Investing in blue-chip stocks can be a prudent way to build wealth over time, offering stability and growth potential even with modest initial investments. Blue-chip stocks are known for their strong financial performance, and established market presence, and often pay regular dividends, making them attractive for both new and seasoned investors alike.

With $1,000 to invest, selecting the right blue-chip stocks can set the foundation for a diversified portfolio that aims to weather market fluctuations while capitalizing on long-term growth opportunities. In this post, we explore ten of the best blue-chip stocks to consider investing in now.

10 best blue-chip stocks to buy

Here’s a look at some top blue-chip stocks that you can consider investing in with $1,000:

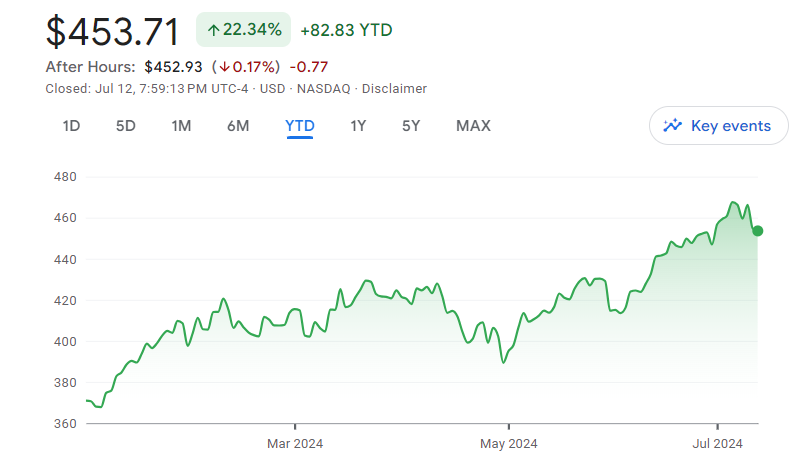

1. Microsoft Corp. (NASDAQ: MSFT)

Microsoft stands as the world’s largest software company, renowned for its Windows operating system, Office suite, and Azure cloud services. Analysts highlight Microsoft’s robust growth in cloud-based offerings like Dynamics and Teams, which are gaining traction among enterprises. Azure, its cloud infrastructure service, continues to drive substantial revenue growth, now comprising a significant portion of Microsoft’s overall earnings. With a strong emphasis on artificial intelligence, bolstered by its partnership with OpenAI, Microsoft remains poised for sustained growth. CFRA rates MSFT stock a “strong buy” with a target price of $475, reflecting confidence in the future performance of this blue-chip stock.

2. Apple Inc. (NASDAQ: AAPL)

Apple needs little introduction as a global leader in consumer electronics, producing iconic products like the iPhone and Mac computers. Beyond hardware, Apple’s services segment, encompassing the App Store and Apple Music, contributes significantly to its revenue stream. Analysts cite Apple’s expanding ecosystem and on-device AI capabilities as catalysts for future growth. With a robust free cash flow generation and a shareholder-friendly capital return program, AAPL stock holds a “buy” rating from CFRA with a target price of $240, underscoring its long-term investment appeal.

3. Nvidia Corp. (NASDAQ: NVDA)

Nvidia has emerged as a powerhouse in graphics and AI technology, supplying advanced computing solutions to gaming, data centers, and autonomous vehicles. As the best-performing stock in the S&P 500 in recent years, Nvidia continues to innovate in AI technologies, positioning itself at the forefront of industry growth. Analysts foresee substantial opportunities ahead, particularly in AI and high-performance computing sectors. CFRA rates NVDA stock a “buy” with a target price of $139, reflecting confidence in continued market leadership and growth potential of this blue-chip stock.

4. Alphabet Inc. (NASDAQ: GOOGL)

Alphabet, Google’s parent company, dominates the online search and advertising landscape globally. With robust revenue growth projections driven by its core search engine and YouTube platform, Alphabet remains a leader in AI technology investments. Analysts highlight Alphabet’s attractive valuation and strong free cash-flow potential, underpinning its position as a preferred investment in the tech sector. CFRA rates GOOGL stock a “buy” with a target price of $190, expecting continued revenue expansion and innovation-driven growth.

5. Amazon.com Inc. (NASDAQ: AMZN)

Amazon stands as the undisputed leader in e-commerce and cloud computing services through Amazon Web Services (AWS). Analysts commend Amazon’s robust free cash flow generation and growth prospects in higher-margin segments like AWS and advertising. With a focus on innovation and customer-centric services, Amazon remains well-positioned for future profitability and market expansion. CFRA rates AMZN stock a “buy” with a target price of $233, reflecting optimism in its ability to exceed market expectations and sustain growth momentum.

6. Meta Platforms Inc. (NASDAQ: META)

Formerly Facebook, Meta Platforms leads in social media and digital advertising, owning popular platforms like Facebook and Instagram. Despite market volatility, The valuation remains attractive for this blue-chip stock, supported by its dominant market presence and ongoing innovations in digital advertising technologies. Analysts project significant earnings-per-share growth in 2024, underscoring Meta’s resilience and potential for long-term profitability. CFRA rates META stock a “buy” with a target price of $540, reflecting confidence in its strategic direction and market leadership.

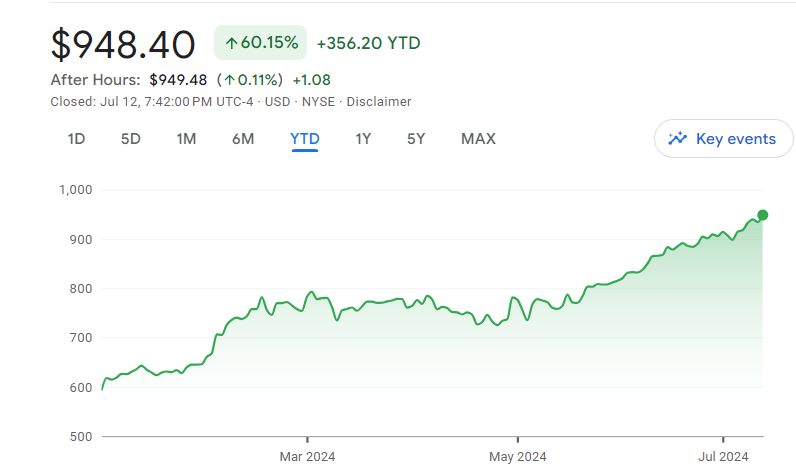

7. Eli Lilly and Co. (NYSE: LLY)

Eli Lilly specializes in pharmaceuticals, developing and commercializing treatments for various medical conditions, including diabetes and cancer. Analysts highlight Eli Lilly’s robust pipeline of late-stage clinical candidates, such as Donanemab and Pirtobrutinib, poised to drive future revenue growth. With a strong portfolio of commercial drugs and a promising R&D pipeline, Eli Lilly offers a compelling investment opportunity in the healthcare sector. CFRA rates LLY stock a “strong buy” with a target price of $990, anticipating continued growth in therapeutic innovations and market share.

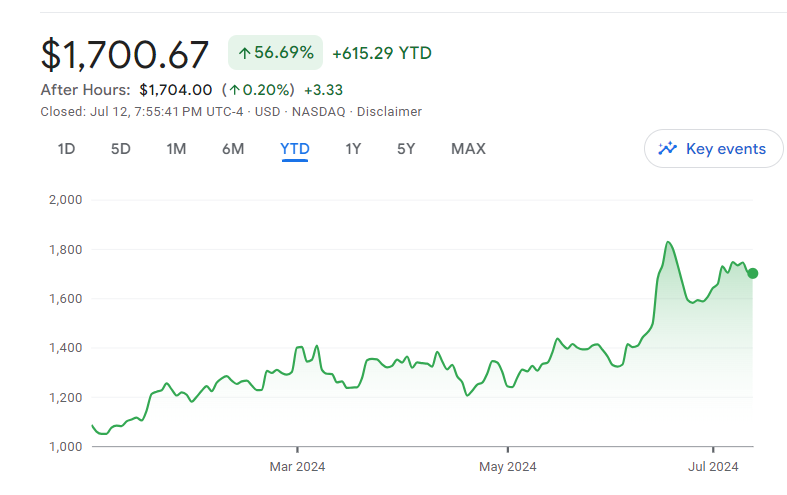

8. Broadcom Inc. (NASDAQ: AVGO)

Broadcom is a global leader in analog semiconductors, benefiting from increased demand for AI infrastructure and network solutions. Analysts highlight Broadcom’s strategic acquisitions and diversification into higher-margin software sales through the VMware acquisition. With a positive revenue outlook and improved financial visibility, Broadcom presents a compelling investment case in the semiconductor stocks industry. CFRA rates AVGO stock a “buy” with a target price of $1,850, reflecting confidence in its growth trajectory and strategic initiatives.

9. Lululemon Athletica Inc. (NASDAQ: LULU)

Lululemon is a prominent retailer of athletic apparel and accessories, renowned for its premium quality and brand loyalty. Despite recent market challenges, Lululemon continues to expand its global footprint and innovate in athleisure wear. Analysts highlight Lululemon’s solid revenue growth and strong cash position, supporting its resilience in the retail sector. With a focus on customer-centric strategies and product innovation, Lululemon remains a favorable investment choice. CFRA rates LULU stock a “buy” with a target price of $310, reflecting optimism in its growth potential and market positioning.

10. Adobe Inc. (NASDAQ: ADBE)

Adobe is a leading provider of software solutions, known for its Creative Cloud and Document Cloud platforms. Analysts commend Adobe’s strong revenue growth driven by subscription-based services and continuous innovation in AI-enhanced software tools. With a robust track record of free cash flow generation and ongoing product advancements, Adobe stands out as a top pick in the software-as-a-service industry. CFRA rates ADBE stock a “strong buy” with a target price of $600, underscoring its leadership in digital transformation and long-term growth prospects.

Final Thoughts

Investing $1,000 in blue-chip stocks can provide a balanced portfolio with growth potential and stability. Each of these companies boasts strong fundamentals, innovative capabilities, and strategic positions in their respective industries, making them compelling choices for investors looking to build wealth over the long term.

Leave a Reply