speculate on a variety of financial instruments has recently grown in popularity. Before starting a new trade, users should be sure to check out the ETF’s historical performance and maintain track of their available investment possibilities.

Frequently Asked Questions

What is an ETF?

An investment that tracks the performance of a stock index, industry, commodity, or other groups of financial assets is called an English Exchange Traded Fund (ETF).

How should I choose an ETF?

Your risk tolerance will determine the ETF you choose, as it does with all financial investments. The name of the entity that issued an ETF must be known to you. In the end, it’s crucial to comprehend the fees, unpaid debts, dividends, and taxation related to ETFs.

Are ETFs a good investment?

The product’s synthetic and frequently changing composition makes it less dangerous. ETFs are therefore widely available and very liquid, even in very tiny quantities.

Where can I locate the top ETFs available today?

ETFs are offered by several companies but don’t fall for their costs, commissions, or credibility. After examining every offer on the market, we think eToro is the best place to buy an ETF.