The most unique investment in your portfolio may be commodities. There are several important aspects of commodity trading that you need to be aware of before beginning.

Our thorough guide seeks to instruct readers on how to trade commodities profitably. Here is a collection of all the information you need, including commodity trading tactics. After completing it, you’ll be ready to start trading commodities with confidence and have a chance to turn a profit. So let’s start the process.

What are commodities?

In essence, commodities are the raw ingredients or supplies that are utilized to create finished things. Contrary to goods, commodities are standardized; two equal units of a commodity will be the same regardless of their manufacturing or place of origin, making them also interchangeable.

What is commodity trading?

You can purchase and sell commodities through commodity trading, which is analogous to trading stocks where one purchases and sells stocks of specific businesses. On certain platforms, traders buy and sell commodities with the goal of making money off of fluctuations in the commodities market. Contracts for Difference (CFDs), one of the most simple trading alternatives in commodities, can make commodity trading simpler for beginners. CFDs are essentially financial tools that give you the opportunity to profit from price changes without taking ownership of the underlying securities.

Types of Commodities

Four major categories can be used to classify commodities:

- Metal commodities: While platinum, silver, and gold are used to make jewelry and for investments, metals including iron, copper, aluminum, and nickel are utilized in building and industry.

- Energy commodities: Oil and natural gas are two primary energy sources that are utilized to power the world’s infrastructure, including transportation, residences, factories, and other buildings. Uranium, ethanol, coal, and electricity are some further examples.

- Agriculture-related commodities: This category includes products like crops and farm animals that produce food and supports other businesses like the textile industry. Sugar, wheat, and cotton are a few examples of agricultural commodities.

- Environmental commodities: This category contains carbon emissions, white certificates, and certifications for renewable energy.

Additionally, commodities can be divided into hard and soft commodities. Natural resources that are mined or taken from the earth are known as hard commodities. These would be things like gold, oil, and copper. The other category is soft commodities, which include farm items like cotton and sugar as well as livestock reared on farms.

Factors influencing the price of commodities

Trading in the aforementioned commodities is referred to as commodity trading. They fall into many categories, thus their supply will fluctuate, which will affect their market price. The following are the main variables influencing commodity prices:

Demand: Our daily actions involve commodities. As a result, a commodity’s price will be determined by economic demand. For example, when the economy of a specific developed country is impacted, the demand for the commodities declines, which has an impact on their market prices. The nations that profit from exportation are the ones who are most impacted.

Supply: The price of commodities is frequently impacted by the supply, whether it is abundant or scarce. Therefore, before choosing to trade, consider the factors that affect a commodity’s supply.

Mother Nature: The price of commodities can be dramatically impacted by weather changes. For instance, if there is a hurricane or earthquake, the price of oil or crops will increase due to a decrease in supply.

American Dollar: Since the US dollar is a major reserve currency, changes in its value will have an impact on commodity prices. Commodity prices often decline when the value of the US dollar increases because the availability of dollars also declines. However, commodity prices rise if the US currency declines.

Substitution: When a commodity’s availability declines due to high prices, you can still continue trading by using a comparable product as a substitute. If the price of either commodity is favorable for trading, for instance, you may swap commodity A for commodity B or vice versa.

Options for Commodity Investing

Numerous methods can be used to trade commodities. Selecting the best broker will be made easier for you if you know the strategies to employ when trading commodities. The most well-liked methods of trading commodities are listed here.

Physical Coins

One of the oldest methods of trading commodities is in this manner. Commodities can be bought in bulk and stored while you watch for a price reversal before selling.

However, using this approach to trade commodities involves a number of steps, such as arranging secure storage and insuring your goods.

Futures

Futures agreements detail the dates by which a specific product was purchased or sold. Additionally, it is still employed today as one of the traditional commodity trading tactics.

Due to the high margins and numerous commodities involved in futures contracts, they are usually advised by advanced traders. If you are a savvy beginner who can easily comprehend the markets using technical analytical techniques, there is no excuse not to give it a try.

Options

Call and put options on commodities that are available in options trading. In this case, you purchase the right to buy and sell a particular underlying asset at a defined price within a predetermined window of time. Call options enable you to purchase a commodity, whereas put options enable you to sell it.

One of the finest ways to trade commodities for beginners is using options. Unlike futures, it doesn’t call for a lot of investigation. Additionally, it does not obligate you to acquire and sell anything.

ETFs

Trading in ETFs makes it simple for you to enter the commodities markets. Commodity ETFs can be used to concentrate on a single commodity or futures contracts.

This system of trading commodities keeps tabs on the efficiency and costs of other instruments. Demand and supply are also driving factors, and in order to make the best decisions, you need to have vast knowledge.

Shares

Another popular trading strategy in the sector is stock trading. It enables you to purchase stock in any organization that possesses commodities. After that, you will watch for prices to rise before selling the shares for a profit.

Commodity share purchases necessitate in-depth market research. To stay on top of your trading actions at this point, you must utilize the technical indicators and chart patterns.

CFDs

Additionally, commodities may be traded through Contracts for Difference (CFDs). You won’t be the owner of the underlying traded assets if you use commodity CFDs. Instead, you will simply make assumptions about how the prices of the commodities will fluctuate differently. Futures contracts, opinions, and ETFs can all be traded using CFDs as well.

With CFD brokers, you simply pay spreads rather than trading commissions. Additionally, it enables you to trade using borrowed money to maximize your earnings at the end of the activity.

Be aware that compared to other transactions, managing commodities CFDs is difficult. They have a great chance of both making and losing money. Therefore, we advise you to do thorough research and be confident in your decisions before beginning this commodity trading approach.

Spread Betting

Spread betting on commodities should be an option for you if you have previous expertise with sports betting. With this strategy, you can only wager on whether the price of a commodity will rise or fall. Furthermore, you won’t possess any underlying assets.

Since commodity spread betting is a challenging trading strategy, success depends on careful market research and selecting the best spread betting broker. The best part is that it maximizes your revenue because any profit gains from using it are tax-free.

Commodity Trading Strategies

Commodity trading contains strategies that can help you increase your likelihood of success, just like any other type of investment. Starting with the most recent news and reading periodicals can help you comprehend the fundamental market trends as a newbie. While deciding which commodity is worth trading, you will also discover important trading advice.

Having said that, let’s look at some fundamental commodities trading tactics that might aid you in your endeavors. They rely on technical indicators, which traders mostly find on charting software.

Range Trading

The industry’s most popular commodity trading approach is range trading. Typically, it entails purchasing commodities at low prices (sometimes referred to as the support level) and selling them when their prices reach the resistance level or the top of a range.

Technical indicators must be used with this range-bound method in order to assist you to choose the optimal entry and exit positions. It is an easy technique to learn, particularly for beginners, as all you have to do to close your positions simply watch for the spectrum to move to a breaking point.

Remember that the supply and demand for commodities have an impact on the ranges of support and resistance. As a result, prices for commodities are likely to rise in response to rising demand, while they will likely decline in response to rising supply.

Range trading is a great way to make money, but it relies on guessing where the support and resistance levels are. Since there is a potential that the support and resistance levels will exceed your expectations, you should exercise extreme caution and diligence before establishing entry or exit positions.

Breakouts

Short-term movements constitute the foundation for most breakouts. Market trends frequently experience new highs and lows, which you must seize. It enables you to purchase a commodity when it is almost at its maximum price and sell it before it falls to its lowest point within the regular moving range.

Breakout levels could happen at any time, therefore to be able to choose the best times to enter and exit trades, you need to keep up with the most recent market trends. Keep in mind that trends may not always be as powerful as you anticipate, which could have an impact on the entire trade.

Fundamental Strategy

Fundamental analysis is used by traders in this market to identify the variables affecting supply and demand levels. These include macroeconomic variables and output levels.

For instance, traders may open long positions when there is a rise in oil demand in order to profit from rising oil prices. One of the most simplest methods to stay up to date on commodity prices would be to start by paying attention to technical chart patterns. This strategy however demands extensive research.

How To Start Commodity Trading?

Before you can start trading commodities, you must first open an account with a commodity trading broker that complies with your criteria and circumstances. Due to the FCA guideline, which every broker in the UK must follow, the registration process is the same for all commodity brokers.

Step 1: Visit the Broker

The first step entails clicking on one of the buttons we’ve supplied to go to the broker you want to utilize. By clicking on one of our links, you’ll be sent straight to the broker’s registration page, where you may begin the procedure.

Step 2: Registration

You will next be required to submit personal data that will serve as the basis for your account. Your name, residence, contact details, and email address are the same details you give when registering on other websites.

Additionally, a simple questionnaire that will be used to determine your leverage limit will be given to you to complete. Leverage raises trading risks, thus this is necessary. As a result, the broker might need to cap the amount of leverage and margin you can use.

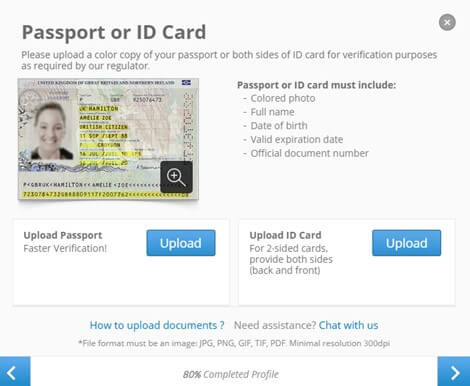

Step 3: Verifying Your Information

To completely activate your account and begin making deposits and withdrawals, you must first comply with the KYC regulation by confirming your identity (Know Your Customer).

The broker must then manually complete the verification, which can delay its implementation by a few hours.

You must send a copy of your identification (passport, driver’s license, national ID) in order to be verified, and you must give proof of your address in the form of a recent utility bill or, in some situations, a bank statement.

Step 4: Deposit Funds

Last but not least, you must make an initial deposit in order to have access to your forex broker’s site. The majority of brokers have requirements you must meet in order to begin trading, known as a “minimum deposit requirement.” Make sure you are aware of the level before you begin creating a commodity account because it changes based on the payment method you use and the jurisdiction in which you live.

Pros and Cons of Commodities Trading

Pros

- Trade in commodities is more volatile than other types of trading, and if you play your cards well, you can make quick money.

- It is a great approach for investors to diversify their holdings.

- Since there is a tonne of options and commodities available in commodities trading, you’ll never run out to trade.

- Commodities can be traded directly by holding the fundamental assets or indirectly through derivatives.

- If you do a lot of studies and use the appropriate tactics, trading commodities may be a profitable endeavor. Rapid growth in a commodity’s demand can be a great way to benefit from trading commodities.

- Contrary to other markets that are badly impacted by inflation, commodity trading is more profitable during this period. Consequently, if you currently have commodities in your portfolio, you stand to gain financially.

Cons

- If you do not employ the right tactics, the significant volatility in commodities might be harmful to your investment.

- If you trade commodities using leverage, there’s a danger you could lose, and if you do, more money than you put in also disappears.

Conclusion

Commodity trading is considered ideal as an investment option for experienced investors. Investors must have a high tolerance for risk because changes in commodity prices have the potential to produce enormous gains or losses. They must be comfortable accepting temporary setbacks in the light of long-term advantages.

Even if they choose to trade in commodities, they should only commit a part of their whole portfolio to this. Investors who want to diversify typically devote 20% or less of their portfolio to an asset class with a higher risk/reward ratio. This is the area where commodity trading really takes off.

Having the greatest platform enhances your chance of making more money, thus picking the best trading broker is crucial. Instead of going through the time-consuming research process, the recommended commodities brokers in our best commodity trading platforms guide will assist you in making your choice and getting started in commodity trading.

Frequently Asked Questions

How can I purchase commodities in the UK?

Commodities are available for purchase on a market, just like other financial assets. However, the only way to do this in the UK is through a broker that is under the FCA’s regulation. Make sure you thoroughly understand the market for your desired commodity before making a purchase by doing a thorough market analysis and research. Based on your trading needs, choose the finest commodity broker from the list we’ve provided in our previous guide. Once your trading account has been properly validated, you can start trading by opening a live account with the necessary information.

Are commodities risky investments?

Yes. The riskiest types of commodities assets are those that can be traded on margin. However, despite the fact that they are risky and might cause you to lose a lot of money, they can also generate large returns for you. Because of this, it’s critical that you carry out the required market research and develop a sound strategy. Additionally, commodities brokers offer risk management techniques that you can employ to reduce your odds of suffering a significant loss in the event of a loss.

Can I buy and sell commodities for £10?

Yes. However, keep in mind that you won’t make as much money dealing with £100. As a result, if you are a beginner who is hesitant to invest a large sum of money, make sure you begin investing with little sums of money and expand gradually as you become more comfortable with how commodities trading operates. The majority of brokers provide demo accounts and educational materials, which is wonderful news. Therefore, your level of skill will only be determined by how much you desire it.