Long-term wealth can be created by investing in FTSE 100 stocks. The kind of returns that we want to achieve by the time you retire are listed below.

According to seven out of ten Britons, retiring today is more difficult than ever. A poll of 2,000 people conducted by the investment comparison website Investing Reviews supports this.

33.2% of respondents say they do not think they will be able to retire comfortably. In contrast, 28.8% of people say they anticipate finishing their jobs in a secure financial situation.

Concerns about State Pension

Perhaps it is not surprising that people are becoming less optimistic about their ability to support themselves in retirement. The cost-of-living crisis makes it harder for people to contribute to their pensions.

The size of the State Pension is a topic that has the British public concerned as well. The age at which people can make claims is also causing the government more anxiety as it struggles to pay for an expanding older population.

But despite these problems, we are not in a panic. We are convinced you can someday retire comfortably by investing in FTSE 100 firms.

Taking the lead

The cost of living crisis makes saving money more challenging than usual. Even those who are severely constrained for cash can make some adjustments to build up a respectable war chest for investing.

If they produced their own coffee at home, someone who spends £5 on coffee each day would have an extra £150 to invest each month. Additional actions like reducing clothing expenditure, changing energy providers, or canceling an unwanted streaming subscription, to mention a few, might help free up money for investment.

At least in our judgment, the FTSE 100’s excellent returns make these modifications justifiable.

Great returns

From its establishment in 1984 until 2022, the UK’s blue-chip share index produced an average annual return of 7.48%*. Of course, there is no assurance that this will be repeated in the future. However, if returns stay at this level, investors could earn a respectable sum of money.

Assume someone gets £300 per month to put towards FTSE 100 stocks. They may have made slightly less than £370,000 after 30 years if the 7.48% annual rate of return continues.

Once the investor retires, they might convert this into an annual passive income of £14,840. This sum is based on the 4% withdrawal rule, which permits a person to withdraw money for many years before running out of it.

With the State Pension and additional funds, this person might enjoy a comfortable retirement income.

3 FTSE 100 stocks you should buy right away

It might be especially wise to begin purchasing FTSE 100 shares right now. Here are three FTSE 100 equities you ought to buy right now if you had the extra money, keeping this in mind.

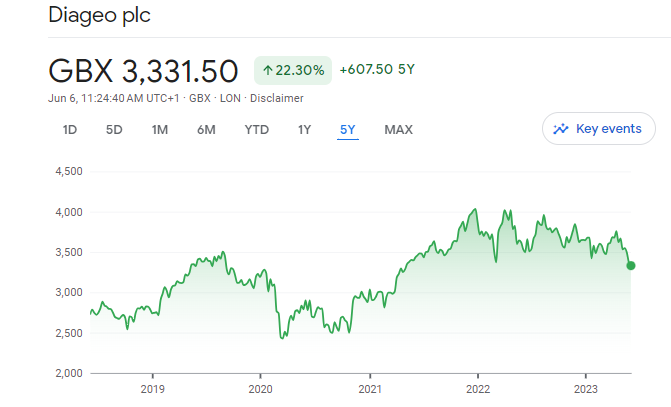

1. Diageo (LSE: DGE)

Over the past five years, Diageo Premium Spirits producer Diageo has easily beaten the FTSE 100 index. In spite of this, the share price has recently been declining.

Investors might be worried about how inflation and the cost-of-living crisis are impacting the economy. Undoubtedly, rising prices have put a strain on the margins of many businesses. Some people might also be concerned about Ivan Menezes’s retirement, the company’s longtime CEO.

We would not be concerned, personally. While there is some cyclicality in every company’s earnings, Diageo’s are as solid as they come. Simply put, even during difficult economic circumstances, individuals will continue to drink. In fact, the £75 billion cap’s capacity to raise dividends over time has been made possible by this predictability.

Although a price-to-earnings (P/E) ratio of 21 is not cheap, it is fair considering Diageo’s stellar track record and extensive brand portfolio.

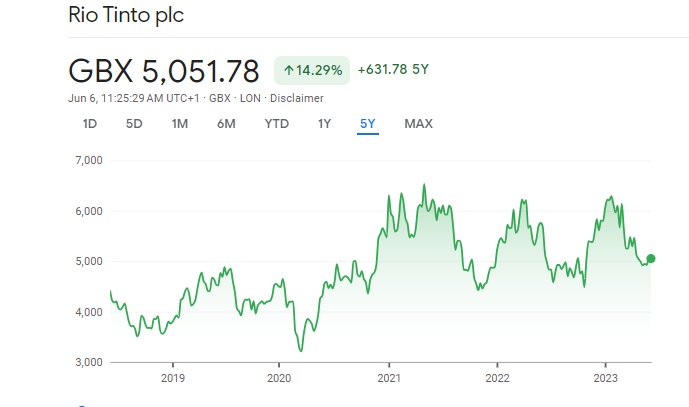

2. Rio Tinto (LSE: RIO)

Rio Tinto, a titan of the mining industry, is another FTSE 100 company we would buy. Its stock price had trouble in 2023, similar to Diageo. This is undoubtedly due in part to recessionary worries and a decline in demand from important markets like China.

On the plus side, Rio stock currently yields 7.6%, so at least we would get compensated for our patience. A P/E of eight is also favorable in comparison to the market as a whole, albeit not being a screaming bargain within the industry. If things do not turn out to be as horrible as some experts and journalists are forecasting, it might really turn out to be a good deal.

It is important to keep in mind the longer-term benefits of investing in this area. Rio stands to gain significantly over the following ten years from the green energy revolution and the ensuing demand for copper in particular.

3. Rightmove (LSE: RMV)

Property site Rightmove is frequently one of the first stocks to come to mind when considering high-quality equities. This business has long been the market leader and has continuously produced fantastic margins and returns on investment.

Despite this, Rightmove’s share price has struggled to increase in 2023. We believe that a significant chunk of this is due to worries about how high-interest rates will rise this year and the effects it would have on the availability of mortgages and the property market.

On the other hand, the beauty of Rightmove is that people will continue to search for housing during difficult times. Therefore, it has some protection that, for example, housebuilders might not have because estate agents will still be required to offer properties on the platform.

This FTSE 100 stock will probably never be offered for sale, just to be clear. The five-year average P/E is 32, while the current P/E of 22 is considerably lower.

Also read: Best FTSE 100 Brokers

Leave a Reply