Scalping is a type of trading strategy that involves taking short positions for a few minutes or seconds. Scalping is a popular day trading strategy that involves taking multiple small trades. The prime objective of scalping trading is to make profits in all possible ways.

This guide aims to answer the most common questions that traders have about scalping trading. It will also explain the various advantages and disadvantages of this form of trading. Learn how to get started in UK scalping trading with our step-by-step guide. We’ll also show you how to use some of the best UK brokers.

What is Scalping Trading?

Scalping is a type of trading strategy that involves taking short positions for a few minutes or seconds. Scalping is a popular day trading strategy that involves taking multiple small trades. The prime objective of scalping trading is to make profits in all possible ways.

Scalping trading is a style of investing that primarily focuses on making small profits instead of large ones. It is usually used by day traders. Scalping is a technique that involves taking advantage of a price movement for a long time. It’s not uncommon for a price movement to last for a long time. Instead of trying to trade through a price movement, scalping systems try to limit the portion of a price movement that can bring in big profits.

The objective is to make money in the short term by taking advantage of the fluctuations in the financial market. Scalping trading is a process that involves increasing one’s concentration and mastery of the financial markets. This discipline requires a lot of practice and discipline.

Most day trading strategies rely on the concept of scalping to make money. This strategy involves placing multiple trades in a day. Scalping trading in the UK is very risky. It is best avoided if you can manage it correctly.

What is best Traded using Scalping?

The scalping trading system can be used for almost any tradable asset. Stock trading and currency trading are particularly good for resale strategies as these assets are highly volatile. The higher the price volatility, there will be more opportunities for resale.

Stocks and currencies are very liquid. This means scalping traders have no problems entering and exiting positions smoothly.

You can also use the scalping trading system for other types of trading such as ETF trading, commodity trading, and cryptocurrency trading. But keep an eye on liquidity. For example, gold and oil trading are highly liquid markets, but resellers may not be able to close positions quickly when trading less popular products like cocoa.

Options trading are possible with a scalping strategy. However, this is relatively risky as options trading is always leveraged and options contracts can be very liquid.

Best Scalping Trading Strategies

Traders use specific strategies to optimize their returns. We will discuss three of them-

Moving Average Strategy

Moving averages continuously create and update the average price of an asset to smooth price action. As a result, traders can use it to guide their financial security. By using this strategy you can calculate the average of all the data points at the given period. This is a great way to help traders generate trading signals.

Given the scalping strategies above for day trading, beginners should start by opening short-term positions. For example, it is worth considering scalping trading for a moment. It is much easier to master and you can open a position, make a small profit (pips) and close that position in less than a minute.

Ichimoku’s strategy

The Ichimoku Indicator was published by Japanese journalist GoichiHosada in the 1960s and allows you to perceive the overall equilibrium of the market through images. It is a trend indicator that works equally well with MetaTrader4, MetaTrader5, and WebTrader. Thanks to this indicator, you can also check forex trends and their reversals, supports, and resistances, or look for trend and breakout signals. Indicators also include tracking stops.

There is no moving average here, but a median where the crosshairs indicate a strong, weak, or neutral signal. These signals can be automated. You can use the Ichimoku indicator to train yourself, perform Ichimoku analysis, and define your Ichimoku strategy.

T-Line Strategy

T-Line is a market analysis technique that uses charts (Heikin-Ashi charts) to help the scalp make quick and easy decisions. It only works with 5 ticks which can scale to 8, 13, or 21 depending on the operator.

The T-Line works very simply. If the floor is green, you have a chance to open a position, if the floor is red, the exact opposite. If the trend is favorable, the trader decides which currency or futures amount to buy (2 or 4), even if the recommendation is 2.

To know when to close a position, the trader should refer to the only stops available on the T-Line and the number of targets that depend on the Average True Range (AVR), which in turn is calculated according to the volatility of the instrument.

Inside Bar M15 Strategy

Inside Bar M15 was implemented by NenazKerkez, a financial analyst well known for his Forex resale strategies available in Admiral Markets. It consists of finding business opportunities very quickly thanks to the Inside Bars contest.

Scalping trading is time-consuming, but thanks to the Inside Bars M15 strategy, it can be limited to potentially profitable trading hours. They are cheap on the New York and London stock exchanges for the first three hours.

Therefore, the Inside Bars strategy is based on three basic principles:

- Price action, trading action during the retrenchment price. Depending on your long or short position, you can see up and down breakpoints suggested by the inner bar.

- A stock trend consisting of utilizing a stock trend signal represented by two exponential moving averages of 16 and 32.

- These are trading hours, and since they are the first three hours of the New York and London stock exchanges, traders do not exceed their average number of trades per day, which can put traders at a disadvantage.

Here, the stop-loss position depends on the trader’s buy or sell position. This strategy allows you to trade up to 4 currency pairs.

Scalping Trading- Advantages

The reason scalps are so popular in the financial markets is because of the benefits they offer professionals. We will cover some of the related ones.

Fast location processing

Being an accelerated form of intraday trading, scalping offers the advantage of being able to quickly lock into the outcome of a trade. This gives you ample room to manage your profits and losses. If you don’t like waiting hours or days for the results of your location, you’ll love your scalp.

Minimum but regular income

With scalping trading, traders get small opportunities regularly throughout the day. You can’t earn a lot from every trade, but it’s the accumulation of small profits that can lead to profits. So, your daily or weekly balance can give you a good capital gain with moderate losses. This is one of the advantages of this form of trading.

Reduction of risk and dependence on market conditions

The shorter the position, there will be lower the risk when the odds are clear. We take advantage of small fluctuations and only hold positions for a short time in the wallet. This means that resellers will not be disturbed by any major events or announcements.

Scalping Trading- Disadvantages

Scalping trading is not recommended for beginners due to its shortcomings. We will discuss the few drawbacks here-

The need for maximum concentration

Scalping trading means constantly lookingfor the smallest opportunities. This requires a constant connection to a computer or smartphone to keep up with the evolution of graphics. It is a tedious task that is difficult for beginners to do.

Risks Associated with Leverage

Typically, leverage is used to increase small profits. But, as you know, this multiplier also works on billing. Unfortunately, if a few bad trades happen on a leveraged day, your capital will be hit hard. So you need to know how to show your composure and control your emotions in a scalping deal that can go from one extreme to another in the blink of an eye.

You need to control the underlying assets

This criterion greatly affects the success of the operation. This is why it can be a huge disadvantage for inexperienced traders who challenge scalping. If you are interested in Forex scalping, you must have complete command of the Forex market: understand currency movements, follow the news, have experience in Forex trading, otherwise you will not have the necessary knowledge and reflexes to do it.

The risk associated with Scalping Trading

Although the risk of individual resale operations is relatively low, the strategy can still contain significant risks. Below is a list of some risk factors to consider before starting a UK scalping trading strategy. The weakest part of scalping trading is:

Steep learning curve

As mentioned above, it can take months or years to learn the basics of scalping trading. You don’t need to know just the basics of trading. It also requires a solid understanding of technical indicators.You should also continue to refine and backtest your strategy with a demo account. If you are completely new to the world of trading or do not have enough time to devote yourself to it, it is not recommended to choose a scalping strategy.

One mistake can be costly

Weighing the risks and rewards of reseller trading requires experience. For example, you can make 10 successful scalp trades with 2 pips per trade. However, if you lose a single trade that costs 20 pips, you will have to make another 10 successful trades to get your money back. As you can see, even a small mistake can be very costly.

Requires significant funds

As emphasized in this guide, your goal as a scalping trader is to make small margins and perform multiple trades throughout the day. This means that if you only bet a small amount, you won’t get a worthwhile profit.

In what markets can we use Scalping Trading?

Scalping trading is excellently used in the currency market. Traders choose spread-controlled currency pairs such as EUR/USD, GBP/USD, USD/JPY, and USD/CHF. In addition to the currency market, you can also practice this form of trading in the stock market using CFDs and futures. However, it is recommended to choose an underlying asset with very high liquidity to make it easier to close your position.

Few tips for the beginners

As mentioned above, scalping is best for experienced traders. Still, if you’re ready to start trading your scalp, here are some useful tips to help you trade prudently, maximize your profits, and limit your losses as much as possible.

Select Cash

This is the first step to success in this form of negotiation. You need to choose an asset to invest in. Otherwise, scalping will not work. And since positions open and close relatively quickly, highly liquid assets will help. To this end, the currency most sought after by resellers who capitalize on small volatility to generate revenue is the currency. But CFDs and futures can also go.

Choose a Broker with Low Fees

In addition to spreads, you should choose a broker with the lowest fees. Scalping only makes a small profit at a time, and high fees keep you from making a profit.

Avoid excessive leverage

This is advice you should always keep in mind as a beginner. You may want to use very high leverage. Never forget that the lever works in both directions. They increase the profit potential but also the loss potential. Since every trade involves risk, it is advisable to have the right leverage at your fingertips that you can manage even in the event of a loss.

Default limit

Being a multi-faceted reseller is not prohibited. However, we recommend sticking with a single asset, such as a currency pair, initially. Focus on effectively evaluating your performance. Other items can be added later if appropriate.

Choose an asset with a narrow spread

The goal should be at least twice the spread the broker applies to the product. For example, you can choose cheap and liquid currency pairs. Items that meet these criteria include EUR/USD, GBP/USD, USD/JPY, or USD/CHF.

Be Receptive

This is the basic principle of scalping trading, so it’s common to have this in mind when starting. Not only do you need to be on the lookout for opportunities, but you also need to know when to take advantage of them to profit with the lowest possible risk. Scalping trading requires a lot of focus and dynamism.

Stay up to date on important economic announcements

These advertisements can have a significant impact on currency prices in a short period. As with any type of business, economic, political, or social conditions can affect capital. And with the leverage of the game, if there is an error in judgment, it can do more damage.

How to choose an online broker for scalping trading in the UK?

Online brokers play an important role in the success of your trading. After all, your earnings often depend on your transaction fees and when your order is executed. However, there are hundreds of online brokers to choose from on the internet.

To ease the burden of the process, we’ve put together a list of considerations to help you find the broker that best suits your business scalping needs.

Regulation

The first thing to do when it comes to scalping in online trading is to evaluate the regulatory position of your chosen broker. You want to choose a broker licensed by at least one reputable financial institution. The regulatory body in the UK is Financial Conduct Authority (FCA).

Advanced technical analysis tools

Scalping trading is a strategy that relies heavily on technical charts and indicators. You need the right tools to understand the price movement of an asset as quickly as possible. Choosing a brokerage platform integrated with technical indicators can save you time and effort. First, you need to provide access to Fibonacci retracement levels, moving averages, charts, and RSI.

Trading Fees and Spreads

As discussed earlier in this guide, commissions and spreads can directly affect the amount of profit you can earn from scalping trades. Therefore, it is best to find a broker with no fees and low margins for the asset of your choice. In addition, it is necessary to pay attention to management fees, such as dormant fees and deposit/withdrawal fees that you must pay when using brokerage services.

Best Scalping Trading Platforms

Online brokers play an important role in the success of your trading. After all, your earnings often depend on your transaction fees and when your order is executed. However, there are hundreds of online brokers to choose from on the internet.

To ease the burden of the process we have picked up the best online trading platforms for our readers.

eToro

eToro is one of our favorite UK Forex and Stock Brokers. The trading platform provides access to over 800 stocks and over 450 ETFs from exchanges around the world. You can also trade CFDs on over 40 currency pairs, dozens of commodities, and popular cryptocurrencies. All trades on eToro are completely free of charge, and CFD trade spreads are among the lowest in the industry.

eToro includes the scalping trading network in its mechanism. Follow other scalping traders to generate ideas and share intraday scalping strategies. Or use a copy wallet to automate some scalping tasks. In this way, you can do more on your account in a day.

Capital.com

Capital.com uses technology to help improve its resale trading system. With this broker, you get artificial intelligence-powered assistants that give you insight into what works and what doesn’t. For example, you may trade better on certain days of the week or discover that certain types of investments or trading strategies are hurting your overall profitability.

Capital.com only offers CFD trading on a variety of assets including stocks, currencies, and commodities. All trades are 100% commission-free and spreads are below the industry average. Capital.com’s leverage isn’t particularly high and is only 33:1 for large currency pairs, but that’s enough for most scalping operations in the UK.

How to start Scalping Trading UK

We complete this guide by explaining how to start scalping with your broker account in the online section. According to our research, eToro is one of the best options for online traders to start scalping. The platform not only pays no commission but also provides access to thousands of tradable stocks. In addition, funds and businesses are regulated by the FCA. With these factors in mind, we use eToro as a reference to show you how easy it is to get started scalping in the UK.

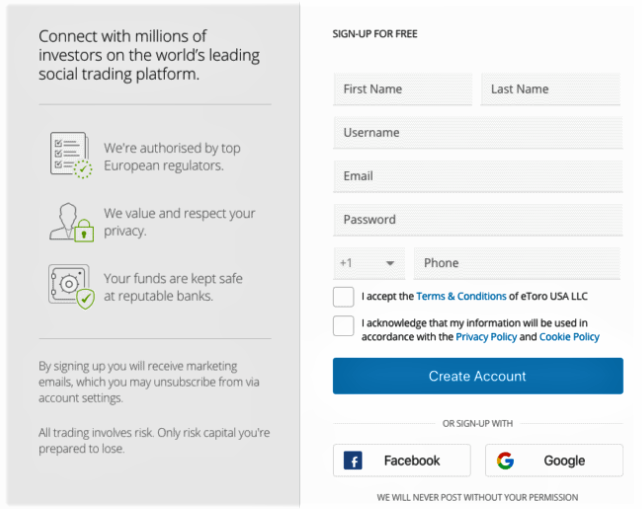

Step 1: Open the trading account

To get started, you need to create a trading account with eToro. The account opening process is very simple.To use the platform, you must provide basic information such as name, address, date of birth, and email address.

As a KYC compliant FCA broker, eToro also requires a copy of your passport/driver’s license and utility bill for identification purposes. Upload your documents and your account will be verified in a few minutes.

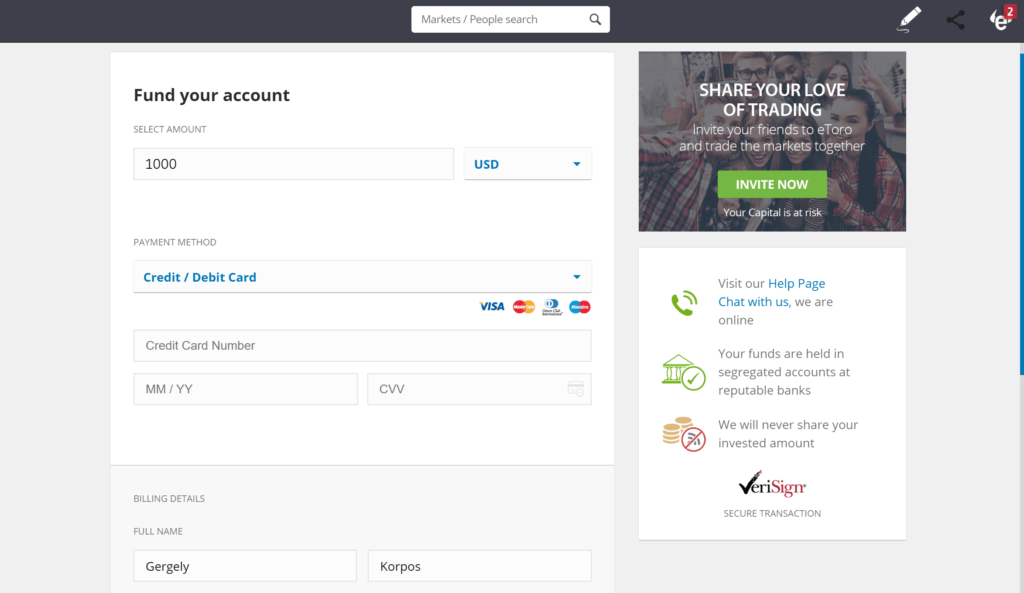

Step 2: Deposit the funds

eToro gives you access to a demo account where you can practice your banknote scalping strategy. Your account is credited with USD 100,000 and you can use all the features of the platform.

When you are ready to start trading live markets, you must first fund your trading account. eToro offers several payment methods to choose from, including debit cards, credit cards, bank transfers, and e-wallets like PayPal, Neteller, and Skrill. The minimum deposit is $200 or around £145.

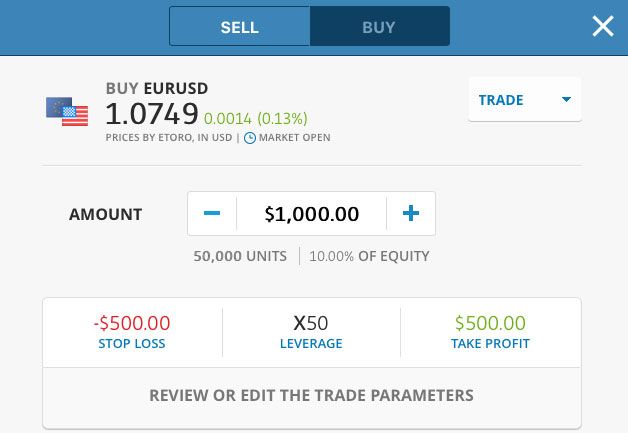

Step 3:Place the trade

Now we can do our first scalping operation. If you have an asset in mind, you can find it by searching on eToro. When the trading page for the selected asset is displayed, you can click on “Charts” to access the price action.

Here you can customize the chart by type and adjust the price change period. For example, for scalping trading, you might choose a 1-minute candlestick chart. When you’re ready to dive in, select the ‘Trade’ option to set Take Profit and Stop Loss orders.

Final Words

Scalping trading is an aggressive and highly strategic technique that, on the one hand, requires good control of the market and on the other hand requires unique skills. So, you need to take the time to train before you start. Also, remember that leverage always has a double meaning. If you want to try more than one strategy, feel free to use the demo account of the best online brokers provided in this guide. Finally, you should know that eToro is one of the best options to benefit from favorable conditions to practice scalping.

Frequently Asked Questions

I am new to the trade. Can I trade with scalping?

Scalping trading is a process that requires a high degree of focus and sensitivity. This is often done by experienced and professional traders who can handle the demands of daily life.

What are the best business scalping techniques?

There are many of them. In the end, the best thing is to feel comfortable after several tries and, most importantly, to optimize your returns.

How much can you earn from scalping trading?

The amount you will earn depends on the number of trades and the outcome. Also, remember that all trading is risky and leverage can increase profits or increase losses. But if you take good care of it, you can end the day on a positive note.

When can I start scalping?

You can start scalping as soon as you feel your needs can be met. Also, you don’t have to make a lot to get started. Don’t hesitate to start step by step by following our advice.

What are the commercial fees for scalping in the UK?

You should look for a broker like eToro that doesn’t offer narrow spreads and commissions.

Can I automate scalping transactions in the UK?

Yes, you can find online trading systems that facilitate automated resale transactions. This requires installing separate software on a trading platform such as MetaTrader 4.

What period should I use when scalping a chart?

Scalping is a short-term strategy, so a 1-minute chart is recommended. It gives you a complete overview of the price movement of the selected asset every minute.

What is the least requirement of pips in scalping?

Experienced scalping traders aim for an average return of 5-10 pips per position.