You’ll need an account with one of the best online brokers on the market if you want to start an investment adventure that involves buying and selling stocks, cryptocurrencies, and other assets in a secure location.

According to our study, the best online brokers offer fair fees and commissions, a large variety of supported markets, a wide spectrum of functions and functionalities, and top-rated customer support.

In this article, we will examine the best Online Brokers currently available in the UK in 2022 based on all of these criteria.

What Is an Online Broker?

Someone or a service known as a broker is the middleman between a potential trader and a trading platform. Since trading platforms only take orders from people that are users of that platform, individual traders need the services of platform members.

Types of Online Brokers

Some trading systems focus on a single asset class, while others provide you access to many other marketplaces.

The primary categories of online brokers to which you will have access are briefly described below.

Cryptocurrency Broker

You may purchase and sell digital currencies like Bitcoin, Ethereum and XRP via a cryptocurrency trading broker. You will trade with other market players on the majority of platforms in this area because they function as third-party exchanges.

However, you can invest directly in cryptocurrencies using brokers like eToro, which is more suited for beginners.

Stock and ETF Broker

There are several options available if you’re seeking a platform that sells conventional stocks and ETFs. Today’s stock trading brokers typically allow investors to deposit as little as a few dollars and typically charge no commission on US-listed stocks and ETFs.

Forex Broker

The largest trading industry on the planet is found in forex, which comprises trading currency pairings. You undoubtedly already know how tightly monitored the forex market is if you reside in the United Kingdom.

As a result, you will have to adhere to a number of tight rules, such as maintaining a certain minimum balance in your brokerage account. However, the best forex trading brokers on the market, in particular low spread forex brokers, provide a wide range of currency pairs coupled with narrow spreads.

Options Broker

Options are extremely intricate financial derivatives that let you make predictions about the future value of an asset without actually assuming ownership.

In essence, this enables you to trade with capital that is greater than what you have available.

Commodities Broker

Oil, natural gas, gold, silver, and wheat are a few of the commodities that are traded the most on a global scale. Again, trading these products may be challenging for you if you’re a UK-based retail client.

On the other hand, eToro, one of the best commodity trading platforms available, makes it simple to invest in commodity-focused ETFs with a 0% charge.

Day Trading Brokers

Those who want to speculate on assets using a short-term approach can use the best day trading brokers available. You’ll have to place orders and close the trade before the respective market ends that same day.

Best Online Brokers 2022

It can be difficult to choose which provider to sign up with so many trading platforms are available online.

Before registering, you should do some research on the broker’s specifics, such as the commissions it levies, the assets it allows you to trade, and how user-friendly the site is.

Below you will view a comprehensive analysis of well-known UK online brokers currently available on the market, saving you the time of further research.

1. eToro

As of Quarter 2 2022, eToro, an online broker founded in 2007, had more than 27 million users. With the click of a button, you can trade a variety of asset types on this platform.

Since eToro does not charge fees to trade with stocks, shares, and ETFs, the commission-free environment of the online broker has received praise from the industry.

This consists of thousands of CFDs, 250+ ETFs (exchange-traded funds), 60+ cryptocurrencies, and more than 2,400 equities from 17 UK and foreign stock exchanges. The latter covers everything from gold and silver to FX and oil.

Aside from the aforementioned assets, eToro’s marketplaces all provide commission-free trading. Additionally, there are no yearly maintenance costs, and deposits only cost 0.5 percent.

In terms of accessibility, eToro provides an iPhone and Android mobile app. Due to the platform’s absence of complicated financial language, the procedure of locating an asset and putting buy and sell orders may be accomplished without difficulty.

The CopyFunds portfolios that eToro provides are also well-known internationally as a quick and easy way to start trading online. Additionally, a Copy Trading option exists that enables passive investing.

You choose a verified trader, decide how much money you want to put into it (at least $200), and all active trades are then reflected in your personal eToro portfolio. If you want to trade in smaller increments, eToro has minimum investment requirements of $25 for cryptocurrencies, $50 for stocks, and $200 for ETFs.

With eToro’s approval and regulation by the Financial Conduct Authority UK investors now have access to a cutting-edge regulatory structure. Finally, this affordable online broker in the UK accepts a number of payment options, including bank transfers, debit/credit cards, and e-wallets like Paypal.

2. Capital.com

In the UK market, Capital.com is a relatively new stockbroker. Over 3,000 instruments, including several stock CFDs, are available on Capital.com. With more than 2,400 shares included, you can trade businesses from all around the world. Additionally, it provides currencies, commodities, indexes, and ETFs.

This UK trading online broker is also exceptionally inexpensive due to its low spreads and absence of fees. Another benefit is that Capital.com offers both CFDs and spread betting, so any profits you generate from spread betting are tax-free.

With individualized trading insights, technical indicators, analytic tools, and complex charts, Capital’s AI-powered trading platform is cutting edge. The company also offers top-notch teaching materials, such as webinars.

Since Capital.com has an FCA license, it is a very safe free trading site. Although PayPal is not available, it does provide several other payment options, such as Apple Pay, Neteller, and Skrill.

3. Libertex

UK traders that prefer low fees and commissions frequently use Libertex as their CFD online broker. The broker tops the list of eToro rivals with its zero spread offering. This means that regardless of the item you choose to trade, there is no price difference between buying and selling.

Libertex does charge a commission on both ends of the transaction, however it is typically relatively low. In fact, commissions at this online broker are frequently less than 0.1 percent for every order.

Libertex offers CFDs on equities, commodities, and currencies as examples of supported markets. You will be allowed to 1:30 leverage on well-liked forex trading pairs and less on other assets because of FCA regulations. Libertex offers the ability to go long or short on every CFD market.

You have a choice between two trading platforms offered by Libertex. This includes its internally developed platform and Meta Trader 4. Both choices are available online or through a mobile app. If you want to install an automatic robot, you must go through the MT4 trading platforms, which can be downloaded to your desktop computer.

You can quickly register an account if Libertex appeals to you. You can use a UK debit/credit card, a bank account transfer, or an e-wallet to make the minimum deposit of just £100. All subsequent deposits must be at least £10 after the initial funding of your account.

We should be aware that Libertex is not subject to FCA regulation in terms of safety. CySEC, one of the top EU license issuers, regulates it. Additionally, Libertex has been providing banking and trading services online since 1997. As a result, the service has a successful track record spanning more than 20 years.

4. Alvexo

Alvexo is a legitimate online broker that provides trading in Forex, indexes, bonds, equities, digital currencies, commodities, and CFDs. There are more than 650k registered users and more than 70 billion dollars are traded on it annually.

Alvexo, a company founded in 2014 by business professionals, features a multitude of real-time trading platforms that are easy to use and support over 500 plus different assets. The platforms include a configurable interface and a number of features that can help with market analysis.

Alvexo is renowned for its approach to trading that is service- and education-focused for all traders. It is a well-liked UK Crypto Trading Platform due to the range of features and graphs. In moreover to regular trading signals and competitive analysis, Alvexo clients have accessibility to a wide selection of financial news, a trading learning academy, webinars, and seminars.

5. Fineco Bank

Fineco Bank can be the best option if you want to build a portfolio that includes both UK and foreign assets. This European online broker has grown a significant following in the UK trading sector for a variety of reasons.

First off, Fineco Bank provides a vast collection of financial markets. This covers conventional assets including stocks, exchange-traded funds, and funds. This includes both FTSE 100 and FTSE 250 firms as well as AIM stocks.

You may navigate numerous of marketplaces outside the UK thanks to Fineco. This covers industries United States, Canada, Asia, Europe, Australia, and other regions. Fineco offers thousands of CFD markets if you’re also interested in a day trading technique with a shorter time frame. This also includes hard metals, energy, indexes, currency, and stocks.

Leverage and short-selling options are additional benefits of these CFD instruments. Due to its affordable costs on its trading marketplaces, Fineco Bank is another well-known UK stock trading broker. Purchasing UK stocks will cost you £2.95 per trade while purchasing US stocks will cost you $5.95 for every trade.

In either case, purchasing trading assets at Fineco will incur a 0.25 percent annual maintenance fee. The asset will determine the CFD costs. For instance, although futures CFDs pay $0.70 per contract, stocks CFDs are commission-free. On popular pairs like EUR/USD, forex can be transacted as low as 0.8 pip.

The minimum deposit is a mere £100 if Fineco Bank sounds right for your online trading requirements. Since the service does not accept debit or credit cards, you will need to transfer money from your bank account. Finally, Fineco Bank is subject to strict regulation in a number of nations. The platform is protected by the FSCS, and this includes a license with the FCA.

6. IG

/IG-ef2684aaa37d4d218af819f98d676d02.png)

Some of you might be in it for the long run, whilst many investors choose to use short-term trading tactics. When we say this, we indicate that you wish to buy stocks or funds with the idea of keeping them for quite a while. If this describes you, it would be worthwhile to take IG Trading into account.

The brokerage company, one of the oldest in the UK trading sector, was created in 1974. In actuality, the platform has a market value of almost $3 billion and is listed on the London Stock Exchange. You can access thousands of traditional assets by registering an account with IG.

This includes a tonne of UK stocks, which can be bought for as little as £3 per trade. However, if you execute fewer than three trades each month, you will be charged an £8 commission. Additionally, IG supports a wide range of global marketplaces, both large and small. Particularly many UK investors will purchase US stocks through IG.

However, IG is also a good option to take into account if you want to trade CFDs. More than 17,000 markets, including spread betting options, are available on the platform. Except for equity markets, all CFD and spread betting markets can be traded with zero commissions. The IG website allows for the purchase of stocks and funds on the broker itself.

To actively trade CFDs, connect your account to MetaTrader 4 platform or use the IG web trader platform. Additionally, IG provides a mobile trading app for iOS and Android devices. This online broker’s minimum deposit requirement is £250 in order to open an account. Using a debit/credit card or a bank transfer, you can add money to your broker account.

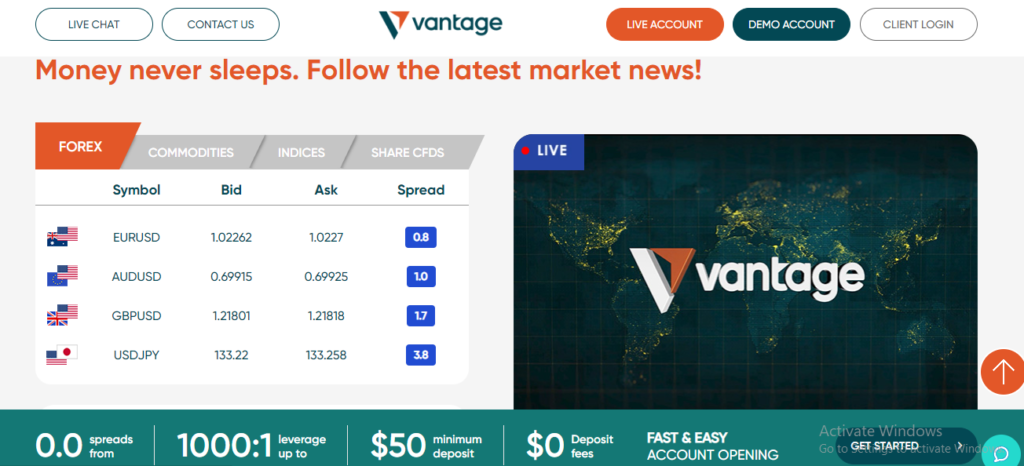

7. Vantage

Vantage is another broker that accepts traders from the UK. This service is for investors who wish to use a high leverage broker because it allows for leverage of up to 500x on some major forex pairs. Leverage of up to 75x is also available from Vantage, even for uncommon forex pairs.

Vantage provides ECN order processing in addition to the two account types. ECN accounts have a spread of 0 pip and a commission of $3 per lot and the STP accounts have a spread of 1.6 pip.

Vantage has a user-friendly interface, however, it lacks several sophisticated charting and technical analysis features. Vantage, therefore, allows automated trading, signals, and bots and is MT4 compliant. This also enables you to test any current strategies against the markets’ historical performance.

Vantage offers more than 40 currency pairs for trading. That is not a trading site that requires no initial investment. Even for trading accounts, its deposit requirements are modest. For example, the minimum deposits for STP accounts are 200 GBP and for ECN accounts they are 500 GBP. 24/7 customer service is offered.

8. XTB

/xtb_productcard-5c61e60d46e0fb0001f08eb8.png)

The first leveraged foreign currency brokerage business in Poland, X-Trade Brokers, was established in 2004 to conform to new Polish legislation. XTB later became publicly traded in 2016, making its appearance on the Warsaw Stock Exchange under the ticker name XTB.

XTB has been rapidly gaining ground in this fiercely competitive and constantly evolving online brokerage sector by providing access to a variety of markets, including FX, shares, indices, metals, commodities, and cryptocurrencies. It is regulated by the FCA and licensed with the Polish Financial Supervision Authority.

The web-based xStation 5 serves as XTB’s platform in addition to the downloadable MT4 and is a useful mobile application. Although XTB’s ancillary costs were ordinary for the industry, its continuously lower spreads set it apart from its rivals.

For investors looking to save money on the expense of making a trade or eliminating dealing with ancillary charges, XTB is an option. At XTB, non-UK accounts can leverage up to 500:1, whereas UK accounts can leverage up to 30:1. It also emphasizes customer service and provides appropriate research resources and educational aids for new traders.

9. Interactive Brokers

/interactive_brokers_productcard-5c61eec746e0fb0001f25462.png)

If you are an experienced stock trader, Interactive Brokers may be right up your alley. This is due to the platform’s extensive list of supported markets and trading resources.

Interactive Brokers gives customers exposure to more than 135 marketplaces across 33 countries. This means with this broker you can trade stocks that are traded in the United States, Canada, Europe, Asia, as well as more.

In other words, there is a good probability that you will find the low-cap international stock you want to trade on this well-known UK trading site. You may trade ETFs, mutual funds, and more with Interactive Brokers in addition to the stock market.

You will pay a commission that varies by the market if your preferred market is located abroad. The reputation of Interactive Brokers in terms of safety is outstanding. It was first introduced in the 1970s, and it is extensively controlled by a number of UK-based agencies.

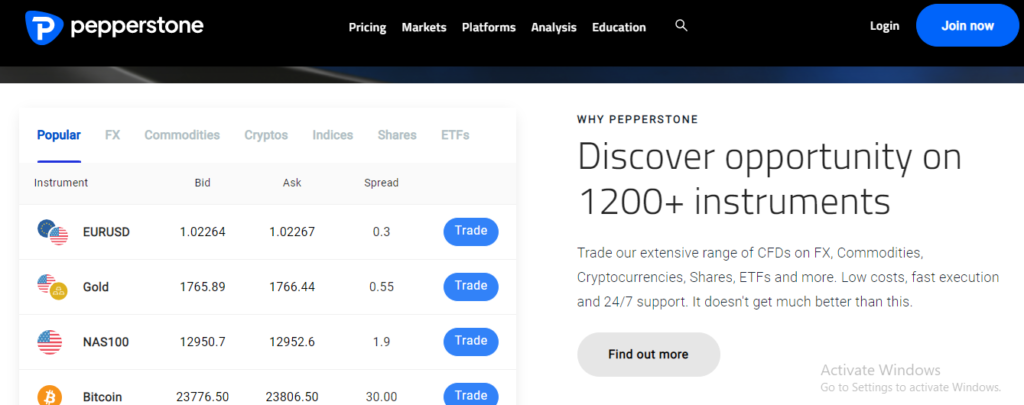

10. Pepperstone

Pepperstone is the last but not least online broker in this guide. This broker differs differently from others in that in addition to spread betting, it also provides CFD trading. Any profits you make from trading with spread betting are tax-free.

On Pepperstone, you can trade stocks, indices, currencies, and commodities using spread bets or CFDs, both of which offer up to 1:30 leverage. All assets traded on Pepperstone are subject to a spread fee, with the exception of share CFDs, which have a commission of up to 0.10 percent.

Although Pepperstone doesn’t have a unique platform, cTrader, MT4, and MT5 are all compatible with it. cTrader is a service for novice traders, but MetaTrader4 and MetaTrader5 are filled with complex trading capabilities and tailored for seasoned traders.

Overall, Pepperstone is a trustworthy broker licensed by the FCA and a well-known spread betting platform, so its users can trade with confidence. It allows a variety of payment methods, including PayPal, so you can benefit from expedient deposits and withdrawals.

Factors for Choosing the Best Online Brokers

We describe how we review and examine the best online brokers in the sections below. This will also allow you to find a broker that supports your trading aims.

Licensing

We only choose brokers who are properly licenced to offer brokerage services in the UK. Typically, FCA regulation is used to do this.

Avoid using any online broker who isn’t licenced to operate in the UK for your protection. We also prefer seasoned brokers over newcomers to the market.

Selection of Markets

You might have inferred from our recommendations that the best online brokers on the market will offer a variety of asset types. With eToro, for example, you may access stocks from the UK and other countries, ETFs, cryptocurrencies, and much more.

Minimum Deposit

There is frequently no minimum deposit needed to start an account with online brokers. By doing this, you can begin trading in the financial sectors without having to take a significant financial risk.

Fees and Commissions

If you buy UK-listed stocks or ETFs, all of the online brokers we’ve evaluated today let you invest commission-free. The prices of other assets, including stocks listed outside of the UK, are typically higher.

Given this, it is wise to verify this before to opening an account. You should be aware that eToro provides 0% commission access to more than a dozen foreign markets if you’re interested in buying stocks there.

Trading Tools

If you’re an experienced trader who wants complete control over your investment choices, seek a platform with cutting-edge features like economic and technical indicators, along with chart-drawing capabilities.

Demo Account

Demo accounts are extremely helpful if you want to test a new technique or simply become familiar with a broker that you are considering using.

Mobile App

A mobile application that is linked to your trading account is offered by the best online brokers as well. The software has to link to your primary trading account and be completely optimized for Android and iOS.

Deposit Methods

We favor online brokers with immediate and cost-free deposit options. For instance, eToro offers fee-free fast fund transfers using debit/credit cards and e-wallets.

Customer Service

Online brokers that provide a smooth 360-degree consumer experience are also appealing to us. Live chat customer service is offered by the best brokers in this area.

How to begin with an Online Broker?

So far, this post has discussed a few of the best online brokers that are currently available. We have also covered all of the crucial metrics you should think about before selecting a service. Finally, we will now walk you through the procedure for signing up with an online broker to buy stocks.

Step 1: Open your account

Typically straightforward and conducted entirely online, creating an account with an online broker. Usually, all that is needed from you is your name, address, and other minimal information. You may also be asked a few questions about your level of wealth or income, financial literacy, or trading experience.

Be sure to have your identification on hand because you may be asked to provide copies of your photo ID, recent bank statements, or utility bills to prove your identity and place of residence.

The verification of your account often takes another day or so after you have finished registering, though at some brokers it may take up to three days or longer.

Step 2: Fund your account

After having your trading account validated, the next step is to fund it, or deposit funds that you will use to purchase stocks. While some brokers require a minimum deposit when you open an account, the majority do not, allowing you to take your time before making any financial commitments.

You can deposit or withdraw money from any broker using a bank transfer; it’s a simple, frequently free, albeit occasionally slow, approach.

Many brokers also permit credit or debit card deposits of money. A select number will also accept “electronic wallets” like PayPal, Apple Pay, Skrill, or Neteller. The main advantage of cards and e-wallets is that transactions are instantaneous, enabling you to start investing or collecting money from a profitable stock sell right away.

Step 3: Find and buy stocks

You may already know the stock you want to buy; if not, it’s worth looking through your broker’s research section, which frequently offers trading ideas and suggestions from in-house specialists or third-party analysts. Alternatively, you can conduct your own research and verify the earnings multiples of the chosen stock, as well as read up on industry news.

Once you’ve decided on a stock, it’s as simple as selecting it from the broker’s search menu, entering the number of shares you wish to purchase, and pressing “Buy.”

Conclusion

This research has analyzed the top online brokers available today. We concentrated on brokers that provide access to a diverse range of markets at reasonable prices, as well as appropriate trading tools and excellent customer service.

We determined that eToro is the best all-around online broker for 2022. The website offers thousands of cryptocurrencies, ETFs, and equities with 0% commission.

Without paying any additional fees, you can also put money into a fully managed smart portfolio and into copy trading capabilities. In just five minutes, US clients can open a verified eToro account.

Frequently Asked Questions

What Is an Online Broker?

An online broker is a cash and security portfolio held on an online trading platform. To purchase and sell stocks, bonds, mutual funds, ETFs, options, and other assets, investors can use online brokers instead of traditional financial advisors.

What is the minimum cost needed to start an online broker account?

Certain online brokers have account minimums ranging from a few hundred to a few thousand dollars. The leading online brokers, on the other hand, allow individuals to register an account with no minimum balance requirement.

What is the best online broker?

The best online broker in 2022 is eToro, which offers equities, ETFs, cryptocurrencies, and more. You will gain from low fees, low account minimums, and a fully licensed environment on this platform.