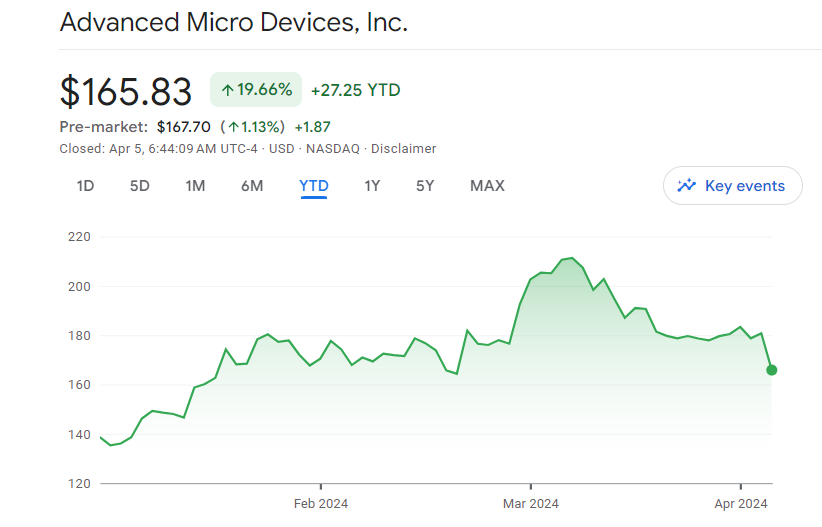

Financial analysts are bullish on AMD stock, projecting a substantial increase in its stock price over the next five years. The forecast, supported by optimistic estimates of earnings per share (EPS) growth and the company’s strategic position in the artificial intelligence (AI) market, suggests significant potential for investors.

Earnings Growth and AI Market Dynamics Driving Optimism

Analysts anticipate AMD’s EPS to grow by approximately 25% annually for the next five years. This optimistic outlook is fueled by AMD’s strategic positioning to leverage the increasing demand for AI technologies. With the AI industry expected to witness exponential growth, reaching over $1.5 trillion by 2030, AMD stands to benefit significantly from this trend, driving substantial revenue and profit growth.

The projection outlines various scenarios for AMD stock price based on different forward price-to-earnings (PE) ratios. Currently trading at a forward PE ratio of 33, AMD stock price could potentially reach $550 per share by 2029 if EPS meets the projected $16.69 by 2030. However, adjustments for different PE ratios suggest potential stock prices ranging from $250 to $550 per share by 2029.

Recommendations for AMD Investors

The optimistic forecast presents an attractive opportunity for investors seeking long-term growth prospects. However, the realization of these projections depends on AMD’s ability to sustain its earnings growth trajectory and effectively capitalize on the expanding AI market. Investors are advised to closely monitor key performance indicators such as EPS performance and forward PE ratio to gauge the stock’s trajectory accurately.

As AMD continues to solidify its presence in the AI technology sector, analysts foresee substantial growth potential for the company’s stock in the coming years. With a bullish outlook underpinned by robust earnings growth expectations and the promising dynamics of the AI market, AMD stock emerges as an appealing investment option for investors eyeing significant returns. Nonetheless, diligent monitoring of market trends and company performance remains essential for making informed investment decisions.

Also read: Best AI Stocks to Buy in 2024

Leave a Reply