2022 has been a challenging year for US stocks. The tech-heavy Nasdaq is down 29.4%, the blue-chip-heavy Dow Jones Industrial Average is down 16.7%, and the benchmark S&P 500 is down 21.1% through June. The main cause has been inflation, which has caused the discussion about whether higher costs are temporary to come to an abrupt stop as prices have risen continuously for months at a rate that is the highest in about 40 years.

With the highest consecutive interest rate increase in 28 years occurring in June, the Fed Reserve has begun a process of tightening that hasn’t occurred in years. Initially hesitant to react, the Fed is now moving quickly. When you pair that with the unexpected Russian invasion of Ukraine and the high oil costs, and Wall Street hasn’t got much to be happy about in 2022.

With all of these considerations, it might be challenging for a UK investor to identify the top US stocks. Don’t worry, we’ve got you covered with our guide, which includes a thorough explanation of how a UK trader can invest in US stocks as well as a list of the top US stocks to purchase in 2022.

Best US Stocks 2022

A list of the top US stocks to purchase in 2022 is provided below:

- Etsy (NASDAQ: ETSY)

- Pinterest (NYSE: PINS)

- Shopify (NYSE: SHOP)

- Disney (NYSE: DIS)

- Amazon (NASDAQ: AMZN)

- EOG Resources Inc. (NYSE: EOG)

- Visa Inc. (NYSE: V)

- Alphabet Inc. (NASDAQ: GOOGL)

- Lowe’s Cos. Inc. (NYSE: LOW)

- Meta Platforms Inc. (NASDAQ: META)

Best US Stocks Analysis

Etsy (NASDAQ: ETSY)

Before the COVID-19 outbreak, Etsy was expanding wonderfully by matching creative entrepreneurs with clients seeking items that were a little bit more unique than the typical fare from online retailers. E-commerce experienced a sharp growth during the outbreak. But Etsy certainly took off, expanding at a rate that is more than twice as fast as general e-commerce.

The fact that Etsy was a logical fit for customers looking for distinctive face masks undoubtedly helped, but the site’s expansion has been amazing in all product categories. When opposed to similar pre-pandemic figures, Etsy’s global volume of sales grew by 177 percent in the Q1 2022.

You’ll see that we pay attention to strong platforms across this list. Etsy is unquestionably one among them. Few online retailers can compete with Amazon and remain successful. When Amazon launched its own platform for handmade goods, Etsy not only made it through, it triumphed. However, this could only be the beginning of a fantastic long-term growth narrative.

Due to its platform and established brand, Etsy has only started to touch the edge of the trillions of dollars worth of market possibility. The stock has dropped significantly as a result of the latest growth stock fall, so now might be a great time for patient long-term shareholders to give it a closer look.

Also read: Best Supermarket Stocks You Should Buy In UK 2022

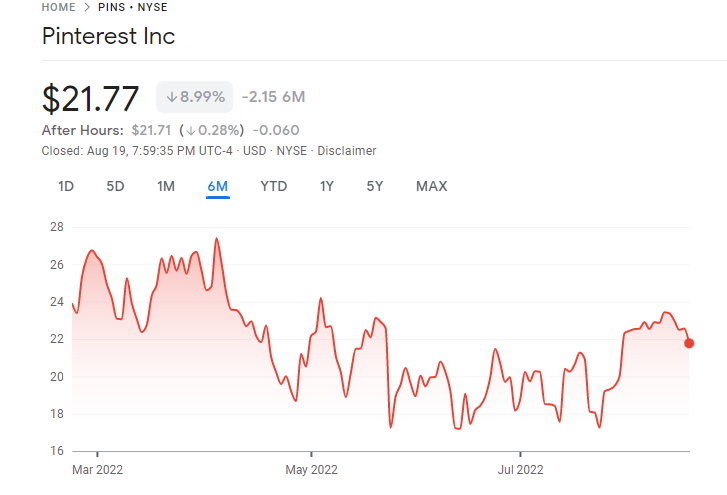

Pinterest (NYSE: PINS)

In a social media ecosystem that has become more dismal and polarising, Pinterest stands out as an oasis of happiness. That partially stems from Pinterest’s focus on ideas.

On Pinterest, users concentrate on items rather than other people. People can find visual inspiration on Pinterest for the things they wish to do, whether it be creating their ideal deck, making a child’s birthday cake, or changing their clothing.

With rapid growth in both community size and revenue, Pinterest has come under fire for not being as profitable as Facebook. This is particularly true given that only a small portion of its revenue comes from its 80% global user base. But there is a great opportunity in purchasing this US stock, in our opinion.

Regarding chances, it’s also important to note that Pinterest is beginning to consider how it fits into the e-commerce market. Users explore Pinterest to find things they might like to buy, and to speed up its turnaround, the business recently named e-commerce expert Bill Ready as its new CEO.

It’s really easy to think how smoothly marketing, lead generating, and product placement might go when individuals are ready to offer guidance. The business recently agreed to purchase fashion purchasing platform The Yes and has been experimenting with tailored shopping feeds.

Shopify (NYSE: SHOP)

Shopify is a service that allows businesses of all kinds to sell their products digitally with a focus on supporting smaller businesses. The firm offers a variety of complementary services that help businesses function more efficiently, and subscriptions to its products start at just $29 per month.

Shopify’s “one-stop shop” approach to enabling e-commerce has helped it grow into a major player. It currently generates higher e-commerce revenues through its network than other businesses except Amazon. But it’s possible that Shopify is just getting established. The site’s $4.8 billion in revenue from the prior year only accounts for a small percentage of the projected $153 billion potential market as more businesses focus on online sales.

Less than 15% of retail sales in the United States are made online, indicating that e-commerce is still in its infancy. Given that shares of Shopify have dropped dramatically after the most recent market crash, it seems like a no-brainer as one of the finest stocks to buy in 2022.

Disney (NYSE: DIS)

Keep your focus and ignore any short-term political obstacles. The epidemic affected Disney’s theme parks and movie business, but it benefited the Disney+ streaming service, which has developed into titan years ahead of schedule.

In 2022, interest for Disney’s amusement parks and films is higher than ever. Disney+ has achieved great success. It makes sense that the company is focusing on expanding it through its other streaming services, Hulu and ESPN+.

Disney may even be the ideal example of a pandemic-fueled expansion company and a reopening play together. With its incredible portfolio of intellectual property (including the Marvel Cinematic Universe, Star Wars, ESPN, Pixar, and Disney), as well as its cash-cow theme park business, it may be the safest stock on this list. Additionally, it still has significant development prospects as its new business areas grow.

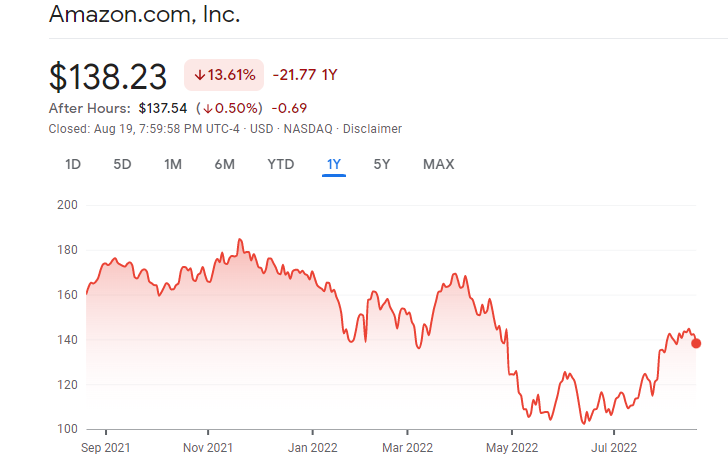

Amazon (NASDAQ: AMZN)

The majority of folks don’t actually need much of an executive summary for Amazon. With roughly $600 billion in gross merchandise sales annually, the company dominates the U.S. e-commerce market, and its Amazon Web Services cloud platform is a market leader.

However, there is more potential for improvement than you might think. Less than 15 percent of all commercial purchases in the United States are conducted online, indicating that e-commerce development remains far from being at its peak. The cloud sector is also a very new one. Amazon also has a huge amount of potential in other sectors, including healthcare, supermarkets, local markets, and more.

EOG Resources Inc. (NYSE: EOG)

A producer of oil and natural gas in the United States, EOG Resources is one of the best-performing finest US stocks to buy for 2022. EOG was chosen primarily as a hedge against ongoing inflation, and it hasn’t let investors down, rising 29% through June 22 despite rising energy prices – U.S. benchmark crude briefly eclipsed $123 per barrel – and rising inflation. After figures of 8.3 percent in April and 8.6 percent in May, the index of consumer prices is currently expanding at its quickest rate in more than 40 years.

Adjusted earnings per share, or EPS, for EOG, increased 147% year over year in the first quarter of 2022, indicating that business was booming. Due to its remarkable profits, the business also issued a special dividend, which includes a $1 special dividend in February, of $1.80 for each share. Analysts anticipate even higher records in 2022 after EOG reported record adjusted earnings in 2021.

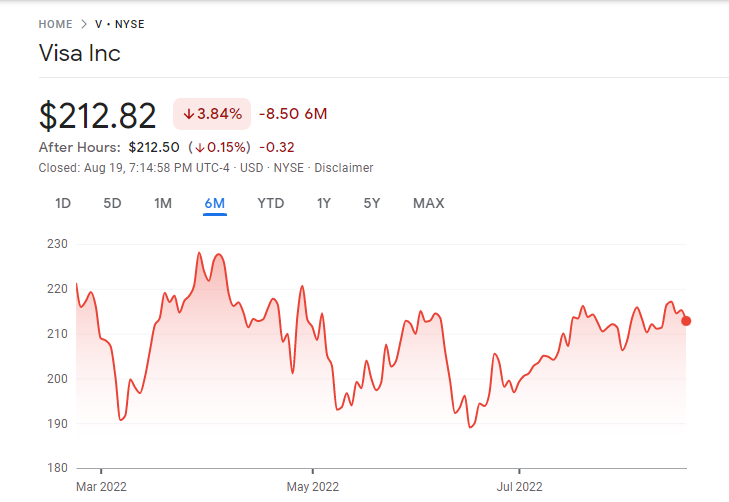

Visa Inc. (NYSE: V)

The rise in international travel has also been advantageous for Visa, the world’s largest credit card company, which is outperforming the bear market by declining 10% year so far compared to the S&P 500’s 21% loss. International revenue grew 38 percent year over year in the Q2 of the fiscal year. Visa’s business is heavily reliant on this sector since it generates higher transactional profits. One of the most powerful long-term competitive advantages in business is provided by Visa’s exceptional network effect. Visa cards are accepted at more than 70 million commercial facilities, and almost 3.6 billion people globally use Visa cards. With revenue and adjusted profits per share growth of at least 23%, Visa outperformed the industry last quarter on both the top and bottom lines.

Alphabet Inc. (NASDAQ: GOOGL)

The parent business of Google, Alphabet, is an incredibly huge organization. Of course, when a shareholder purchases GOOGL, they gain exposure to the largest search engine in the world as well as to other Alphabet businesses, including its dominant YouTube video platform, expanding cloud business, and “moonshot” initiatives like investing in self-driving cars and attempting to provide internet access to 4 billion people who do not currently have it.

A wonderful offer in accordance with the current price-earnings ratio of the S&P 500, the $1.5 trillion GOOGL saw a 23% increase in revenue during the most recent quarter and trades for just 20 times earnings. GOOGL has been negatively impacted in 2022 without any fault of its own due to the fact that it is a tech stock in a rising-rate environment.

Also read: Best Tech Stocks You Should Buy In UK 2022

Lowe’s Cos. Inc. (NYSE: LOW)

As a bet on the booming housing industry, Lowe’s was chosen as one of the finest stocks to purchase. That argument was supported by its February results report, which showed a 5% increase in same-store sales in the United States. But things changed in May, as same-store sales in the United States decreased 3.8% from the previous year. Lowe’s attributed a portion of the findings to “unseasonably cold conditions in April,” which hampered sales of outdoor seasonal goods. However, now that interest rates are swiftly rising, the housing market may also be affected. Long-term, there will continue to be a significant housing scarcity, and millennials will continue to need homes. Analysts anticipate EPS growth of 12.5% in 2022 despite the challenging second quarter.

Meta Platforms Inc. (NASDAQ: META)

Meta Platforms is a name that almost everyone is acquainted with, but you may only know it by its previous name, Facebook. Last year, after experiencing one of its yearly PR disasters, the business made the hasty decision to change its name in an effort to highlight the expanding potential of the metaverse. Unsurprisingly, the developing technology has been nothing but a money pit, with Reality Labs’ metaverse subsidiary reporting a $10 billion loss in 2021.

The sluggish beginning of the metaverse, the technology sell-off, and challenges resulting from Apple’s iOS privacy restrictions that are harming ad income have all contributed to META’s poor start to the year, with the company dropping more than 50%. On the plus side, META is trading at only 13 times forward earnings, which is a significant discount to the normal multiple attributed to the industry leader in digital advertising and half the valuation it was at in early 2021.

How to invest in US Stocks?

To include the well-known US stocks in your portfolio right now, do a few steps. A step-by-step investment procedure for US stocks is provided below:

Step 1: Choose a broker

After deciding which US stocks to buy, look for a UK stock broker that gives you exposure to the US markets. These days, you can pick from dozens of possible brokers.

However, you also need to consider fees in addition to making sure the site is regulated and allows your preferred payment option. This is due to the fact that most UK brokers charge more when investing in US stocks.

In light of this, you will find a review of the finest UK share dealing platform that enables traders to affordably purchase US stocks below.

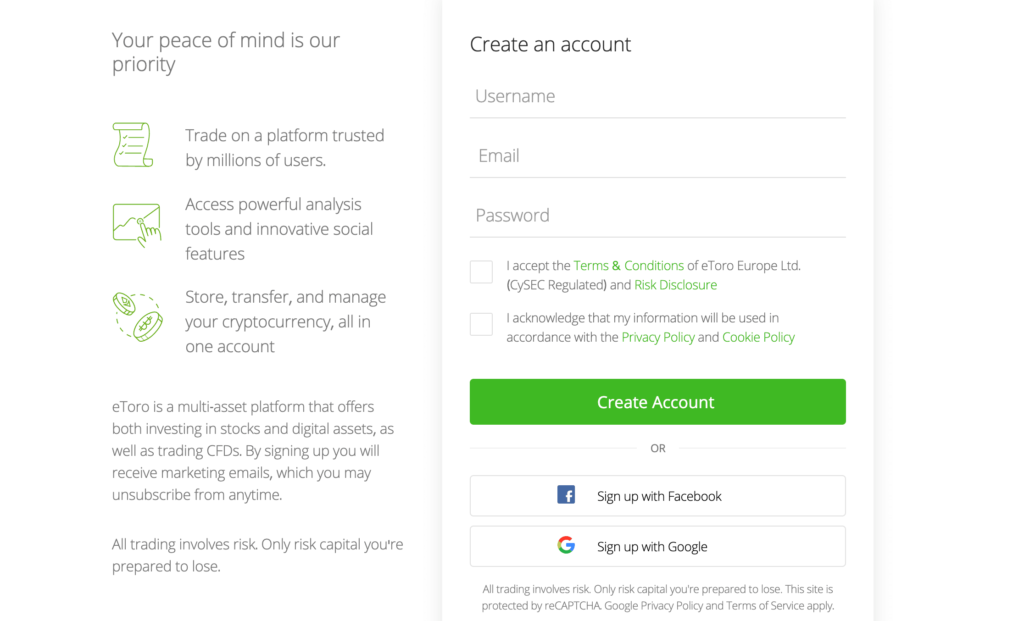

eToro: Best broker to buy US stocks

eToro, a stock broker that was established in 2007 and currently has over 20 million investors as members, is incredibly well-liked in the UK. Nearly 2,400 shares from 17 different markets are available on the site. This obviously includes the NASDAQ and NYSE, so you can be guaranteed to find US stocks with a single click.

We find that eToro really stands out because there are no commission fees. This is true across the board for the 17 nations it offers you access to, not just US stocks. As a result, you won’t pay any trading costs if you want to purchase shares of Amazon, Apple, Tesla, or Meta.

We also like that all of eToro’s shares are eligible for fractional ownership. This is especially advantageous for US businesses because shares of corporations like Amazon and Google trade for thousands of dollars.

You may also find the eToro Copy Trading feature interesting. This enables you to browse among the platform’s thousands of verified investors. Finally, eToro is subject to FCA regulation, and the FSCS investor protection scheme ensures your funds.

Step 2: Open an account

After choosing a trading platform to buy US stocks on, you must open a trading account in order to use this broker’s features. Therefore, we will walk you through the procedure of creating an eToro account in order to purchase US stocks.

First, click Open Account on the eToro website. You will now be required to input facts about yourself, including your name, address, date of birth, and contact information. Additionally, you need to pick a secure username and password.

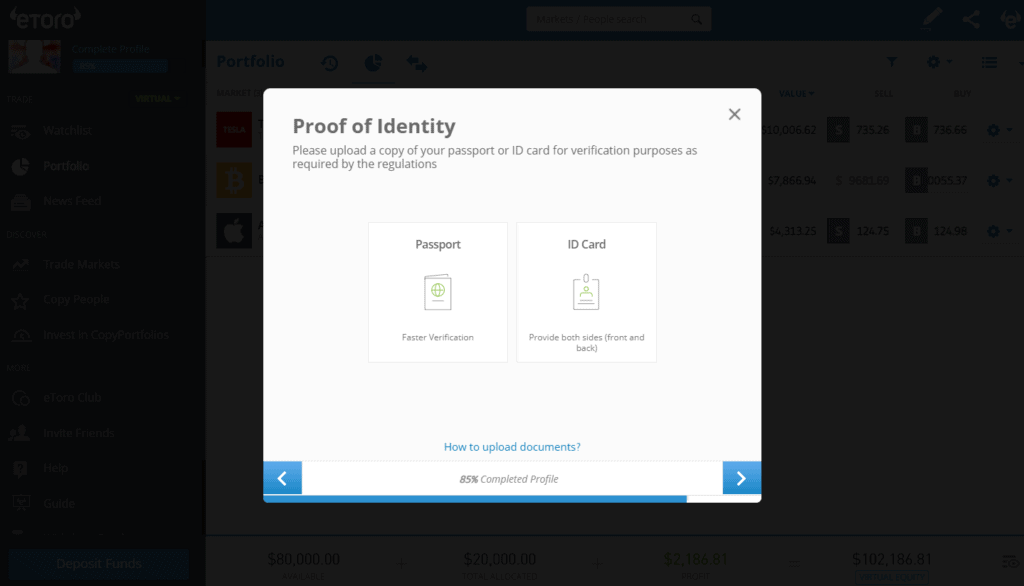

Step 3: Verify your identity

ASIC and CySEC are additional regulatory bodies for eToro in addition to the Financial Conduct Authority (FCA). As a result, we must identify each user that created an account. Simply attach a copy of your bank statement or utility bill together with your US passport or driver’s license.

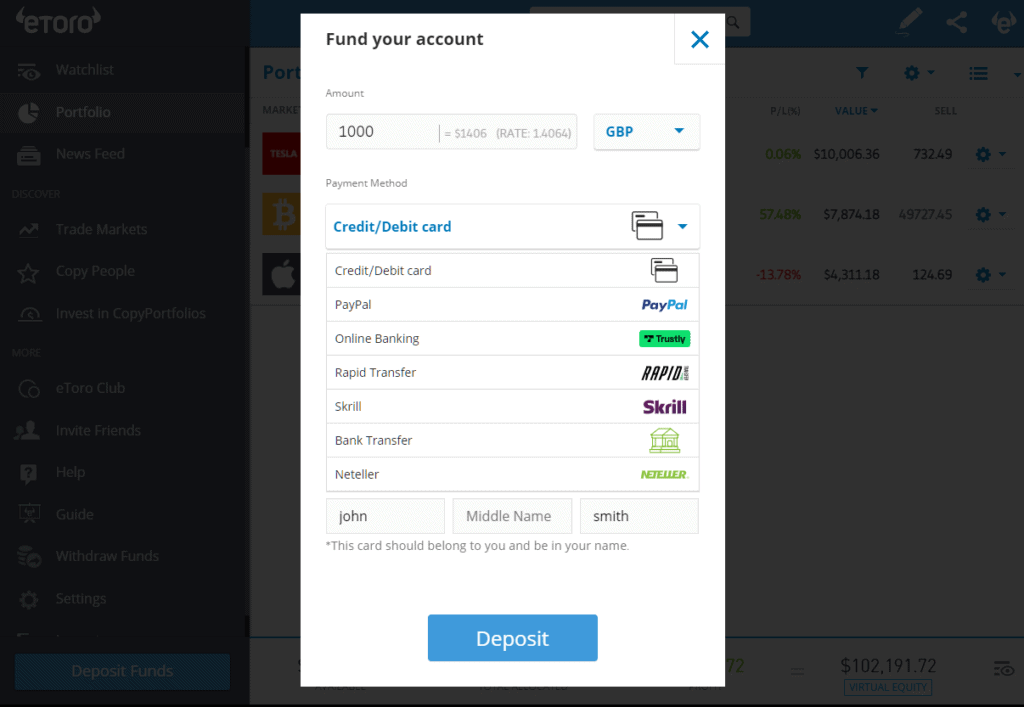

Step 4: Deposit the funds

After your identity has been confirmed, you must deposit the money into your account. To start trading, you must deposit a minimum of $200. It accepts payments made by bank transfer, wire transfer, debit/credit card, and e-wallet.

Step 5: Buy US Stocks

Simply enter the name of the company you want to purchase stock in the search box at the top of the screen and press the “TRADE” button. In this instance, we want to purchase Amazon shares.

After that, enter the amount of your investment in the “Amount” box.

Finally, choose “Open Trade” to buy the best stocks without paying a commission.

Conclusion

Read through our stock trading guide if you’re just beginning your investing journey. It covers all the fundamentals, including how to get started, how to choose your own personal investment plan, and how much money you should put into stock investments.

Despite our strong outlook for each of these equities, we don’t necessarily believe they are the greatest investments for investors without established and diverse portfolios. If you’ve never traded before, we suggest starting with eToro.

Frequently Asked Questions

What is the price of purchasing US stocks in the UK?

There can be charges if you buy US equities in the UK, based on the broker you use. The majority of the time, a premium is required to access non-UK shares.

Can I invest in US stocks without a deposit?

You cannot invest in US stocks without first wiring (remitting) USD to your US brokerage account since US stock transactions must be conducted in USD.