The stock market has demonstrated to be a fantastic tool to increase wealth. However, it’s not the only option, alternative investments may sound right for some individuals to include in their portfolio.

Any investment that is not traded on the stock or bond exchanges is considered an alternative investment. In this guide, we will examine each type of alternative asset in more detail, along with the benefits and drawbacks of investing in each.

What are Alternative Investments?

Asset types other than stocks, bonds, and cash are known as alternative investments. Because they can’t be simply sold or turned into cash, these assets are different from more conventional investment categories. Alternative assets are another common name for alternative investments.

Alternative investments, one of the most dynamic asset groups, include a variety of investments with distinctive qualities. Knowing about these alternatives is crucial for all types of investors and industry professionals as a number of them are becoming more and more accessible to retail, or individual, investors.

Types of Alternative Investments

There are two types of alternative investments available.

Tangible Investments

These are the alternative investment categories intended for physical assets. A tangible investment occurs when an investor spends money on a genuine asset, personal property, or hard asset. Some of these assets are valued based on their ability to appreciate, while the remainder is valued based on their ability to create revenue as they deteriorate. Collectibles, for example, have a high appreciation value and are thus valued accordingly. Leased equipment, on the other hand, is appraised based on its amount of depreciation.

Intangible Investments

Intangible investments are made in assets that cannot be seen or touched, but whose status and worth may be tracked and judged based on market performance.

Best alternative investments in UK 2022

Following are some of the most common types of alternative investments:

1. Real Estate

Real estate has long been a very well-liked alternative investment. In fact, many people were hesitant to invest in real estate after the 2008 real estate market crisis in the United States. However, real estate can present a wonderful investment opportunity because prices are still incredibly low. Purchasing rental property on your own, joining a real estate investment group, or purchasing shares in a real estate investment trust are the three easiest ways to invest in real estate (REIT). If you find the right renters, buying rental property may typically generate consistent, dependable income. Although there are costs like property taxes and routine maintenance that can limit profitability, there are also significant time and effort inputs.

Real estate investment organizations provide a more hands-off, risk-free approach to real estate investing. Money is contributed by a number of private investors to a business that buys real estate. For a percentage of the monthly payment, the corporation oversees the property. The real estate investment trust is another choice (REIT). They offer incredibly convenient options for people to invest in real estate. A group that invests in a variety of real estate holdings is known as a REIT, and the IRS grants it advantageous tax status in return for it paying the majority of its revenue to shareholders. Since REIT shares may be purchased on public exchanges, they are among the more liquid alternative investments. Another benefit is that REIT shares pay out dividends on a regular basis, just like equities do.

2. Financial Derivatives

Futures, options, forwards, and swaps are within the category of financial derivatives, which also includes other securities. Derivatives are essentially an agreement between an investor and a third party that provides for a payout when a particular asset reaches a specific level. Due to the fact that derivatives are a fairly broad category of security, this definition may seem ambiguous. In a futures contract, the investor promises to purchase a particular item on a specific date for a specific price. Similar to a choice, but with the purchase being optional. Two parties trade an asset in a swap, frequently in exchange for a preferential interest rate.

Because experts attribute the 2008 credit crisis to flaws in the derivatives market, derivatives have come under fire. Derivatives are frequently employed, nevertheless, to lower risk in a portfolio of investments. For instance, a fund manager might employ interest rate swaps to profit from fluctuations in interest rates or foreign currency futures to offset potential losses in investments made abroad. Options and futures are two derivatives that are reasonably accessible to individual investors. Some (such as several swaps) are often exclusively traded by significant institutional investors.

3. Venture Capital

Venture capital is a special kind of private equity that concentrates on start-up companies that are very early in the business growth process. The firms of venture capital give these businesses the initial funding they need, and they get paid back when the business issues stock or sells it to another business. Typically, if at all, the return on investment is delayed by roughly 10 years. Because these companies are so young when venture capital firms invest, their investments are very hazardous. However, in order to reduce that risk for the entire company, they distributed their capital across a wide range of businesses.

The disadvantage is that most venture capital funds demand a sizeable minimum commitment from investors and a net worth of at least $1 million. Additionally, venture money is quite difficult to convert into cash; typically, investments must be held for a number of years.

4. Hedge Funds

Hedge funds frequently stake a sizable amount of money in the direction of the stock market, but they also make clever investments in securities to lessen or hedge against the danger of sizable losses. The investing of Hedge funds can expose you to a potentially lucrative investment technique, but you run the risk of losing all of your money.

A hedge fund’s standard fee structure is divided into two components. The management fee for a hedge fund is 2% of the assets under management each year, and 20% of the profits generated by the investments in the fund are retained by the manager.

It is feasible to invest in hedge funds that correspond to your level of risk tolerance because hedge funds use a wide variety of investing strategies. Look for hedge funds with managers who have comparable investing views when conducting research on them.

5. Managed Futures

Managed futures funds operate similarly to hedge funds in that fund managers pool investor money and invest it in a variety of financial instruments. Hedge funds are less regulated than managed futures, though. Investments in managed futures funds are made in futures or options on the markets for commodities, currencies, and interest rates. Futures and options are essentially wagered on the performance of specific equity or investment.

A futures contract is an agreement to purchase a specific quantity of a commodity, stock, or even money at a specific price and date. Depending on how the actual price changes in relation to the agreed-upon price, either the buyer or the seller may potentially profit. The main difference between options and obligations is that options provide the buyer the choice, not the obligation, to purchase the investment.

Hedge funds are more difficult to obtain than managed futures funds. Although most investors have large net worth’s, many managers only require low minimum commitments of $5,000 or less. Since managed futures typically do not follow the patterns of other markets, they can aid in maintaining a portfolio’s diversity. The funds’ nature as a method of forecasting the performance of other markets, however, makes them extremely risky.

6. Private Equity

Private equity refers to investments in businesses that don’t sell publicly traded stock. When a business reaches a particular stage—often an initial public offering of stock or a merger—investors start to see a return on their initial investment. Start-up businesses in high-tech industries like telecommunications, biotechnology, and more recently, alternative energy, have frequently been financed by private equity investments. The performance of a start-up company determines whether an investment is successful or unsuccessful, which is obviously a risky undertaking even in a favorable economic climate. Due to this, high-net-worth individuals and venture capital firms have historically been much more active than small investors in the private equity market. Investors frequently play a direct role in developing the management plan of the developing business.

A private equity firm can help an individual investor join a pool of investors, which is one of the safer ways to participate in private equity. However, the price is very high: A buy-in of $250,000 to $25 million is common for businesses. The least risky choice is to buy shares in exchange-traded funds, which reduce investment risk by buying stakes in numerous private equity ventures at once. There are valid reasons to include private equity in a portfolio of investments. Indexes of private equity funds have performed better than the stock market both during the first half of 2010 and during the 20 years prior, despite returns suffering during the economic slump like most industries do.

7. Commodities

Agriculture-related commodities like wheat and corn, energy-related commodities like oil and gas, industrial metals like steel, and precious metals like gold are all examples of commodities. Since most investors find it impractical to hold commodities in their physical form, those who have a strong financial appetite for physical commodities typically concentrate on owning gold and other precious metals.

The three main types of physical gold are coins, jewelry, and bullion. When you directly own any precious metal, you must pay to keep it in secure facilities and to ensure the asset against theft. You can purchase gold certificates from businesses like Perth Mint Certificates that can be exchanged for actual gold if you don’t want to handle and store a tangible asset.

Even owning gold as a physical asset does not ensure financial success. Any precious metal’s price, including gold, might fall, and you must pay broker fees to complete transactions when purchasing or selling a physical good.

Commodities are regarded as an alternative asset class even when they are simply traded as futures contracts since their price movements are typically unrelated to those of the stock market. Commodity futures trading is by far the most popular technique for investors to invest in this asset class.

8. Peer-to-peer lending

Peer-to-peer lenders offer money to individuals by pooling their funds with those of other investors. Platforms for peer-to-peer lending, like LendingClub and Prosper, are designed to let you distribute your capital over a variety of loans and risk profiles, diversifying your assets and reducing your overall risk. In accordance with your own risk tolerance and time horizon for investing, you can also tailor your peer-to-peer lending portfolio.

There is always a chance that you won’t get your money back when you lend it. Peer-to-peer loans are unsecured, which means that you cannot reclaim them if necessary because they are not secured by tangible property like a house or car. However, it is often beneficial at lowering the overall risk of this sort of investing to be able to diversify your money across numerous loans with varied risk profiles.

9. Cryptocurrency

Cryptocurrency is a type of digital money made possible by blockchain technology. While it is simple to obtain cryptocurrency, investing in this growing alternative investment is dangerous. Cryptocurrency price volatility is quite high, and with so many developing digital currencies available, predicting which cryptocurrencies will be widely adopted is impossible. Because the market is still in its infancy, your cryptocurrency holdings face increased security risks because the digital wallet where you store your crypto assets may be subject to hacking. You may potentially lose access to your digital assets.

The values of several cryptocurrencies are anticipated to rise sharply as their practical applications become more apparent. Despite the fact that it is still unclear whether transactions involving cryptocurrencies will become regular, they already serve as stores of value. The rise of cryptocurrencies is causing concern in many nations, and they are working to create legislation that will have a big impact on the future of the cryptocurrency industry.

10. Collectibles

Collectibles encompass a variety of things, including Fine art, Coins, Rare wines, Stamps, Vintage cars, Mint-condition toys, Baseball cards, and many more.

Purchasing and preserving tangible assets in the hopes that their value would increase over time is the definition of investing in collectibles.

The high prices of acquisition, absence of dividends or other income until they are sold, and probable destruction of the assets if not stored or cared for properly make these investments riskier than other sorts even though they may sound more entertaining and engaging. Experience is the most important talent needed when investing in collectibles; you must be a true expert to anticipate a return on your investment.

Best brokers to invest in alternative investments

Although there are countless brokerages available, it can be very difficult to choose the one that best suits your needs and aligns with your financial objectives. Analyzing and considering the important factors for each platform, such as fees, commissions, investment assets, and regulations, takes a lot of effort.

Therefore, in order to save you time and effort, we have provided a list of the top brokerage services in the UK that you may use to make alternative investments.

1. eToro

The best broker in the world for accessing alternative investments is eToro. This platform possesses all the outstanding features that make it the greatest brokerage platform according to our standards. For a number of reasons, it is the most popular trading broker in the UK. But the primary factor drawing thousands of traders to it is that it provides a wide range of assets, including the best alternative investments commission-free. Except that every deposit will have a 0.5 percent fee, and each withdrawal will cost $5. It is the UK’s least expensive brokerage platform.

eToro offers the copy trading feature for new users. You can imitate the active transactions of seasoned traders using this option. You can diversify your investment portfolio by using the clone portfolio tool as well. Account creation on this platform is quicker than on other sites.

An eToro account can be created in a matter of minutes. After finishing the account creation process, you must fund it in order to begin your trading career. It allows a variety of payment options for making a deposit, including debit/credit cards, bank accounts, electronic wallets, and more, for the convenience of its users. For the convenience of its users, the platform also provides a mobile application.

2. IG

/IG-ef2684aaa37d4d218af819f98d676d02.png)

IG is yet another outstanding broker that provides a wide range of assets, such as alternative investment assets, foreign equities, ETFs, mutual funds, and many more. You don’t need to worry about the safety and security of your funds because it is governed by the FCA.

Users get access to more than 12,000 assets through the platform. You can also use leverage, access cryptocurrency markets, and engage in short-selling thanks to it. For individuals wishing to make long-term investments through stocks and shares ISA, this trading platform is ideally suited.

On this trading platform, opening an account is also really simple. You must, however, pay an initial cost of £8. The good news is that this entry-level cost will be reduced to £3 if you trade frequently. Once you’ve opened an account, you must deposit a minimum of $250 before you may start trading on this platform. This minimum deposit isn’t the platform’s charge; rather, it represents the operating money that investors will need to begin their investment journey.

How to invest in Alternative Investments?

Here, we’ll use eToro as an example to help you quickly grasp the entire process of investing in an alternative investment. Because it is free of commissions, user-friendly for beginners, and helps you to diversify your portfolio, eToro is our preferred trading platform.

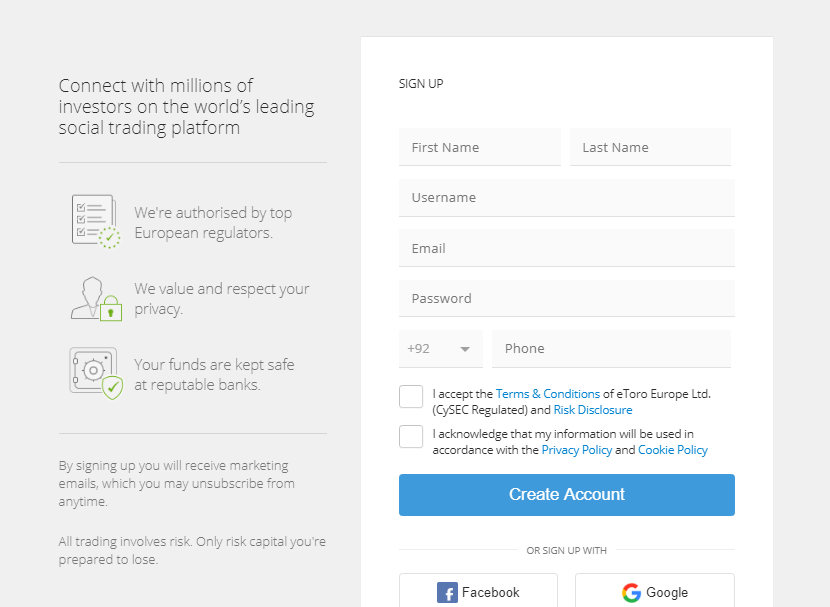

Step 1: Create an account

The first step in creating an account is to register on the company’s official website. To do so, you must complete a registration form, which may be found on the organization’s official website. In this registration form, you will be asked to input some personal information such as your name, email address, phone number, and a strong password. After entering all of your information, be sure to accept the terms and conditions.

eToro will request that you verify your identity by uploading some of your documents; nevertheless, don’t worry, your documents are completely secure on this platform.

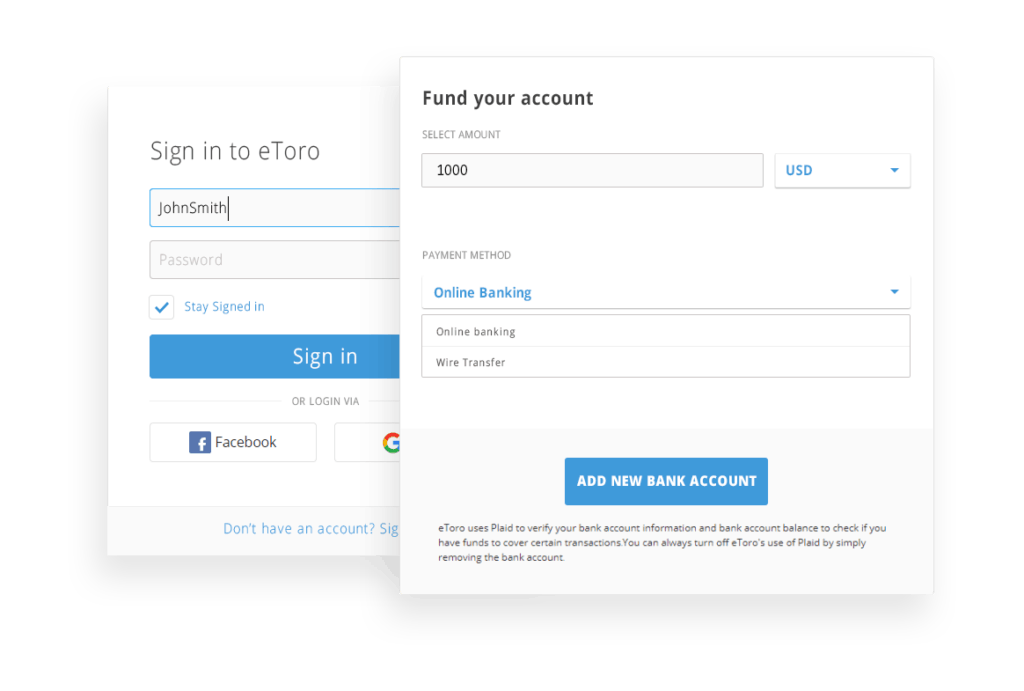

Step 2: Deposit Funds

After successfully creating an account on this platform, you are now ready to fund it with a minimum deposit of $50. This funding amount, which represents the working money required by the traders to carry out deals, is not the robot’s charge. For the convenience of its traders, eToro provides a variety of payment options. You can select the option with which you are most familiar. Debit/Credit Card, PayPal, Skrill, Nettler, and Bank Transfer are all accepted payment options by eToro.

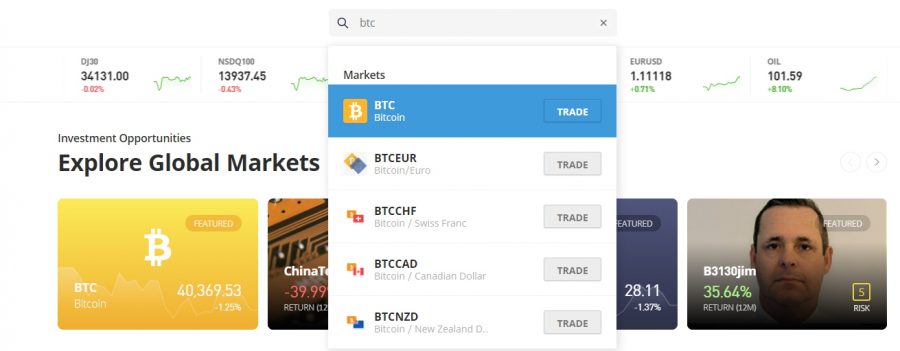

Step 3: Invest in Alternative Investments

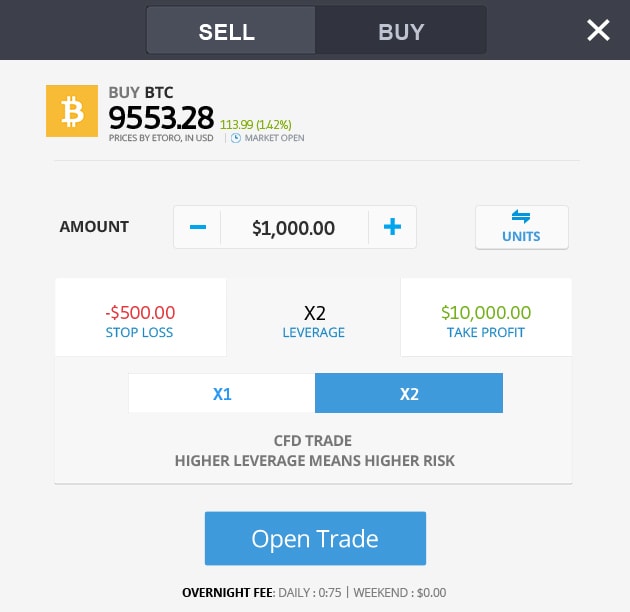

After successfully funding your account, you must now choose the alternative investment you want to make. For instance, if you want to purchase the cryptocurrency Bitcoin, just type its name into the search bar at the top of the page.

Select it, enter your desired investment amount, and then click the “Open Trade” option.

Advantages of Alternative Investments

- Low correlation: The most significant advantage of alternative investments is their low correlation with traditional asset types. Commodities, for example, may perform well when the stock market is under pressure.

- Diversification: Because of their minimal correlation to stock or bond markets, alternatives can help diversify a portfolio.

- Low volatility: Alternative investments may help to lessen overall volatility within a portfolio of traditional investments because their performance has traditionally had a low to moderate correlation with market indices.

- Potentially higher returns: Alternative investments are riskier, but they also have the potential for bigger returns.

Risks of alternative investments

- Illiquidity: Alternative investments are typically private rather than public, and they are frequently less liquid, with reduced liquidity ranging from monthly to 12+ years, making it more difficult to exit and keeping your money in them for a long time.

- Lack of regulation: Alternative investments are not regulated and do not involve reporting. Furthermore, the underlying assets of alternative investments are frequently difficult to evaluate, posing pricing and price transparency issues.

- High minimum investments: Many alternative investments have significant minimum investment requirements and may not be accessible to all investors. Furthermore, alternative investments typically have greater fees.

- Complexity: Alternative investments are frequently sophisticated products that necessitate a higher level of due diligence. If you are thinking about making an alternative investment, make sure you investigate and understand the potential tax implications.

Conclusion

Alternative investments provide more portfolio diversification, lower overall risk, and the possibility for higher returns. These investments are becoming increasingly important to know about for both investors and current or aspiring investment professionals looking to advance their careers as they become a bigger part of the investing environment and more accessible to various types of investors.

If you want to start investing in this investment class in the UK, we strongly advise you to start with the world’s best trading platform, eToro. Because it provides access to a wide range of asset classes without changing any commissions and because the account is extremely user-friendly.

Frequently Asked Questions

What are the alternative investments?

Alternative investments are those made in assets and methods that are not considered to be stocks, bonds, or cash.

What alternative investments in the UK are the best?

Bitcoin, real estate, and peer-to-peer lending are a few of the best-known alternative investment products.

Where in the UK can I purchase alternative investments?

You can access alternative investments through a huge number of platforms. To our knowledge, the finest platforms for purchasing alternative investments are the ones stated above: eToro and IG.

Are alternative investments risky?

Every investment involves some level of risk. There is no investment that is completely risk-free; different types have different levels of risk. And certainly, alternative investments do carry a significantly larger risk.

Are ETFs regarded as alternative investments?

Like shares, ETFs are exchanged on a public exchange. These are not regarded as alternative investments as a result. However, you can use an ETF to invest in alternative investments like gold and silver.