Aviva Stocks are currently trading at 380p, down 6% this week. Only a few pennies separate this from the 52-week lows of 366p from October of last year. Given that Aviva stocks are only marginally down 6% over the past year, the current decline may present a decent chance for investors to acquire the stock at a discount.

Positive indicators for income investors

Aviva stocks (LSE: AV) now offer one of the highest dividend yields in the FTSE 100 at 8.18%. This has recently received a small boost thanks to the share price decline. However, we believe the yield can stay high given the upward trajectory in dividends paid per share.

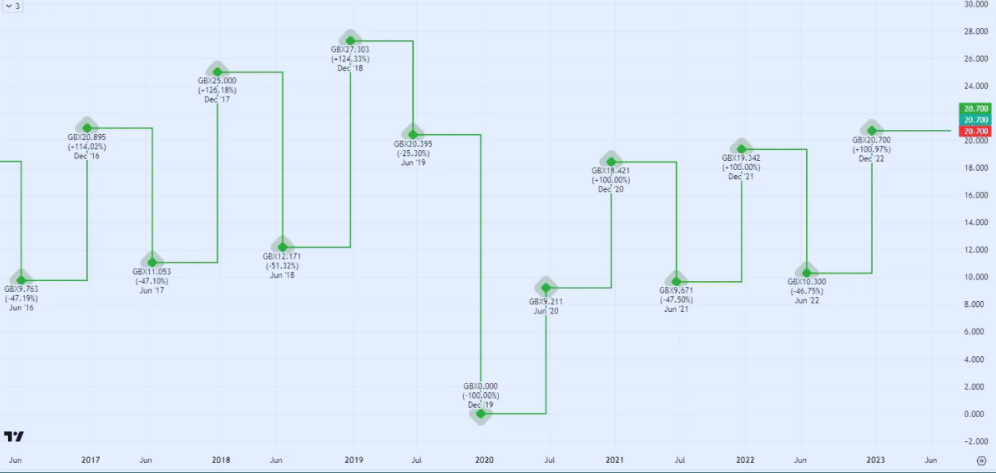

The data below demonstrates that, before the pandemic, the December dividend had increased to 25p in 2018 and 27p in 2019 (respectively). Two dividends are typically distributed by the company each year, with the final payment being the greater of the two.

This collapse occurred during the pandemic as the company tried to maintain financial flow. The payments have resumed since that time. However, they have not yet returned to their pre-pandemic levels.

Based on this, we anticipate the company will attempt to increase both the interim and the final dividend in the upcoming years. For investors who purchase the stock right away, this is encouraging.

Having appealing valuation metrics

We can not use the price-to-earnings ratio on a chart to determine whether Aviva is a good investment because the company lost money in its most recent results. Instead, we might make use of the price-to-book ratio (P/B).

This variant compares the share price to the book value, which contrasts the assets and liabilities. Anything below one often indicates that the stock is undervalued in the company’s fundamentals.

The graph displays several 0.89. The P/B ratio has decreased recently, despite being significantly lower during the pandemic. This brings us to the conclusion that the company still provides value to potential investors even though it is not as undervalued as it has been since 2020.

Beware of profits

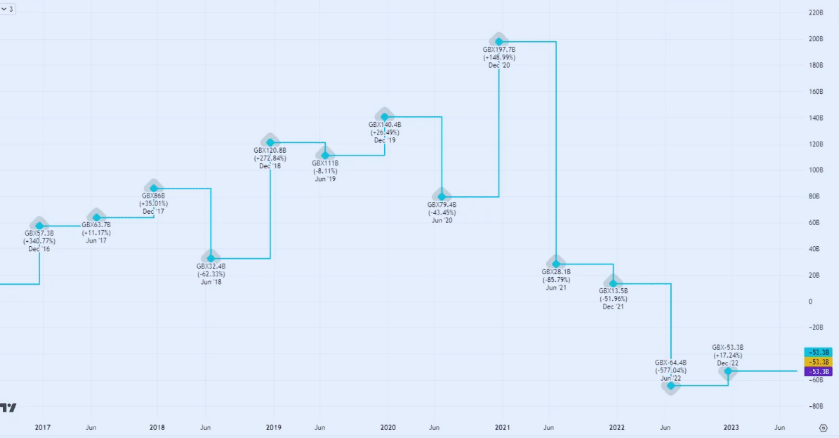

The decline in profits is one factor contributing to the share price decline. The net income over the previous few years is depicted in the graph below. The unfavorable effects of Covid-19 resulted in a significant reduction. Yet when examining this particular earnings indicator, the corporation has not exactly been able to recover.

Future concerns stem from this. If Aviva stock can not improve its bottom line (by cutting expenses or raising income), it will start to have an adverse effect elsewhere. This includes prospective dividends as well as free cash flow.

The aforementioned charts, in our opinion, do suggest that buying Aviva Stocks right now would be a wise move, especially for those who are income-focused. The danger of declining net income is clear, but we believe this has already been taken into account given that the stock is so close to 52-week lows.

Also read: Reasons To Avoid And To Buy Cheap Lloyds Stocks Today

3 reasons to purchase Aviva Stocks

We believe it to be a winner right now for the following three reasons:

1. An expanding market

Rapid demographic change in the company’s domestic and Scandinavian markets offers a plethora of opportunities. In other words, as the senior population grows, demand for its pension, retirement, and investment services may soar.

According to the Office for National Statistics, one in five individuals in the UK will be 65 or older by 2030. As people make plans for their older years, this gives the company plenty of business to win.

The company has the brand power to take full advantage of this opportunity as well, as it was formed by the 2000 merger of two titans of the sector, Norwich Union and Commercial Union.

2. Awesome money generation

Make no mistake: Aviva has elevated the art of making money. Cash remittances increased 11% to more than £1.8 billion in 2022, helped by a successful £750 million cost-saving effort.

Additionally, the company stated last month that it is on track to surpass its £5.4 billion cash remittance goal for the two years leading up to 2024. Such remittances are surplus funds that its units transfer back to the parent company.

Excellent cash flow production provides the business with extra funding for growth investments. This brings us to our next point and gives it additional money to distribute to its stockholders.

3. Huge dividends and share buybacks

Like many other life insurers, Aviva stock has been extraordinarily liberal in giving investors their money back.

It has promised to spend an astounding £915 million on dividends in 2023 alone. After that, the company intends to increase dividends annually by low to mid-single-digit percentages.

The company has also lately undertaken several significant share buybacks, the most recent of which was a new £300 million repurchase that was completed in June.

Over the next ten years, Aviva stocks could produce exceptional gains. And the current price decline gives a fantastic opportunity to buy on a dip.

Leave a Reply