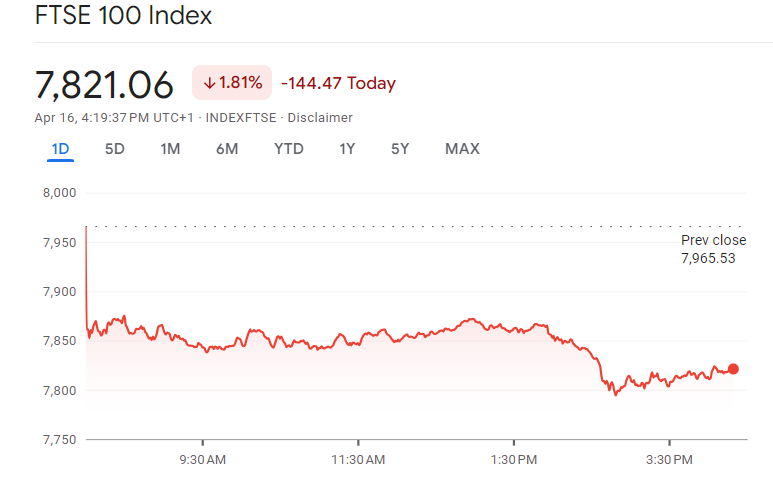

Today, the global stock market saw a notable decline, with major indices such as the FTSE 100 experiencing a 1.4% drop at the start of trading. Analysts attribute this significant downturn to several key factors, chief among them being escalating tensions in the Middle East following a recent attack on Israel by Iran.

Investors, wary of potential geopolitical instability, have begun to sell off stocks and seek refuge in safer assets like bonds and gold. The uncertainty surrounding the situation has cast a shadow over multinational companies with significant operations in the region, such as oil and gas giants BP and Shell. Concerns abound regarding potential disruptions to their operations and the broader implications for their businesses.

Interest Rate Hike Speculations

Another factor contributing to today’s stock market downturn is the expectation of higher interest rates, particularly in the United States. Strong economic data has led investors to believe that interest rates will remain elevated for a longer period than previously anticipated. This development has adverse implications for global firms like Glencore, which has sizable operations in the US, particularly in the energy sector.

The prospect of prolonged high interest rates poses challenges for companies with substantial debt burdens, such as Glencore, which reported higher-than-expected net debt in its 2023 financial report. The increased cost of servicing debt could dampen demand and profitability, weighing down on stock prices.

Concerns Over China’s Economic Outlook

Furthermore, concerns about China’s economic outlook have added to the stock market’s woes. Disappointing overnight economic data from China has fueled worries about a potential slowdown in the world’s second-largest economy. Given the interconnected nature of global supply chains, many FTSE 100 companies rely on China for production and other crucial activities. The uncertainty surrounding China’s economic trajectory has contributed to the general unease in the market.

Despite today’s downturn, it’s essential to note that the FTSE 100 recently reached 52-week highs above 8,000 points, reflecting an impressive rally since the beginning of the year. While short-term fluctuations may cause concern, investors remain cautiously optimistic about the stock market’s long-term prospects.

In conclusion, today’s stock market decline can be attributed to a combination of escalating geopolitical tensions, expectations of higher interest rates, and concerns about China’s economic performance. While these challenges may exert downward pressure on stock prices in the short term, investors are advised to maintain a long-term perspective and monitor developments closely.

Also read: 3 Cheap FTSE 100 Stocks Under £100

Leave a Reply