Small-cap stocks have been gaining significant traction in 2024, outpacing larger counterparts due to various market dynamics. Despite a rocky start to the year, exemplified by the roller-coaster ride of the Russell 2000 index, certain small-cap stocks have defied the odds, boasting remarkable gains in 2024.

Let’s delve into the narratives behind three such standout small-cap stocks performers, evaluating their potential for continued growth amidst prevailing economic uncertainties.

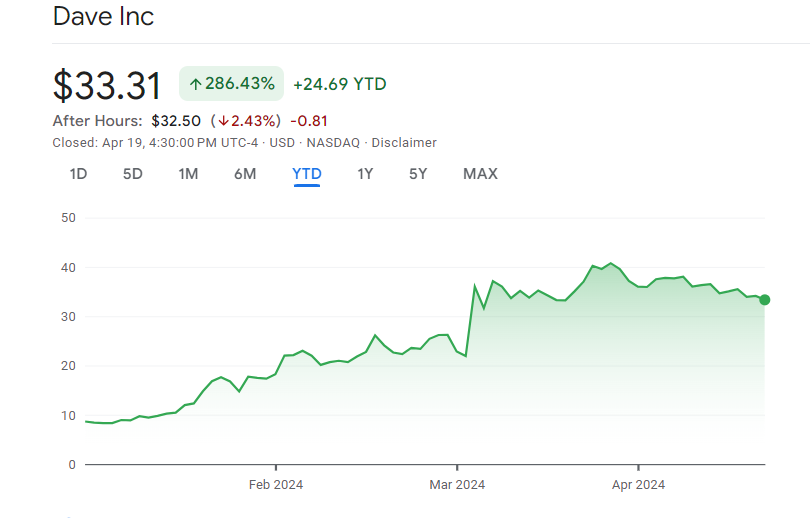

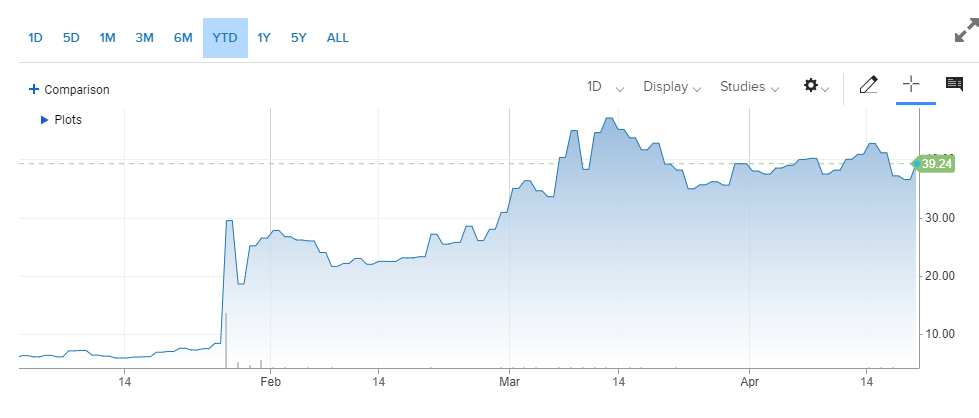

1. Dave (NASDAQ:DAVE)

Dave has emerged as a disruptor in the banking sector, offering digital banking services with a focus on financial inclusion. Despite criticisms surrounding its fee structure and lending practices, Dave’s innovative approach has attracted over 13 million registered members. The small-cap stocks impressive 286% surge in 2024 reflects growing consumer demand for alternative financial solutions.

While Dave’s growth trajectory seems promising, regulatory scrutiny and potential backlash from consumers could pose challenges in the future. As policymakers address concerns regarding payday lending practices, Dave may need to adapt its business model to ensure long-term viability and sustained growth.

2. Corbus Pharmaceuticals Holdings (NASDAQ:CRBP)

Corbus experienced a dramatic surge of 515% following positive results from its early-phase trial for CRB-701, an antibody-drug conjugate (ADC). The excitement surrounding potential acquisition opportunities fueled investor optimism, driving the stock to unprecedented levels.

However, the speculative nature of biotech investments, coupled with the early-stage development of CRB-701, raises questions about the sustainability of Corbus Pharmaceuticals’ valuation. As investors recalibrate their expectations and assess the company’s pipeline beyond CRB-701, the stock may face volatility and potential corrections in the coming months.

3. Skye Bioscience (NASDAQ:SKYE)

Skye Bioscience has garnered investor attention with positive developments in its clinical trial programs, particularly with its glaucoma drug SBI-100 Ophthalmic Emulsion (OE). The completion of enrollment in a phase 2A study and progress in obtaining FDA clearance for nimacimab indicate promising prospects for the biotech company.

Despite a temporary setback due to equity financing, Skye Bioscience’s successful transition to the Nasdaq exchange reflects investor confidence and the company’s commitment to growth. However, as it awaits topline data and navigates the complexities of clinical development, Skye Bioscience must demonstrate continued progress to justify its remarkable 493% surge in 2024.

Also read: Should You Buy EV Stocks in 2024?

Leave a Reply