The majority of people usually associate stocks with publicly traded shares that are exchanged on stock exchanges. However, it’s crucial for investors to be aware of the many types of shares available, comprehend their distinctive qualities, and be able to recognize the circumstances in which they can be a viable investments. In order to clear up any confusion regarding the numerous stock classes available to investors, we have listed the different stock classifications below.

Types of Shares

Investors have varying risk appetites, investment timeframes, and objectives, such as income or growth. Investors, therefore, look for stocks that meet their goals. Stocks are divided into groups based on their qualities as investments to make selection easier. The categories that are most popular are mentioned below.

Types of shares based on market capitalization

Shares can be categorised using the firm’s market cap, which is the overall number of stocks held by a company. By dividing the share’s present market value by the overall number of existing shares, this result is obtained. Below is a list of the different stock categories according to market capitalisation.

Large-cap stocks

Due to the limited growth potential of huge corporations, blue-chip, income, defensive, and cyclical equities make up large-cap stocks. But you can make capital gains by either holding onto these equities for a long period or buying them at the bottom of an economic cycle and then selling them when the economy picks up speed. The most stable prices and lowest risk can be found in large-cap stocks.

Mid-cap Stocks

Mid-cap firms encompass the bulk of the classes mentioned in this guide because their market caps range from the peak of the small-cap market to the bottom of the large-cap market. One specific class of mid-cap stock is called a “baby blue-chip stock,” which is a stock of a company that, like blue-chip businesses, has stable profit growth and consistency, minimal amounts of debt, and is smaller in scale than the large-cap blue-chips.

Small-cap stocks

The bulk of small-cap companies are growth or speculative stocks since they represent the small companies with the most possibility for development. Most tech stocks fall into this category as well, as many of these businesses either focus on a particular market segment or were founded to create a brand-new good or service, like the numerous Internet businesses that sprang up during the stock market bubble. Small-cap stocks and even smaller micro-cap stocks can occasionally be distinguished from one another.

Types of shares based on ownership

There are three main stock classes that give varied rights and growth potential to investors.

Common and preferred stocks

In contrast to common stocks, preferred equities provide investors with a fixed dividend payment each year. While common shares is provided priority when the company has excess money to distribute, preferred stock values are less volatile than common share prices.

Priority over preferred shareholders during a company’s liquidation is given to the company’s debtors, including its bond and debenture holders. Common stockholders are allowed to vote, whereas preferred stockholders are not.

Hybrid Stocks

Some businesses offer preferred shares with the possibility of changing them into common shares under specified restrictions at a specific period. They might or might not have right to vote and are sometimes known as converted preferred shares or hybrid shares.

Stocks that incorporate derivative options

These type of stocks might be “called” or “putable” and are less frequently accessed. A “callable” stock has the opportunity to be bought back by the company at a set price and timing. Similar to this, a “putable” stock gives its owner the option to sell it to the business at a specific price and time.

Types of shares based on dividend payment

Income Stocks

Compared to growth equities, income equities pay out a larger dividend as a percentage of the stock price. Because increased income equates to more dividends, “Income Stocks” got their name. Income stocks are a sign of a reliable company that can pay out dividends on a regular basis, but these are also businesses that do not guarantee rapid growth. This means that there may not be a big growth in the value of their shares. Income equities consist of preferred shares.

Growth Stocks

Growth stocks are those that don’t pay out a lot of dividends since the firm prefers to reinvest its profits in order to expand more quickly. As a result of the company’s rapid expansion, the value of its shares rises, enabling investors to make more money through larger returns. It can be most ideal for investors seeking long-term potential for growth as opposed to a quick second income source. Riskier than their counterparts, growth stocks.

Types of shares based on fundamentals

To determine a share’s intrinsic worth, value investors examine share prices along with factors such as earnings per share, profitability, etc. They hold the view that a share price must be equal to the inherent value of a company’s share.

Overvalued Shares

These are shares that are seen as being overpriced since their prices surpass their inherent value.

Undervalued Shares

The value investor community favors undervalued shares because they think the share price will increase in the future.

Penny Stocks

A penny stock is very speculative equity with a value of less than $5.

Types of shares based on Risk

Depending on share price changes, the risk level of stocks varies. Stocks with greater risk provide investors greater profits, whereas stocks with lower risk produce lower returns.

iBeta Stocks

Calculating the stock’s price volatility yields the beta, or measure of risk. The beta of a stock can be either favourable or unfavourable, indicating whether it follows the market closely or moves independently of it. The risk quotient of the stock increases as beta increases. If the beta number exceeds 1, the company is thought to be more volatile than the overall market. This indicator is used by many traders who are aware of it to help them make investment decisions.

Blue Chip Stocks

Blue chip companies have lower obligations, dependable earnings, and a track record of dividend payouts. These very massive, well-known companies with a history of outstanding financial success may be selected by investors seeking safer investment possibilities.

Types of shares based on price trends

This classification is based on how stock prices change in relation to or in contrast with business earnings.

Defensive Stocks

Defensive equities are favored during difficult market conditions since they are mostly unaffected by economic circumstances.

Cyclical Stocks

Cyclical equities are those of businesses that are significantly impacted by economic conditions and have significant price variations in response to market developments. These stocks expand quickly during boom cycles, but their expansion slows during recessions.

Tech Stocks

Technology companies that produce computer hardware, communication equipment, and other technological products are represented by tech stocks. Most tech companies’ stocks are classified as growth or speculative stocks, however, some, like Intel or Microsoft, are blue-chip stocks. Due to the difficulty in evaluating research and development efforts and the rapid pace of technological advancement, which frequently results in the replacement of existing goods with new ones, tech companies are subject to tremendous risk.

Speculative Shares

Speculative shares are shares of companies with little to no profits, or profits that are extremely volatile, but have a high possibility for growth since they are entering a new market, are operated by fresh management, have the potential to become monopolies, or are creating a potentially very profitable product that, if the business is successful, might send the stock price soaring. A lot of Internet businesses were viewed as speculative investments.

Since speculative stocks fluctuate greatly in price as investors’ perceptions of their future prospects change regularly, many speculative stocks are widely traded by investors, or some may say gamblers, with the goal of profiting by timing the market.

Where to Invest in Shares?

After talking about so many various types of shares, we must now draw a conclusion to the most recommended reliable stockbroker to invest in shares.

1. eToro

Since there are no commissions or yearly fees associated with buying shares through this broker, the cost is clear.

The ability to both buy shares in the conventional sense and trade share CFDs is one of eToro’s advantages. With CFD trading, you can wager on a price decline and use eToro’s 1:5 leverage to place bigger deals.

Additionally, eToro is renowned for being a social trading platform that enables interaction with other traders. Additionally, it provides copy trading tools, such as the well-known “CopyPortfolio” tool that enables you to duplicate the complete portfolios of successful investors.

Starting minimum deposits are $10, or about £7.50. Despite this, eToro does not demand that you buy all of the shares, which are now selling for well over $3,000 each. Instead, eToro offers fractional share trading, which enables you to invest as little as $10 to purchase a “fraction” of an equity share.

Your money is safe since eToro is governed by the FCA, ASIC (Australia), and CySEC (Cyprus), as well as other regulatory bodies. A further advantage of eToro is the stock trading software it provides, which you may use to purchase shares on your mobile device.

Learn more: eToro Broker Review UK 2022 – Complete Guide

2. Capital.com

Capital.com is yet another well-liked trading platform. Due to the platform’s strict regulation and open fee structure, Capital.com enjoys a strong reputation among traders. Regarding the latter, Capital.com is currently subject to regulation from a number of agencies, including the FCA, ASIC, CySEC, and the NBRB.

Capital.com, a broker that specializes in CFD trading in the UK, makes sure that investors have access to a wide variety of assets. Notably, Capital.com also provides genuine stock trading, even though trading real equities and CFDs both entail commission fees. The spread, which varies from asset to asset, is the only thing investors need to be cautious of.

Capital.com accepts deposits starting at $20 (£15.20) by credit/debit cards, bank transfers, and e-wallets. The broker accepts five other base currencies, so you can fund your account using PayPal or Apple Pay in a currency other than GBP. Capital.com doesn’t charge any fees for deposits or withdrawals either.

Customers have a choice of trading platforms, including MetaTrader 4, the mobile app, and browser-based platforms (for those interested in forex trading in the UK). You can perform stock analysis using the browser-based platform, which includes real-time price charts and a variety of technical indicators. A variety of order kinds are available, and the mobile app even lets you establish fast price alerts.

Learn more: Capital.com Broker Review UK 2022 – Complete Guide

How to buy stocks?

The next step is to open an account with your preferred UK brokerage once you have completed the process of conducting independent research on your chosen shares.

The steps to investing in stocks are listed here to demonstrate how simple the process is.

Step 1: Open an Account

You must first choose to register an account on your trading platform’s homepage. The majority of brokers will next request some personal information from you, such as your name, home address, email address, and phone number.

You’ll probably be prompted to prove your identity after that. This will guarantee that any deposit restrictions are removed and that you can withdraw money immediately.

Step 2: Deposit funds

You can add money to your account after uploading the required documents.

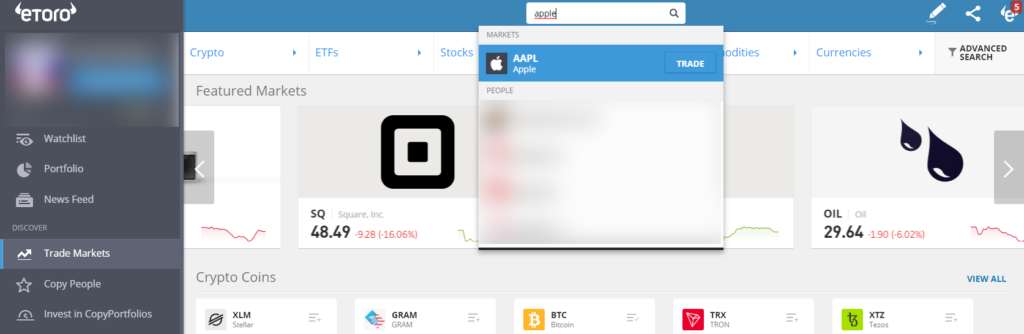

Step 3: Buy stocks

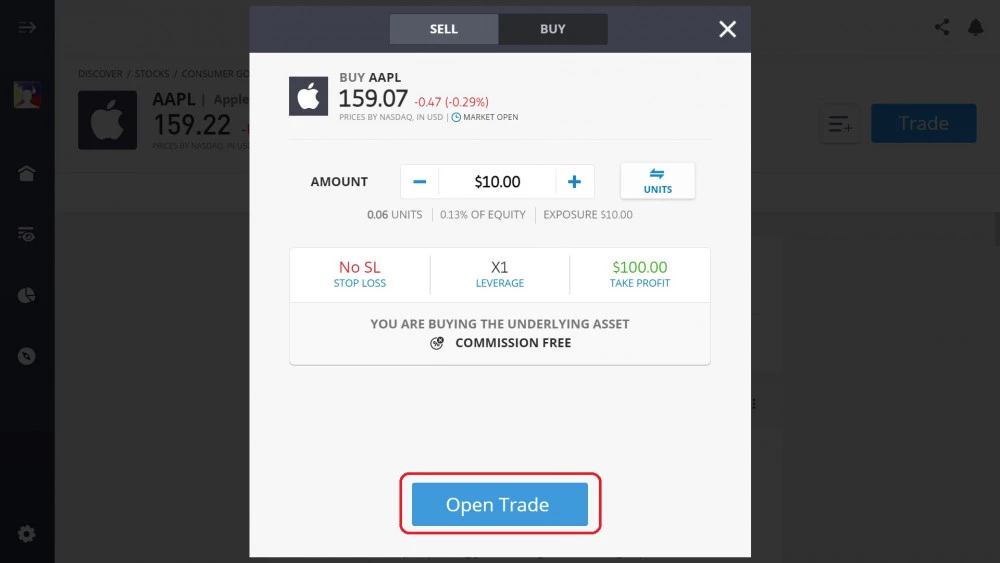

You can then purchase the various sorts of shares as soon as your brokerage account has been funded. Start by typing the stock name into the trading dashboard’s search box. Click the result when it appears.

After that, an order box will appear. You only need to specify the amount you desire to invest if you are content to accept the share’s existing market price. To complete your share purchase, click the “Open Trade” button.

Conclusion

We hope that after reading our entire guide, you have a thorough understanding of the numerous varieties of shares that are available for purchase. Importantly, there are multiple sub-sections of each form of share, so you must be able to distinguish between them before investing.

We advise using our suggested broker, eToro if you want to start creating your share portfolio right away. Every kind of share you can think of is available on eToro, where you may purchase over 800 shares without paying a commission!

Frequently Asked Questions

What types of shares are the safest to buy?

While there is some risk associated with every investment, it is generally agreed that during economic turbulence, investors place a high value on robust, steady blue-chip shares. Make important to conduct thorough research before making an investment because each type of share carries a unique set of dangers.

What distinguishes the LSE and AIM from one another?

The main stock exchange in the UK is the LSE. It, therefore, houses the biggest publicly traded businesses situated in the UK. But the UK’s AIM stock exchange is designed for smaller businesses that aren’t quite big enough for the LSE.

Do all FTSE 100 firms fall under the blue-chip stock category?

In principle, no. On the one hand, the FTSE 100 lists all blue chip stocks with a UK base. However, not every FTSE 100 company is a blue chip stock. This is due to the fact that just because a firm has a market valuation of several billion pounds, it doesn’t automatically follow that it is a reputable, well-established, and established entity.

Which share classes make the best investments?

It is usually essential to think about a diversification approach because each sort of company share has advantages and disadvantages. This implies that your portfolio will include a wide variety of share classes.