Goldman Sachs Group Inc (GS.N) outshone the superlatives on Friday, reporting third-quarter revenues and profits that exceeded expectations across the board. Goldman Sachs Group Inc. reported a surprising increase in trading revenue, capping off a strong quarter for Wall Street’s major banks.

The bank earned $5.28 billion, rising from $3.23 billion one year ago, capping off a great quarter for Wall Street lenders, who benefited from a growing rising stock markets, US economy, and a global deal-making boom.

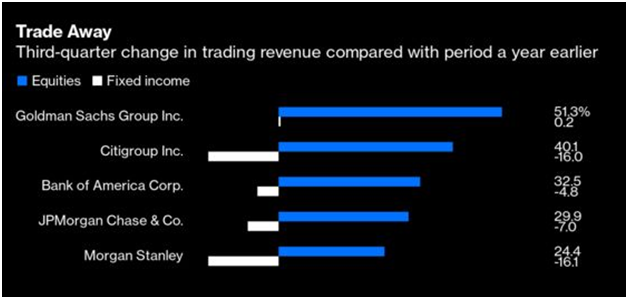

In its primary business of trading equities, bonds, currencies, and also in commodities trading, Goldman surpassed all other banks that reported this week. Investment banking, as well as its consumer and wealth businesses, performed well.

With a total income of $3.70 billion, Goldman’s investment bank had its second-best quarter ever, and officials expect revenue to remain high.

On a conference call with analysts, Goldman Sachs Chief Executive Officer David Solomon said, “I remain positive about opportunities. Activity is still high, especially in investment banking.”

According to Refinitiv’s IBES estimate, earnings per share increased to $14.93 from $8.98 a year ago, outperforming analysts’ expectations of $10.18 per share.

Goldman is achieving this in a number of ways, one of which is by growing its balance sheet and funding additional trades. Its risk-weighted assets, a measure of assets used to determine capital requirements, have increased by 10% this year and are up by 23% since the end of 2019.

The majority of that growth has come from Goldman’s trading division, where it has done things like lending to emerging financial technology businesses to help them pay the mortgages they generate. Goldman will then repackage the securities and sell them to other investors at a later date. With GreenSky, the buy-now-pay-later company it is buying for $2.2 billion, this type of business should develop even more.

This activity contributed to a 55 percent increase in FICC financing year over year, and that was a primary reason that Goldman was the only major U.S. bank.to keep its total fixed-income trading revenue flat in the third quarter, despite a forecast for a 22 percent drop and the revenue loss experienced by its peers.

Financing for the stocks trading industry was even higher. Revenue more than doubled year over year, helping the equities trading revenue line outperform expectations by 41%, easily the best among rivals and putting it ahead of Morgan Stanley for the quarter.

Hedge fund lending is the most common form of equity financing. It’s possible that the gain was more about moving out weaker, less profitable clients for more interesting and profitable ones, rather than just stealing market share from European banks like Credit Suisse that have lost their appetite.

Goldman did not extend its balance sheet by luring billions of dollars in additional deposits from common citizens, which it would otherwise have had to retain in low-yield Bonds or central bank funds. After all, this isn’t your typical bank.

It is, however, the type of bank that outperforms its peers in terms of net interest income growth, which investors had hoped would be the case for all of the big traditional bankers. In its consumer and wealth division, lending more to wealthy clients increased net interest income by 36 percent year over year. And all of that money in the trading arm boosted the markets division’s NII by 45 percent year over year.

Solomon spoke a sobering note on dealmaking: private equity investors have been driving M&A, and this will have to slow down. He indicated Goldman was being more cautious about big-deal risk, which sounded like he was concerned about being stuck with a substantial part of leveraged buyout funding at some time.

Leave a Reply