Portfolio Management is the art and science of selecting and monitoring various investments that are aligned with the long-term financial goals and risk appetite of a client, company, or institution. Portfolio management requires the ability to assess strengths and weaknesses, opportunities, and risks across the scope of investment.

This guide explains in detail what portfolio management is, the basic concepts, and the different types of portfolio management.

What is Portfolio management?

Portfolio management is the process of handling and monitoring multiple financial instruments. Now let’s look at the definition of portfolio management and first explain what an investment portfolio is.

Portfolios are opened through portfolio management companies or online brokers that allow you to manage your portfolio yourself. Therefore, eToro offers this opportunity. This makes it easy to open an account and manage your assets.

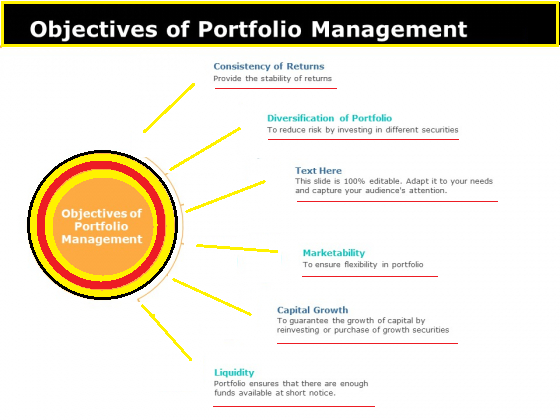

Portfolio Management Objectives

Managing a portfolio means practicing the art of choosing the investment policy that works best for people with minimal risk and maximum return.

Portfolio management is the process of managing and selecting an individual’s investments in the form of bonds, stocks, cash, mutual funds, etc. In a way that maximizes profitability within the allotted time.

Portfolio management is the management of individual funds under the professional guidance of a fund manager (portfolio manager) to minimize the risk of investment and increase the opportunity to earn profits. This allows portfolio managers to tailor investment solutions to their clients’ needs and requirements.

What is a portfolio manager?

A portfolio manager is someone who understands a client’s financial needs and develops an investment plan tailored to their income and risk tolerance. A fund manager is a person who invests on behalf of clients and signs powers of administration for them.

The fund manager advises clients and provides them with the best possible investment plan that guarantees the maximum profitability for them. Portfolio managers need to understand their clients’ financial goals and objectives and provide tailored investment solutions.

Portfolio management style

Now that we know there are three main types, let’s take a look at the different portfolio management styles- Active management, passive management, and alternative management.

Active Portfolio Management

Investors with an aggressive management approach can use a fund manager or broker to buy and sell stocks that outperform certain indices such as the S&P 500 or CAC 40.

An investment portfolio can be managed by the investor himself or by a portfolio manager. A portfolio’s success depends on a combination of in-depth research, market forecasting, and the experience of a portfolio manager or investor.

Actively investing portfolio managers keep a close eye on market trends, economic changes, the changing political environment, and news affecting businesses. This data is used to time the purchase or sale of an asset. Active managers claim that this process increases the likelihood of higher returns than simply mimicking a stock in a given index.

Passive Portfolio Management

Passive portfolio management, also known as index fund management, aims to track the performance of a specific market benchmark or indices. The fund manager buys shares of the stocks listed in the index at the same weight as they are listed in the index.

A passive strategy portfolio can consist of something like an Exchange Traded Fund (ETF), a mutual fund, or a mutual fund. Index funds are passively managed as each has a portfolio manager responsible for tracking the index rather than selecting the assets to buy or sell.

Alternative Portfolio Management

Alternative management refers to different strategies for generating active or alpha returns for investors. Hedge funds can generate high returns by managing them aggressively or by using derivatives and leverage in domestic and foreign markets.

It is important to note that hedge funds are generally less regulated and therefore only accessible to eligible investors. One thing that sets the hedge fund industry apart is that it is less regulated than mutual funds and other investment vehicles.

All alternative management strategies are designed to take advantage of specific identifiable market opportunities. For example, you can build a portfolio tailored to socially responsible investing, biotechnology, or homework skills.

Diverse Portfolio Management

In this section, we will look at the different types of portfolio management: individual management and different variant and collective management.

Individual Portfolio Management

As part of personal management, the management firm offers investors individualized and personalized management of their portfolios.

Recommended dosing

In this case, investors will continue to manage their portfolios, typically through a securities account or PEA, and may seek advice from financial investment experts.

Managed management

Portfolio management companies are under the control of all or part of an investor’s portfolio. The Client instructs the Management Company regarding the risks and objectives for making investment decisions for the Investor.

Management under mandate

Investors assign full control of their capital to an asset management company, which invests according to the client’s risk profile.

Collective Portfolio Management

In the case of collective management, asset managers do not provide individual or individual management to investors. The latter acquires products managed by Sociedad Gestora on behalf of all customers who are owners of those products.

These are typically shares in an investment fund (FCP) and/or shares in a variable capital investment company (SICAV). Collective Investment Arrangements (UCITS) for these transferable assets are fully managed by the management company that makes the decisions on the sale or purchase of the securities included. Investors have the right to control, but do not intervene in investment decisions.

To make an investor’s decision, a portfolio management firm may review the investor’s risk profile and provide advice on prior investments by referring to the relevant UCITS. Each UCITS also has a Key Investor Information Document (KIID) that shows the fund’s strategy, risk profile, and past performance. Therefore, investors in collective management select and invest in collectively managed products, and the manager directly decides individual investments in the fund.

eToro CopyTrading and CopyPortfolio: The ideal alternative to portfolio management

Have you heard of social commerce? In short, it replicates performance by copying other traders’ investments. Social trading is also much cheaper in terms of fees than leaving your portfolio to a fund manager.

And in this field, the online broker eToro is the undisputed leader in the global market. Investors can copy locations and investments from the best eToro traders thanks to Copy Trading and CopyPortfolio services.

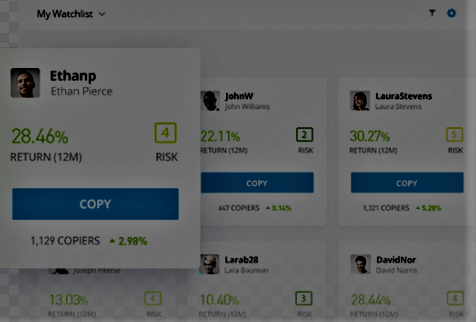

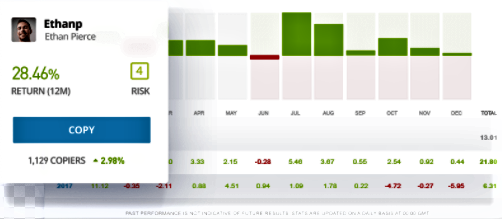

CopyTrader

The CopyTrader tool is an eToro service that allows investors to clone the positions of other traders that they do well. CopyTrader allows you to see the location of the best traders in real-time and automatically copy your investments. The CopyTrader service is even more interesting because there are no handling fees or additional fees other than the usual transaction fees.

CopyPortfolios

CopyPortfolio is another portfolio management service available through the eToro trading platform. This product allows traders to invest their money in different managed portfolios. Investing in CopyPortfolios allows you to automatically copy multiple markets or traders based on your exact investment strategy. Two ways of using CopyPortfolios-

- Best Traders Portfolio where you can copy specific groups of top traders from eToro.

- A market portfolio that groups selected CFDs, commodities, currencies, or ETFs according to a defined strategy.

A good trader portfolio is based on a trader portfolio. Each trader copied as part of the portfolio is selected according to the CopyPortfolio strategy. The market portfolio includes only financial assets. Portfolios can consist of stocks, ETFs, indices, commodities, or currencies.

Portfolio Management: What Types of Assets Can You Invest In?

This section looks at the different types of assets that can be part of your portfolio management strategy.

Shares

When you buy shares, you become part of the company. There are two ways to make money in stocks-

- With the stock prices rise

- Dividend paid by the company to shareholders regularly

So, when managing your investment portfolio, it makes sense to divide your capital into promising stocks that may rise in price and stocks that are more stable and older but pay regular dividends. . There are many industries, and it is also important to spread equity investments across industries.

Bond

Buying a bond is lending money to a company (or state in the context of government bonds) for a predefined reward in the form of an interest rate. The only way to lose money on bonds is for the issuer to file for bankruptcy. There are various types of bonds, such as general bonds and convertible bonds.

Mutual funds

These three terms refer to the same type of investment. These are investment portfolios managed by experts and sold in the form of shares. Funds may track indices such as CAC 40 or reflect specific investment topics that specialize in companies that produce renewable energy.

In addition, the fund has a variety of risk profiles. Depending on the level of risk in the composition of the fund, it can be risky, balanced, or conservative. We also recommend buying stocks from other regions. This increases the diversification of assets.

Derivatives

Derivatives are typically reserved for experienced traders who want to hedge their investments or make short-term investments in stocks. For example, it can be a leveraged product that increases a portfolio’s risk (and potential return) by increasing its gains (and losses). As part of your portfolio management strategy, only a portion of your capital should be reserved for derivatives or futures trading.

Cryptocurrency

Cryptocurrencies are a relatively new asset class, and although controversial at times, the fact is that many portfolio managers currently spend a portion of their managed capital on Bitcoin or other cryptocurrencies. The digital currency has many advantages. Some call it “digital gold”, others see it as the future of the global monetary system.

Commodities

The best-known and most traded commodities are gold and oil. While gold has a place in all portfolio management strategies to hedge against price losses in the stock market (gold tends to rise when the stock market is down), investing in oil is primarily speculative. In case of doubt, you can reserve 20% or 30% of your capital in gold. On the other hand, generally risky oil bets should only take up a small portion of your portfolio.

Forex

Forex or currency markets are virtual places where currencies are exchanged with each other. First of all, it should be remembered that Forex is a market primarily interested in short-term trading and leverage. Therefore, currencies such as oil or cryptocurrencies should constitute only a limited portion of the total investment.

The Importance of Diversifying Your Equity Portfolio

As with asset allocation, diversification is an essential part of portfolio management. Here we explain everything you need to know to optimally diversify your investments in your portfolio.

What is diversification?

Diversification is a risk management strategy in which multiple investments are mixed within a portfolio. A diversified portfolio includes a combination of different investment types and investment instruments to limit exposure to a single asset or risk.

The reason for using this technique is that portfolios of different types of assets yield, on average, higher long-term returns and reduce the risk of each portfolio or security.

Diversification Basics

The diversification benefit only works when portfolio values are perfectly uncorrelated, that is, they respond differently to market impacts, often in opposite directions.

Diversification by asset class

Different asset classes are-

- Shares: Shares of publicly traded companies

- Bonds: Public and Corporate Fixed Income Debt

- Real Estate: Land, Buildings, Natural Resources, Agriculture, Livestock, Water and Mineral Resources

- Exchange-traded funds (ETFs) – baskets of tradable securities that track an index, product, or sector

- Raw materials: Basic goods necessary for the manufacture of other goods or services.

- Short-term cash and cash equivalents: Treasury bills, certificates of deposit (CDs), short-term financial instruments, and other short-term, low-risk investments.

They then diversify their investments across asset classes, for example by selecting stocks in various sectors that tend to have a low correlation of returns, or by choosing stocks with different market caps. For bonds, investors can choose from investment-grade corporate bonds, US Treasuries, government and municipal bonds, and high-yield bonds.

Geographic diversification

Investors can take advantage of diversification by investing in foreign securities. This is because they tend to be less correlated with domestic securities. For example, the forces weakening the US economy may not affect the Japanese economy in the same way. Thus, holding Japanese stocks provides investors with a small buffer against losses in the event of a US recession.

eToro stock brokers allow you to invest with unparalleled geographic diversity. You can invest in all horizontal stock indices like DAX 30, Nasdaq, FTSE. For stock, you can buy Apple, Orange, or even FDJ stock. This guarantees a highly diversified portfolio.

Advantages of portfolio management

This section summarizes the key benefits and strengths of portfolio management.

Leverage the expertise of professional fund managers

The key benefits of delegating portfolio management to a company are that you are more likely to make the right decisions than you are and benefit from the experience of professionals who respect preventive principles such as diversification and protection.

Protection against major negative stock market trends

A well-managed portfolio will not only allow you to take advantage of the best opportunities in the stock market but will also protect you from market downturns. Some stocks are unlikely to decline in times of crisis or pay solid dividends that at least partially offset falling prices.

Market Accident Protection

Investing in different stocks, different markets, and different commodities will help prevent individual accidents. Sometimes stock prices can drop suddenly for unclear reasons. In this case, the overall financial impact is minimal by using only a portion of the portfolio.

Portfolio management and diversification

As opposed to investing in a single stock, managing a portfolio of multiple stocks allows you to apply the diversification principle mentioned earlier in this guide. This helps reduce risk but also reduces potential returns.

Disadvantages of portfolio management

Portfolio management offers many advantages, but also has some disadvantages, which will be discussed below.

High portfolio management costs for fund managers

Entrusting portfolio management to the experts is not free! Management fees are paid regardless of income. Fees on income are paid to you by the fund manager from time to time. So you end up paying more than you make money. Therefore, you need to be careful not to make a mistake when choosing a manager to entrust your portfolio with.

Limiting risk limits profitability

As explained in this guide, diversification is a fundamental principle of portfolio management. The main benefit of diversification is that it limits your risk. An increase in stock will offset the loss of a falling stock. It is rare for all stocks in a highly diversified portfolio to rise together. This means that it is unlikely to deliver an amazing performance.

Conclusion: How are you managing your portfolio?

At first glance, portfolio management seems like a business for professionals. However, we have seen in this guide that this is not the case. Of course, some solutions allow you to manage your investment portfolio yourself.

You can learn more about portfolio management, apply the principle of diversification, and learn how and when to choose stocks to buy. This is no small feat, but anyone who can afford it can do it. You may choose a different solution, but it responds to the same needs. The online broker eToro gives you access to already assembled wallets through social trading. You can then automatically copy the decisions of the best operators at no additional cost.

Frequently Asked Questions

Is it better to manage your portfolio yourself or have a professional fund manager manage it?

It depends on your profile. If you have a good understanding of the financial markets, you can manage your portfolio yourself and save a lot of fees. If you’re a beginner, you can avoid costly mistakes by leaving your portfolio management to a fund manager.

Who is the best broker to manage your portfolio?

eToro is the ideal solution. It provides all the financial and market instruments needed for optimal investment diversification. It also provides social commerce services. It can be a great alternative to portfolio management or simply in addition to your strategy.

What are the main disadvantages of delegating portfolio management?

When you delegate portfolio management to a fund manager, you lose control of your investments. Therefore, in many cases, it is impossible to intervene in the manager’s strategy. Fund managers also charge fees that reduce the overall return on investment.

What is the difference between portfolio management and trading?

The main difference between portfolio management and trading is the investment period. Trading is an activity that aims to take advantage of short-term market trends. Rather, portfolio management aims to invest in the long term and generate regular returns.

What are the basic principles of portfolio management?

The most important pillar of portfolio management is diversification. It consists in purchasing securities with different profiles to reduce global risk. Another fundamental principle of portfolio management is allocation. It consists in knowing how to change the risk level of a portfolio according to market conditions.

What are the main benefits of managing your portfolio yourself?

The main advantage of managing your investment portfolio yourself is cost. This is because the management cost of the manager and fund manager can be reduced. Sometimes it can have a serious impact on your investment performance.