On Monday, Apple Inc (AAPL.O) became the first organisation to achieve a stock market value of $3 trillion, before closing the day a centimetre below that figure, as shareholders bet the technology giant will keep going to launch finest new products while discovering new industries such as electric cars and virtual reality technology.

Apple’s share price hit an intraday new high of $182.83 on the first day of trading in 2022, placing the company’s market value just above $3 trillion. Apple’s market capitalization is $2.99 trillion, and the stock ended the session up 2.5 percent at $182.02.

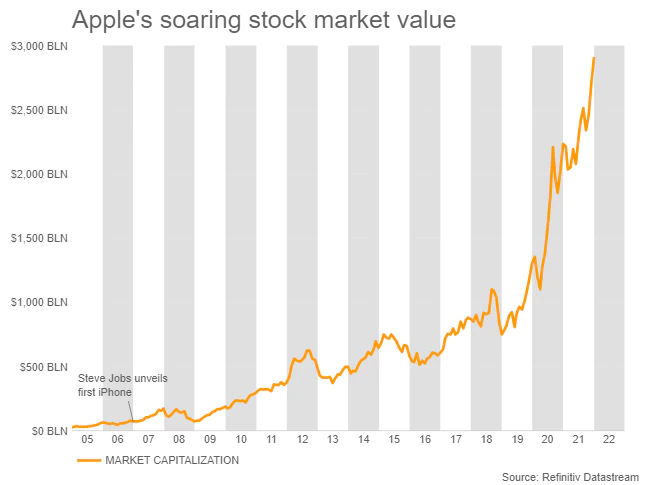

Apple’s rise to a market cap of $3 trillion, based on its stock price, comes less than two years after it reached a market cap of $2 trillion. After surpassing $2 trillion in June, Microsoft could be on its way to the $3 trillion mark.

The phenomenal success of Apple’s iPhone column, which has created accessories like the Apple Watch and AirPods, as well as services like Apple Music+, AppleCare, the App Store, and Apple TV+, has propelled the company to $3 trillion in market capitalization.

Apple (AAPL.O) and Microsoft Corp, which is now worth $2.5 trillion, are both in the $2 trillion club. Market capitalizations of Alphabet Inc (GOOGL.O), Amazon.com Inc, and Tesla Inc (TSLA.O) all exceed $1 trillion. The Saudi Arabian Oil Company (2222.SE) is worth $1.9 trillion.

Since co-founder and former CEO Steve Jobs unveiled the first iPhone in January 2007, Apple’s stock has risen around 5,800 percent, far outpacing the S&P 500’s (.SPX) gain of about 230 percent over the same period.

Apple’s revenue from services like video streaming and music has increased dramatically under Tim Cook, who took over as CEO after Steve Jobs died in 2011. This helped Apple reduce its reliance on the iPhone from over 60% of total revenue in fiscal 2018 to around 52% in fiscal 2021, assuaging investor concerns that the company was overly reliant on its best-selling product.

Nonetheless, some investors are concerned that Apple is reaching the limits of how large it can grow its user base and how much money it can extract from each user, with no assurances that upcoming product characteristics will be as financially rewarding as the iPhone.

Apple and other Big Technology firms have benefited from the rapid adoption of technologies which include 5G, VR technology, and artificial intelligence.

According to reports, Apple maintained its lead in China, the world’s biggest mobile phone industry, for the second consecutive month, defeating competitors such as Vivo and Xiaomi.

Many shareholders anticipate Apple to introduce its own vehicle in the next few years, with Tesla now the world’s most highly valued auto manufacturer as Wall Street stakes heavily on electric vehicles.

Apple’s stock price as a proportion of the Nasdaq 100 index’s (.NDX) valuation is significantly increasing against a key technical stage as its market capitalization approaches $3 trillion. In the past, the stock price has risen above this level and then fallen.

Leave a Reply