One of the most popular ways for people in the UK to enter the market is through equity trading. Equities are essentially stocks or shares of corporations that are publicly traded. Therefore, equity trading in the UK is purchasing and selling company shares in order to generate revenue.

This post is meant for anyone who are enthusiastic in trading equities. We’ll go through trading on equities strategies and how equity trading operates in the UK. Top UK equity brokers with whom you can begin trading are also highlighted.

What is Equity Trading?

In order to try and turn a profit, equity trading entails purchasing and selling equities. It has many similarities to stock trading.

In actuality, the words stocks, shares, and equities are frequently used synonymously. All three speak about stock in publicly listed businesses. The main variation separating the two is that exchange-traded fund trading is included in the definition of equities trading.

Buying low and selling high are the aims of UK equity trading. According to your trading technique, equity trades can range in length from a few minutes to a few weeks. If you believe that, for example, Tesco shares will increase in value, you can acquire shares and then sell them for a profit.

Additionally, you can trade equities when their prices are declining. This practice of selling shares at a premium and then buying them again at a discount is known as short selling. In the United Kingdom, short selling allows you to trade equities whether the stock market is growing or dropping.

Option to start trading equity

In the UK, there are three major ways to trade equity: directly trading shares or ETFs, trading CFDs, and trading options. It’s critical to comprehend how each of these financial instruments functions and the reasons why you might favor one over the others.

Shares

Equity trading can be initiated simply by buying and selling shares outright. Any stocks you buy through this sort of trading are yours to keep as long as you own them.

Limiting your trading possibilities is a disadvantage of trading on equity with stocks. Your ability to purchase more with a small account is constrained because you cannot leverage your trades. Furthermore, short selling necessitates money borrowing from your broker, which entails additional expenses.

CFDs

Trading stocks in the UK can be done effectively using CFDs. Contracts for difference, or CFDs, are agreements you enter into with the broker that let you predict the future value of a stock without really owning it.

The benefit of trading equities CFDs is that you can purchase or sell CFDs to speculate on either upward or downward price movements. Leverage, which increases the effective size of your position, is another advantage of using CFDs for trading. For instance, if you use a 10:1 leverage ratio to trade £100 worth of AstraZeneca share CFDs, you are actually dealing with £1,000 worth of shares.

Options Trading

Trading options is far more difficult than trading shares or CFDs. Equity options are contracts that you purchase that grant you the authority to purchase or sell a stock at a predetermined price on a particular date. In essence, you are making predictions about a pricing movement’s size, timing, and trend in addition to its direction.

Options trading on equities allows traders a lot of tactical freedom and spending power. Options, however, are best suited for experienced traders.

Pros of Equity Trading

When opposed to conventional stock investing, equities trading in the UK has a number of significant advantages.

Earnings Potential

First, there is a greater chance for financial gain. You are open to all of the volatility and fluctuations in the movement of shares when you invest long-term in stocks. Even though the market may finally move higher, it may take some time to do so.

By trading all the ups and downs in a share’s price, equity trading allows you to consistently make money. With each successful trade, you deposit more money into your trading account, increasing your purchasing power for subsequent trades. Over the long run, compounding your account balance through numerous profitable trades can produce extraordinarily substantial returns.

Short Selling

Another advantage of trading on equities as opposed to investing is that you can make money both when a stock’s price rises and falls. Short selling is to blame for this.

Because you can locate trading opportunities regardless of which way the market is heading, short selling is crucial. Additionally, it enables you to partially hedge your bets, which is crucial for lowering risk.

Leveraged Trades

Furthermore, while trading equities in the UK, it is possible to leverage the investments. Leverage enables you to raise the actual size of your equity stake, as we previously mentioned.

That matters for two factors. First of all, it implies that you don’t need a huge sum of money in your trading account to generate significant returns from stock trading. You can use 10:1 leverage with just £100 in your trading account to open equity trades worth up to £1,000. If the underlying share’s price changes by 5%, you would instead make £50 as opposed to only £5.

Second, using leverage allows you to open more equity trades because you only need to invest a little sum of money in each transaction. As a result, you can diversify your trading portfolio and take advantage of several trading opportunities at once, which lowers risk.

Market Access

You are not restricted to trading UK equities, which is another advantage of equity trading in the UK. You can purchase shares in the UK, US, Europe, and other countries through many equities brokers.

This is particularly significant for CFD brokers because they are not absolutely required to travel abroad and buy shares from an international stock exchange. Alternatively, they can simply create a CFD agreement that follows the value of a share, regardless of the exchange where it trades.

Cons of Equity Trading

All forms of trading have risks, including equity trading. You might have to sell equity at a loss if you purchase it using shares, CFDs, or options, and the price drops. When trading, losses are normal and unavoidable, but it’s crucial to limit them so that they don’t eliminate the gains from all of your profitable trades.

Some other thing to keep in mind is that risk increases when trading with leverage. Leverage increases both your potential return and your potential loss, and vice versa. To reduce the amount you could lose if a transaction goes against you, we advise implementing stop losses on every trade, but especially on leveraged deals.

Best Equity Trading Strategies

Having a well-defined trading plan in mind when you enter the market is essential for success in UK equity trading. A lot of experienced traders will create unique techniques that they have refined through time. But you can also get started trading stocks right now by following these well-liked and simple approaches:

Scalping

In a quick-paced day trading approach known as scalping, stock trades are opened and closed in a matter of minutes. The objective of scalping is to profit from a price action at its peak and then close the position quickly before things alter. Although you will place dozens to hundreds of trades per day, this trading technique is designed to provide relatively tiny profits from each deal.

While there are several methods to go about scalping, looking at moving averages is an excellent place to start. Open an equity transaction when the shorter-term 5-minute moving average crosses over the longer-term 20-minute moving average.

Swing Trading

A multi-day trading approach called swing trading aims to profit on shifts in price momentum. The objective of swing trading is to enter a trade following a significant event, such as a breakout or reversal. The momentum that follows will be used by swing traders to generate returns of several percent or more.

Understanding breakouts and reversals is a requirement for swing trading equity successfully. Utilize technical indicators such as RSI (relative strength index) to locate overbought or oversold values and the MACD (moving average convergence-divergence) to detect momentum movements.

Range-based Trading

An equities trading approach that is effective over a variety of timescales is range-based trading. Prices that are bouncing back and forth between a higher resistance level and a lower support level are indicative of this style of trading.

Determine the levels of support and resistance that define the range, then trade the changes in between them to trade equities in a range. Keep a watch out for technical signs that could point to a breakout from the range, which can occur quickly and violently, such as the MACD and RSI.

Best trading platforms to begin Equity Trading

It’s crucial to pick the best stock trading platform. What stocks you can trade, as well as whether you can trade shares, CFDs, or options, will depend on your broker. The fees charged by various equities trading platforms vary as well, and these fees might affect how profitable your trading is.

In light of this, let’s examine two of the most well-known UK equity brokers you may use to begin trading right away:

1. eToro

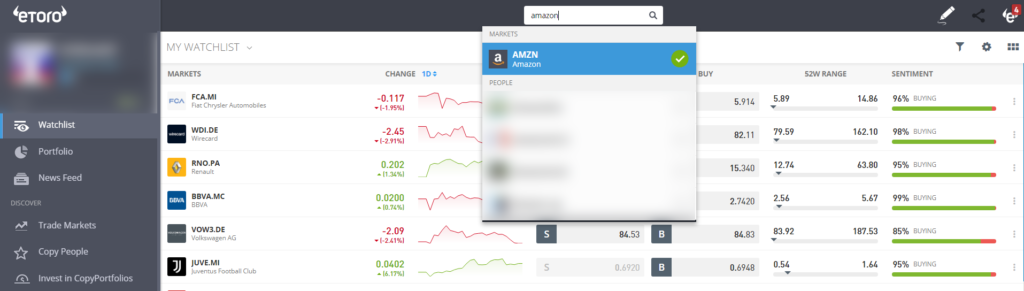

One of the equities brokers in the UK is eToro. With the help of this trading platform, you can exchange upwards of 1,200 stocks and also more than 550 ETFs from foreign exchanges. By buying shares directly or trading CFDs on eToro, you can benefit from the financial asset that best fits your trading strategy and goals.

One feature of eToro is its social trading network, which lets users communicate with other stock traders from across the world. To help with trading decisions, the network enables you to view what other traders think about a specific stock or ETF. Additionally, you can use copy trading to gain from the expertise and abilities of more seasoned traders.

At eToro, there are no trading commissions at all. The broker is subject to the highest standards in the sector because it is governed by the UK’s Financial Conduct Authority. Additionally, we appreciate that eToro has a strong mobile trading app with all the same functionality as the website platform.

2. Plus500

One of the most affordable equity trading platforms in the UK is Plus500. Spreads on CFD trading are smaller with this broker than with practically every other CFD broker, and all transactions are 100% commission-free.

Plus500 isn’t pricey, but it doesn’t skimp on resources. Along with CFDs for dozens of ETFs, you can trade options or CFDs for hundreds of US and UK shares. The broker also distinguishes out since it offers leverage up to 1:5, whilst most other UK brokers only offer leverage of 5:1 for equity trading.

The Plus500 trading platform is simple to use and comes with free web and mobile applications. There are about 100+ technical signals and sketching instruments integrated right in. Price notifications are another feature of the equity trading platform that can help you remain on top of your watchlists during active trading days.

How to begin equity trading?

For equity trading, we advise using eToro for our traders. This website allows you to buy, sell, and trade multiple stocks at once, offers more than 1,700 equities, and gives you access to 17 UK and international marketplaces all in one location. Follow our detailed instructions below to start trading stocks in minutes.

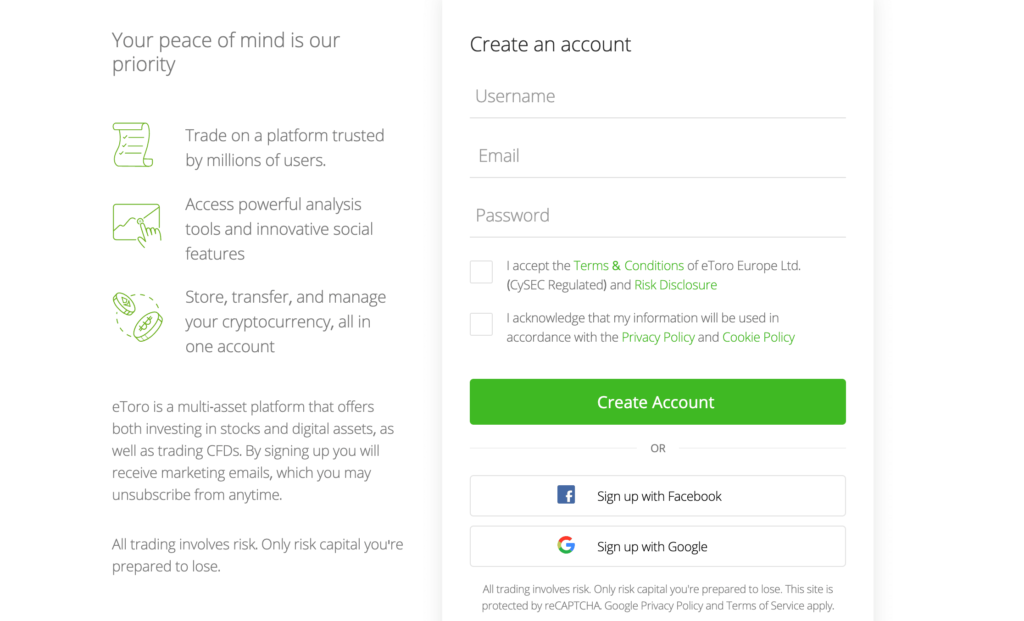

Step 1: Open an account

In order to open an account, you must fill out the registration form. Your name, email address, contact number, and confirmation of your mobile phone number and email address are required.

Traders must present proof of photo ID. Additionally, a copy of a recent utility or bank statement is needed for the verification process. Since eToro has received FCA approval, it conforms with all legal requirements for verification.

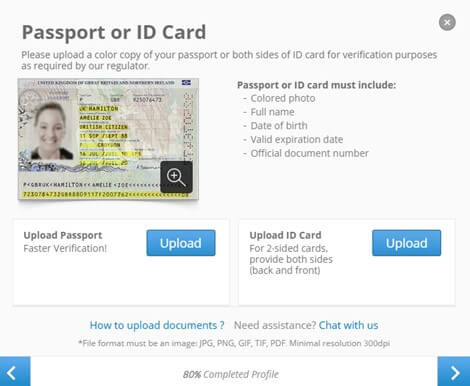

Step 2: Deposit funds

You must deposit money into your particular account before you can trade equity stocks. To start learning if you are a beginner, use the demo account first. Debit/credit cards, wire transfers, e-wallets, and bank transfers are all acceptable methods of depositing money.

The $200 minimum deposit is required. A 0.5% conversion fee applies to any deposits made in British pounds. Since your eToro account is in US dollars, this allows you to access 17 UK and international markets without worrying about currency rates.

Step 3: Start Equity Trading

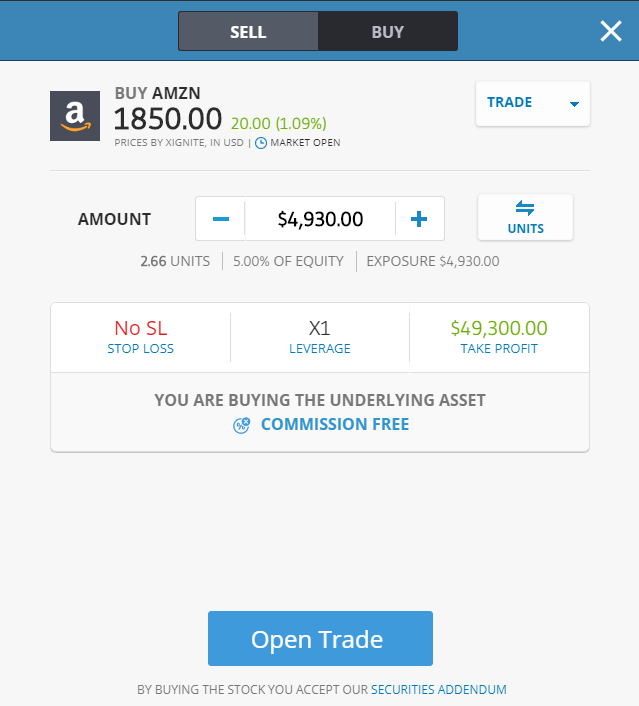

You can start trading stocks on eToro as soon as your account has money in it. Once you’ve decided which stocks to trade in, just type the name of the firm in the search box.

Select the stock after it appears on the screen, then click “Open Trade” to start trading. To reduce the risk features, you can specify your risk exposure.

Conclusion

In order to make money, equity traders in the UK trade stocks and ETFs. Equity trading offers potentially better gains compared to typical equity investing, but at the cost of greater risk. Depending on your trading technique, you can hold equity deals for a few minutes or a few weeks.

Simply click the button below to begin equity trading if you have made up your mind and want to begin your journey in stock trading.

Frequently Asked Questions

What are equity derivatives?

CFD trading and options trading are two types of equity derivatives trading. Instead of trading shares or ETFs straight, equity derivatives allow you to trade alternative investment products whose price is reliant on the price of the underlying equities.

Is trading in equity the same as trading in stocks?

In the UK, stock trading and equity trading are largely equivalent. The main contrast is the inclusion of ETF trading in stock trading.

Can I trade international equity from the UK?

Yes, you can trade foreign stocks with numerous UK equity brokers. Depending on the options offered by your broker, you can purchase shares or trade CFDs for stocks from the US, Europe, Japan, and other countries.

Are bonds regarded as equities?

Bonds are not regarded as equities. They do not trade on equity exchanges and are a part of the debt market.