One of the most valuable publicly traded organizations in the world is Alphabet Inc. The vast majority of Google’s earnings and sales are generated by Alphabet, the holding company behind the search engine. The primary areas of interest for this well-known international technology company are cloud computing, internet advertising, artificial intelligence, and, of course, search engines.

This article will walk you through the process of buying Alphabet shares. Additionally, you’ll discover if Alphabet is a wise investment based on the outlook for its stock price in the present and the future.

How to Buy Alphabet Shares: A Step-by-Step Guide 2022

You can quickly buy Alphabet stock by following the simple steps listed below.

- Examine Alphabet Shares- This phase is essential, especially when trading stocks since it will allow you to decide whether or not a company is a wise investment.

- Choose a Stock Broker-You must choose a trading platform before you can begin. Access to UK equities is available via a number of brokers, each with its own features and pricing models. This may lead to confusion because you may not be aware of which party is best to trade with.

- Open an account– On the homepage of your broker, create an account. You must need a valid email address, username, and password in order to register.

- Verification– Next, you must upload some official documents you have, such as your passport or license.

- Deposit Funds – Fund your account with a method of your choice.

- Buy Alphabet Shares– Enter the ticker symbol or company name in the search bar. Enter the amount of your chosen investment and complete the transaction.

Examine Alphabet shares

It’s important to do the extensive study before spending your hard-earned money. As a result, learning about buying Alphabet stock includes doing research on the company’s inner workings as well as its performance on the exchange it trades on.

The Alphabet stock price performance, P/E ratio, market capitalization, and other topics are covered in detail here.

What is Alphabet

The largest of the firms included in Alphabet Inc., which serves as a holding company, is Google. In addition to its search engine, Google also runs Chrome, Android, Gmail, online data storage, YouTube, and other digital services. Additionally, it provides cloud computing services via Google Cloud, enabling the creation, testing, and deployment of apps.

Beyond its main businesses, Alphabet runs a sector called Other Bets that consists of start-up companies that generally make money from licensing, internet, TV, and research and development services. Additionally, it has made sizable investments in Waymo’s self-driving cars and the Stadia cloud gaming platform.

Under the name Google Inc., Alphabet was initially established in 1998 as a search engine company. Google issued shares of Class A common stock in an initial public offering (IPO) in 2004 and listed them on the Nasdaq Global Select Market with the ticker “GOOG”.

In 2014, the firm divided its stock. As a result, the company issued a new set of Class C shares that started trading on the Nasdaq Global Select Market under the ticker “GOOG,” while also renaming its Class A shares to “GOOGL.” The business underwent reorganization in 2015 and established the holding company known as Alphabet Inc.

With an 87 percent market share, Google has become the most widely used search engine in the world since its creation. Additionally, it has expanded much beyond its basic search engine services.

The headquarters of Alphabet is in California. The position of CEO is now held by Sundar Pichai, who replaced co-founder Larry Page in 2019. The business is categorized as providing communication services. Alphabet is in competition with businesses that offer enterprise cloud services, digital content and application platforms, online platforms for uniting people with information and relevant advertising, and more.

Alphabet share price history

In August 2004, Alphabet launched its shares on the stock market for $85 each. The internet was just getting started at the time, and the corporation wasn’t well-known. Since that time, Alphabet has grown to be one of the biggest technology firms in the world. Alphabet’s stock price has climbed by about 115 percent in the past five years of trading.

The S&P 500 index achieved just over 64 percent during the same period. The year 2021 was an interesting one for major tech firms like Alphabet. The US Justice Department filed antitrust lawsuits against monopolies in advertising and search at the beginning of the year. Additionally, it was said that Apple’s operating system privacy standards were changed.

Apple’s new upgrade, which was in its early stages, mandated that apps obtain users’ consent before storing and gathering data. Investors were initially concerned about new internet rules because advertising accounts for the majority of Google’s revenue. Nevertheless, Alphabet’s all-time high was almost $3,000 in November 2021.

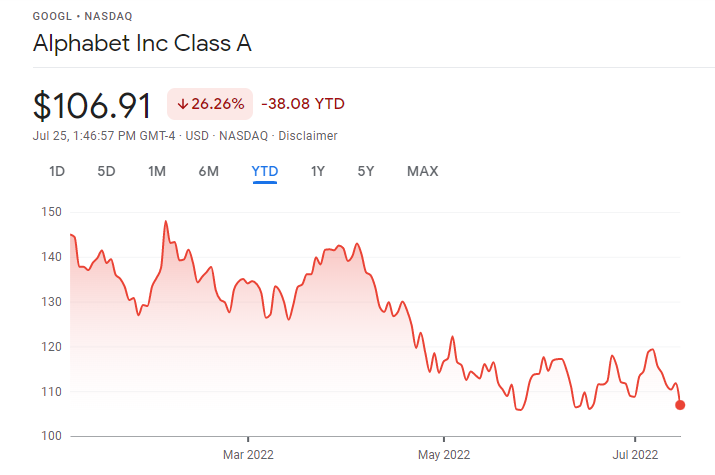

Alphabet share price 2022

Despite decent profits in 2021, Alphabet’s stock declined in early 2022 along with the rest of the tech industry. Analyst downgrades for a number of software companies affected the price of GOOGL stock. As a result, it decreased to around $2,535 by the end of January 2022. The price of GOOGL stock rose steadily once more, peaking at about $2,960 at the beginning of February 2022.

GOOGL stock, on the other hand, was back at $2,551 later in the month, a fall of about 14 percent in a few weeks. Additionally, this occurred at a time when investors were staying away from high-growth stocks as a result of rising interest rates, inflation, and other challenges including the conflict between Russia and Ukraine.

Since its peak in 2021, Alphabet’s worth has decreased by more than 26% as of this writing. The company still has a lot of room to expand, as seen by the quarterly financials from March 2022, which showed a roughly 23% rise in revenue.

Alphabet’s latest financial results

The most recent earnings report from Alphabet for the fourth quarter and fiscal year of 2021 revealed substantial growth on top of a year that had previously been successful. Alphabet reported a 41% increase in sales from the previous year. Both its quarterly revenue of $75.3 billion and earnings per share of $30.69 exceeded estimates.

Due to the rise of rival TikTok, YouTube ad revenue is the only area where Alphabet fell short of forecasts. Alphabet announced a high year-over-year revenue rise of 45 percent, reaching $5.54 billion, in the area of cloud computing. According to Alphabet CEO Sundar Pichai, Google’s Pixel smartphone experienced all-time high sales despite supply-chain problems brought on by the epidemic.

All of this shows that Alphabet is not only surviving the pandemic but also thriving despite the difficulties it provides.

A 20-to-1 stock split was also announced by Alphabet along with the earnings release. On July 15, investors will get 19 more shares for every share they now own, should the plans are approved by shareholders. Despite the fact that the modification has no effect on the business’s core operations, it will significantly lower the price per share of the company. For individual investors who are scared off by the idea of shelling out hundreds of dollars for a single share, this is good news.

Alphabet Stock Dividends

Alphabet does not currently pay dividends and has made it clear on numerous occasions that it does not have any plans to do so in the near future. For those wanting to purchase Alphabet stock for a consistent cash flow, this can be discouraging.

However, the company cites the retention of future earnings for business expansion as the justification for not providing investors with cash or stock distribution. The hope is that this will boost the company’s value, which will be advantageous to investors.

Market Capitalization

Alphabet is a large-cap company. Alphabet has a market capitalization of almost $1.5 trillion at the time of writing. This places it among the world’s largest firms by market capitalization, alongside Apple, Microsoft, and Tesla.

Best trading platform to Buy Alphabet Shares

We’ll discuss some of the most reputable stockbrokers in this section, where you can purchase Alphabet Stock.

1. eToro

Investors in the UK wanting to purchase Alphabet shares have access to an easy-to-use social trading platform through eToro. An opportunity to network with other investors is provided by social trading platforms. You are able to like, copy, and follow other people. In this area, eToro invented Copy Trading, which is incredibly user-friendly.

You can automatically mimic another investor’s deals in real time if you find them and invest $200 or more. This implies that, in proportion to your investment in copy trading, any gains or losses they incur from their stock positions will also be reflected in your portfolio.

All 2,500+ stocks on eToro are available with a 0% commission fee, including Alphabet. As a result, you can invest in businesses all around the world for a relatively cheap spread. Hundreds of commission-free ETFs are also available in the US, in addition to cryptocurrencies with a negligible 1 percent trading cost.

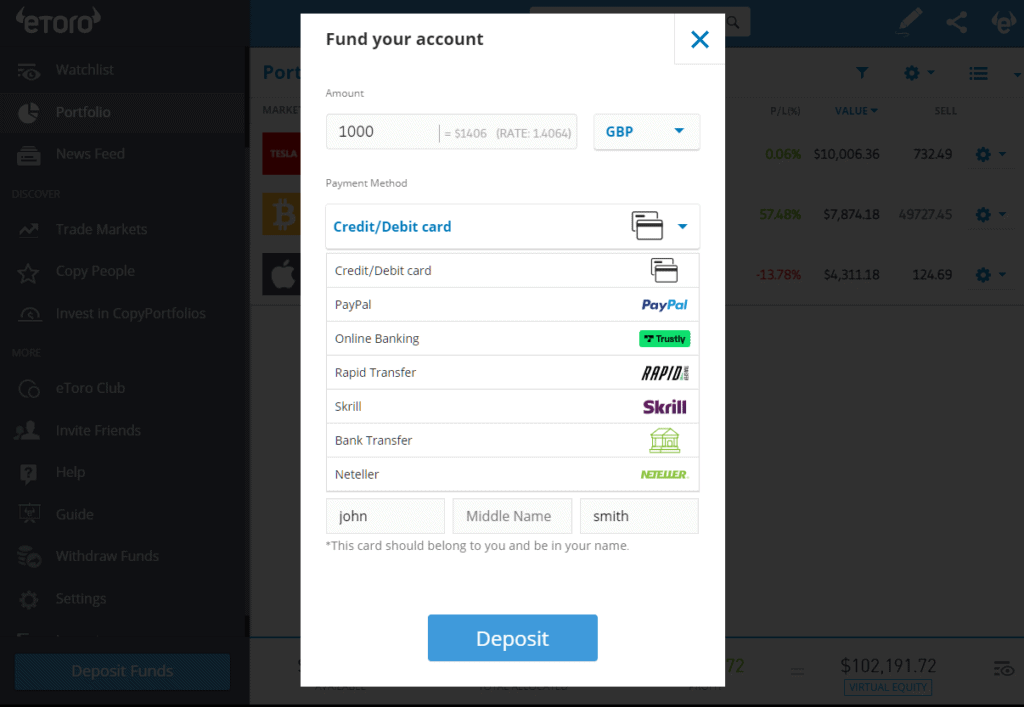

A credit/debit card or an online wallet like PayPal, Neteller, or Skrill are the payment options offered by eToro. In any event, there is no deposit fee when using US money to fund your account, and you can begin going with just $10. By adding to a Smart Portfolio, you can reduce the learning curve for trading.

2. Plus500

Plus500 is the next brokerage service to buy Alphabet share; it provides access to a wide range of financial assets via CFDs with a 1.25 percent spread and a 0.5 minimum deposit. Furthermore, you can utilise a leverage ratio of up to 5:1 on GOOGL shares. Advanced charting software, an economic calendar, a risk management feature, and a price notifications service are all included in the platform.

The FCA oversees the platform. As a result, it ensures that none of the cash belonging to its traders is ever compromised. The London Stock Exchange lists its parent business. On this platform, creating an account takes very little time. You only need to input a few simple pieces of information, go through a verification process, and make a deposit. You can use PayPal, bank transfers, debit or credit cards, or this platform to make deposits.

How to buy Alphabet Shares?

You can place an order to include Alphabet in your portfolio once you’ve determined where to purchase the stock. We found that a regulated broker was the best place to purchase Alphabet stock.

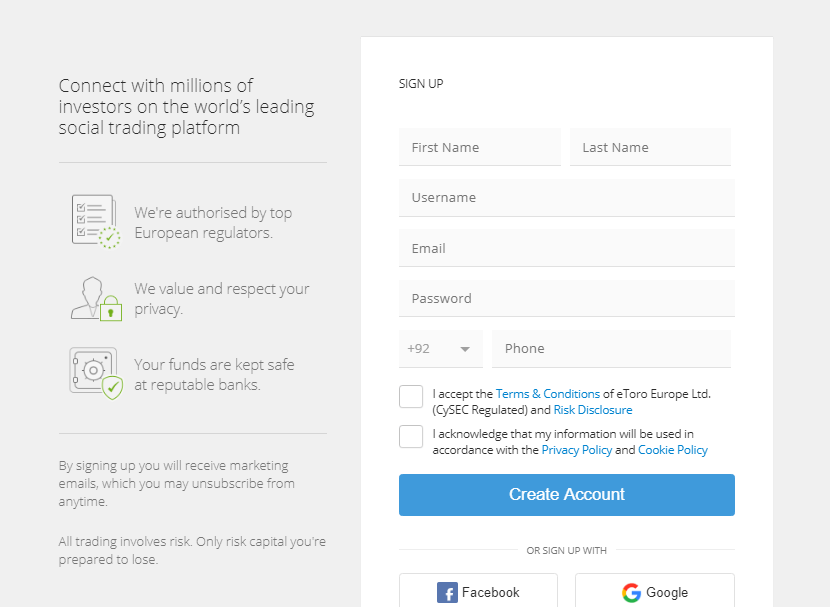

Step 1: Open a Broker Account

Create a simple account on the broker’s website by going there. By selecting “Join” and completing the registration form that appears, you can start the process.

Give the broker your complete name, address, nationality, birth date, and social security number after that.

You must complete the KYC procedure after providing any additional basic information needed to open an account from which to purchase Alphabet stock.

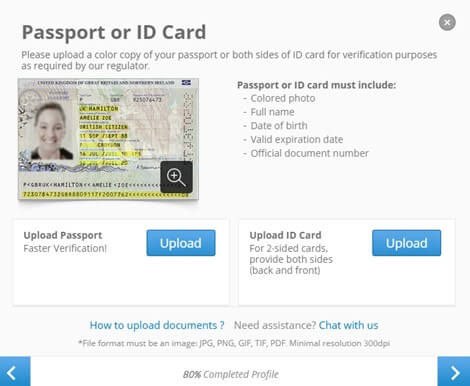

Step 2: Upload ID

The KYC procedure is finished in no time at all. To verify your name and date of birth, you can upload a copy of your state identification, your driver’s license, or your passport.

Using a recent utility bill, bank statement, or one of the many other supporting documents, the broker can then confirm your residency.

Step 3: Deposit Funds

Enter a deposit amount and click “Deposit.” Next, pick the list option for your preferred payment method. ACH, wire transfer, debit/credit card, and e-wallets like Skrill, Neteller, and PayPal are among the methods that fall under this category.

Step 4: Search for Alphabet Stock

You can use the basic search feature to find Alphabet stock. Enter Alphabet or Google in the search bar.

When you select “Trade,” the broker will provide you an order form to complete in order to purchase Alphabet shares.

Step 5: Buy Alphabet Stock

You can purchase Alphabet stock by entering a quantity in the “Amount” box and submitting your order. You’ll receive the stock in your portfolio.

%20order%20on%20eToro's%20platform.jpg)

Conclusion

Since Alphabet has enormous growth potential, its shares are a good long-term investment. In this guide, we went into great detail about how to buy Alphabet stock, including a step-by-step tutorial on how to open an account with a brokerage and complete your purchase.

If you want to invest in Alphabet shares, we advise using an FCA-licensed broker. These brokers enable you to trade as safely as possible and offer exceptional investor protection in the UK.

Frequently Asked Questions

Are Google and Alphabet shares similar?

Yes, Google’s parent company is Alphabet. Additionally, its shares are divided into Class A and Class B shares, which trade under the ticker symbols GOOGL and GOOG, respectively. In order to maintain their overall influence over the business, Google, founders Larry Page, and Sergey Brin formed these two categories.

How do I purchase Alphabet shares?

Choosing and joining a brokerage is the first step in purchasing Alphabet stock. You can open an account and finish the KYC procedure quickly with large brokers. After that, locate Alphabet stock using the search bar and place a buy order.

Where can I acquire shares of Alphabet?

Since Alphabet is one of the biggest firms in the world, you may buy its shares on most trading platforms. An SEC-regulated broker is the best option for purchasing Alphabet shares since they provide customer safety.

Does Alphabet pay a dividend?

It does not offer a dividend.