The largest market to date, with an average daily investment of more than $5 trillion in 2021 is the forex market. Forex (FX for Forex Exchange) stands out as a decentralized financial center based on global currency exchanges. Forex has created a strong international scene with significant liquidity visible around the world. But despite all that… is it appropriate and profitable to invest in Forex?

In this guide, we will review whether you can get rich by trading currencies. We will teach you everything you need to know to succeed in the financial space.

Steps to follow in trading forex

- Step 1- Choose an online forex broker

- Step 2- Learn the basics

- Step 3- Forex Money Management

- Step 4- Select a suitable forex trading style

- Step 5- Select the forex trading strategy

- Step 6- Choose automated trading or forex signals

- Step 7- Start forex trade

Step 1- Choose an online forex broker

The first thing you need to do before learning how to get forex money is to choose an online forex broker that can meet your trading goals. There are hundreds of such brokers running in this space, so you need to do some homework. Before starting forex trading you are needed to choose an online forex broker. The following factors should keep in mind while choosing a crypto broker.

Broker Trading Regulations

One of the most important steps before investing money is to make sure that the forex broker is legit. In recent years, with the rapid growth of the financial market, foreign exchange platforms have appeared in large numbers. Entering the foreign exchange market requires moving (sometimes massively) funds on the Internet. Therefore, it is important to select from the crowd a site that is accredited by regulators and whose data in transit is protected.

Because the Forex market is decentralized, it can be much more vulnerable to scams and fraudulent websites than other promotions. Therefore, it is essential to choose a legitimate Forex Broker that is regulated by at least one financial institution. This ensures that the broker is legit and your money is in good hands. The most common regulations for Forex brokers are CySEC, FCA, and ASIC.

Security

Security standards apply not only to Forex trading but also to all activities on the Internet. All commercial platforms, without exception, are required to encrypt data passing through their domains. Transaction encryption corresponds to Secure Socket Layer (SSL) rules. To verify that your site meets SSL standards, the URL must start with https:// and precede it with a lock symbol.

Forex Broker’s Reputation

This factor may be obvious to some or maybe overlooked in the process of finding the best Forex Broker, but it is a key criterion. The reputation of a forex broker is not based on these services. Learn about these strengths. Read the broker reviews. For expert advice, check out our guide to find the best trading sites like ours.

Leverage

To participate in leveraged Forex trading, you need a broker that offers the desired leverage. Typically, the maximum leverage for European Forex brokers is 1:30, but some platforms may offer more if you have a professional account.

Easy payment system

When choosing a forex platform, you should consider the payment methods offered by the broker. Several conditions are essential for this. The first is access to a legal and secure payment solution to deposit and withdraw with confidence.

Commission and spread

Whenever you enter a trade, you have to pay a margin or fee. Choose a broker with low spreads to get the most out of your profits. Also, pay attention to the spread of the currency pair you want to trade. Spreads typically start at 0.5 pips on major currency pairs like EUR/USD.

Customer service

Any support provided to members of the Forex platform is very important. This is to test the legitimacy of the broker. How do you judge a stockbroker’s customer service? First of all, the platform should have a professional team available via various contact options (email, phone, live chat, WhatsApp, or Skype).

Beginner-friendly

The intuitiveness of the user interface is an essential criterion, especially for inexperienced traders. You need to be able to do things quickly and easily, while at the same time have real-time access to all information. Make sure the site can view market analysis curves and real-time quotes and prices.

Mobile trading

Best Forex Broker of 2021 to trade anytime, anywhere. Two solutions allow you to trade in a portable version-

- You can trade from your Internet browser through your portable device.

- You can trade via mobile application.

The broker you choose should ideally work on Android, iOS, and Windows devices. Make sure your platform’s website is HTML5 encoded to avoid any browser degradation on mobile devices.

Forex brokers allow you to intervene in the foreign exchange market and trade currencies. eToro and Capital.com are two arguably the best forex trading brokers.

eToro

eToro was founded in 2007 and is based in Cyprus. eToro is a successful CySEC, FCA and ASIC regulated Forex Broker with over 10 million clients worldwide. eToro offers the easiest-to-use platform for forex trading.

eToro is arguably one of the best forex brokers operating on the UK trading scene. With over 10 million users, the broker is especially popular with beginners in trading. Because you can get started with eToro in minutes and the trading platform is very easy to use.

Copy-trading technology allows beginners to copy successful forex traders over the network and utilize their knowledge, advice, and strategies for stock trading. In addition to a variety of financial products, the platform offers 47 currency pairs for low-margin trading and no deposit fees.

Capital.com

Capital.com platform is a UK-based Forex Broker offering competitive spreads and 160 CFD currency pairs in a single platform. Capital.com was founded in 2016 and has more than 300,000 clients in 50 countries. The platform offers leverage of up to 1:200 depending on account type and is well regulated by FCA and CySEC.

Capital.com has a fantastic mobile currency trading platform and differs from 0.6 pips in major currency pairs like EUR/USD, which is a very cheap spread. The broker also has fantastic educational resources, from technical analysis tools to training guides. Finally, this trading site provides access to the popular MetaTrader 4 trading platform.

Step 2- Learn the basics

The foreign exchange market has several characteristics that set it apart from other markets. For example, there are certain basic vocabularies that one should understand before entering the market. Let’s take a look at the main characteristics of the Forex market.

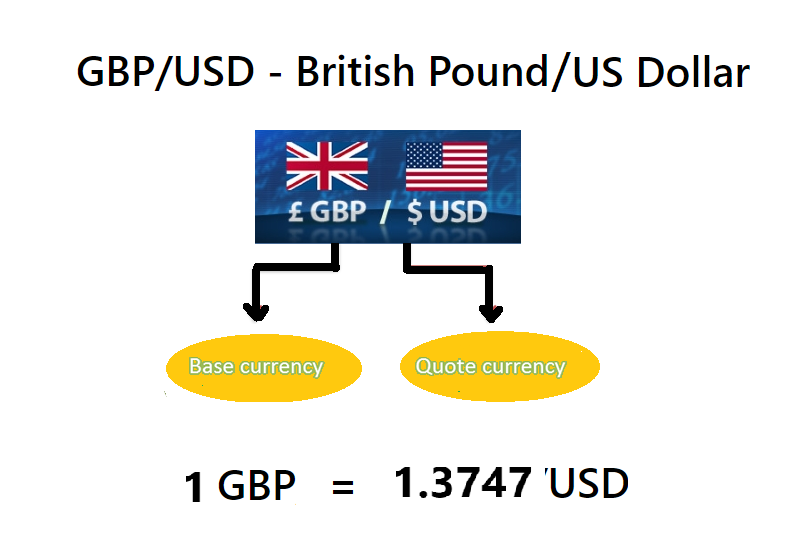

Pairs

It is not possible to buy (or sell) Euros or Dollars. Currencies are always quoted in pairs. For example, a GBP/USD price of 1.37 means that 1 British Pound is worth $1.37. It also means that buying and selling a currency pair is equivalent to buying one currency and selling another currency at the same time. For example, buying a GBP/USD pair means betting that the Pound will rise or the dollar will fall. In the same way, selling GBP/USD means betting on the fall of the Pound and/or the rise of the dollar.

Pips

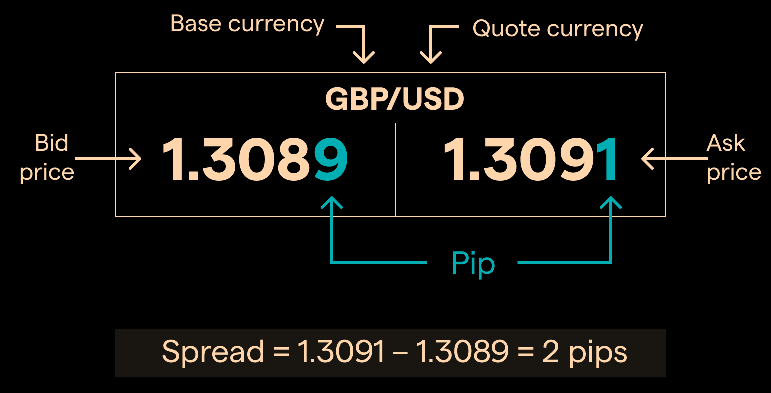

Changes in percentages are usually expressed as percentages. In currency trading, percentages are considered difficult to read because the nominal fluctuations of the currency pair are minimal. Therefore, we display the movement of a currency pair in “pips”. A pip represents the last decimal number of a currency pair quote ( 4 decimal places for EUR/USD, 2 decimal places for USD/JPY).

Lots

You should also know that currency pairs can be bought and sold in bulk. Most brokers offer lots of different sizes from 1000 (micro lot) to 100,000 units (standard lot). This makes it easy to calculate P&L because we know the value of 1 pip depending on the size of the lot we are trading. For example in Euro-dollars (EUR/USD), a pip is $0.1 for a lot of 1,000 units, $1 for a lot of 10,000 units, and $10 for a lot of 100,000 units.

Leveraged and Margin Trading

Specifically, leverage allows you to invest in the market with more money than you have in your trading account. For example, a leverage of 100 with a capital of $1000 means you can invest an amount of $100,000. The amount required for this operation is 100 times less than this amount. This increasing amount is called margin.

Spread

At time, the selling price and the buying price of the currency pair are different. The difference between the two prices is called a spread and can be viewed as an offset to the broker. Spreads are usually less than 3 pips on major Forex currency pairs. The buying price at time T is always higher than the selling price. So, if you buy a GBP/USD pair with a margin of 3 pips, you will start trading with a loss of 3 pips and start accumulating profits on 3 pips increments.

Currency Pairs

Currency pairs in the foreign exchange market are divided into three main groups: major currency pairs, secondary currency pairs, and foreign currency pairs.

- Major currency pairs- The main currency pairs are those with the US dollar at the intersection. Major currency pairs are the most liquid to trade because they have the highest volume. For traders, this liquidity means that major currency pairs have relatively stable prices and low spreads.

- Minor currency pairs- If a currency pair does not contain US dollars, it is considered a secondary currency pair. Small pairs are sometimes referred to as “currency crosses”. Secondary currencies are not as liquid as major currencies. This means that they move more erratically and the spreads shown by forex brokers are larger than in major currencies.

- Exotic currency pairs- The last type of currency pair is known to be exotic. Exotic currency pairs are smaller pairs that contain currencies from emerging markets. Emerging markets are characterized by less stability and therefore greater currency volatility. This means price movements are more brutal and spreads are much higher.

Step 3- Forex Money Management

Money management is a set of rules designed to optimally manage the capital to invest in Forex. These are the main fundamentals on which money management is based.

- Profitability and risk are proportional- This is the basic principle of any investment in the financial markets, especially the foreign exchange market. In other words, the higher the return on investment, the greater the risk involved. Money management is designed to give you total control over these risks.

- The number of profitable trades does not determine profitability- Then you should know that your Forex balance can be positive even if the number of trades you win is less than the number you lose. In fact, according to Money Management, it is worth focusing on that it is a risk-reward ratio.

- You should focus on the risk/reward ratio- The risk/reward ratio is defined as the ratio of the expected return of a Forex investment to the risk of loss. The expected return is calculated from the difference between the entry price and the target price you set. The risk of loss comes from the difference between the entry price and the protection freeze.

- Stop Loss Should Be Respected- Protection Stop or Stop-Loss is a tool that allows you to control possible losses if the development of the market does not follow the desired direction. Most forex brokers offer orders to traders, including a stop loss. It is also possible to change the Stop Loss in the expected direction as the price changes.

- Choosing the right leverage- Leverage selection is also an important factor in Forex money management. This system effectively multiplies your losses as well as your profits. Therefore, it is important to choose carefully, especially if you are new to the field. The European Financial Market Authority has also updated its regulations on maximum leverage limits for currency trading to protect individual investors. For major currency pairs, it is 20 and for exotic and smaller currency pairs it is 20.

Step 4- Select a suitable forex trading style

A forex trader’s style is usually related to the time zone in which he trades. Are you a short-term trader or a long-term trader? Therefore, this section details the different trading styles. We will help you choose the one that is best for you by explaining its features and pros and cons.

Scalping Trading

Scalping is a very short-term trade. The operation usually takes a few seconds to a few minutes. Resellers run many trades per day, often dozens of times, and are happy with a few pips profit with significant leverage. Scalping Trading is primarily based on technical analysis and requires a constant presence in front of the screen.

Day Trading

Day trading consists of entering positions for several hours, starting in the morning and ending the day with no open positions. It is the most popular trading style that allows you to be active in the market while still having time to properly analyze Forex and make informed trading decisions. Daily traders primarily use technical analysis to make decisions, but they also consider the economic calendar to know which events may affect the forex market during the day.

Swing Trading

Swing trading consists of taking a Forex position for days or weeks. This is a trading style suitable for those who do not have much time to devote to this activity. Swing traders take a lot of macroeconomic data and market sentiment into account, but they also use chart analysis tools to analyze the underlying trend of currency pairs.

Step 5- Select the forex trading strategy

After choosing the suitable forex trading style now it is time to choose the forex trading strategy. Therefore, this section recommends training you to get started in the Forex market with ready-to-use Forex trading strategies.

Moving Average strategy

A simple moving average is a slippery weighted price moving average. On hourly charts, a moving average of 100 calculates the average price over the last 100 hours, updated every new hour. Moving averages have many uses. For example, it can be used to check a trend. When a moving average rises, it usually reflects an upward trend in the underlying price. A falling moving average usually reflects a downward trend in price. However, it is also possible to obtain buy and sell signals using moving averages.

Trend with trend lines

Trend lines are a tool for graphical analysis near support and resistance. If the support line is a horizontal line in which the price rebounds, the uptrend line is an ascending line in which the price rebounds at all junctions.

Resistance is a horizontal line that lowers the price at each junction, whereas a downtrend line is a descending line that lowers the price at each junction. As you can see in the figure below, a downtrend line is drawn connecting the peaks and an uptrend line is drawn connecting the valleys.

Step 6- Choose automated trading or forex signals

It takes considerable effort to learn all of the Forex strategies and achieve consistent profits. Because of this, most Forex beginners will eventually lose interest or worse, burn all their money. Your best bet is to increase your knowledge of Forex trading further, but there are many alternative options available for those who don’t have the time or patience to learn. These include:

Automated trading

As the name suggests, automated trading allows you to buy and sell currency pairs without performing any action. Typically, this is done in one of two ways: copy trading or expert advisors (EAs).

Copy-trading

Copy Trading allows you to copy experienced Forex traders similarly. This means that whenever a selected Forex trader places a buy or sell order, that position will appear in your trading account. copy trading of the eToro is the best. Especially because the platform gives you access to millions of investors.

Forex signals

An additional option to consider if you do not have the time or knowledge to do your research is call signaling services. This means that your chosen supplier will send you a business offer in real-time. Signals tell you which pairs are involved in the offer and whether you need to place a buy or sell order. You can also read our list of Top 10 Forex Signals Providers with High Success Rate

Step 7- Start Forex trade

The step-by-step tutorial you will find below details the process of opening an account with the online broker eToro. Not forgetting the training on the forex demo account and the transition to real trading, we explain not only registration but also validation and withdrawal of the account.

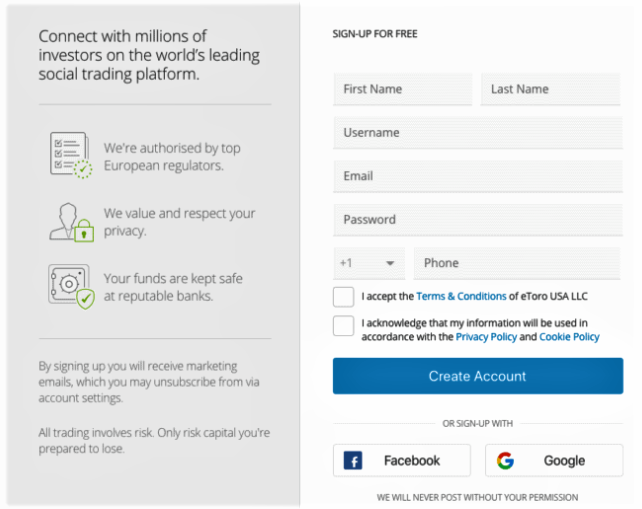

Step 1: Register with eToro

In this first step, you need to fill out a registration form that requires basic information. You will be prompted for your first and last name, phone number, and email address. Next, you need to choose a strong password for logging into the eToro Forex platform. After entering the required information in the form, you must confirm your agreement to the Terms of Use and Privacy Policy. Press on create to get started.

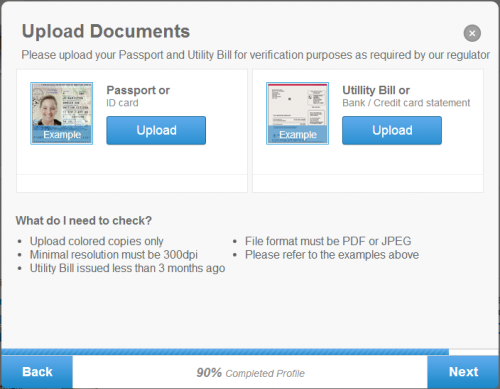

Step 2: Verify your account

The second step in opening an eToro Forex account is account verification. This is a process that involves two tasks. Press on the “Full Profile” button to begin trading. The system will verify your identity with government identity proof.

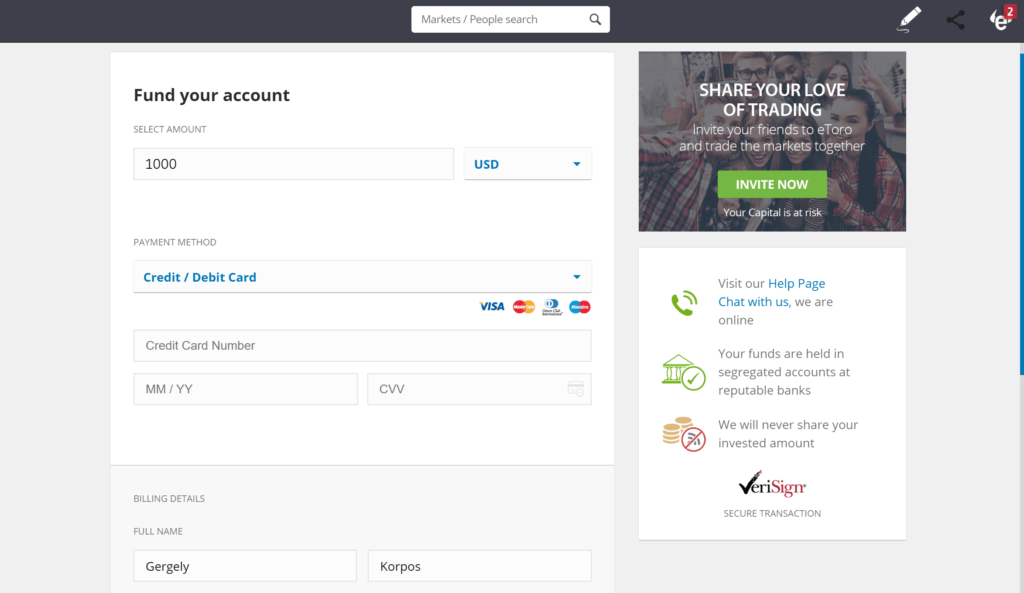

Step 3: Deposit to your trading account

Once your account verification is complete, you can fund your eToro Forex account and start trading Forex. To deposit the funds you have to open the payment gateway and fill in the payment details to deposit the funds in the account.

Step 4: Practice with Forex Demo Account

You can start trading immediately after depositing funds into your eToro Forex account. However, we recommend that you start training on a demo account first. To switch from a live account to a demo account, you must click on the “Real” button in the left column of the eToro user interface.

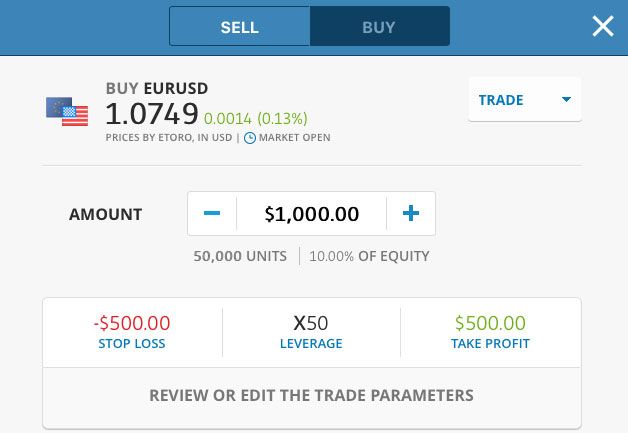

Step 4: Start Forex Investing

Now that you have your Forex account ready, the first step in investing in Forex is choosing the currency pair you want to trade-in. To find the 52 currency pairs available on the eToro currency platform, you need to click on “Markets” in the left column of the interface. In the screen that appears, click on Forex at the top of the interface. This will display a list of forex currency pairs available on the eToro platform.

Conclusion

If it was easy to trade forex and get rich, we would all do it. Unfortunately, the situation is not that simple. The good news is that countless investors make a living by trading currencies. The potential benefits of forex investments are very high. Afternoon and evening forex trades are also possible and costs are minimal.

Investing in Forex is an attractive way to get used to trading quickly and skillfully. However, this decentralized market is not for beginners, but offers profitable prospects; so many seasoned brokers do not hesitate to specialize to take advantage of liquidity.

FAQs

Is forex trading profitable?

The available leverage allows the Forex trader to profit from a single trade that is a multiple of the margin used to initiate the trade. However, leverage is a double-edged sword because big gains can mean big losses.

What can I trade with my Forex investment?

Forex accounts allow the opener to trade all kinds of currency pairs- major, minor, or exotic.

Are Forex Accounts a Good Investment?

As mentioned in this guide, you can potentially make huge profits with your Forex account. But it is also a risky market. Therefore, it is recommended to invest in Forex.

Are Forex accounts suitable for beginners?

Forex is a fun market for beginners because it is easy to analyze and responds well to technical analysis.

How much initial money is required for forex trading?

The minimum capital required to open a Forex account is usually very small. eToro requires an initial deposit of at least $200.