Options are a very complex form of financial trading, which allows investors to profit from both rising and falling markets. In options, you have the right to sell your purchase of the underlying asset but you are not obligated to do so. It is completely your choice. Trading options is not a piece of cake, you cannot start trading options when you have no idea what exactly is options trading and how it works?

What is Options Trading?

An option is a contract that allows an investor to buy or sell. Options are a form of financial trading that allows traders to access their chosen asset class in a low-risk manner. There are no requirements to purchase the underlying asset in full unlike traditional financial products such as stocks, Uk bonds, or ETF trading. All you need to get access to the options trading market is to pay a small percentage of the asset, known as a premium.

The knowledge required for options trading is to determine whether you think the asset will rise or fall in value before the options contracts expire.

Pros and Cons of Options Trading

Pros

- Access the market by paying a small premium

- Can be traded on most asset classes

- Great for hedging

- Numerous of strategies to choose from

- You can never lose more than the premium

- Can be traded with leverage

- Allow to cashout your contracts at any time before expiry date

Cons

- Complexed form of trading

- Chances to lose all your money

Options Trading Strategies

There are various options trading strategies that you can use. Following are the row most widely used strategies that are highly used by experts:

Married Put

In this strategy, investors purchase shares of an asset and also purchase put options for a similar number of shares. By doing so, investors earn a right to sell stocks at strike prices. This strategy is used to mitigate the risk of loss and is often called a form of hedging. It works just like an insurance policy.

Let’s assume an investor buys one hundred shares of stocks and purchases one put option simultaneously. For this investor, this strategy may be a game-changer because he is protected even if the value falls. Simultaneously, he can also participate in every upside opportunity if the stock value rises. However, this leaves investors with one disadvantage, which is if the stock value doesn’t decrease, the investor will lose the premium amount he paid for the Put Option.

Long Straddle

On the contrary, the long Straddle strategy is a strategy in which an investor purchases a call option, puts an option on the same underlying asset with the same strike and expiration date, simultaneously. This strategy is used when investors are sure that the price of the asset will move out of a specific range, but they are not sure of which direction the price will move. This strategy allows investors to get benefited, no matter which way the market will go.

For example, let’s say you are holding both call and put options on gold, and the asset is likely to go on a continuous upward trajectory. Then the smart thing you will do is to offload put options and keep your call options in the Market. Therefore, even though you are making a loss on your puts, you also have a prolonged upside potential with your calls option.

Options Trading Terminology

Call option and Put option

Options trading allows investors to go both long and short on the asset, which means investors can profit from both rising and falling markets.

“Calls” and Put “Options” are the most important terminology in options trading. These two terms are simply used for telling in which direction you think the market will move. Therefore, calls and puts works to buy and sell orders. A call option is used when you predict the increase in the prices and A put option, on the contrary, is used when you predict the prices to fall. Simply put, a call option is purchased when you predict an increase in the value of the asset, similar to placing a buy order. And, put options are purchased when you predict a decrease in value, similar to placing a sell order.

Expiry Date

Option Contracts also have an expiry date just like futures contracts. However, the period of the contract is different from that of the futures contract. It can be either three months, one month, a week, or even a day. Well, it doesn’t matter how long or short a contract period is, it will always have an expiry date. The best thing in options trading is that even though you have a contract expiry date, you are not obligated to purchase or sell the asset. Here, it is your choice to decide whether you want to purchase or sell an asset depending on whether you are in the possession of calls and puts. Therefore, the most you can lose in options trading is the premium amount that you have paid at the very beginning to access the options market when your predictions fail.

Premium

Premium is the amount that you pay to access the options market. It is a non-refundable security deposit, which means if your trade is unsuccessful you lose the premium but even if your trade is successful you again lose the premium because in this case, you have to subtract the premium from your profits. The premium varies from asset to asset as it depends on various factors including, asset class, length of the contract, the broker behind the contract, the strike price. However, it will always be priced between 5-10 percent of the total contract price.

Contract Value

In options, we have noted that an unsuccessful trade would have resulted in a loss of a premium only. And, UK brokers require you to purchase more than one contract. For example, if stock options normally consist of one hundred contracts. Therefore, paying a premium of $10 per your total outlay would have been $1000. Therefore, if the contract had expired, you would have lost $1000.

Thankfully, UK options trading sites are ideal for those who have zero to no experience in options trading as these sites allow investors to access the market at very low premiums.

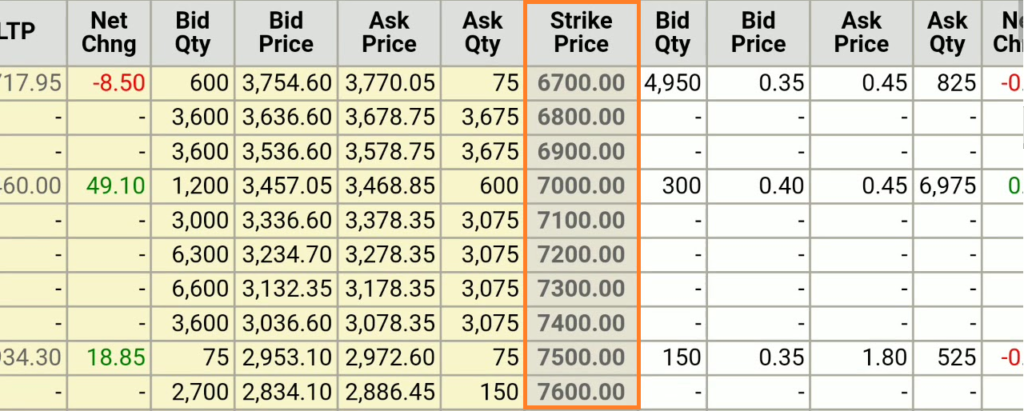

Strike Prices

Strike prices are the prices that are needed by the assets to surpass to make a profit. Strike prices in every scenario will always be different from the current value of the underlying asset and will always be set by the market itself.

What Assets can be traded as Options in the UK?

When trading options in the UK you can enjoy the benefits of accessing a variety of asset classes. Following are some of the major asset classes that you can trade on the options market :

- Indices

- Stocks

- Energies

- Forex

- Agricultural Products

- ETFs

- Hard Metals

One thing to note here is that stock options can usually be traded in lot sizes of 100 contracts.

Binary Options Trading

You might have come across the term Binary options in the online space when reading about options trading. In some cases, binary options trading is similar to traditional options trading. However, there also are differences that are worth noting. The very first thing you should know is that binary options trading has a yes or no outcome, which means you can either win or you won’t. And, the most important thing is that the winning amount on binary trading options is always fixed.

For example, let’s say you are trading ABC stocks, which are currently priced at $70per share and the strike price is $71 as offered by your chosen broker.

The market is active for about twenty-four hours from when you have placed the binary options trade. So, the task you are left with is to speculate whether the ABC share will be worth more than $71 or not this time tomorrow. And, the broker offers a win rate of ninety percent and you stake $100.

That means you purchased a call option on this trade. Therefore, if your predictions are correct you will win 90 percent of your stake and if the price falls below $71, you will lose your $100 stake.

It also doesn’t matter even if the ABC stocks surpass $71 and finish at $71.50, $75, or even $100, you will only make 90 percent of your stake. This means that having fixed potential gains are very unfavorable.

Benefits of Options Trading in the UK

Options are a bit tricky but there sure are few benefits of trading options, which are as follows:

Hedging

The key benefit of trading options is that you can hedge. Hedging with options enables you to minimize the risk that is involved in the underlying market. Hedging is a strategy that should not be used for making money because the returns with hedging are always low. Therefore, it is a strategy that should be used as a shield against losing money.

Exposure to low risk

You can access the options trading market by investing in a small percentage of the contract value called Premium. That means Options allow investors to access the financial market with a small amount. For example, if you want to purchase ABC stock, but you don’t have the required amount to do so, then Options are ideal.

Can’t lose more than premium

There are no limits on losing in the trading industry. You can never know how much you are going to lose and ETFs and Stocks are known for huge losses. On the contrary, with trading options in the UK, you can never lose more than the premium amount. Therefore, losses with options are always fixed.

Things to Consider while Trading Options

Following are the things to consider while trading options in the UK:

Options Trading Signals

Predicting in which direction the market will move can be very challenging even at the best of times. Therefore, opting for a service where someone experienced in trading gives you trading suggestions can be very beneficial. One such service is options trading signals, in which your chosen provider is always there to send you trading suggestions like, specific options market, whether you should purchase put or call options, and what your exit strategy should be. Having this knowledge beforehand can change the whole trading game for you. These signals are derived from algorithmic trading software. This automated software puts off the burden on the investors since all the hard work from scanning the financial markets to finding the best opportunities to sending you the trading suggestions.

Options Trading Course

If you can afford to enroll yourself in an options trading course then there is nothing better to learn options trading from. There are many options for trading courses available in the UK, which can help you set your trading career. However, if you cannot afford to join a course then you can get educated from the internet, as it has everything you need to know. Make sure to read blogs and watch YouTube videos.

Use a Demo Account

To use a demo account is highly advisable, as there is no better way than this to practice options trading without investing in your real money. Demo Account provides you the exact copy of how options trading works, it allows you to gain all the knowledge that you need. It is often used to test new trading strategies by seasoned investors.

Stick with Stocks

Stock options in comparison to other asset classes are a lot easier to understand, one reason is that it is less volatile. Therefore, it is advised to stick with stocks until you get confident enough to diversify into other asset classes.

Best Options Trading platforms in the UK

There are numerous platforms for options trading that you can choose from. Following are the best options trading platforms:

AvaTrade

Avatrade is an online options trading platform that was founded in 2006 under the name AvaFX. It is regulated by multiple jurisdictions. It allows you to trade in various tradable instruments, including stocks, commodities, forex, and cryptocurrencies in the form of CFDs.

AvaTrade. Offers a department that is truly dedicated to options trading which gives access to options contracts on over 40 + pairs, besides gold. The platform is packed with all the features that help in minimizing the risk, it even allows investors to use trading strategies in a successful manner.

To start options trading on this platform you first need to create an account on this platform and then deposit a minimum amount of £100. This platform offers payment modes like bank transfer and credit/debit cards for making a deposit.

Pros

- Supports both MT4 and MT5

- Regulated platform

- Offers spread from just 0.9 pips

Cons

- Do not have fundamental research features

IG

IG is the most popular UK brokerage platform that ranks the top in the world’s largest CFD brokers list. It was founded in 1974 by Stuart Wheeler. It is licensed and regulated by Financial Conduct Authority (FCA) and as well as by foreign financial regulators including the Australian Securities and Investment Commission (ASIC) and Germany’s Federal Financial Supervisory Authority (BaFin). This platform is now home to thousands of traders. When trading Options through IG, Plus500 works the same. It offers the tightest spreads, and transparency since everything is built-in spreads. The major benefit is that it allows you to apply leverage on your trades.

IG is packed with all the amazing features that a reputed broker should have. It has a user-friendly interface that makes it easy for everyone to access and navigate the platform. It uses the latest encryption technology to safeguard user’s data and funds. It requires a deposit of as low as $250, which can be funded either by the bank transfer by debit/Credit card.

Pros

- Allow trading options via CFD

- Everything is built into the spread

- Offers great research department

Cons

- Charges a fee of 1% when using Visa and 0.5% when using Mastercard

- Offers expensive spreads on some cryptocurrency pairs

Plus 500

Plus 500 is a CFD broker that is Israeli-based and was founded in 2008. Just like the above mentioned, this platform offers various tradable assets options including stocks, forex, and commodities. Options CFDs at this platform are available on numerous asset classes, including gold, FTSE100, natural gas, gold, and various stocks. The account creation process on this platform is very simple and easy. Unlike other platforms, this platform charges no commission or fees. The customer support of this platform is active 24/7 so that it is able to provide instant help to its investors. The minimum amount required on this platform is $100.

Pros

- No withdrawal fees

- No commission

- Regulated platform

Cons

- No research department

How to start Options Trading

Following are the steps to start options trading :

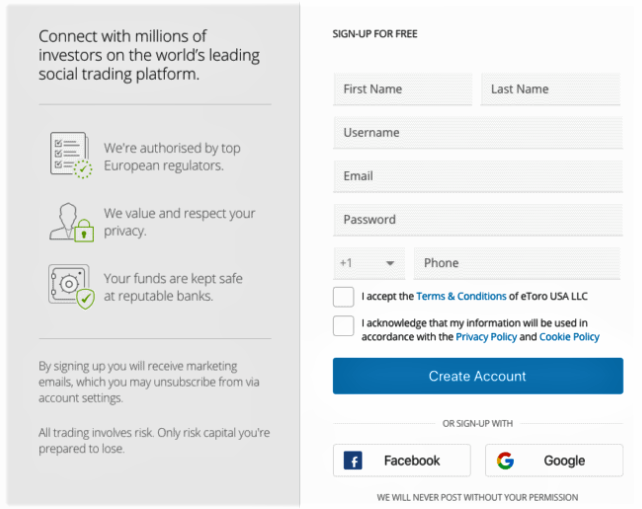

Step 1: Open a Trading Account

The very first step to start trading options is to create an options trading account. To do so you are required to register yourself by filling in a few basic details such as your name, email, and phone number. You can create your Options trading account on whatever platform you desire. However, we recommend you to choose either Avatrade, Plus 500, and IG. The registration process on every platform is almost the same. Once you have successfully created your options trading account you can then move to the next step.

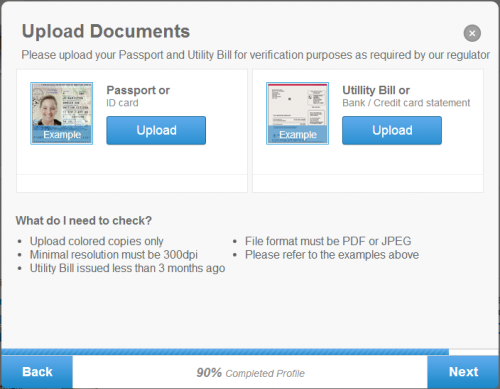

Step 2: Verification

Now you are required to provide your ID, because of the anti-money laundering laws of the UK. It can either be a copy of your driver’s license or passport so that you get verified. The verification process is a very important step that you cannot skip, it ensures that the bot isn’t trying to access the account.

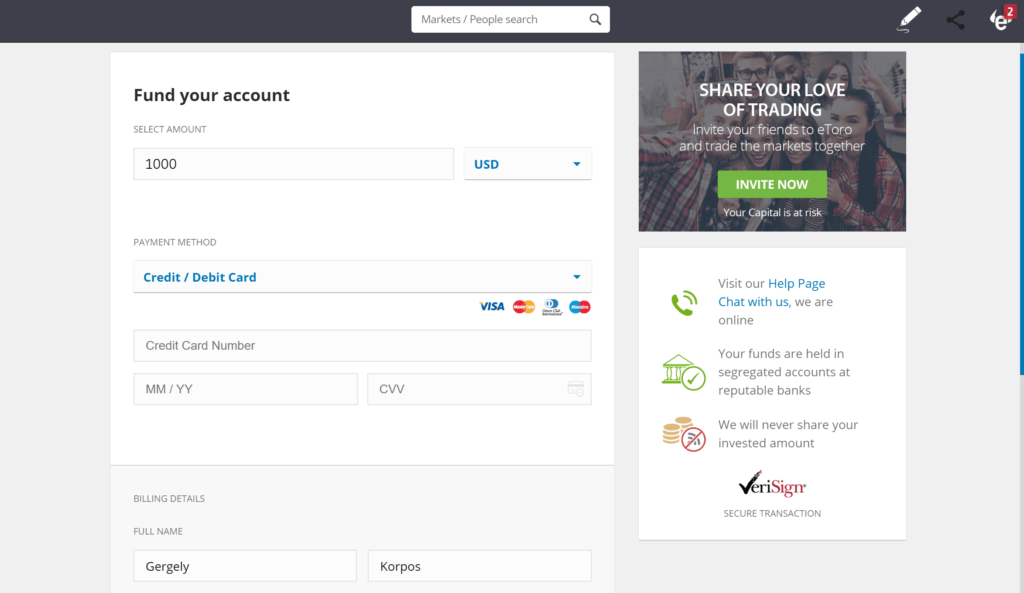

Step 3: Deposit Funds

Now that you are successfully verified, you are now required to fund your account by making a deposit of as low as possible. The minimum deposit required on a platform varies from platform to platform. The minimum amount required on AvaTrade is $100, on IG is $250, and on $100.

Step 4: Place an Options Trade

Now that you have successfully funded your account, you are all set to start options trading by choosing the asset class you want to trade options on. Let’s take an example of trading Oil CFD, to get a better understanding of how to place an options trade.

After choosing the asset a list of various call and put options will appear and each list has different strike prices and the buy and sells price varies as they depend on the strike price you opt for.

Once you have made up your mind on a market, push click on the buy or sell option as per your predictions. Now that you have decided whether you wanna sell or buy, you need to fill out an order form. To fill this order form you only require to enter the number of ‘options’ CFDs that you are willing to purchase and then the only work left for you is to confirm the trade, and exiting your position can be done at any point before the contact’s expiry date.

Conclusion

From all the information we have gathered we can confirm that Options Trading can be challenging for those who have no to zero experience in trading. However, if you have the right knowledge of what options are, how options trading works, then this has the potential to profit investors from the financial markets in a low-risk manner by providing various opportunities.

FAQs

- How are options different from futures?

When trading options, you are free from the obligations to purchase or sell the asset, however, the right remains in your hands. However, when trading futures you are obligated to buy or sell the assets on expiry.

- Who can start trading options in the UK?

Anyone can trade options as long as they are willing to trade, there are no eligibility criteria.

- What assets can be traded with options contracts?

Options can be traded on stocks. However, you can trade them on any asset class including, indices, ETFs, bonds, cryptocurrencies, and forex.

- What is the premium in options trading?

The premium is the small percentage of the amount that you need to pay to get access to the options trading market.

- What is the difference between a call and put option?

Call option simply means an increase in asset value and put option simply means a decrease in asset value.

- How many options contracts do I need to buy?

The number of contracts that you need to buy varies from asset to asset. However, traditionally 1 call or put contains one hundred stocks.