Different methods are used by day traders in their trade plans. Their decision with the day trading strategy will typically be influenced by their trading, educational, and personality preferences, as well as by their past. They might also need to act quickly in order to profit from swift intraday market swings.

Despite any variations in their actual approach, the most successful day traders all share the ability to design and then maintain the self-discipline to stick to a trading plan that is at least moderately profitable.

Due to the objective trading indications it can provide under typical trading situations that help increase your chances on a day trade, most day traders employ technical analysis as the foundation for their trade strategies. When the underlying assumptions of technical analysis fail, other day traders may employ fundamental information and news releases as trading signals.

In this guide, we have mentioned the best day trading strategy to provide you with some fantastic ideas you can use in your own trade plan.

Best Day Trading Strategy

Market Entry Gap

Greater entry gaps, according to technical analysts, normally indicate that the market will move forward in that direction, but smaller entry gaps are frequently filled. Therefore, you can check for opening price disparities in exchange-traded markets that exceed a certain percentage threshold, like 5%, for instance.

Pre-market stock scanning programs can typically be used to swiftly do this task if you trade stocks. The healthcare stock Aprea Therapeutics Inc. stock experienced an opening gap down of around 80% following disappointing results from a trial of its main investigational treatment for myelodysplastic syndrome (MDS).

Once you identify a stock that is actively changing around the time that its stock market opens, you may search for a recent news story that caused the movement to ensure that it makes sense on a fundamental level. Finding a good entry point and setting your stop loss below support are the following steps. You should choose these parameters with as much consistency as you can.

As an example of a market entry gap strategy, you may focus on the pre-market high point and then set a limit order to purchase if a pullback occurs there. A different choice may be to observe the opening range during the first minute of trade. Then, you can place a buy order and a stop loss order at the high and bottom of the first 1-minute candle of the market, respectively.

Ichimoku Kinko Hyo Indicator

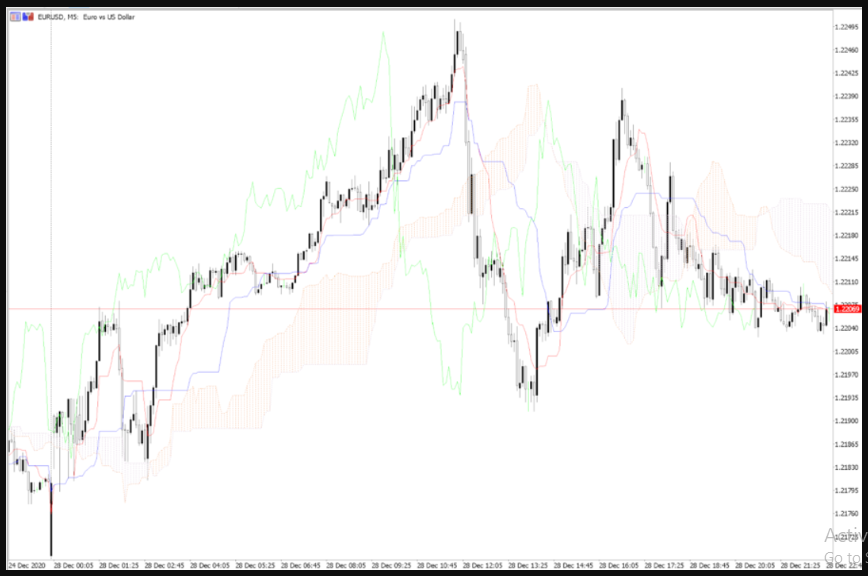

You can utilize the Ichimoku Cloud or Ichimoku Kinko Hyo indicator alone to offer technical trading signals that you can act upon. Two of its five lines, the Senkou Span, are visible as the “cloud,” and its Kijun Sen line provides trading indications and an appropriate stop loss area.

When the price moves outside the cloud to indicate a new trend, for instance, day traders employing this indication might place a trade. This position can be kept until the close of trading for profit-taking or until the Kijun Sen line is crossed for loss-taking. Therefore, traders may employ a trailing stop loss that is placed on the other side of the Kijun Sen line and tracks price movement.

Momentum Trading

An investor who uses the momentum strategy buys a stock whose price is rising. According to Warrior Trading, only roughly 10 out of 5,000 companies will meet the criteria for momentum stocks on any given day. If you are utilizing a momentum trading technique, look for the following characteristics in stocks:

- a significant change in price brought on by factors like unexpected profits growth, the discovery of new therapy by a pharmaceutical business, or the announcement that a smaller company will be bought by a larger one

- 30 to 40% increase or decrease in stock price

- Smaller companies, which trade more quickly because there are fewer shares outstanding (the float should be less than 100 million shares),

Day Trading places a stop-loss order right below the first price decrease as a safeguard against excessive losses. The stop loss functions as insurance. You place a sell order for the stock at a specified value, and if the asset price falls to that level, the shares are instantly liquidated, protecting you from further losses.

Scalping Strategy

The idea behind a scalping approach is that little victories throughout the day might mount up to a substantial sum of money. The scalper establishes buy and sell targets and adheres to them. The scalping tactic moves quickly. It’s not unusual for many trades to be completed in a short period of time.

Scalping is the nicest day trading strategy for seasoned traders who are able to act quickly and decisively. Users of scalping have the self-control to sell straight away if they notice a price decline, minimising losses. This is not a day-trading method for those who are easily distracted and lack laser-like focus.

Pullback Trading Strategy

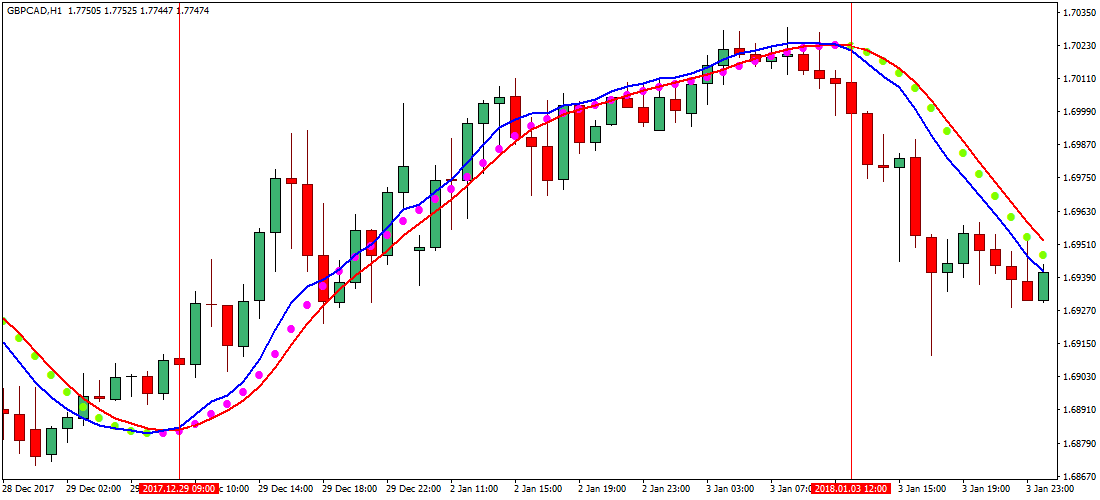

To start using the pullback technique, find a stock or ETF that has a well-established trend. After that, keep an eye on the trend until prices diverge from it. If the existing trend keeps rising, the downward move, or pullback, provides an entry point for the day trader to buy.

Technical charts are used by day traders to determine the trend of a stock. Prior to the pullback or price fall, Fidelity advises searching for an uptrend with at least two consecutive high price moves. Or, if you were shorting the stock, you would watch for two consecutive price declines. Additionally, there’s no need to fear if the trend entirely changes after you buy in because it typically does so for a considerable amount of time. From the equities making the highest gains, you might uncover downturn potential.

Breakout Trading

A breakout trade happens when the asset price increases past the top resistance price. But it’s not as simple as identifying the resistance on a chart, buying following a breakout, and so on. You should keep an eye on the volume of stock trading, or how many shares are being exchanged. This is because, in accordance with Fidelity, breakout trades with larger volume are more possible than those with lesser volume to be sustained at the new, higher cost. It is more challenging to profit from lower-volume breakouts since they are more likely to collapse below previous resistance levels.

After hitting the resistance level, the stock will typically decline until a catalyst for a more significant price movement emerges. Above this value, there are more sellers than buyers, restricting the value from rising further.

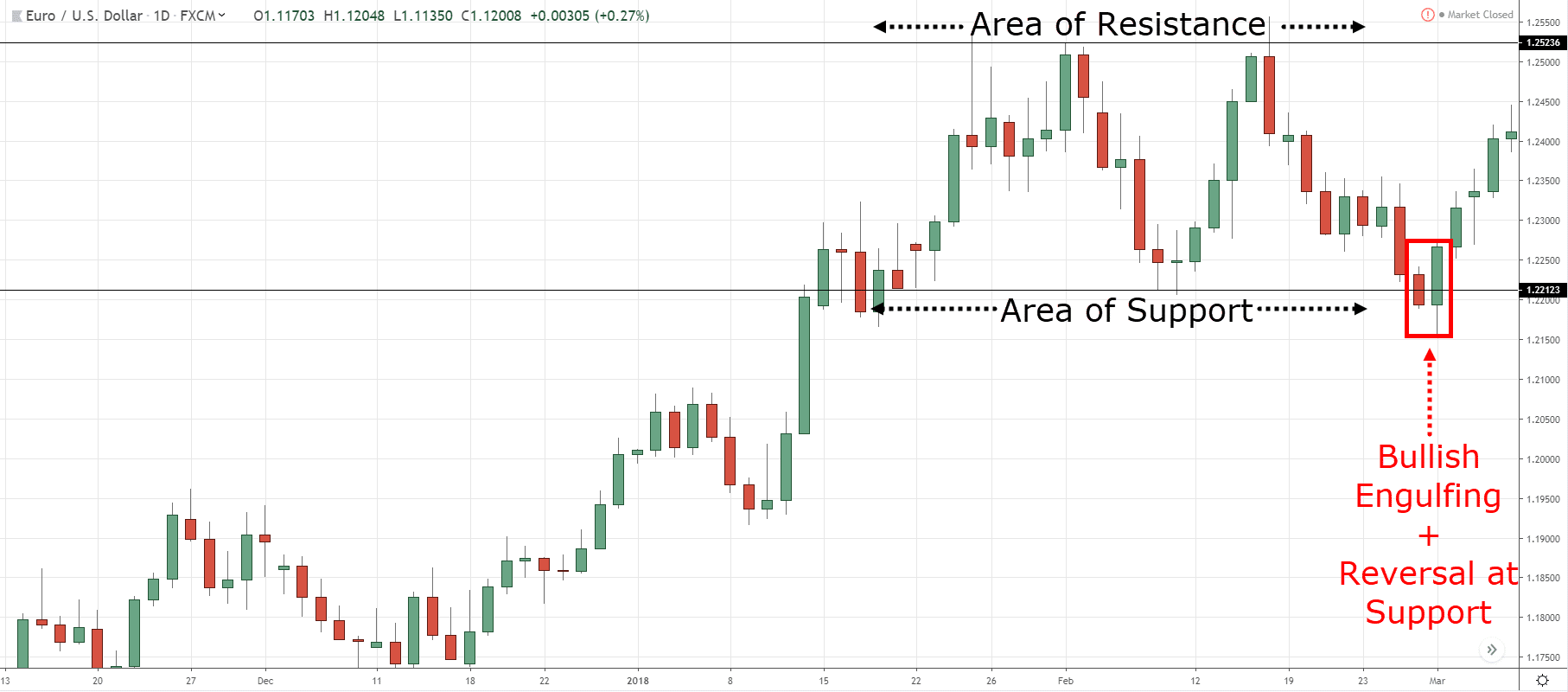

Reversal Trading Strategy

It is not advised for beginning traders to use the high-risk trading strategy known as reversal trading. Using this method, trades are made in opposition to trends. The calculations and analyses will help the business recover and turn a healthy return. Due to the high level of experience and market understanding required, this technique is not at all suggested for novice day traders. It is a difficult approach since investors must precisely identify the pullbacks and their benefits. One of the main strategies in the reversal trading technique is the daily pivot, which day traders use to focus on trading the regular low and high pullbacks.

News Trading

You may already be aware of how quickly stocks respond to breaking news. An unfavorable earnings report alone might lower a stock’s price. On the other side, something like the FDA approving a new medicine may make a stock soar. Day traders might profit from the widely-read daily stories by keeping an eye on the business headlines.

If bad news has been disclosed, you can short the assets during the trading day by lending shares of the stock from the purchasing business and selling them later. You can benefit from the difference less a commission if the stock price drops as anticipated and you repurchase the shares at the lower price. If the news is positive, you should buy stock altogether or go long and sell your shares once the price has increased.

Day Trading Strategy Limit orders to minimize losses

Make your trade placement and execution orders. A market order is filled at the present best price without any price assurance. It can be useful if all you want to do is enter or exit the market without worrying about getting filled at a specific price.

Although execution of a limit order is not ensured, the price is.

You can trade more accurately and confidently by using restricted orders because you get to choose the price at which your order should be filled. You can minimise your loss while using limit orders. If the market doesn’t hit your price levels , your order won’t be filled, and you’ll hold your position.

Options methods can be used by day traders who are more knowledgeable and skilled to hedge their positions.

How to start day trading?

For the enormous volume of trades that day trading creates, not all brokers are suitable. However, some work fantastically with day traders. Check out our guide of the best day trading brokers if you’re looking for companies that allow day trading.

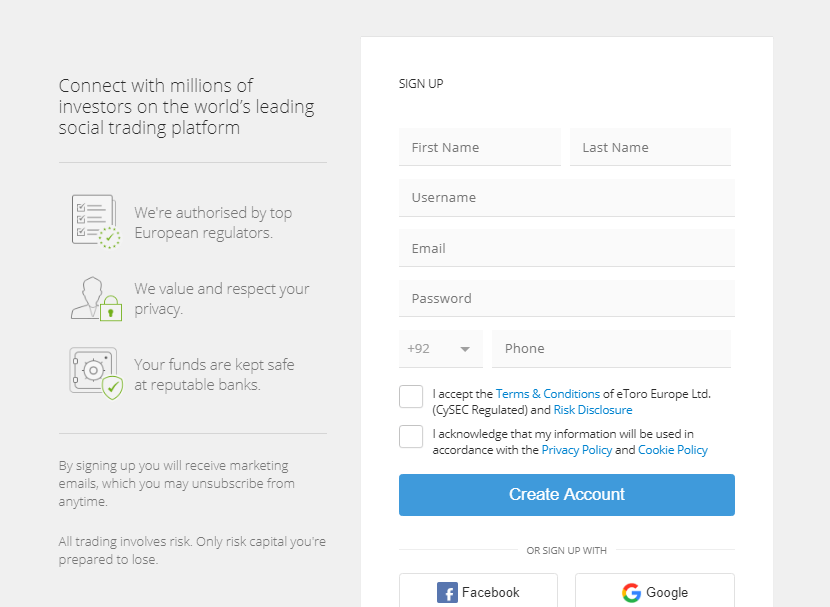

The step-by-step instructions are provided below to help you understand how to begin using your day trading methods right away. We’re using eToro as an example because it’s our top choice for a trading platform.

Step1: Create an account

Making an account on the official eToro website is the first step in beginning day trading on a trading platform. You must first register by completing a registration form with your basic information, including your name, phone number, and email address, as well as choosing a secure password. Don’t worry, since your documents are completely protected on this site, even though eToro will require you to upload some of your documents to prove your identification. However, until you deposit more than $2,250 or make a withdrawal request, you are not required to go through verification.

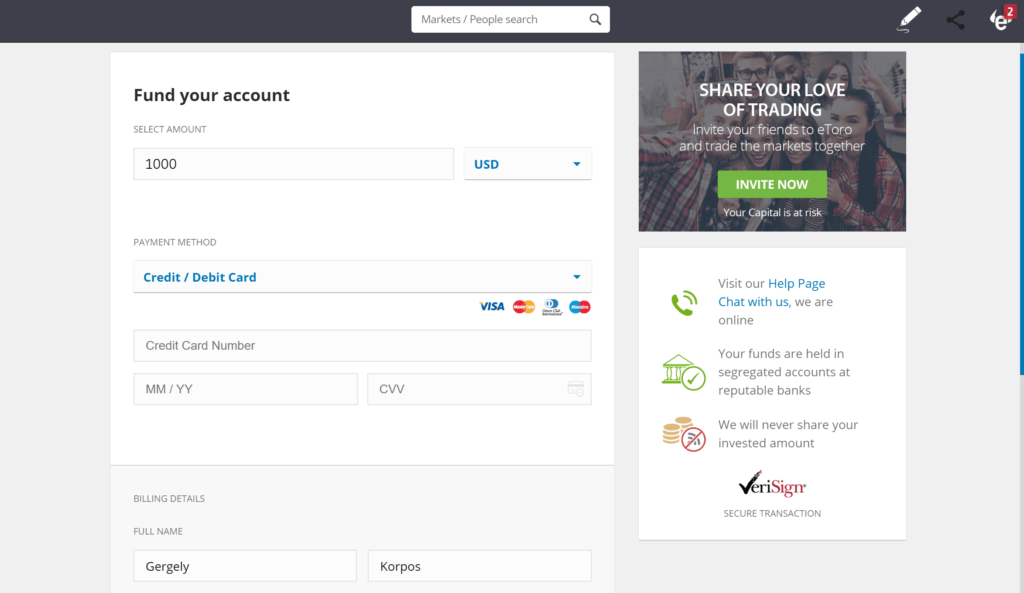

Step 2: Fund your account

After successfully creating an account on this platform, you are now ready to fund it with a minimum deposit of £150. This funding amount, which represents the working money required by the traders to carry out deals, is not the robot’s charge. eToro accepts payments using debit/credit cards, PayPal, Skrill, Nettler, and bank transfers among other options.

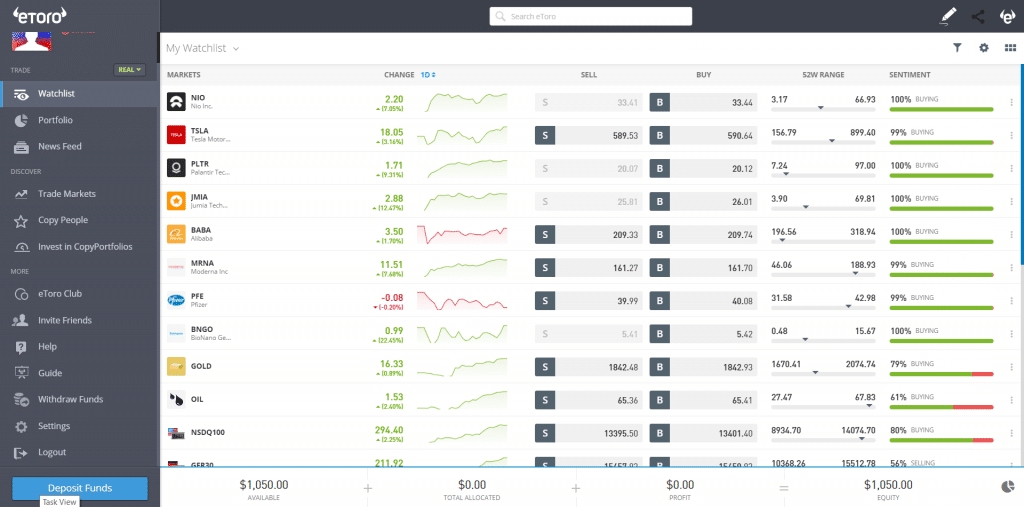

Step 3: Search for a Day Trading Market you want to invest

You are now prepared to look for the market of your choosing after successfully creating an account and funding it. Additionally, you can browse the “Trade Markets” and choose from a selection of assets that appear in front of you if you are unsure of which financial instrument you are willing to day trade.

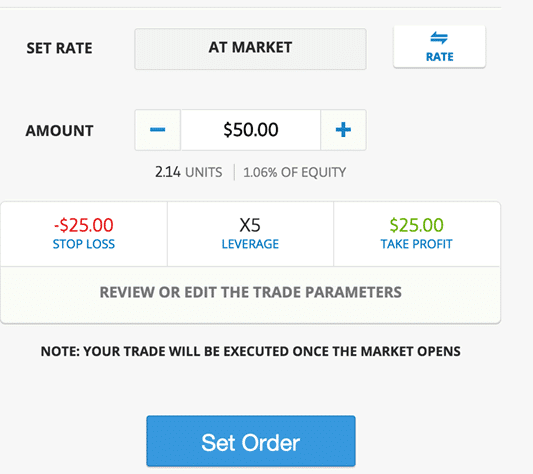

Step 4: Start Day Trading

You are now prepared to use the day trading methods you have chosen. To do this, you only need to create trade orders for buying or selling, stop loss, and take profit. To place a day trading position, you must first enter the desired amount and then click the “Set Order” option.

Conclusion

The best day trading strategy is the one that you must use in your day trading so that you may consistently make money. Additionally, before you begin day trading, be sure to select the best online brokers by evaluating them according to criteria like rules, commissions, spreads, withdrawals and deposits, and customer support.

Choose from the aforementioned trading platforms if you don’t have much time to look and determine whether a platform is worthwhile. But eToro is, in our opinion, the best platform.

Frequently Asked Questions

What day trading approach is the simplest?

The simplest day trading technique is the breakout trading method; after acting swiftly on the news, you can sit on your roof and watch the market profit.

What is a breakout trading strategy?

The breakout trading method involves locating the points where the stock price crosses over or under the predetermined threshold.

What is a momentum trading strategy?

Before making a big change in the market trends and investing in the direction of momentum, investors choose the appropriate stock.

Which day trading strategy is most efficient?

There are numerous day trading methods; some of the finest ones are the “risky” reversal trading strategy, the momentum trading strategy, the breakout trading strategy, the moving average crossover trading strategy, and the gap and go trading strategy.

What is a reversal trading strategy?

Investments are made in opposition to trends, but with calculations and analysis, trading will turn a profit. It is dangerous because it demands higher market understanding and experience, especially for novices.