Samsung stock is poised for a significant resurgence in the semiconductor market as investors increasingly recognize the potential of its artificial intelligence (AI) strategy. Despite lagging behind the global semiconductor rally in recent times, Samsung stock is now attracting renewed attention from investors, buoyed by optimism surrounding its AI initiatives.

Rising Demand for NAND and High-Bandwidth Memory (HBM)

Analysts and fund managers alike are acknowledging the potential of AI to drive demand for NAND and high-bandwidth memory, both areas where Samsung stock holds a strong market position. As AI applications continue to expand, the need for high-speed storage solutions becomes paramount. This shift is expected to benefit Samsung, particularly in the face of competition from rivals like SK Hynix Inc.

Investors are redirecting funds towards Samsung, anticipating a significant upside as the company leverages its AI strategy to capitalize on emerging market trends. With expectations of a rebound in memory demand and prices, coupled with the increasing adoption of solid-state drives (SSD) for AI applications, Samsung stands to gain substantially in the coming quarters.

Analysts have revised price targets for Samsung upward, citing the potential of its AI-focused initiatives to drive earnings growth. Moreover, recent reports suggesting a looming “replacement cycle” favoring SSD over traditional hard disk drives (HDD) in AI applications further bolster Samsung’s position in the market.

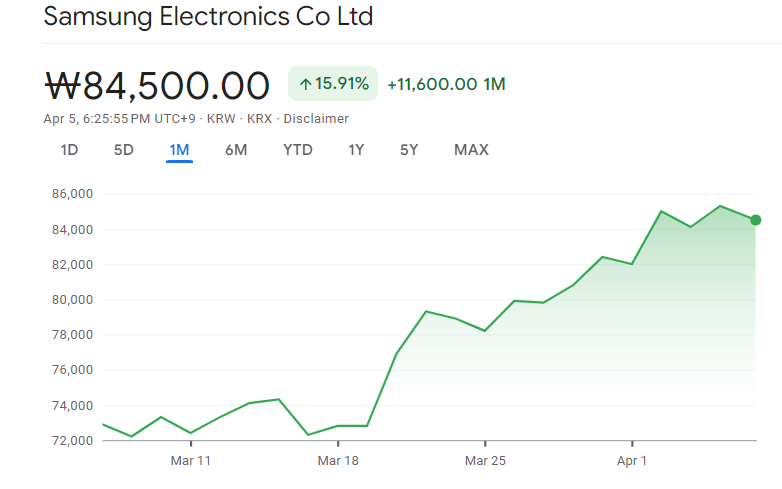

Despite trailing behind some of its competitors in year-to-date performance, Samsung stock’s recent 15% rise indicates a growing investor confidence in the company’s ability to capitalize on the burgeoning AI market. As Samsung continues to demonstrate clarity and progress in its AI strategy, it is poised to emerge as a frontrunner in the semiconductor industry, driving its comeback and solidifying its position as a key player in the AI-driven future.

Also read: Broadcom Emerges as a Leading Semiconductor Stock Amid AI Surge

Leave a Reply