Social trading or copy trading consists of automatically or manually copying the trading positions of other traders, which involves risk but has the tremendous advantage of being able to replicate the performance of the most talented traders.

This guide walks you through the pros and cons of social trading, how they work, the pros and cons, and introduces you to the best social trading websites.

How do you do social trading UK?

Getting started with social trading is very easy and fast. Just follow the steps below and you’ll be done in less than an hour.

- Choosing a broker for Social Trading (recommended eToro)

- Open a trading account

- Account Verification

- Deposit the funds

- Getting Started with Social Trading

The following sections explain these different steps in more detail as part of a comprehensive tutorial on how to start social trading using the example of the online broker eToro, the undisputed market leader in this field.

Social Trading: A Complete Tutorial

Here are the steps you need to take to start trading social media with eToro.

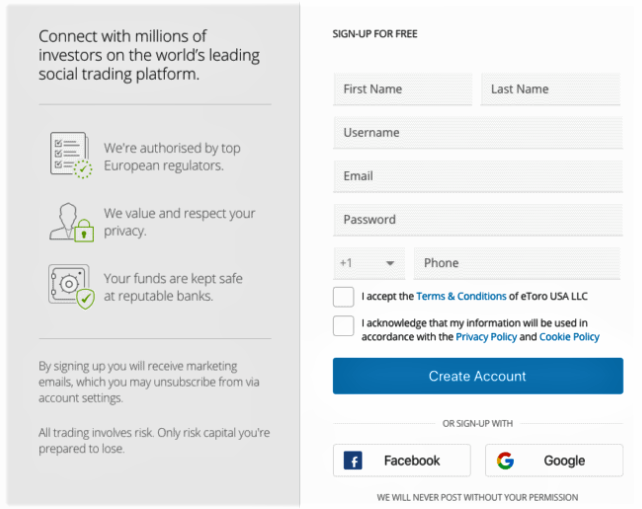

Step 1 – Open your eToro account

To get started, click the “Sign up now” button to go to the eToro website for a quick and easy registration where you can open an account.

All you need to do is enter your connection information along with your username, email, and password on the registration page. You will also need to confirm that you agree to the terms of use and privacy policy, and then click “Create Account”.

These quick and easy steps are enough to access the eToro social trading platform. However, if you want to invest and copy other investors, you will need to fill out a profile. To do this, click on “Full Profile” in the left menu and answer the questions.

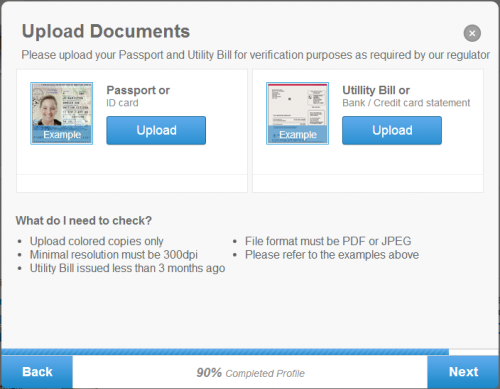

Step 2- Verify the user’s identity

At the end of the survey, you will be asked to verify your identity with your ID and address that can prove your address. After that, your real money account will be ready to receive funds.

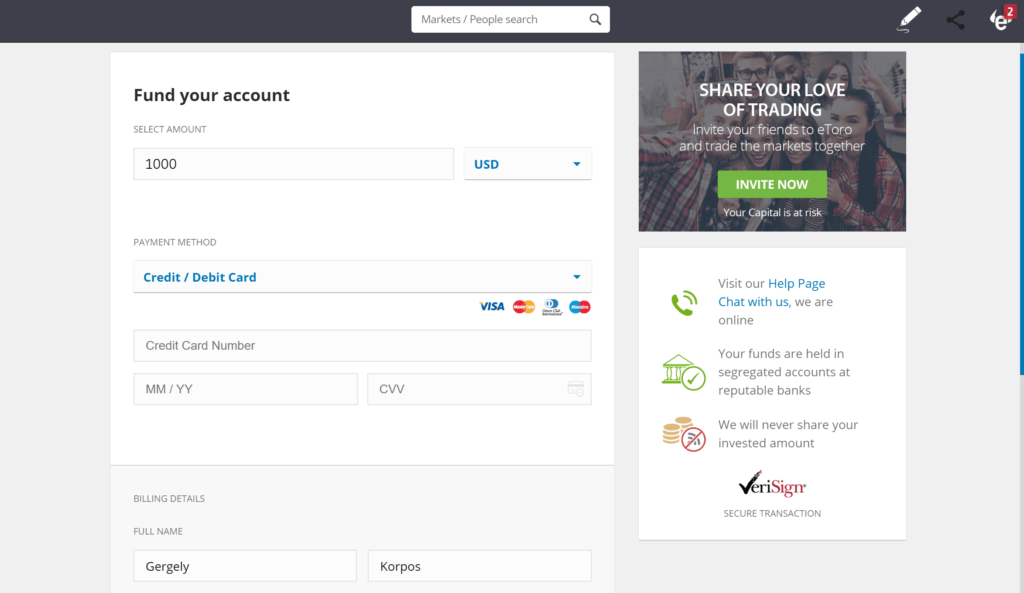

Step 3- Deposit the funds

To deposit funds and deposit funds to your social trading account, you must click the “Deposit” button at the bottom of the left menu.

You will then need to enter the amount to be deposited into your account and currency. Finally, you need to select your preferred payment method and the corresponding information. Click Submit to complete the transaction.

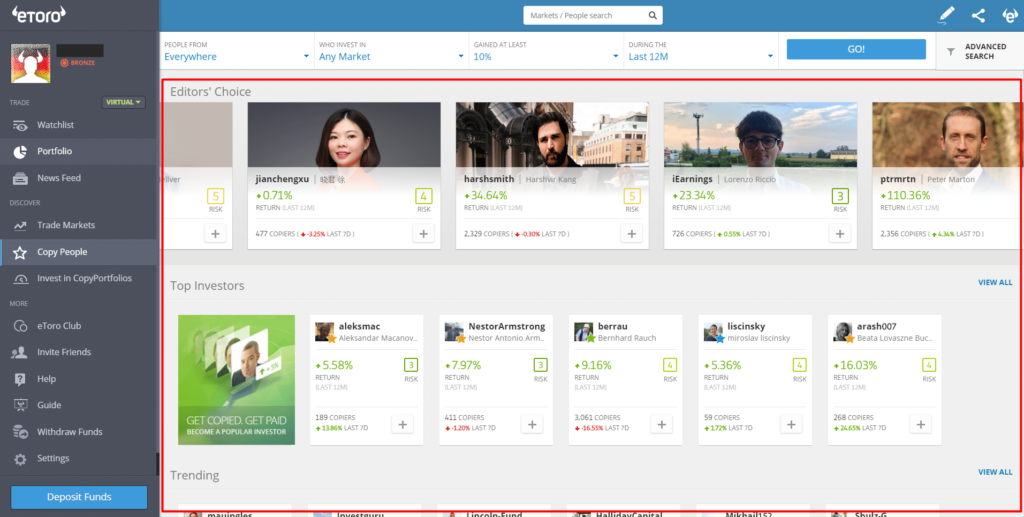

Step 4-Start Social Trading

Once your account is verified and funded, you can start social trading. To get started, go to the People section of the left menu.

You can then go to the page with all sellers to track and copy the sellers. Each trader has a unique profile with nickname, name, return over the year, risk rating, the number of people who copied him, and popularity over the past 7 days. Hover your mouse over the profile you are interested in to read a brief description of the reseller.

You also have the option to filter your profile in the top menu based on the country of the operator, the market in which the business operates revenue, risk indicators, and other selection criteria. eToro already offers options based on publisher’s recommendations, most copied, most popular in the last 7 days, long-term stock investors, short-term investors, and multi-strategy investors.

Once you find the investor you want to copy, click “Copy” in the profile field. Then enter the amount you want to invest and the threshold for loss at which you no longer want to follow this investor. Finally, click “Copy” to confirm.

What are the best social trading sites?- Our top 4

Many trading platforms today offer social trading. So navigation can be complicated.

- eToro

- AvaTrade

- XTB

- Alvexo

eToro

The eToro trading site has been operating since 2007 and has become the world’s leading social trading site with millions of registered users. eToro is based in Cyprus and is regulated by CySEC for European traders. As a result, the eToro social trading site is very reliable. eToro is very popular thanks to its very accessible and easy-to-use trading platform, making it ideal for beginners.

In addition, eToro, the world’s leading social trading provider, offers Copy Trader and Copy Portfolios tools, advanced social trading products that make eToro a great option to start trading.

eToro enables social trading in a variety of financial markets including stocks, stock indices, currencies, commodities, cryptocurrencies, and ETFs. Fee-free stock trading and the ability to purchase real stocks and cryptocurrencies attract the most experienced traders in addition to trading CFDs.

Advantages

- Regulated, accredited, and established brokers

- Intuitive and easy-to-use social trading site for beginners

- Provides ergonomic business applications

- Very low trading rates and spreads

- 0% commission on stock

- CFD trading on stocks and buying stocks in physical form

- Cryptocurrency trading and purchase of cryptocurrencies in physical form

- Various financial products

Disadvantages

- Lack of advanced trading tools

- $5 withdrawal fee

AvaTrade

AvaTrade is an Irish social trading site regulated by the Central Bank of Ireland. It claims to have over 200,000 clients, making it a great online broker.

AvaTrade traders can use the MetaTrader 4 and MetaTrader 5 platforms in addition to the AvaTradeGo mobile app. The broker also offers an automated trading platform, social trading, and options trading app.

AvaTrade brokers offer social trading through a dedicated application that allows traders to automatically trade discuss and copy other investors. AvaTrade offers a variety of trading instruments including Forex, Stocks, Commodities, Equity Indices, Bonds, Cryptocurrencies, ETFs, and Options.

Advantages

- Regulated social trading sites in Europe

- Social trading that you can take with you wherever you go through a dedicated app

- Trade Education Articles and Tutorials

- Free deposit and withdrawal through various payment methods

Disadvantages

- Not a desktop social trading site

- Call option only

- High inactivity rate

XTB

XTB is a well-established trading platform with offices in over 13 countries, including the UK. Founded in 2015, it has more than 170,000 customers worldwide. The website is regulated by the FCA.

XTB offers trading on the xStation 5 platform and the xStation Mobile application. The website offers its clients over 3000 assets that can be traded. Available markets are Forex, Indices, Commodities, Spot Stocks, ETFs, and Cryptocurrencies.

Advantages

- Well-known business sites

- Forex Spread Reduction

- Intuitive trading app

- Good market research and analysis services

Disadvantages

- Relatively high fees for stock CFDs

- Limited range of instruments

- Unresponsive customer service

Alvexo

Alvexo is a relatively new commercial site that has been around since 2014. It is based in Cyprus and is growing very fast. Alvexo is striving to be one of the best trading sites, but it still has a long way to go to catch up with a leader like eToro.

The website offers a simple and easy-to-use platform, including MT4. Clients have access to a variety of markets including stocks, ETFs, indices, currencies, commodities, and cryptocurrencies.

Advantages

- Safe and easy to use trading site

- No brokerage fees for 3 accounts except for spreads

- Extensive assets

Disadvantages

- Product limits for Standard, Gold, and Premium accounts

- High minimum deposit

What is social trading?

Social Trading was born around 2005, and initially, it was possible to copy the positions of traders connected to us through the algorithms or EAs of the MT4 trading platform.

The first historical player in the field is Zulutrade, but eToro has since established itself as a global benchmark in social trading and copy trading. From its inception, social trading has exploded and now has many traders.

According to a survey conducted in 2020, 1 in 3 say that investing or trading manually is too complex and that copying another trader’s trades makes it easier. Also, 1 in 4 investors plans to try social trading in the short term. Finally, according to market research, social trading platforms are expected to grow by nearly 50% by 2025.

How does social trading work?

Social trading is automatically or manually copying the positions of other traders. After analyzing and observing the performance of many operators, we will select them in advance. Of course, the positions are proportionally replicated. In addition, most of the time associated with stops and restrictions is also copied.

Social trading platforms like eToro provide a search interface that allows you to rank different traders to copy based on performance, age, regularity, or other criteria. Therefore, the first step in implementing social trading is to analyze the performance of traders on the platform.

So, you need to know whether to prioritize safety or potential benefits. We know that risk levels often correlate with potential returns. You should also be interested in the markets in which the traders being copied are operating. That way, you know if the market is right for your investment goals.

For example, if you are looking to copy traders as part of long-term portfolio management, it is best to avoid traders specializing in currencies or cryptocurrencies with short investment periods.

Once the trader to be copied is selected, the trading account will automatically (and proportionally to capital) duplicate the copied trader’s position.

What can you negotiate with social trading?

A trader that can be copied to a social trading platform can trade several different markets at the same time or specialize in a particular market. Discover the most popular markets in the world of social trading and copy trading.

Trade stocks

Buying stock on the stock market is like owning part of a company. The value of the stock itself can rise or fall, but dividends must also be considered. Dividends are the portion of a company’s actual earnings that your stock is entitled to receive.

The stock market is arguably the best market for long-term investing, and many studies show that investing in stocks is almost always profitable over 10- to 20 years, regardless of the index studied.

However, some actions are riskier than others, depending on the size of the company, industry, or economic situation. This is where social trading makes sense because it is difficult to make the right choice among thousands of stocks, and professionals can choose the best stocks to invest in.

ETFs

Exchange-Traded Funds (ETFs) or ETFs are mutual funds, which consist mainly of stocks that are traded continuously during trading hours and can be traded in real-time promotions.

These funds may be linked to indices such as the CAC 40, NYSE, or FTSE, or they may follow a specific investment subject, such as biotech or fair trade-respecting companies. ETFs, like stocks, are suitable for long-term investments. However, the risk profile of ETFs varies widely and, like stocks, it can be difficult for beginners to make the right decision.

Cryptocurrencies

Cryptocurrencies, whose undisputed star is Bitcoin, is a new asset class that is considered relatively risky. Some see this as a long-term investment but expect cryptocurrencies to one day replace the national currency. The current reality is that their volatility makes them more suitable for short-term trading than long-term investments.

The movements of digital currencies are often violent and unpredictable, and many beginners lose all their crypto capital in a matter of days. Therefore, it is often better for beginners to rely on the expertise of cryptocurrency experts to copy the trading location to buy cryptocurrency.

Commodities

Gold and oil, the two commodities traded the most every day by traders around the world, are volatile assets that can be useful for short-, medium- or long-term trading.

In the short term, large daily fluctuations in these assets offer many opportunities for traders. In the long run, the theory of high oil prices and the devaluation of national currencies against gold are strong arguments that should push prices up.

However, these markets are markets that respond to many macroeconomic factors that are sometimes difficult to grasp, and copying the positions of qualified traders onto social trading platforms is often the most lucrative solution.

Forex and social trading

Forex is the virtual place where currencies or foreign exchange markets and currencies are traded. It is the world’s largest financial market, trading more than $4 trillion per day. It is a preferred market for trading days or very short-term traders doing scalping.

However, like commodities, currencies react to many factors that are difficult for beginners to find. Therefore, trading forex through social trading platforms is preferable for beginners who expect to gain sufficient experience to make their own forex trading decisions.

How much return is expected with social trading?

It is difficult to say how much money you can make with social trading. Because it depends on the trader you follow and you know that past performance does not guarantee the same future performance.

“Richardstrout”, the most copied trader on eToro, has over 10,000 followers and has a positive performance for the month of 2020, closing at a cumulative plus 48%. This means that an investment of 1000 Euros at the beginning of the year will bring this trader a profit of 480 Euros.

One of the best long-term investors, Motivated Trader has had a total return of 43% since early 2020, including a loss of 4 months. If you had invested 1000 Euros at the beginning of the year with this trader, you would have made a profit of 430 Euros today.

Finally, you should be aware that Popular Investors eToro is posting profits of thousands of percent per month. This is tempting, but it should keep you away from these traders unless you have a long proven track record of similar earnings that seems unrealistic.

Social Trading: Advantages

You will understand that social trading has many advantages, especially for beginners. Let’s use this section to summarize.

Leverage the expertise of experts

Of course, the first advantage of social trading is that you can replicate the trading performance by copying the positions of experienced traders. Learning to trade takes time and money, and many want to make money by trading without training in technical, fundamental analysis, and risk management.

Thousands of Distributors You Can Replicate

Social trading platforms like eToro have hundreds if not thousands of traders copying them. So you have a lot of choices and the platform’s search function allows you to rank according to a variety of criteria, so you can choose the traders who will follow the strategy that best suits your expectations in terms of risk appetite and potential return.

Watch and learn

If some people are satisfied with copying a trader’s position and observing the results, then the traders we follow may be more proactive by trying to understand the logic and rationale behind the positions they traded.

Better assessment of possible returns

Finally, as long as the detailed historical performance of the trader to be copied is presented on social trading platforms, it is very easy for us to estimate how much money we can expect to follow a particular trader by reporting ourselves. For example your average monthly revenue.

Social Trading: Disadvantages

While the benefits of social trading are undeniable, there are also some downsides and risks to be aware of. This is what we will discuss next. Following experienced traders with a strong historical track record can create a false sense of security. This allows you to place more bets than you could lose in a very risky market.

Business accidents happen even to the best traders. Also, gains accumulated over several weeks can sometimes fly away in minutes. The risk of loss is usually lower with copy trading than manual trading. But they still exist.

A copy trader that doesn’t live up to your expectations

Likewise, it is possible to choose the wrong operator to copy, not to mention accidents or business mistakes. For example, an operator may be disappointed with poor performance. Other copiers will be happy with the reduced risk.

Trading Signals and Social Trading

Trading positions of experienced and successful traders in social trading are copied automatically. However, there are less practical but interesting alternatives. It’s a trading signal.

Unlike copy trading, trading signals must be manually duplicated. In particular, you may receive commercial signals consisting of entry prices, suspensions, and free limits via email, notification, SMS, or otherwise, then copy this location or not allocate the desired capital. So, when you can make your own trading decisions, you can filter out trading signals and only follow those you think have the best profit potential.

How do you become a popular investor?

In the context of eToro brokers, the term “hot investor” refers to verified and verified eToro traders who can copy positions through copy trading platforms.

This popular investor is rewarded with fluctuations. This is discussed later in this section. Any eToro trading account holder can become a popular investor regardless of the amount of capital in the trading account.

However, several conditions must be met.

- Do not live in the United States, Canada, Japan, Iran, Brazil, North Korea, or Turkey.

- Post real photos and names on the eToro network in the context of eToro brokers, the term “hot investor” refers to verified and verified eToro traders who can copy positions through copy trading platforms.

Social Trading: Tips for Beginners

At the end of this social trading guide, here are some basic tips to get you started with copy trading.

Choose your social trading platform carefully

Just as Facebook, Twitter, and LinkedIn pursue different political goals, social trading platforms have different offerings to investors. Investors need to know which assets they are investing in (stock indices, currency pairs, CFDs) and which platforms support them.

Some platforms offer demo accounts, some do not. Also, some platforms offer automatic trading while others only offer manual options. The platform also needs to consider a minimum deposit for trading and may or may not offer a mobile trading app.

Start a demo account

Whether you’re a beginner or not, it is always advised to start with a demo account. The demo account allows you to observe the strategies of different traders and learn how to rank different opinions through independent research and observation. You can also study how traders think and trade and choose which ones to follow.

Don’t follow too few or too many traders

Social trading always carries certain risks. An imitated trader needs to perform well, but no one can be perfect. As a result, traders you follow can sometimes make the wrong decisions just like any other investor. Your risk is to follow the wrong operator. Traders who make big profits suffer big losses and generate very little net profit.

Follow the trader’s strategy

Verified traders can incorporate information into their trading strategies, even if they appear automatically. Traders have personal issues and stress points that can affect their trading decisions and strategies. Some traders may be overconfident and pay less attention to news and advice. Traders who were previously stable can panic and buy and sell assets without good reason. You may also suddenly decide to hold your assets against market movements.

Think long-term investments, not quick returns

Social trading is an attractive proposition for those looking for fast payments. As with all investments, alternative or not, the best chance of success comes from long-term planning with accumulated profits. Investing in extremely high payouts in the shortest possible time maximizes risk and minimizes success.

Conclusion: Should we use social trading in 2021?

Therefore, social trading has many advantages. While beginners benefit the most, social trading can be useful for a variety of merchant profiles. Copying and observing the positions of experienced traders is not just making money by replicating their performance. You can also learn to trade by looking at the strategies underlying the positions.

Several online brokers are offering social trading platforms, but there is no denying that eToro is a leader in this field. Many traders can copy it, its advanced search feature ranks the best experts, and most importantly, its practical and easy usage – Platform usage.

Frequently Asked Questions

What are the biggest advantages of social trading?

The great thing about social trading is that you can copy professional traders’ positions for free. How to replicate performance? No one has any errors. Even the best traders can incur huge losses. However, there is no denying that it is less risky to imitate the positions of a verified trader than to make your own trading decisions without taking the time to properly analyze the market.

Is social trading suitable for beginners?

People new to trading are usually most interested in social trading. You can benefit from the experience of successful traders. This is while learning by tracking and analyzing the copied location.

How much money should I invest in social trading?

The minimum investment required to run social trading is the minimum required to open an account with the broker. With eToro, for example, you can open an account and start trading social media for just $200.

What is the best social trading platform?

eToro is undoubtedly the world’s leading social trading provider. Thousands of sellers offer copies. It also offers advanced sorting features to help you select a dealer to copy. You’ll find an intuitive platform that learns quickly over time.

Is social trading risky?

As with any business activity, social trading involves risks. However, the experience of imitative traders reduces the risk compared to traditional trading, especially for beginners. This is better than making business decisions on your own without experience.