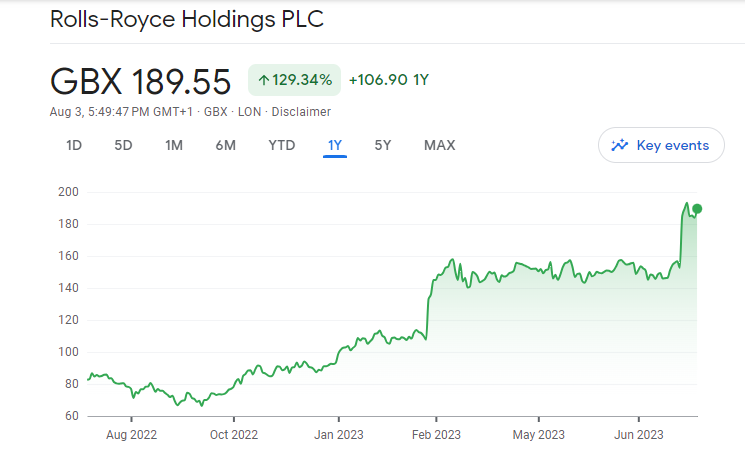

Following a large increase in profits, Rolls-Royce shares increased by nearly 20% last week. Many investors were taken aback by the announcement, but is it too late to go on board at this point?

We do not initially believe that it is past due. We thought this trading report was really fantastic. But let us look more closely.

The golden terms

In the first half of the year, the aerospace engineer recorded significantly higher profitability and cash flow. It stated that results are anticipated to be “materially above consensus expectations” for the second half.

These four golden phrases are frequently used as a cue to pay attention.

The organization’s multi-year transformation initiative appears to be succeeding. And when long-haul flying has recovered, the outcomes have significantly improved.

It now projects operational profits of £1.2 billion to £1.4 billion for the entire year. Even at the top of the range, that is significantly more than the market consensus by 50%.

Because of this, we believe that Rolls-Royce‘s stock still has room to rise.

The progress

Tufan Erginbilgic, the CEO of Rolls-Royce, only assumed his position at the beginning of the year. He was charged with increasing revenue. And so far, it appears that we are progressing really well.

Since a large portion of Rolls-Royce’s sales come from maintaining its engines, the company gains when more aircraft are in the air. Given that the pandemic’s travel restrictions severely disrupted aviation, it becomes sense to examine how things are doing now compared to 2019.

This paints a more accurate picture of how the company is bouncing back. In light of this, it is heartening to observe that engine flying hours have now surpassed 2019 levels by 83%.

We anticipate that by the end of the year, this number will increase as travel restrictions around the world continue to loosen.

The Noteworthy points

What possibly could go wrong with so many positive factors? Well, the Rolls-Royce share price has increased by double so far this year, and it is currently leading the FTSE 100. One could contend that any potential benefits are already constrained and that everything is currently priced.

Additionally, the global economy continues to struggle with widespread high inflation. The squeeze on household budgets could increase if interest rates rise. It might then cause a decline in air travel, especially leisure travel.

Typically, we do not like capital-intensive, heavily indebted businesses. Rolls-Royce had almost £3.3 billion in net debt in the previous year, which is still unacceptably high.

Investors should monitor how effectively it handles these borrowings going forward.

Final thoughts

Overall, we believe that Erginbilgic still has work to do despite significant progress. Having said that, we are pleased with how things are progressing.

This company is robust and expanding. We anticipate seeing additional development in the multi-year restructuring initiative.

We believe our optimism will grow if current trends continue. We believe that today’s share price might even seem like a bargain in a year or two. We will thus include these in our Stocks and Shares ISA as soon as we have money available.

Also read: Five Benefits Of Dividend Paying Stocks For Our Financial Well-Being

However, we want to purchase this stock in August for dividends

We find it bittersweet that Rolls-Royce shares have increased 108% in value during the past year. This is so since we only purchased the stock in March, thus capturing the final stages of these enormous returns. Therefore, we will increase our holdings in this FTSE 250 investment trust this month rather than the hot Rolls shares.

A portfolio of several international mining and metal stocks is managed by top-performance BlackRock World Mining Trust (LSE: BRWM).

However, one major draw for us is that we receive exposure to miners who we would not otherwise invest in. These include smaller privately-held enterprises including Canadian copper miner First Quantum Minerals.

Over the past five years, the trust’s share price has performed quite well. Even after falling 20% over the previous six months, it had increased by 62% (excluding dividends) over the past five years.

If we also count the payments, the total return has significantly outperformed the FTSE 250.

High demand for metals

The amount of metals and minerals required to manufacture sustainable energy technology like wind turbines and electric cars is enormous.

While iron ore is the main raw material required to produce steel wind turbine structures, a standard EV requires six times more key minerals than a typical automobile.

Furthermore, if hydrogen production keeps increasing at its current rate, there will be a huge market for nickel and zirconium for use in electrolyzers.

One might even contend that we are switching from a fossil fuel-based energy system to one that is based on metals.

Copper and gold

It goes without saying that mining equities are cyclical, which means that the principles of supply and demand govern them. As a result, the sector may become exceedingly volatile as a result of the ups and downs of the world economy.

Therefore, the management team of the trust’s expertise in navigating mining boom-and-bust cycles gives us comfort.

The portfolio is currently significantly weighted towards copper and gold, according to the managers.

Global scarcity of copper is currently in effect, caused by difficult South American supply streams and rising global demand. Future copper prices could rise significantly as a result of these deficits.

In contrast, management in the case of gold believes that a declining US dollar will benefit the precious metal. Part of the reason for this is that central banks are still investing in gold as a store of value to diversify their foreign exchange holdings.

This is good news for both the price and the gold miners.

Passive income

We like the 6.5% dividend yield that is currently being offered.

This yield is not assured, though. The trust did significantly reduce the distribution in 2017 since miners are known to slash dividends. However, altogether, since its launch about 30 years ago, it has a fantastic track record of producing income.

We seek exposure to the decarbonization megatrend as long-term investors. Along with excellent levels of passive income and the possibility of capital development, this trust provides us with that.

Leave a Reply