Investors must take into account more than just yield. Here is our assessment of whether BT and Sainsbury stock is currently a good dividend stock for investors.

The market reacted differently to recent interim results from J Sainsbury and BT Group: the grocer’s shares were driven up 6.9% on the day, while the telecom firm was sold off 8.9%.

However, both equities currently have high dividend yields. Additionally, both businesses plan to raise shareholder returns in the future.

How well do BT and Sainsbury perform as top purchases for income investors?

Dividend Yields

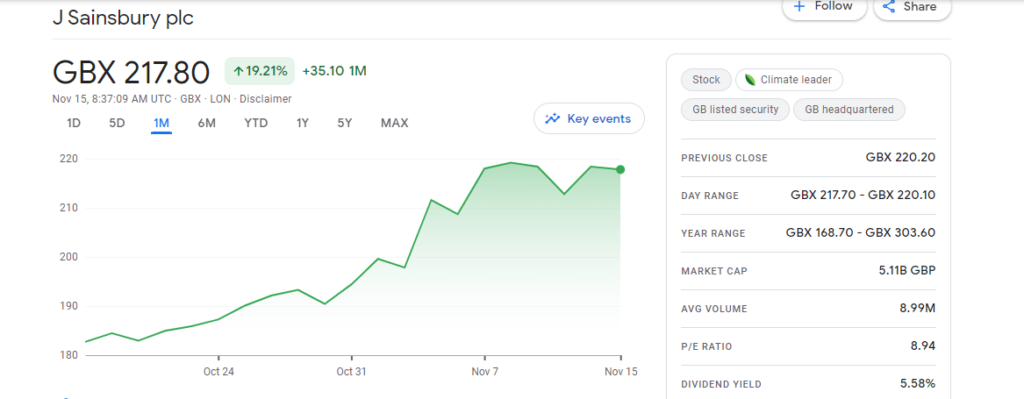

Firstly, let’s talk about their dividend yields. Sainsbury declared a 3.9p interim dividend, and according to analysts, the full-year distribution will be 12.1p. If the analysts’ consensus is accurate, the potential yield at a share price of 209p is 5.8%.

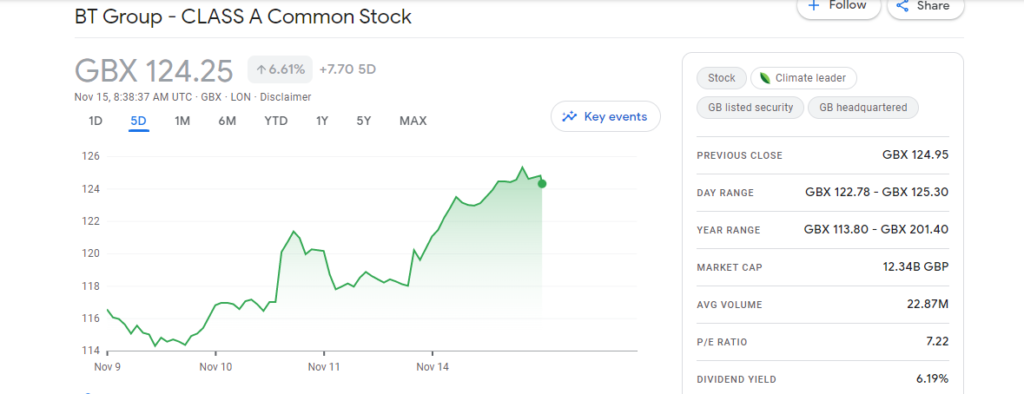

Analysts anticipate a 7.77p total payout for the year after BT’s interim dividend of 2.31p. The expected yield at 114p per share is 6.8%.

Dividend Policies

Sainsbury’s board plans to pay out substantial ordinary dividends and to return future cash surpluses to shareholders through increased dividends and/or share repurchases. A progressive dividend policy is employed by BT.

As a result, initial yields for both businesses are higher than the industry standard. Additionally, shareholders are given the chance of potential future increases in returns.

- Sainsbury: Ordinary dividends trail capital expenditures to support the business and uphold a strong investment-grade balance sheet in Sainsbury’s capital allocation priorities. The additional returns from excess cash go even lower on the priority list, after specific investment opportunities like lease buy-ins.

- BT: The goal of BT’s progressive dividend policy is to consistently maintain or increase the payout. The board takes a number of things into account when determining compensation. These consist of projected earnings over the next few years and levels of corporate investments.

Any corporation that wants to keep or increase its dividend must ultimately keep or increase its profitability.

If profits temporarily decline, it might be able to support the dividend by using its borrowing capacity. The dividend will almost probably need to be rebased to a lower level or suspended altogether if profits are consistently lower or drop over a sustained period of time.

Free cash flow

- Sainsbury: In its most recent results, Sainsbury stated that it still anticipates an average retail FCF of at least £500 million annually over its three fiscal years through 2025. Dividend projections from analysts for the current year come at £284 million. As a result, FCF would easily cover the dividend.

- BT: In its findings, BT stated that it now anticipates current-year FCF to fall within the previous forecast range of £1.3 billion to £1.5 billion. The City projects no more than £1.3 billion in yearly FCF until 2025. However, this covers the £772 million projected dividend by analysts for the current year.

Difficult Times

Sainsbury and BT, like many companies, are experiencing substantial operating cost inflation due to rising energy prices and other factors. They must strike a balance between keeping their customers’ costs competitive, making investments for the future, and paying dividends to shareholders.

To compete with Tesco, which benefits from a greater level, and Aldi and Lidl, with their inexpensive, limited-assortment business strategies, Sainsbury in particular must absorb costs.

BT is currently engaged in a period of particularly high investment for the future, with a significant fiber rollout program underway.

Given the difficult macroeconomic and corporate environments, City analysts now anticipate little to no dividend increase from each company through at least fiscal 2025.

Our verdict

If you’re seeking to develop a portfolio of 10 or 15 top sector picks, Sainsbury and BT wouldn’t be on our list of best buys for income.

They fall behind businesses where we believe there is more potential for dividend growth in the next years, especially given the high rate of inflation.

With that, Sainsbury and BT would interest us as backup options if you’re wanting to develop a more comprehensive income portfolio, doubling up in sectors to reduce individual business risk.

Their comparatively high initial yields appeal to us. And we believe they have a good chance of keeping their payouts.

Leave a Reply