As third-quarter results from Corporate America begin to trickle in next week, investors are gearing up for another period of high profit growth in the United States. However, as the economy recovers from the coronavirus outbreak, new issues develop, such as supply-chain problems as well as inflationary pressures, which are putting pressure on Wall Street.

A number of corporations have offered dismal outlooks in the run-up to earnings season. FedEx Corp (FDX.N) cited labour shortages for rising wage rates and overtime expenditures, while Nike Inc (NKE.N) cut its fiscal 2022 sales forecast and cautioned of holiday-season delays, blaming a supply-chain crisis and surging freight prices.

“The rate of increase has slowed, but it is still significant,” stated Terry Sandven, chief equity analyst at U.S. Bank Wealth Management. “We’ll be examining to see to what level desire is there, and what would it indicate for the key holiday spending time,” he says, referring to supply and labour shortfalls as well as inflationary concerns.

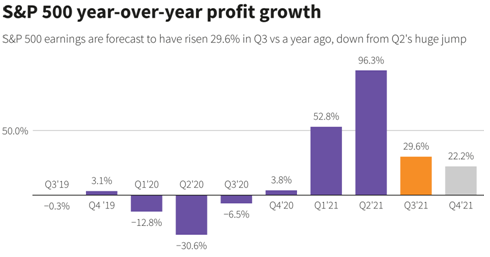

According to IBES statistics from Refinitiv as of Friday, analysts expect a 29.6 percent year-over-year gain in earnings for S&P 500 businesses in the third quarter, down from 96.3 percent growth in the second quarter. The third-quarter prediction is down somewhat from a few weeks ago, reversing a recent upward trend in estimates.

Due to the outbreak, third-quarter profit growth was always predicted to be significantly smaller than the second-quarter outburst, when corporations had far simpler year-ago benchmarks.

“We were climbing at such a rapid rate. The upward trend in revisions has slowed “According to Nick Raich, CEO of The Earnings Scout, an independent research business.

The top banks, such as JPMorgan Chase (JPM.N), are beginning their profits season this week.

Costs, Supply Chains

Following the current spike in oil and natural gas costs, investors are considering the consequences of dramatically increased energy costs on consumers and businesses. Increased energy prices should benefit energy producers, but they pose an inflation risk for many other businesses, such as airlines and other industrial companies, and they reduce consumer expenditure.

Since corporations have slashed expenses and carried on high prices to customers, profitability in the United States has remained at record levels so far this year. Several investors are curious as to how long this will continue.

After a dismal and tumultuous September, third-quarter profits came with the market still shaky. In September, the S&P 500 (.SPX) experienced its largest monthly percentage decrease since the outbreak began in March 2020. This was also the first monthly drop for the index since January. Read our article to Learn more about How to Trade Indices

“The consequence of Covid-19 outbreak on the supply chain has spread beyond consumer goods.”Longer-term signals of global turbulence are also easy to uncover “Bank of America Securities’ head of U.S. equity and quantitative strategy, Savita Subramanian, said in a report on Friday. However, she claims that these risks are not yet fully priced in stocks.

According to Morgan Stanley strategists, average earnings forecasts have not completely factored in supply-chain limitations, making it considerably more difficult for companies to beat predictions at the similar rate as in previous quarters.

“All Consumer Discretionary organizations are directly affected by supply constraints, higher logistical costs, and higher labour expenses,” they stated. Those experts believe the stock market is due for a deeper correction, and that third-quarter profits will dictate how far the market falls.

Leave a Reply