Stocks are an investment in a financial market that you make by buying a share in the company that issued the stock. Stocks allow ordinary people to invest in the world’s top leading companies. A stock market is more organized and regulated when compared with other markets, such as forex. In this guide, we will give detailed knowledge on how to trade Stocks for beginners?

What are Stocks?

Buying stocks means that you are buying indirect ownership of the company because of the shares you hold in that company. Well, it doesn’t mean that you get to sit next to them in the company’s official meetings. However, if you choose to exercise it, you get a right to vote in those meetings.

Pros and Cons of trading Stocks in the UK for beginners

Pros

- Great profit potential

- Require a lot of money to get started

- A good way to stand inflation

- Easy buying and selling

Cons

- Some investments might involve risk

- Time-consuming investment

- Highly competitive

- Roller coaster investments

Why Investors Own Stocks?

Investors buy shares in the hope of earning returns. They buy stocks at a low price and hope for the value to increase so that they can enjoy huge returns on their investments.

Another reason that traders buy stocks is that stocks pay dividends. Well, not all stocks pay dividends but yeah, many do. Dividends are the payments that are made to shareholders out of the company’s revenue.

Over the past ten years, the annual average return of the stock market has been somewhere between 7 % to 8% after inflation, if we do not count inflation then it is about 10 percent a year. That means if you had invested $1000 30 years ago, then today it would be worth more than $7000- $8000.

However, not every company offers the same returns, some offer less and some offer Insane returns. Therefore, having invested in more than one company is the wisest decision one can make.

Types of Stocks Available

There are various categories of stocks depending on their performances. We have Top stocks, Dividends, and Tech Stocks. Let’s understand each of them clearly.

Top Stocks: Top stocks are those stocks that tremendously outperform in the market, just like a blue-chip. Read more about Top 10 UK Stocks to Buy Now

Dividend Stocks: Dividend stocks as we have studied above are those stocks that focus on offering earnings to shareholders out of companies’ revenue in comparison to the wider market.

Tech Stocks: Tech Stocks, as the name suggests are the stocks that are in the technology industry.

Growth Stocks

A growth stock is a stock that is anticipated to perform at an above-average rate compared to the market. One thing to note here is that growth stocks do not offer dividends because these companies prefer reinvesting earnings to accelerate growth in a short period. Growth Stocks share some sort of competitive advantage that justifies their potential of staying ahead of others in the market, it can be either a new product or a great process, Innovative plans proprietary patent. One such good example of growth stocks is pharmaceutical stocks. Because of the fact that it lacks dividends and requires heavy investment, growth stocks are highly risky.

Value Stock

In Value stocks, stocks are traded at a lower price than their original price. Unlike Growth Stocks, Value Stocks are capable of generating high yield dividends. For several reasons, the price of value stocks can be undervalued. It could be for a reason that the company has a low stock valuation or maybe because of the bad press or tighter regulations.

Conversely, value stocks and growth stocks are equities of companies that have growth potential.

Penny Stocks

A share that has a value worth below £1 in the UK or below $5 in the US is known as a penny stock. The value of this stock is the only thing that distinguishes it from other stocks.

When deciding to trade penny stocks in the UK, you are highly advised to handle them with care as they can be highly volatile.

How to trade stocks in the UK for beginners- Choose a Stock Broker

License and Regulation

With thousands of brokers around, it is very hard to select the one and it is even harder to trust the broker. Therefore, the first and foremost thing you should consider while searching for the best stock broker in the UK is to check whether the broker is licensed and regulated by jurisdiction or not. If the platform is not licensed and regulated by financial authorities then you cannot trust brokers with your funds. The non-regulated brokers are the scams that dupe away with your money. In the UK, the FCA is the regulatory platform that ensures the platform can be trusted with the funds. Therefore, when selecting a broker in the UK, check whether it is regulated by FCA or not. If not then, find another. If yes then the platform is good to go with. ASIC and CySEC are other regulatory bodies and if the platform has regulation from multiple jurisdictions then it is icing on the cake.

Stocks to Buy

While selecting a stock broker you should first consider checking whether your broker cooperates with more exchanges or not. Because the more exchanges the more will be the stock pool.

Below is the list of some important exchanges:

- London Stock Exchange (UK)

- Alternative Investment Market (AIM)- (UK)

- NASDAQ (US)

- NYSE (US)

- Deutsche Börse (Germany)

- Euronext (Europe)

- Australian Securities Exchange (Australia)

- Tokyo Stock Exchange (Japan)

- Hong Kong Stock Exchange (Hong Kong)

If your broker covers the UK as well as other international markets such as Australia, Japan, US then it’s a win-win you can easily diversify your portfolio to lower trading risk.

Payment Methods UK

Another thing that you should consider before choosing a stock broker is to confirm whether the platform offers various payment methods or not. Having various payment methods is very convenient for investors, as it allows them to choose the payment method of their choice. And, to your relief, many UK stock brokers offer a whole range of payment methods. Below are the most popular ones:

- Visa/Mastercard

- PayPal

- Sofort

- Neteller/Qiwi/Skrill

- Wire Pay

- Fastapay

- POLi

- China Union

- Bpay

Where to Buy Stocks in the UK for beginners

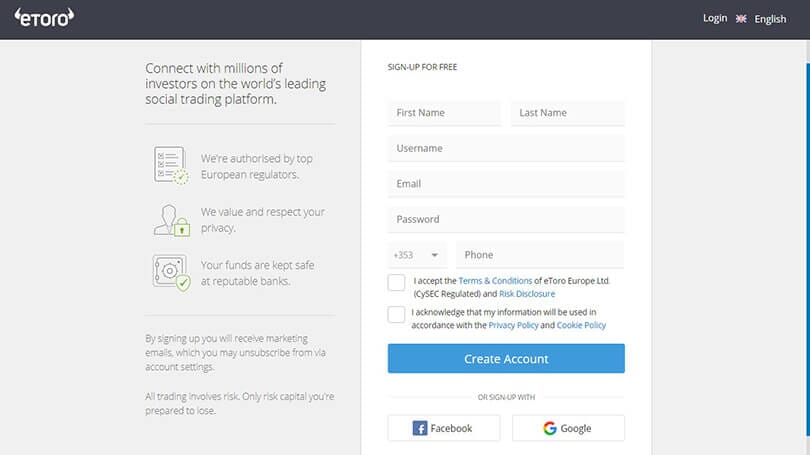

eToro

eToro is an online broker in the UK that ranks number one on our list. This stock broker has everything you are looking for from regulations to minimum investments to fees and commissions to supported payment methods. This stock broker is regulated by FCA and allows you to diversify your portfolio by offering CFD trading, ETFs, Stocks, and highly secured assets, and many more. On eToro you can benefit in no time by using its Copy trading feature and ready-made Portfolios.

The user interface of this broker is beginner-friendly, that is it is easily accessible even by new investors. Moreover, the platform offers a demo account feature to help its traders practice trading before initiating live trading. The best part is that this platform charges 0 percent commission on stocks

Pros

- Regulated broker

- Offers mobile application

- Transparent platform

- Safe and secure platform

- Offers powerful social trading feature

- Offers free demo account

- The commission-free platform for stocks and ETFs

Cons

- Doesn’t offer much educational and research tools.

Capital. Com

Capital. Com is another best online broker that is available in the UK. It is regulated by FCA CySEC and NBRB. The platform has received many accolades recently including, the best Online Trading platform 2020, Most Innovative broker Europe 2020, Most Transparent Broker 2020, and Service Provider Europe 2020. This platform charges no commission, no hidden fees, and AI-powered trading.

Pros

- No commission or hidden fees

- Regulated by FCA CySEC and NBRB

- Provides high-quality online courses

- Provides trending financing news

- Highly secure

- Offers hedging to mitigate risk

- Use the latest encryption technology

Cons

- Only offers CFD trading

- Offers limited leverage for shares

CMC Markets

This popular stockbroker allows traders to go long or short on thousands of international markets. This broker offers various trading instruments to diversify your portfolio including, Forex Pairs, Indices, Cryptocurrencies, Commodities, Shares and ETFs, and Treasuries. This UK stockbroker offers two types of accounts one for beginners and one for experienced traders, and both of these brokers charge no minimum deposit. If you are a kind of investor who is planning on a long-term investment then this platform is highly advisable. On this platform, you get access to more than 115 indicators, tools to analyze profitable stocks. The platform is easy to use and is very transparent. The only drawback to this platform is that its funding process is very slow, it takes two to three days to fund your account.

Pros

- Allow convenient trading on margin

- Offers risk-free demo account c

- Doesn’t require a deposit

- Easy trading platform

- Offers 24/7 customer support

- Regulated platform

Cons

- Slow funding process

Pepperstone

Now that the stock broker that we have on our list is Pepperstone, this stock broker is highly popular as it allows access to more than 800 CFD instruments with a low spread. It also offers Forex trading. The user interface of this stock broker is beginner-friendly. The platform offers you access to equities such as Pfizer, Tesla, Uber, e.t.c. Most importantly the platform boasts high-security standards so that the funds and details of the users do not get compromised at all.

Pros

- User-friendly interface

- The easy and fast registration process

- Highly secure platform.

- Regulated platform

- Access to more than 800 CFD

Cons

- Lack of research and educational tools

- The customer care staff isn’t active 24/7

Markets. Com

This brokerage platform allows you to trade more than 7,500 stocks from 16 exchanges. This platform was created in 1999 and currently is available in the UK. The platform doesn’t compromise on the security sector.

Pros

- Plenty of CFD trading options

- Offers low spreads

- Offers more than 7000 stocks

- Access to sixteen exchanges worldwide.

- Stay updated on the latest stocks

- Provides high security

Cons

- Bit pricey than other platforms

- Requires initial deposit.

Things to Consider before you purchase Shares in a Company

Diversify your investments

Diversifying your investments simply means reducing economic risks that are involved in investments by speeding your investments among different assets. The purpose of diversifying is to maximize the returns by investing in different financial categories that would react differently, often in opposite ways, to market influences.

It simply means that you should never put all your eggs in one basket. Well, it also doesn’t mean investing in different assets in the same industry. For example, If you are buying 10 Apple Shares, 100 Google Shares, 10 Microsoft shares, then this is not what diversification is. Because the shares are different but they all belong to technologies. Instead, the wise decision is to buy 10 Shares in Apple, 10 in Amazon, and 10 in Tesla. Now, this is what diversification is, buying different shares in different sectors.

Don’t Rush

This is something very important, if you don’t have knowledge of what you are doing then it is better to quit it and first learn it because it is better to have little in your pocket instead of having nothing. Therefore, if you have never experienced trading or invested in the UK, US, or other shares, then it is better to give it a rest and start with the smallest possible Investment instead of rushing it. Because of the reason you have no experience, losing money at the start is natural. That’s why it is advised to start with making a small investment with small-cap stocks because they are cheap yet highly profitable.

Analyze a company

Before you buy shares in a company it is important to analyze the company. Make sure to analyze key business metrics, its past and present performance, its financial health. Don’t buy shares without having macro, fundamental, and depth in analysis of the company.

How to Buy Stocks in the UK for beginners?

Step1: Open an account

The very first thing to start investing in is to create an account on your chosen brokerage account. Here, we are taking eToro as an example so that you get a better understanding. To create an account on eToro you are first required to fill in a registration form, by entering in your basic details like your name, phone number, email, address, and date of birth.

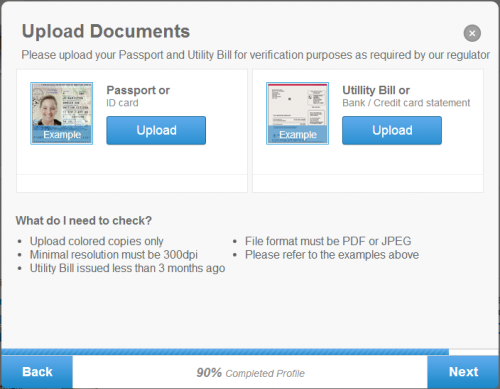

Step 2: Verification

After registering yourself on the platform you are then required to undergo a verification process by uploading a copy of your ID proof. It can either be a copy of your driver’s license, passport or address proof.

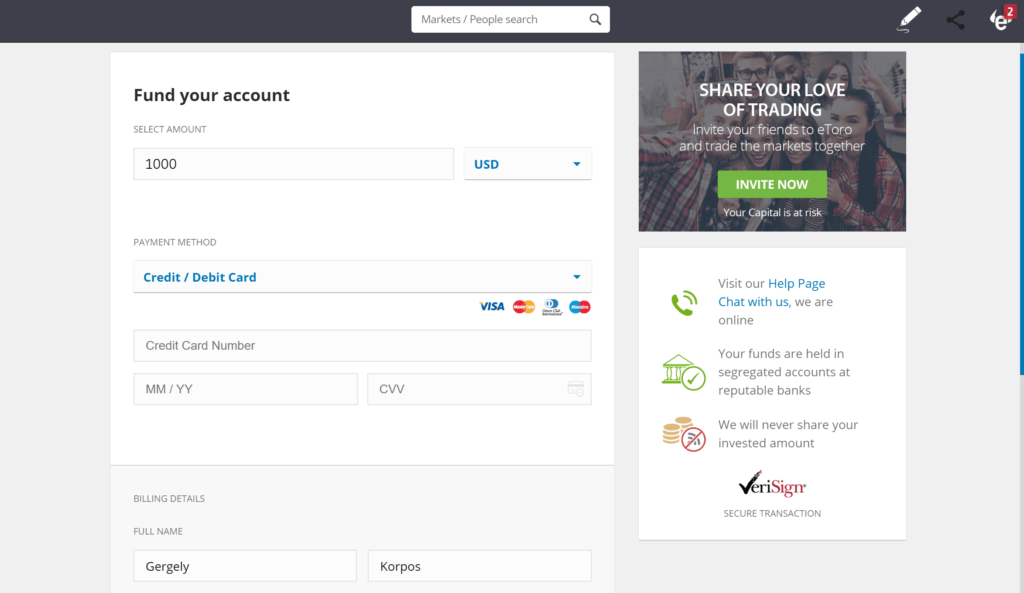

Step 3: Fund your Account

Now that you have successfully a registered and verified member on eToro you are now required to fund your account by making a deposit.eToro offers various payment modes to make a deposit through credit/debit card, Nettler, PayPal, bank transfer, and Skrill for the convenience of its traders.

Step 4: Select Stocks to Buy

Once your funding is complete, you are now allowed to select the stocks you want to purchase. You can do so by utilizing the Trade Markets tab or by using the search box on the top of the website.

Sometimes the names of the companies are in the database so if you want to search Apple, you could type APPL.

When you find the stock you are searching for, click on it and you will then see a piece of detailed information about the company including, graphs, pricing aspects, current, position, e.t.c.

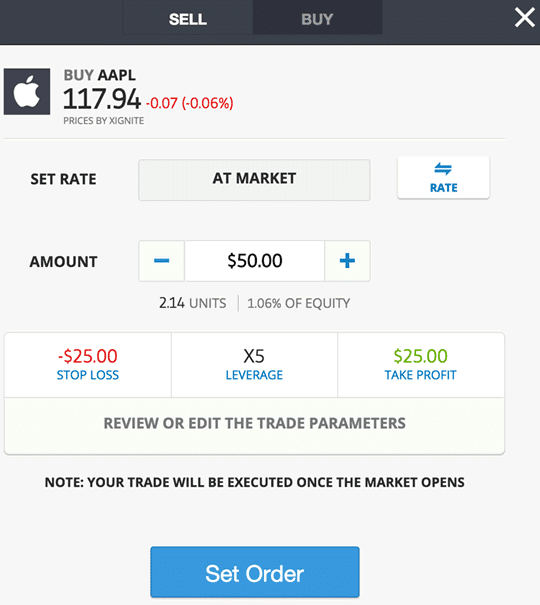

Step 5: Buying Your First Share on eToro.

Once you have selected your desired asset, you can click on “Trade” and then another window will open which requires you to enter the amount of your desired asset. After entering the amount click on the Open Trade. You can also schedule your purchase if you want by setting an order.

Step 6: What’s next?

Now you officially are an investor. If you have decided on holding your stocks for a longer period then you don’t have to check price movements regularly. But, If you are a short-term buyer, you should set stop loss and Take profit features. The Stop-loss feature minimizes the risk by closing the trade automatically when it reaches a certain loss, and Take profit on the contrary automatically sells the stock when it reaches a certain profit. Such parameters put off the burden of following the market since trades are closed automatically when the levels are reached.

How to buy stocks in the UK for beginners- Basics for Beginners

What is a Stock?

Stocks are an investment in a financial market that you make by buying a share in the company that issued the stock. Stocks allow ordinary people to invest in the world’s top leading companies. A stock market is more organized and regulated when compared with other markets, such as forex.

What do Shareholders get in return?

You have probably come across the term “controlling interest”. It means getting control of the company because you own most of it. However, if you bought a tiny part of the company, you become a shareholder of that company and also get privileges to various rights, the main ones being:

- Right to vote at shareholders meetings

- The right to receive dividends

- In the case of liquidation, the right to receive part of the company.

What do share earnings depend on?

It depends on three major conditions: what resources and strategies you have in your mind, on what platform you trade, and what the chosen assets are.

Below are the questions that you are required to ask yourself before you invest:

- How much money do you have and how much you can afford to lose.

- For how long are you willing to hold shares to buy the UK?

- What is the affordable level of risk?

Stocks Trading Methods in the UK

There are two methods in which you can trade shares, either by buying the physical share or by trading via Spread betting or CFD trading account. The major difference between these two is that with spread betting or CFD trading you do not need to own the underlying asset, you trade virtually on its price movements.

Spread Betting Stocks

When trading shares with spread betting you will see some major differences in comparison with CFD trading in Tax and Availability.

Tax: Spread betting puts off all the burdens of paying capital gains taxes unlike CFD trading and share trading.

Availability: It is only available in the UK and Ireland.

CFD Trading on stocks

CFD trading is different from traditional share trading accounts in terms of Stamp Duty, Leverage, Native mobile apps, and Lower Costs.

Stamp Duty: CFDs are exempt from stamp duty.

Leverage: To amplify both profits and losses, CFD trading accounts are pre-set to trade with leverage.

Native mobile apps: CFD trading offers mobile apps for its customers

Lower Costs: It offers lower costs than share trading.

Conclusion

So, now I hope you got all the information you were looking for.

Let me summarise how to buy stocks in the UK for you. To buy stocks all you are required to do is to search for the online brokerage platform that allows you to diversify your portfolio and then register yourself on its website to create your trading account. After registering yourself, fund your account and start trading stocks.

However, if you still are not sure whether you are ready to dive into the stock trading market then don’t hurry and if you are a beginner you are again advised to start stock investment with the lowest possible amount.

FAQs

- How do beginners trade stocks?

To trade stocks, beginners should first research what trading stocks really mean and once you get all the information and feel confident then start trading stocks by creating an online trading account on an online brokerage platform.

- What are the best stocks to invest in the UK for beginners?

This depends on your trading goals and strategies, how much you are willing to take risks because there are traders who prefer investing in stable and reliable stocks and there also are traders who prefer investing in riskier stocks and this varies depending on the sector the company trades in.

- Who is responsible for regulating the UK stock market?

For regulating the UK stock market, the Financial Conduct Authority (FCA) is responsible.

- What kind of payments are accepted to buy shares online in the UK?

In Uk, the stock brokers mostly accept Visa, Master Card, bank transfer, PayPal, skrill, sofort, and many more. You can choose the payment method that works the best for you.

- Is trading stocks the same as Buying and Selling?

Trading stocks is similar to buying and selling stocks physically, the only difference is that when trading you don’t need to own the underlying asset. You get indirect ownership of the assets. When trading derivatives, you open based on your predictions on whether the price of a share will rise or fall, and subsequently enjoy returns or losses depending on the results.

- When should you buy and sell stocks?

You should buy a stock when it is undervalued, and hope for its value to rise and if you think the value of the stock is overvalued, you could sell it at a higher price hoping for the value to drop.

- Where do I trade stocks?

For each country, there is a major Centralised stock exchange on which stocks are traded. Just like the New York Stock exchange and London Stock Exchange.

- What are stock trading apps?

Stock trading apps are mobile applications that are specially designed for the convenience of traders who prefer mobile or desktop devices. These apps work exactly the same as they do on desktop devices.