We examine Lloyds Banking Group (LSE: LLOY), a significant player in the UK banking industry, in this thorough research to see if it is the best option for investors looking for potential chances in the current market.

We will start by looking at its current market position, previous financial performance, and position relative to other British banks. The performance of Lloyds historically during the last two years will then be examined, taking dividends and any investment risks into account.

Lloyds as an Investment Today

With a 6% year-to-date decline, Lloyds stock is an attractive prospect for investors looking for value in the UK banking industry. The following criteria make Lloyds appealing as a possible investment:

1. Possibility for Growth in the Future

Lloyds presently has a price-to-earnings (P/E) ratio of just 5.5, which is incredibly low. The average P/E ratio for the FTSE 100 is 14, putting into perspective the huge discount at which Lloyds shares are currently trading. Furthermore, Lloyds provides significant value when compared to a reputable UK company like HSBC, which trades at a higher P/E ratio of 6.5.

For investors looking for prospects with significant upside potential, this P/E ratio suggests that the market may be underestimating Lloyds’ earnings potential.

2. Excellent Financial Performance

Along with having a favorable valuation, Lloyds has had great financial results in 2023. It generated £9.2 billion in net income during the first half of the year, a remarkable 11% rise over the same period in 2022. Profit after taxes increased by 17% year over year as well, showing strong margin growth. Such outcomes give rise to trust in the bank’s resiliency and growth potential amid the difficult market conditions of today.

3. High yield on dividends

With a dividend yield of 5.7%, which is much higher than the FTSE 100 average of 3.8%, Lloyds also offers investors a compelling income prospect. Notably, it outperforms Barclays, a rival that pays a dividend yield of 4.8%, as well. This high dividend yield demonstrates Lloyds’ dedication to providing shareholders with value, which is especially important in a volatile market.

4. Managing Economic Headwinds

There are challenges for Lloyds in the challenging macroeconomic environment. Rising interest rates and inflation could have an effect on homeowners and jeopardize the bank’s ability to service mortgages. Housing expenses may fluctuate as a result of the property market’s unpredictability, which could affect the value of Lloyds’ mortgage portfolio.

It is crucial to remember, though, that higher interest rates can also be advantageous for the bank because they allow it to charge more for loans, which increases interest income. In comparison to the prior year, Lloyds’ net interest margin increased by almost 0.4% for H1 2023, suggesting that higher rates would be good for the bank.

Performance of Lloyds over the previous two years

Let us change our attention to Lloyds’ historical performance over the last two years, taking into account dividends and associated risks, to get a thorough understanding of the company as an investment.

The last two years have seen a period of stasis for Lloyds shares, which have remained largely unchanged. Two years ago, if an investor had put £10,000 into Lloyds shares, they probably still would have had about the same amount of money, plus the advantage of dividends.

Notably, investors have had access to income during this time thanks to Lloyds’ above-average dividend yield. Over the two years, dividend payments increased, and an investor would have gotten about £800 in dividends. This is equivalent to a yield of about 4% on an annualized basis, which is consistent with the performance of the FTSE 100 index during the same period.

Issues and dangers that may arise

Concerns about Lloyds’ susceptibility to increasing interest rates, which could result in higher impairment costs and a wave of loan defaults, have been the main factors behind the share price decrease in recent years. According to Lloyds’ worst-case scenario, estimated credit losses (ECL) would total £10.1 billion, or a sizeable chunk of its market value.

Furthermore, even minor fluctuations in interest rates were estimated to have a significant impact on ECL, with a mere 10 basis point increase potentially resulting in a £226 million rise in ECL. These factors heightened market concerns and contributed to the decline in Lloyds’ share price.

Current Outlook

Thankfully, it seems as though the worst-case situation may have been avoided, especially now that the Bank of England has stopped its cycle of tightening monetary policy. The share price of Lloyds has experienced less downward pressure as a result, as indicated by the fact that it has increased by 6% over the past month.

The Monetary Policy Committee chose to keep interest rates at 5.25%, leaving room for unforeseen uncertainties, so some risks still exist.

The Potential for a Favorable Environment

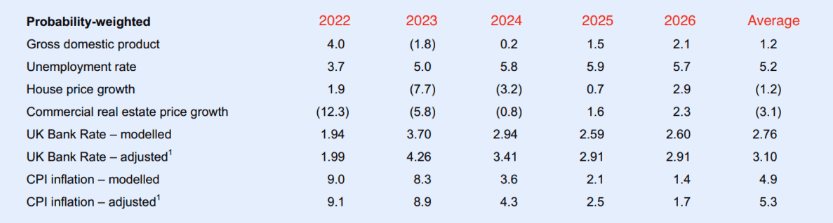

The banking industry may see favorable circumstances in the future. According to Lloyds’ probability-weighted projection, interest rates will probably decline as economic growth stabilizes. Interest rates between two and three percent are frequently referred to as the “Goldilocks zone” for banks, where net interest revenue is consistently strong and impairment charges are kept to a minimum.

As cyclical stocks, banks typically do well in a strong economic climate. Due to lower loan default risks and reduced impairment costs, they can operate with higher net interest income. Additionally, during times of economic prosperity, banks typically operate at their best, with higher lending activity and better financial outcomes.

Furthermore, valuation continues to be crucial to Lloyds’ investment strategy. The bank offers a strong value proposition at its current price of just 5.8 times earnings and 0.72 times book value.

Conclusion

For many investors, Lloyds stands out as their top choice in the UK banking industry. It is an attractive option for portfolio diversification due to its low valuation, large dividend yield, and great historical performance.

Even though macroeconomic concerns still exist, particularly given its high exposure to the UK housing market, the potential benefits of increased interest rates may outweigh these dangers. As a result, Lloyds seems prepared to offer a promising investment opportunity.

With its combination of value, income, and growth potential, Lloyds stands out among the UK banking industry’s investment possibilities as a strong contender for inclusion in your investment portfolio.

Also read: Rolls-Royce Or Lloyds Shares? Which FTSE 100 Stocks Should You Buy Right Now?

Leave a Reply