Apple PLC, one of the largest IT companies in the universe, is well-known on a worldwide scale. You may have considered investing in the company’s stock in the hopes that its value would rise and you will make a profit. If you’re just starting out, you might also believe that you need a large sum of money—likely millions—in order to get Apple Shares. This is untrue, though, as it is possible to purchase or sell Apple shares as CFDs and perhaps make money doing so for just a few pounds.

This post will demonstrate how to buy Apple shares through online brokerage services. We also offer a guide of the best UK brokers for buying Apple shares.

How to Buy Apple Shares: A Step-by-Step Guide 2022

If you want to purchase Apple shares right away, you’ll have to create an account with a reliable trading platform. The procedure for purchasing Apple shares on a regulated market can be understood in the four phases that follow.

- Open a Trading Account: Create a Free Trading Account by going to the homepage of a broker. By entering your email address, username, and password, you may create an account.

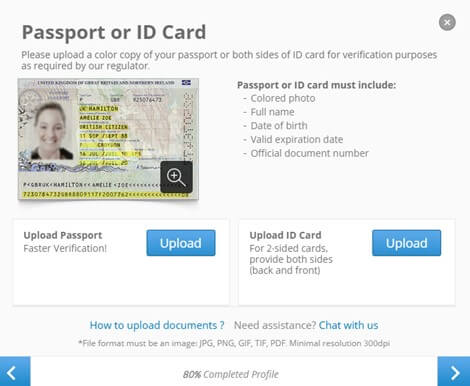

- Upload ID: After clicking “Complete Profile,” complete the KYC checks, and then upload identification documents (such as a passport) and evidence of residency (e.g. bank statement).

- Deposit Funds: Select your desired payment option by clicking “Deposit” and selecting from a credit/debit card, bank transfer, or e-wallet.

- Buy Apple Shares: Enter “Apple” in the search box and then select “Trade.” Enter your chosen position size in the order box that opens, then click “Open Trade” to confirm your position.

Examine Apple Stock

Analyzing the company’s finances and business model is essential to make sure that any investment you make is suitable for the long term, much like when you purchase Amazon stock.

In light of this, the sections below show an in-depth analysis of Apple stock, including the company’s background, financials, and if purchasing Apple stock now is a wise decision given the state of the market.

Apple Overview

When Apple Inc. was founded in 1976, its first focus was on building customised computers, but it quickly expanded. As a result, Apple increased the scope of its offerings and included more tech-related goods, such as iPhones, MAC laptops and desktop computers, the iOS operating system, Apple Watch, iTunes, and iPods, among other things. More than 1.5 billion Apple products are currently in use worldwide.

In 1980, the business went public on the NASDAQ exchange for just £22 per share. If you had purchased company shares during the company’s IPO, this would have been a wise investment. Steve Jacobs, Apple’s previous CEO, who took over in 1997, guided the firm to greatness until his death from cancer in 2011 left Tim Cook as the new and current CEO.

One of the largest corporations both domestically and globally, Apple was the first to have a market cap of over $1 trillion in 2018. The firm’s shares are listed on the NASDAQ market under the ticker code “AAPL.. You can speculate on the price movement of Apple shares by trading them as CFDs.

Apple Share Price History

Apple made its debut on the stock market on December 12, 1980, trading under the ticker code “AAPL.” Stocks were initially priced at $22, but after taking into account subsequent stock splits, this amounts to about $0.39.

Apple’s first public offering (IPO) was a huge success, raising more than $100 million in the capital by selling 4.6 million shares. This resulted in it being the most profitable IPO in decades, which benefited investors as well because stocks instantly took up the next day and increased Apple’s market valuation to more than $1.7 billion.

Although Apple’s stock saw ups and downs throughout the ensuing years, things started to look better for the company in the early 2000s. This was a pivotal time in Apple’s history because it marked the time when the company debuted the first Apple Stores and refined the Mac OS X operating system.

The introduction of the iPod and the iTunes Store contributed to the almost 2,500% increase in the price of Apple stock between 2003 and 2008. During this time, Apple also unveiled the MacBook, which has since grown to be one of the most popular computers worldwide. Thanks to the introduction and subsequent popularity of the iPhone, Apple’s stock kept rising throughout the ensuing years.

Due to the iPhone’s significant impact on Apple’s revenues, the stock price of the company is still rising. Statista estimates that Apple sold 1.39 million iPhones in 2007, with over 217 million sales by 2018. Apple’s stock price increased by another 798% over that time, peaking at $58.

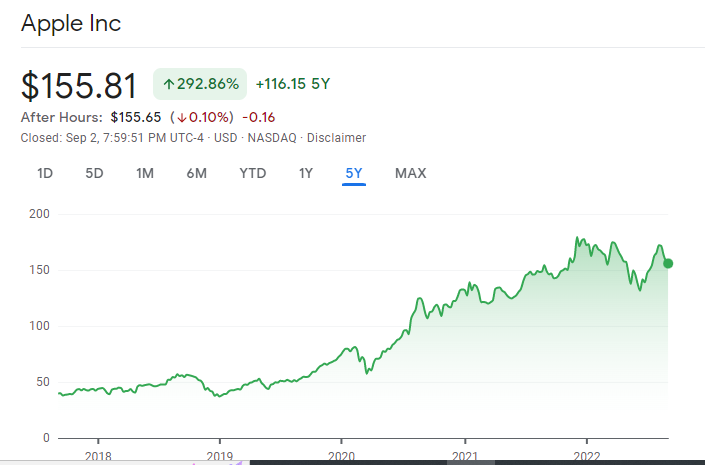

The price of Apple’s stock increased by 409% between 2018 and late 2021 despite a few brief dips along the way.

Apple Share Price 2022

Data from MacroTrends shows that on January 3, 2022, Apple’s stock reached an all-time high of $182.01. As a result, Apple became the first firm to ever have a market cap of $3 trillion.

Apple’s stock has since fallen from these highs and is currently trading in the $155 range. Apple is not exempt from the effects of several macroeconomic concerns, such as growing prices and rumors of interest rate increases, which are hurting IT companies.

Apple Stock Dividends

Even if Apple’s history with capital gains is illustrious, it may still be regarded as one of the most well-liked dividend stocks on the market. First of all, it should be noted that Apple has been paying cash dividends since 1987. These quarterly dividend payments have only been interrupted by Apple’s stock splits in recent years.

At the present, Apple distributes a dividend of $0.22 per share. The most recent payment was issued on February 10th, and this represents an increase over the $0.205 per share received in 2021. Apple is renowned for raising its dividend payments each year, which shouldn’t be an issue given its impressive profitability.

Apple’s current dividend yield, according to Dividend.com, is 0.56%. This is less than the 1.37% yield that technology businesses typically offer. Intriguingly, Apple’s payout ratio is only 13.47%, underscoring the fact that less than a fifth of the business’s profits is paid to shareholders. Although this appears low, Apple has a history of using its revenues to fund the development of innovative new goods, and this pattern doesn’t appear to be changing anytime soon.

Financial Results

When talking about Apple as an investment opportunity, the company’s outstanding financial situation is the first thing to keep in mind. Apple’s net profit margin for the last 12 months was a remarkable 26.58%, according to Investing.com. Due to this, Apple made over $34 billion in profit in the first quarter of its fiscal year 2022.

Based on its most latest quarterly report, the company had roughly $18 billion in cash on hand, setting the stage for more innovation. Given the company’s enormous profit margins, Apple’s P/E ratio, which is currently 26.03, is reasonable from a value investment.

Best trading platform to Buy Apple Shares

To purchase Apple shares, you need a reputable online stock broker. The best part about purchasing Apple shares through brokers is that you may do so in fractions and that there are numerous ways to pay for them.

Be aware that there are hundreds of stock brokers on the UK financial market, making it difficult to identify the finest provider of Apple shares. We have reviewed the top two stock brokers below to help you get started.

1. eToro

When it comes to stock trading platforms, eToro is at the forefront. With over 27 million registered users, eToro is one of the most reputable trading platforms for novice and experienced traders. Since eToro is governed by the FCA, ASIC, CySEC, FinCEN, and FINRA, customers are guaranteed a high level of investment protection.

Both CFDs and genuine stock trading options are available on eToro, with the former allowing customers to apply leverage if they so choose. Leverage on stocks can be as high as 1:5, which multiplies prospective gains (and losses) by five. Notably, eToro enables fractional investment, allowing you to open stock trades with as little as $10, and charges no costs.

The spread is the sole cost to be aware of, and it is usually tight for liquid assets like Apple shares. As one of the free trading brokers to choose, eToro has no administration fees, rollover fees, or ticket fees to worry about.

Additionally, there are no deposit fees when funding your account, and there is a $10 minimum deposit requirement. All well-known credit/debit cards, bank transactions, and e-wallets are accepted as payment methods on eToro. It is easy to fund your account securely using these e-wallets, which include PayPal, Skrill, and Neteller.

In addition, eToro offers one of the most well-liked stock apps available, which features a stylish user interface and a number of indicators to support technical analysis. Additionally, eToro provides a wide range of useful tools, with its well-known “CopyTrader” service. This makes trading fully passive by enabling you to automatically mimic the transactions made by knowledgeable eToro users without paying any extra fees.

2. Capital.com

There may be a point when you want to use CFDs to access Apple shares (contracts-for-differences). These financial products, which are provided by licensed brokers, let you trade an asset without actually owning it. Therefore, if you properly predict whether the item will increase in value or decrease in value, you will earn.

You can trade Apple shares using CFDs on the FCA-regulated broker Capital.com. According to what your analysis indicates, you can therefore make predictions about the value of Apple shares both rising and dropping.

First off, there are no trading commission fees at Capital.com. On Capital.com, this represents just 0.10% at the time of writing. The fact that Capital.com just requires a £20 minimum deposit is another reason we like it.

Additionally, you can trade Apple share CFDs using the demo account on Capital.com. By doing this, you can practice short-term CFD trading without taking any financial risks.

Capital.com accounts can be opened in a matter of minutes. The broker accepts a number of e-wallets and debit/credit cards. Bank transfers are another accepted form of payment, however, they raise the required minimum deposit to $250. Finally, the FCA has approved and is in charge of Capital.com.

How to buy Apple Shares?

The two stock brokers mentioned above can assist you in beginning your purchase of Apple shares. However, not all of them will meet your trading needs, so if you want to have a chance of successfully purchasing Apple shares, you should be able to make the ideal choice. Here are the steps to follow in order to purchase Apple shares using eToro.

Step 1: Open an Account

Go to the broker’s webpage and select “Create Account” first. Following that, you will be required to enter a working email address and select a username and password for your account. If you like, you may also download a mobile app from Google Play or App Store and register through that.

Step 2: Verify your Account

When you click “Complete Profile” on your account dashboard after creating your account, you will be prompted to complete the platform’s KYC checks. You will next need to upload identification documentation (like a passport) and proof of residence (like a bank statement) for verification. When everything has been verified, the broker will email you to let you know.

Step 3: Make a Deposit

Choose a payment method that won’t make your activities lag and deposit the broker’s minimum amount. The good news is that deposits on eToro are free of charge.

Step 4: Search for Apple shares

You can purchase Apple shares once you’ve funded your account. Enter “Apple” or “AAPL” in the dashboard search bar, then click “Trade” when Apple appears. Click “Trade” once more on the screen that appears after that.

Step 5: Buy Apple Stock

Your screen will show an order box similar to the one below. Simply input your position size in this box, decide if you want a stop-loss or take-profit level, choose leverage if you want it, and when you are satisfied with everything, click “Open Trade.”

Conclusion

We hope this tutorial has provided you with the information you need if you were unsure about purchasing Apple shares. The ability to purchase fractional shares of Apple and receive dividends as a shareholder is the strongest feature of these shares. Despite discussions about human rights abuses sparked by Apple’s collaboration with China, the stock of the firm still has a chance to rise in value soon.

So, before selecting a reliable stock broker, think about the dangers involved. Use the broker’s practice account to practice stock trading before making your first transaction. It will only take a short while for you to become successful at trading Apple shares if you use discipline, consistency, and extensive study.

Frequently Asked Questions

Are Apple stock shares a wise purchase?

Yes. Apple is a wonderful investment because of its stellar track record of performance. To decide when to open a position with profit potential, you need to keep track of the company’s performance.

Are Apple shares easy to buy?

Yes. The finest stock broker makes it simple to purchase Apple shares. Simply look up Apple’s stock ticker (AAPL), choose how many shares you want to buy, and you’re ready to go. But bear in mind that there are hazards involved, and how well you manage those risks will determine your success.

Can I purchase one share of stock in Apple?

Yes. In reality, you can purchase a portion of Apple shares rather than a full share. Find a stockbroker who will let you buy fractional shares of Apple.

Is it possible to profit from one share of stock?

Yes. You can gain from a Apple share with thorough research and strategy. For instance, you could purchase a share today, keep it for a while, and then sell it for a profit if the price increases. Additionally, you can make money by speculating on an equity’s price movement (CFD trading).