Most investors seek to make financial investments that will provide them with significant returns as rapidly as possible while minimizing the danger of losing their principal. This is why many people are always looking for the greatest financial investment programs that will allow them to quadruple their money in a matter of months or years with little or no risk.

You should combine your risk exposures with the product’s associated hazards before investing in a commodity. Many financial investments have a high-risk profile but have the potential to provide higher adjusted returns on inflation over time than other asset classes, whilst others have a low-risk profile and thus lower returns.

This article will give you an overview of the ten most profitable financial investments for 2022, as well as the advantages and disadvantages of each, as well as how to get started with each.

What is a financial investment?

Financial investment is described as putting money aside for a specific length of time with the hopes of reaping a profit, whether in the form of income (interest or dividends) or capital gains.

Yet, it’s vital to note that the money earned is only a representation of the risk taken and the possible immobility of the assets spent over time when choosing a profitable financial investment.

Why put money in a financial investment?

Investing can provide a secondary source of income, assist with retirement planning, and even assist you get out of debt. Investing, above all, assists you in achieving your financial goals by increasing your buying potential over time. Perhaps you’ve recently sold your home or received a windfall. Allowing your money to work for you is a good option.

While financial investing might help you grow your money, you must consider the advantages and disadvantages. And you’ll need to be in a financial position to do so, which implies you’ll need to keep your debt under control, have a sufficient emergency fund with the ability to ride out market highs and lows without needing to use your money.

Which broker to choose for financial investment?

It all relies on your requirements, prior trading experience, and current circumstances. eToro, on the other hand, provides the greatest overall service and the most assets to invest in. They also provide an excellent platform for newcomers and are governed by a number of financial agencies.

eToro: Beginner-friendly financial investments

eToro was founded in Tel Aviv in 2006 and has since expanded internationally. It now has roughly 11 million customers throughout the world who can invest in equities and ETFs with no commissions.

In a user-friendly and interactive marketplace, their social platform allows investors to share their knowledge and skills. Users can mimic the trades of top traders on their platform using their Copy Trader technology, making it an excellent choice for newbies.

Moreover, CySec and FCA oversee eToro. In Italy, ASIC takes control, while in the United States, FinCEN takes over. It also boasts one of the most user-friendly stock market apps for iOS and Android devices for trading on the move.

Commissions and Fees

When trading stocks and ETFs listed on the exchange, you will not be charged a commission under the “Zero Commission” scheme. A spread is applicable to all other marketplaces, which is the difference between the selling and buying prices.

Types of assets available for financial investment

- Stocks and ETFs

- Forex

- Cryptocurrencies

- Raw materials

Pros

- 0% commissions on stocks and ETFs

- CySEC, FCA, and ASI are all regulators for this broker

- There is a large selection of assets available

- Beginners can use the Mimic Trader software to copy the moves of the finest stock market investors

Cons

- Advanced traders should avoid it

- Fee for withdrawal

The Best Financial Investments for 2022

Here is a quick list of the top 10 best financial investments for 2022:

- Stocks

- Bonds

- ETF

- Cryptocurrencies

- Gold

- Forex market

- Real Estate

- Structured products

- Crowdlending

- Crowdfunding

The 10 Best Financial Investments for 2022

It is now needed to assess the ten best financial investments by examining their functioning, unique characteristics, and predicted return, as well as their primary benefits and drawbacks.

1. Stocks as a financial investment

Stocks, among the recommended long-term investments, are the most profitable in the long run if appropriate investment practices are followed. An annual rate of return on a well-diversified stock investment portfolio normally ranges around 6 to 10 percent per year. On the other hand, because stock market prices are volatile by nature, it is vital to understand that performance is irregular and sometimes negative.

What kind of profit can you expect?

Investing in publicly traded equities has a wide range of rewards. However, taking into consideration the dividends received by the shareholder, we can expect an annual return of between 6 and 8% on an annual basis over the long run.

Pros

- Over time, there is a lot of money to be made

- The performance of this investment is inherently erratic

- If you choose the PEA tax envelope, you can save a lot of money on taxes

Cons

- Time commitment is required

How to get started?

We recommend eToro, an online broker that provides all of its customers with a copy trading feature that allows investors to watch and copy the trading activity of the platform’s best traders.

To register for a trading account all you have to do now is follow the steps below:

- Open a trading account

- Verify your account

- Fund your account

- Choose a company to invest in

- Confirm your investment

2. Bonds as a financial investment

Bonds, like stocks, are publicly traded financial instruments. But Bonds, on the other hand, are a claim or debt security for the corporation or government that decides to issue them, rather than a property title. In the case of a bond, you lend money to the corporation in exchange for a predetermined return (called a coupon). Bonds, on the other hand, are less volatile than equities, with lower volatility but come with reduced profitability.

What kind of profit can you expect?

In terms of profitability, depending on the type of bonds bought, you can expect yearly returns of 2% to 5% every year. Indeed, because a bond is a loan to a firm or a government, the longer the loan term, the higher the interest paid.

Pros

- Profitability that is appealing

- Investing through unit-linked life insurance is a possibility

Cons

- Risk of bond issuer collapse

How to get started?

We recommend that you use an online broker that specializes in bond trading, just like you would with the stock market.

3. ETFs as a financial investment

If you don’t have the time or knowledge to invest in a share or a bond, you can invest directly through an Organization for Investment in Securities (UCITS) investment fund, such as ETFs (“Exchange Traded Funds”), also known as trackers, which copy the performance of the major stock market indices in real-time.

These investment vehicles allow people to profit from the volatility of stock markets over time without having to pick individual stocks for their financial portfolio.

What kind of profit can you expect?

The predicted profits are similar to those of stock exchange-listed shares, i.e., an annual return of 6 to 8% on an annual basis, as evidenced by the Dow Jones index’s growth of 7 percent per year over the last 100 years.

Pros

- Profitability is high, but it is volatile

- Investing via a PEA or life insurance account unit is one option

Cons

- To make money, you must invest in the long term

How to get started?

On ETFs, as with the stock market, we recommend using the online broker eToro. Check out our guide to ETF investing to discover more about the finest ETF investments.

4. Cryptocurrencies as a financial investment

A further excellent financial investment in this year 2022 is to invest in cryptocurrencies, for example buying Bitcoin (BTC), buying Ethereum (ETH), or buying Ripple (XRP) (XRP). However, no other financial investment has seen an equal return in recent years, albeit at the cost of excessive risk-taking due to price volatility.

What kind of profit can you expect?

The profitability of cryptocurrency investments is highly varied, with double-digit monthly returns not unusual. Bitcoin, for example, has increased by about 5,000 percent in the last five years, surpassing the symbolic mark of 45,000 dollars today.

Pros

- Profitability potential is really high

- There is a large selection of investments offered

Cons

- Price volatility is high

- There is a significant chance of loss

How to get started?

You’ll need an account on a digital currency exchange platform if you want to take advantage of it and acquire crypto-currencies. You can again turn to eToro, an online broker that allows you to acquire cryptocurrencies easily and rapidly through its trading interface, which features more than a dozen digital currencies, including some of the most popular.

5. Gold as a financial investment

Gold is also a good financial investment to think about in 2022, especially if you want to protect your funds against inflation. To do so, it is suggested that you invest online, rather than owning real gold (gold coins or gold bars). The best way is to invest in exchange-traded funds (ETFs) that track the price of gold in real-time.

What kind of profit can you expect?

It’s tough to answer this question, but gold has shown to be a winning investment throughout time, as evidenced by the graph below, which shows its evolution from 1970. In the long run, expect an increase of a few percent per year, roughly equal to the rate of inflation.

Pros

- Long-term profitability is remarkable

- ETFs are an option for investing

- Protection against inflation

Cons

- Loss is a possibility

How to invest?

ETFs that are related to the price of gold can be purchased or sold using the eToro trading platform without paying commissions.

6. Forex Market as a financial investment

Trading on the Forex market, or the currency market, is also a viable investment option for 2022. Due to the volatility of currency markets and the potential of using leverage to increase performance, it is limited for individuals, financial market professionals.

What kind of profit can you expect?

Profitability is highly variable and is determined by the efficacy of your trading strategy. Be warned that the amount of capital gains that can be realized is nearly endless due to the ability to use extremely high leverage effects (greater than 100).

Pros

- A lot of money can be made

- Protection from economic cycles

Cons

- Leverage can cause you to lose more than your initial investment

How to get started?

The online broker eToro allows you to trade the major currencies at a lower cost, such as EUR/USD, USD/CHF, GBP/USD, USD/JPY, GBP/EUR, and so on.

7. Real estate as a financial investment

Standard real estate investing involves purchasing a building and then selling it for a return, as well as holding a property and receiving rent as a source of fixed income. There is now a variety of other, considerably less time consuming alternatives to invest in real estate.

Real estate investment trusts, or REITs, are one popular method. These are businesses that hold income-generating properties (such as shopping malls, hotels, and offices) and payout dividends on a regular basis. In recent years, real estate crowdfunding platforms, which pool investors’ money to participate in real estate projects, have grown in popularity.

What kind of profit can you expect?

According to the IEIF Institute, real estate investing is profitable at roughly 5% per year after taking into account property revenue and revaluation of the investment.

Pros

- Profitability is fairly high in the recent low-interest-rate market

- Inflation prevention

Cons

- Unstable investment

- Purchase costs are high

How to get started?

Some REITs can be purchased through an online stockbroker on the public stock market, while others are exclusively available in private marketplaces. Similarly, some investments systems are only limited to accredited investors, while others allow everyone to invest.

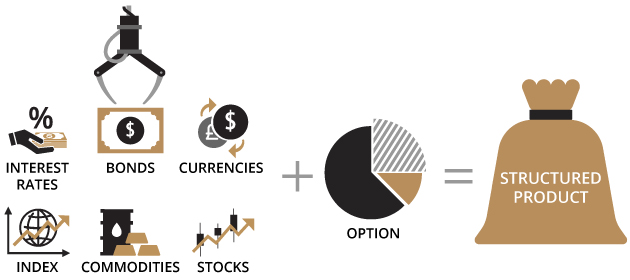

8. Structured products

A structured product is a sophisticated financial instrument offered by a bank or insurance business. The declared goal is to combine capital protection with the pursuit of financial performance, notably on the stock market.

Because structured products are rather sophisticated products whose technique of calculation must be thoroughly understood, they can find a place in the portfolios of individual investors with a medium/long-term objective, provided they are well understood.

What kind of profit can you expect?

The profitability of these products is highly variable because it is based mostly on the risk that the subscriber is willing to assume. Nonetheless, profitability will be slightly lower than that of the equity markets, i.e. roughly 4/5 percent per year.

Pros

- Profitability that is appealing

- Through a partial capital guarantee, you can have exposure to the stock market while lowering your risk

Cons

- The investment is illiquid

- Possibility of capital loss

- Complicated product

- Critical costs

How to get started?

Banks are the ones who sell these structured products. Nonetheless, they are custom investments (tailored to your specifications if you want from a considerable minimum amount) that satisfy the needs of savers based on market conditions. The operating conditions are spelled out in detail in the prospectus for the comprehensive offer.

9. Crowdlending as a financial investment

One of the key benefits of Crowdlending, also known as participatory finance, is that it will be able to give very attractive rates of return in 2022, allowing savers to lend their money to entrepreneurs who are presenting highly profitable initiatives, typically in the field of business formation.

However, because crowdlending is not a liquid investment (no option of reselling before the conclusion of the contract), it is best to stretch your investments out over time to meet your specific goals.

What kind of profit can you expect?

Because the risk of the corporation requesting a loan determines the profitability of these products, it is highly variable. Nonetheless, depending on the creditworthiness of the borrowers, the returns displayed on average range between 4% and 12% per year.

Pros

- Profitability is quite appealing

- Possibility of expanding your loan portfolio

Cons

- The investment is illiquid

- Possibility of capital loss

- Major costs

How to get started?

These products are available through Crowdlending sites on the internet. Then it’s up to you to find the project that appeals to you based on your criteria (activity of the company, desired interest rate, duration of the loan, etc.).

10. Crowdfunding as a financial investment

It is a participation investment in the case of Crowdfunding. Unlike Crowdlending, this involves becoming a stakeholder of a start-up or small business and investing in its shares.

Dividends or the capital gain realized over time provide the cash benefit. As a result, the risk is higher, but so are the chances of profit. Crowdfunding, on the other hand, is a very illiquid investment, so only invest what you can afford to keep aside for several years.

What kind of profit can you expect?

Because the success of the business determines the profitability of these products, it is extremely unpredictable. Even if we are successful, we can assume a double-digit average return.

Pros

- High-yielding potential

- Tax breaks that may be available

- Possibility of putting its assets into a PEA or a PEA PME

Cons

- The investment is illiquid

- Possibility of capital loss

- Crucial expenses

How to get started?

These services are also available through online crowdfunding sites like Kickstarter, for initiatives in real estate, renewable energy, and even the agricultural and food transition.

What to consider before investing in a financial investment?

You should think about your risk tolerance, time horizon, investment knowledge, financial condition, and how much you can invest when determining what to invest in.

If you want to increase your wealth, you have two options: lower-risk investments with a small return or higher-risk investments with a higher return. When it comes to investing, there is usually a trade-off between risk and reward. You can also take a more balanced strategy, putting your money in totally safe assets yet allowing for long-term development.

With varying levels of risk and return, the best financial investments for 2022 allow you to accomplish both.

Risk tolerance

Risk tolerance refers to how much volatility in the value of your investments you can tolerate. Are you willing to take significant risks in exchange for a chance to make a lot of money? Or do you require a more conservative investment strategy? Tolerance for risk is both a psychological feature and a result of your personal financial situation.

Conservative investors, especially those approaching retirement, may feel more at ease investing a larger portion of their portfolios in lower-risk products. These are also excellent for folks who want to save for both immediate and long-term goals.

Time horizon

The term “time horizon” simply refers to when you will require the money. Do you require the funds immediately or in 30 years? Are you putting money down for a down payment on a house in three years, or are you preparing for retirement? What types of investments are more appropriate depends on your time horizon.

If you consider a relatively short time horizon, the funds must be in the account and not locked up at a specific time. As a result, you’ll need to invest in safer instruments such as savings accounts, CDs, or bonds. These have fewer fluctuations and are therefore safer.

You can afford to take some chances with higher-return but more volatile financial investments if you have a longer time horizon. You can invest in stocks and hold them for at least three to five years if you have a longer time horizon.

It’s critical that you match your investments to your time horizon. You don’t want to invest next month’s rent money and hope it will be there when you need it.

Your knowledge

What you invest in is influenced by your expertise in investment. Savings accounts and CDs require little understanding, especially since your account is insured by the Federal Deposit Insurance Corporation (FDIC). Market-based assets, such as stocks and bonds, however, necessitate a higher level of understanding.

You’ll need to improve your comprehension of assets that require more knowledge if you wish to invest in them. If you want to invest in individual stocks, for example, you’ll need a lot of information about the company, the industry, the goods, the competitive landscape, the firm’s finances, and so on. Many folks do not have the time or resources to devote to this process.

How much money do you have to invest?

How much money do you have to put into an investment? The more money you have to invest, the more likely it is that higher-risk, higher-return investments will be worthwhile.

If you have more money, it may be worth investing the time to learn about a specific stock or industry because the potential benefits are so much bigger than with bank products like CDs.

It might not be worth your time if it isn’t. As a result, you can either continue with bank products or invest in ETFs or mutual funds, which require less time.

Conclusion

Investing may be a fantastic method to develop wealth over time, and investors have a variety of investment options to choose from, ranging from low-risk, low-return assets to higher-risk, higher-return assets. To make an informed decision, you’ll need to understand the benefits and drawbacks of each investment option as well as how they fit into your overall financial strategy. Many investors handle their own investments, despite the fact that they may appear frightening at first.

There are numerous profitable financial investments in 2022, as you have just read in our guide. However, the first step in investing is simple: open a brokerage account. Even if you don’t have a lot of money, investing can be surprisingly reasonable. Our top recommendation is eToro, which provides newcomers with access to a variety of investment possibilities.

Frequently Asked Questions

Is it possible to make money with cryptocurrencies?

It is now possible to make passive income by holding crypto-currencies in a variety of ways, including staking and lending, which is the act of lending them to others in order to earn an interest rate.

Why are stocks one of the most reliable long-term investments?

According to an AMF analysis, equities are one of the finest investments for saving, considerably outperforming other assets like gold and real estate.

Is there a danger associated with crowdfunding?

It is vital to learn about the risks associated with any investment in an unlisted firm, just as it is with any other investment. In general, you should consider the following risks when making a Crowdfunding investment: the possibility of losing all or part of the money invested, as well as the illiquidity of the securities owned.

Why should you buy stocks with eToro?

As we’ve seen in this article, the eToro broker offers a number of benefits. It is suitable for investors who want to buy shares because there are no commissions on both the purchase and sale of the shares.