Dell Technologies stock recently experienced its most significant stock drop in four years, falling 16% after releasing its quarterly earnings report.

Despite the first revenue increase since 2022 and robust performance in its AI server segment, the results did not meet the high expectations set by investors.

Financial Performance Highlights

Dell reported a 6.3% increase in revenue, totaling $22.2 billion for the quarter ending May 3, 2024. This figure surpassed the average analyst estimate of $21.6 billion. The company’s profit, excluding certain items, was $1.27 per share, slightly above the average projection of $1.23 per share. Notably, Dell’s AI server sales more than doubled from the previous quarter to $1.7 billion, with a backlog increase of over 30% to $3.8 billion.

Despite these positive metrics, Dell Technologies stock fell sharply by 16% on Friday morning. The decline can be attributed to the extremely high expectations surrounding Dell’s AI server business, which were not fully met in the latest earnings report.

Dell’s AI Server Segment

Dell has been viewed as a major beneficiary of the growing demand for AI servers. Large corporations require powerful servers to train and run complex AI models, and Dell, alongside a few other companies, is well-positioned to supply this hardware. Over the past year, Dell Technologies stock has more than tripled, driven by investor excitement over AI opportunities.

However, the earnings report revealed some underlying concerns. Analyst Toni Sacconaghi from Sanford Bernstein highlighted a decrease in adjusted operating margin, suggesting that AI servers might be sold at near-zero margins. This margin compression indicates that while revenue from AI servers is growing, the profitability might not be as strong as investors hoped.

Dell’s Chief Financial Officer, Yvonne McGill, expressed confidence in the continued momentum of AI demand throughout the year. The company raised its revenue outlook for the fiscal year ending February 2025 to a range of $93.5 billion to $97.5 billion, surpassing analysts’ average estimate. Despite this positive outlook, the implied flat growth in AI server sales through the rest of the year has cast doubts on Dell’s near-term competitiveness in the AI market.

The Broader Business Landscape

In addition to its AI server business, Dell has other significant segments, particularly its Client Solutions Group, which includes personal computers (PCs) and related products. For the reported quarter, revenue from this segment was $12 billion, showing little change from the previous year. Business PC sales increased by 3% to $10.2 billion, contrary to analysts’ expectations of a 2% decline.

The overall PC market has been struggling since the pandemic-driven boom ended, with a historic decline over the past two years. However, there are signs of recovery, with industry analysts noting a 1.5% increase in shipments in the first quarter of 2024. Dell’s primary competitor, HP Inc., also reported positive signs of recovery, particularly in the business PC market.

Dell’s Infrastructure Solutions Group, which includes servers, networking, and storage equipment, reported a 22% increase in revenue to $9.2 billion. This strong performance underscores the ongoing demand for enterprise infrastructure, although it also highlights the competitive pressures and margin concerns in the AI server segment.

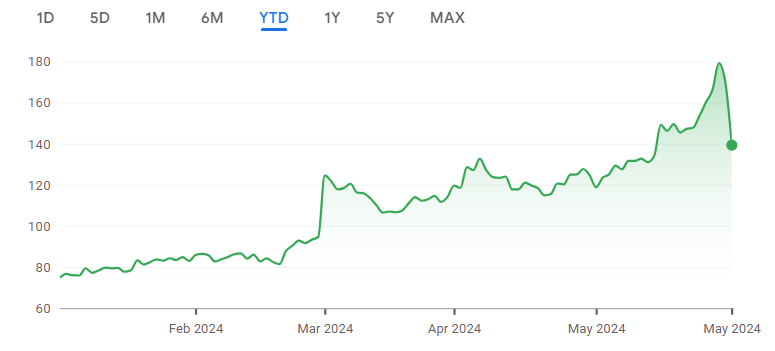

Dell Technologies Stock Performance

Despite the recent drop, Dell Technologies stock had seen a substantial rise earlier in the year, driven by the AI hype. From January to April 2024, Dell Technologies stock gained nearly 95%, reflecting strong investor sentiment. However, this rapid increase also led to heightened expectations, setting the stage for a sharp decline when the latest earnings report fell short of those expectations.

Looking at Dell’s valuation, the stock’s forward price-to-earnings (P/E) ratio, price-to-free-cash-flow ratio, and enterprise-value-to-EBITDA ratio have all risen dramatically this year. While these ratios indicate that investors are willing to pay a premium for Dell’s future earnings, they also suggest that any deviation from expected performance could lead to significant stock price volatility.

Is Dell Technologies Stock a Buy Now?

Given the recent stock drop, the key question for investors is whether this presents a buying opportunity or if further caution is warranted. Here are some factors to consider:

Positive Aspects:

- AI Server Potential: Despite concerns about margins, the AI server segment shows strong revenue growth and backlog, indicating robust demand.

- Revenue and Profit Growth: Dell has raised its revenue and profit outlook for the fiscal year, suggesting confidence in continued growth.

- Competitive Position: Dell remains a leading player in the enterprise infrastructure market, with diversified revenue streams beyond just AI servers.

Concerns:

- Margin Compression: The potential for low or zero margins on AI servers could limit profitability despite revenue growth.

- High Expectations: The recent stock run-up has set high expectations, increasing the risk of volatility if future results do not meet these expectations.

- Broader Market Conditions: The overall tech market, including PCs, remains competitive and cyclical, which could impact Dell’s performance.

Final Thoughts

The recent Dell Technologies stock decline highlights the challenges of meeting high investor expectations, particularly in a rapidly evolving market like AI. While the company’s financial performance shows positive trends, especially in AI server sales, concerns about profitability and margin compression remain.

For investors considering investing in Dell stock, the decision should weigh the potential for continued growth in AI and enterprise infrastructure against the risks of high valuation and competitive pressures. Given the current market sentiment and Dell’s strategic position, the stock may offer a buying opportunity for those with a long-term perspective, but it is essential to monitor future earnings reports and market trends closely.

Also read: Salesforce Stock 25% Down! Should You Invest in CRM Stock Now?

Leave a Reply